This article will review Standard Chartered Online Trading, one of the countless options for DIY investors out there.

This article will partly focus on the Singapore offering, but it has to be noted that Standard Chartered has similar offerings in several other markets around the world.

For any questions, or if you are looking to invest, you can contact me using this form,

Introduction

Standard Chartered is one of the world’s leading international banking group.

The bank has worked for over 150 years in some of the world’s fastest growing markets and generates about 90 percent of its revenue and profits in Asia, Africa and the Middle East.

This kind of geographic focus and the drive to develop deep customer relationships have contributed to the Bank’s growth in recent years.

Standard Chartered PLC is listed on the London and Hong Kong Stock Exchanges and the Bombay and National Stock Exchanges in India.

With more than 1500 offices in 60+ different markets, the Group suggests really valuable and competitive service to its customers.

The company claims that they are committed to the long-term development of a sustainable business and is trusted throughout the world with high standards of corporate governance, social responsibility, environmental protection and employee diversity.

Standard Chartered group’s rich heritage and values you can see in the brand promise “Here Forever”.

But in this article we will review one of the offered services called Online Trading.

In addition to providing a full wide range of banking services which allows them to meet both consumer and corporate needs, Standard Chartered also opens the door to convenient trading on 15 stock exchanges around the world through its multi-channel online trading platform.

- Standard Chartered Online Trading Overview.

For all the investors or individuals who think about making an investment, Standard Chartered can be one of the possible options to cooperate with, despite the numerous negatives I will speak about below.

If you are interested in trading shares or ETFs, you can easily start your route with this company.

But anyways Standard Chartered trading platform will always be an option for novice investors considering that it has the lowest fees in the investment market.

And the main reason many investors choose Standard Chartered is because they didn’t have to pay minimum fees.

For a beginner investor with a very small investment, this is very important. When you make trades worth about $2,000 each time, you only need to pay $4 in commission fees, instead of $15 or more from other competing brokers.

But since the end of 2016, Standard Chartered has set a minimum fee of $ 10, which is again not so much and still is a competitive fee amount.

Standard Chartered Online Trading allows its clients to trade most of the securities listed on 15 exchanges in which the bank allows trading: Singapore (SGX), Honk Kong (HKG), Japan (TSE), Australia (ASX), United States (ASE, NMS, OTCB, OTCQ, and NYS), France (PAR), Germany (XETR), Netherlands (AMS), United Kingdom (LSE), etc.

Wheat you can trade? With SC you will be able to trade in the following investment spheres:

- Shares – you can invest in listed companies that are on Singapore (SGX) and other global exchanges

- Exchange traded funds (ETFs) – also make investments in a diversified portfolio of securities from a range of asset classes and markets

- The company guarantees – securities issued by a listed company to increase capital, which in turn gives an investor the unique opportunity and a right to subscribe or buy a share of that company at a conditioned price for a conditioned period of time before the expiration of the guarantee. Company guarantees have an expiry (usually 3 years) and are useless after expiration, unless the owner signs up for new shares before the expiry date.

Actually there are many reasons why you would like to open a Standard Chartered bank account.

And one of them is the lower trading fee compared to other brokerage services, let’s see the pros and cons of Standard Chartered and after discuss the strong and weak sides of it.

Pros:

- Have some of the lowest and competitive fees in the market if you DIY invest.

- This is a multi-channel platform which is also compatible with web and android/iOS devices.

- Trade international stocks in 15+ global securities exchanged.

- Has a very simple mobile and web interface design, which allows the user to easily navigate.

Cons:

- Statistically speaking, DIY investing is unlikely to work long-term.

- Being a big brand is actually a negative. You are customer number 1,006,008 and don’t get tailored services.

- No deep market researches.

- No trading recommendations.

- No instruments or tools to chart.

- Your investments will be kept in a custodian account, which means that all the shares you have are not kept in your depository account, instead they are held in a custodian account of the company.

- The lack of SRS and CPFIS, which means that the shares you purchase will not be available for leverage for trades.

- How to open an account?

This depends on which countries you are from. If you are from an eligible country, to register a trading account, you must be at least 21 years old and already a customer of Standard Chartered Bank (Singapore).

Non-Singaporeans in other parts of the world often need to go through a local branch.

Once you meet the eligibility criteria, you can proceed to apply by applying through the online banking platform (only applicable for those with online banking access and single mandate account apps).

For applicants who do not have Internet Banking access, or if you are applying for an Online Co-operative Trading account, you will be required to submit a duly completed copy of the application form (available for download on the SC Online Trading website) at any SC branch.

As part of the online trading account application process, customers are also required to complete a Common Reporting Standard (CRS) form.

In case you are already in the bank waiting for your turn, just note that after completing the administration at the branch, you will have to wait several weeks before the trading account is ready to trade.

How to set up your account? First of all you must have a saving account or a settlement account in different currencies.

To be able to start trading you must transfer money from your personal account to your saving account.

After you did the transfer, the next step is to transfer the money from the saving account to your settlement account, BUT this step must be completed through a ‘local transfer between personal accounts’ within Standard Chartered online banking.

The role of having a settlement account is really big. This is because Standard Chartered does not allow an action called contra-trading, which means you cannot just reserve a share and only pay a few days ago. You choose the share and pay immediately, this is the main rule of the bank.

In order you have any problems or issues with any kind of situation you can contact a customer support, which is very strong

First of all you can call Standard Chartered’s 24/7 Online Trading Hotline at 1800 242 5333 (local) or +65 6242 5333 (abroad). The only disadvantage here is that the customer support is only available from Monday to Friday.

- Standard Chartered Trading Platforms.

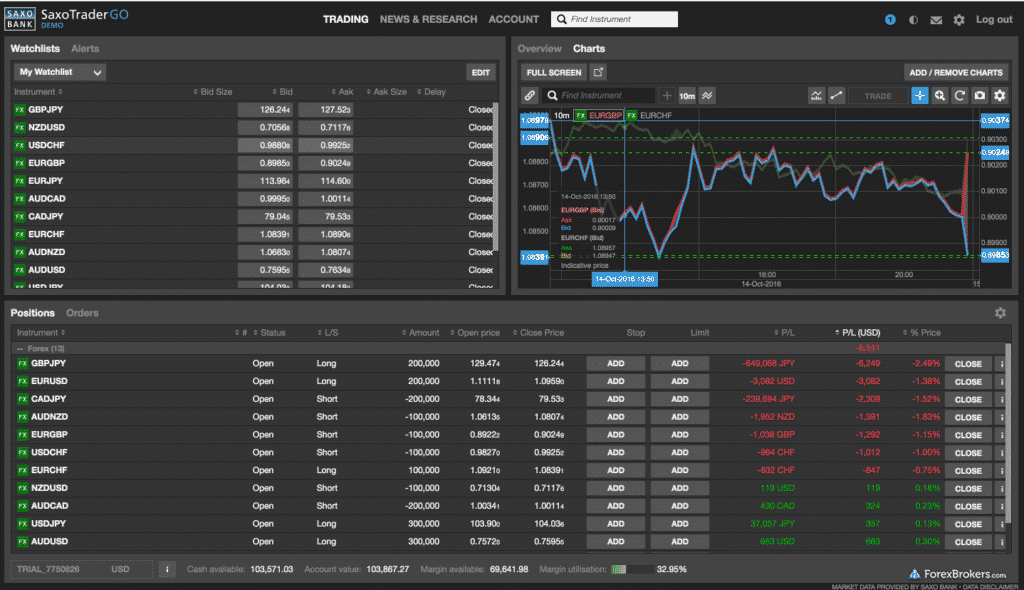

Standard Chartered suggests three different types of web trading platforms plus Mobile Trading Application, with different levels of development.

- Easy Trade – is a web-based application that allows users to access their accounts from anywhere and anytime. This makes it easier for users to trade on the BSE, NSE, FONSE and CDNSE. Users can also place orders for mutual funds, IPOS, promissory notes and bonds using the trading platform. Easy Trade platform has the ability to create customized market views and view reports such as historical trades, contract records, ledgers and other back office reports. Portfolio Tracking allows you to track your portfolio online. Payment transfers and withdrawals can also be done instantly, and there is also the option to block shares for trading and to provide margin.

- Advance Trade – is a more advanced version of the web based trading platform. In addition to the Easy Trade features, it provides streaming quotes with an automatically customizable market view. The platform is also equipped with the advanced Market Trendz tool. It can be used for various research, resistance and script support levels, moving average and block information about transactions.

- Super Trade – is a highly advanced trading platform. In addition to the great features of other web platforms, it can be customized to suit the needs of traders. The platform monitors market movements and transmits daily, daily and weekly charts. It also allows traders to set script alerts.

Mobile Application SC Online Trading

Standard Chartered’s mobile application, SC Trading, is a simple and user-friendly application. It can be used to access your account anywhere anytime. The mobile application can be used to trade the stock, derivatives and foreign exchange markets.

Users set up market surveillance and receive live script updates right on their mobile phones. The app also makes easy post-sale order placement and cross-segment funds transfers.

Here are some of the main features offered in the mobile trading app:

- Market Watch to quickly monitor specific stocks and asset classes

- Regulations for the Order Book, Trade Book and Net Position

- Modification and cancellation of an order is allowed

- Allocation / redistribution of shares between segments is allowed

At the same time, Standard Chartered clients also expressed little concern:

- There is good room for improvement in the user interface,

- limited features are provided,

- application performance can be an issue for multiple users.

- Trading shares as CDF.

CFDs (or “Contract for Difference”) are a way to trade instruments such as stocks without having to own the stock. Here are some of the pros and cons of trading CFDs versus using traditional brokerage services.

Benefits:

The main advantage of a CFD broker is the leverage they offer their clients. This means that the trader will require much smaller account sizes compared to trade size compared to a traditional stock broker.

CFD brokers allow traders to take long or short positions, which means that the trader can benefit from the rising and falling markets.

CFD brokers usually do not charge a commission and instead, their commission is included in the spread.

CFD brokers like AvaTrade, which offer the MT4 platform, allow clients to use advisors to automate their trading strategies.

British shares purchased as CFDs are not responsible for the normal 0.5% stamp duty payable on traditional purchases of shares (please note that tax laws are subject to change and depend on individual circumstances).

Unlike traditional brokers that only offer stock trading, CFD brokers such as LCG provide access to a wide range of instruments such as stocks, commodities and currencies.

Minuses:

Leverage is a double-edged sword that can magnify both gains and losses. And, as with all trading, traders risk the markets moving against them.

CFD brokers usually charge per night for long positions overnight. Basically, it is the cost of borrowing money from a broker to buy stocks at margin. If you closed the position on the same trading day, there would be no overnight fee. Hence, this will only be a disadvantage if you are not a day or intraday trader.

- Main Features the company offers.

Let me present the main and the most important features and advantages that the company offers to its customers.

- A wide range of global markets. Quickly and conveniently browse and search for the stocks you need on 15 exchanges around the world.

- Several types of orders. Choose the way to execute a trade with such order types as Stop Loss orders, Limit orders, etc.

- Latest market news. Make more informed trades with the latest market news available after logging into your trading account.

- Page setup. Customize the page layout according to your preference. Customizable features include, but are not limited to, landing page, alert configuration, font settings, and search filter.

- Order notifications. Receive instant order confirmation by email or SMS.

- ETF selection tool. Filter ETFs available for online trading effortlessly.

- Stock analysis tools. Take advantage of technical and fundamental stock analysis tools to analyze market movements and identify entry or exit points to the market.

- Profit and loss calculator. Get clarity on all fees and charges for your trade to calibrate your target buy / sell prices.

- 128-bit SSL encryption. All information exchanged on secure pages is encrypted to protect your data from being tampered with before being sent to the Standard Chartered server.

- Two-factor authentication (2FA). Your trading account is protected from unauthorized access through two levels of identity verification – your login and password, and a one-time password (OTP) generated from your security token or sent to your registered mobile phone number.

- Standard Chartered Online Trading Pricing and Fees.

Unlike many of its competitors, Standard Chartered charges a flat fee based on your banking relationship when you trade on its platform.

Literally the percentage of the commission depends on in what segment you are trading. So if you are in a minimum commissions segment, the SGX commissions will be equal to $10. From here the numbers are rising, don’t be surprised. If you a Priority Banking client, the SGX commission will be 0.18% and the commission of other markets will be 0.20%. The next and the last one, if you are a personal banking client, SGX fees will be 0.20% and the other market fees – 0.25%.

All transactions are also subject to CDP clearing fees (0.0325%), SGX trading fees (0.0075%), SGX settlement instruction fees ($ 0.35 per contract) and GST. Check the payment schedule listed on the Standard Chartered Online Trading website.

- The best and the worst.

Here I want to talk about the most important best and worst sides of the company that will make people either become a loyal customer or just ignore this bank.

It may sound trivial, but the Standard Chartered login token is one of the best users have used so far.

Unlike other keys you get from other banks, the Standard Chartered login token is as thin as the card. It’s the same thickness as any business card (and possibly even thinner than a credit card), so the entry token can be easily inserted into your wallet without making it too thick.

According to many reviews, many people are obsessed with this and still see it as a big plus because you can use the login card without telling anyone that you are a customer with a standard diploma, unlike these DBS / OCBC / UOB keys that many add as bright accessories to your wallets or phones.

Now it’s time for the negative. In short, the interface is outdated. It hasn’t changed over the years, although other competitors have been constantly updating it to get a sleek interface.

There are useful options for selling directly from your portfolio or buying more stocks that you already hold. This interface hasn’t changed since 2015 and it looks like there won’t be any major changes anytime soon.

The Standard Charter Trading Platform has never been able to test multiple stocks.

Yes, you can play with the chart and add all kinds of technical indicators you want. There are enough bells and whistles on this platform to do a thorough research.

But that old 32-bit interface just might turn you off. In fact, using the free Yahoo Finance and Google Finance pages, which have the same set of charts, an equal number of technical indicators, but with a much more attractive interface, is more pleasing to the eye.

It really says something when a search engine can look better than a professional trading platform.

- Customer Support.

Standard Chartered Securities provides its clients with exemplary customer service.

Customers can contact the company by toll-free number, email, or visiting a branch.

There is a 24/7 IVR that can be used to post trade requests and Demat accounts even after business hours. It can also be used to check the status of an application as well as check ledger balance and purchasing power.

There is also a dedicated NRIS helpline number. Clients have dedicated account managers.

You can contact the support team of this full-service stockbroker from 8:30 am to 5:30 pm on weekdays. On weekends and holidays, the broker does not provide any support.

The customer support quality is definitely good and even exemplary for many financial companies.

- Final Opinion about SC Online Trading.

In the US, large brokerage companies have already switched to cashless trading in stocks and any other instruments (except for futures). Robinhood is the new starter broker that brought about these changes.

This is not happening in Singapore yet. Hence, SCB is still quite competitive in terms of brokerage rates.

Standard Chartered is undoubtedly one of the cheapest broker to trade in Singapore at the moment.

SC Online Trading charges as little as 0.20% commission on all SGX trades (and only 0.25% on all other markets), while most brokerage firms in Singapore charge a tiered rate ranging from 0.18% (for transactions over $ 100,000) to 0.28% (traded below $ 50,000). This means that as long as each trade is less than $ 100,000, you will have a better rate with SC than other brokers.

But in order to charge such low fees, the SC Online Trading platform has compromised several trading features that you usually find in other brokerage companies.

Some salient features that the platform lacks are charting tools, advanced analysis and detailed daily market reports. Therefore, if you require access to these features to make better informed trading decisions, you may have to look elsewhere.

Overall though, they are trading on brand name, which is the worst aspect of all.

Further Reading

Utmost International Managed Capital Account Review analyzes customized investment approaches, akin to the digital trading insights of Standard Chartered Online Trading Review 2022.

Additionally, the article below looks at the best investment option for expats.