Hargreaves Lansdown, a top-tier Financial Conduct Authority (FCA) regulated UK broker, is well-known for its user-friendly web and mobile trading platforms, high-quality educational tools, and excellent customer service, making it a great choice for beginner investors.

While Hargreaves Lansdown’s trading fees for stocks and ETFs are on the higher side, it offers low fees for funds and bonds, and there are no inactivity or withdrawal fees for a standard Fund & Share account.

The annual fees for SIPP and ISA accounts are capped, which means they can’t exceed a certain amount annually, a beneficial feature for long-term investors.

However, it’s important to note that Hargreaves Lansdown only offers GBP accounts, which might pose a challenge for clients outside the UK, as the account opening process is not fully digital for them.

When moving abroad, managing your investment portfolio becomes a critical task. This guide will help you understand the implications of moving your Hargreaves Lansdown shares and ETFs to another country.

If you want to invest as an expat or high-net-worth individual, which is what i specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Table of Contents

Understanding the Implications of Moving Abroad with Your Investments

Tax Considerations and Implications

Residency Status and Tax Liability

Moving abroad can lead to complex tax situations, especially for American expats due to the U.S. taxing citizens based on citizenship, not residency.

This means American expats might have to pay taxes both in their new country of residence and to the U.S., including taxes on capital gains, interest, rental, and ordinary income.

The Foreign Tax Credit and tax treaties between the U.S. and other countries can mitigate double taxation.

The Foreign Earned Income Exclusion allows U.S. citizens abroad for a significant time to exclude a portion of their foreign earnings from U.S. taxes.

It’s essential to consider state tax requirements as well, as some states aggressively collect taxes regardless of how long you spend abroad.

Capital Gains Tax and Inheritance Tax

Capital gains tax and inheritance tax are significant considerations when moving shares and ETFs held with Hargreaves Lansdown to another country.

The tax rates and regulations vary significantly between countries, and understanding these differences is crucial to making informed decisions about your investments.

Exchange Rate Fluctuations and Its Impact

The value of the U.S. dollar, being the currency of the world’s largest economy and the dominant reserve currency for central banks globally, influences global economic conditions, investment, debt servicing, and inflation.

The dollar’s value can significantly affect investments, especially if they are denominated in a currency other than the investor’s local currency.

The rise of the dollar in 2022, driven by factors such as interest rate differentials and the strength of the U.S. economy, had wide-reaching implications, including increased import costs and heightened financial pressures for businesses and consumers outside the U.S.

However, trends indicate a potential decline of the dollar in 2023, though exchange rate volatility is expected to remain high.

Legal Restrictions and Compliance in Different Countries

Legal compliance and understanding investment regulations are crucial when moving abroad. Different countries have various laws and regulations governing overseas investments.

For instance, the Indian government issued new Overseas Investment Rules in 2022 to simplify the existing framework for overseas investment and reduce the need for specific approvals.

These rules cover operational requirements and provide guidance on compliance for investors. Significant changes include enhanced clarity on definitions, introduction of the concept of “strategic sector,” and changes in approval requirements for certain investment activities.

Step 1: Assessing Your Current Portfolio with Hargreaves Lansdown

When you plan to move abroad, the first critical step involves thoroughly evaluating your investment strategy with Hargreaves Lansdown. This assessment should consider the latest market trends and forecasts for 2023.

Notably, Hargreaves Lansdown experts predict that while inflation rates may stabilize, they are expected to remain high, impacting investment returns and purchasing power.

Additionally, the global energy market remains volatile, influenced by geopolitical tensions and fluctuating demand.

In this context, you should review your portfolio’s exposure to sectors sensitive to these trends, such as energy stocks or inflation-linked bonds.

It’s also crucial to reassess your risk tolerance in light of these developments, as heightened market volatility might necessitate a more conservative approach or, conversely, present new growth opportunities.

Moreover, consider how changes in mortgage interest rates might impact your property investments or real estate funds, as a potential downturn in the housing market is anticipated.

Diversification and Risk Management

Effective diversification and risk management are vital in navigating the uncertainties of 2023. With predictions of fluctuating job markets and potential changes to the state pension age and policy, it’s important to diversify your portfolio across different asset classes and geographies.

This strategy helps mitigate risks associated with specific market segments or economies. Hargreaves Lansdown offers a range of investment options, including global equities, bonds, and funds, allowing you to spread your investments.

Evaluate the geographic and sectoral distribution of your assets, ensuring they align with your new living circumstances and financial objectives. Also, consider the impact of currency fluctuations on your investments, especially if your portfolio includes significant non-sterling denominated assets.

The Impact of Moving on Your Investment Goals

Moving abroad might shift your investment goals and time horizons. If you plan to purchase property or start a business in your new country, liquid assets might become more important.

Conversely, if you’re moving for retirement, your focus might shift towards income-generating investments.

Review your current holdings with Hargreaves Lansdown to ensure they align with these new goals. You may need to rebalance your portfolio, shifting from growth-oriented investments to more conservative, income-focused options, or vice versa.

Consider the implications of any tax changes due to your relocation and how they might affect your investment choices.

Step 2: Navigating the Transfer Process

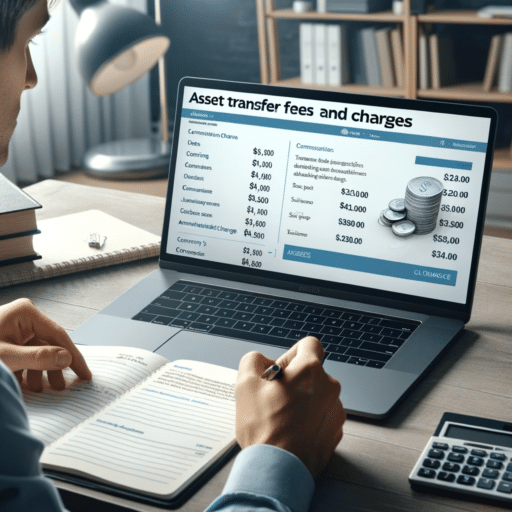

When transferring assets from Hargreaves Lansdown, it’s essential to understand the associated fees and charges.

Hargreaves Lansdown’s fee structure is varied: for U.S. stock transactions, the fees are tiered based on the number of trades, with costs ranging from £11.95 to £5.95 per trade.

For investments in technology funds, a tiered annual fee based on the total volume held applies, decreasing as the investment size increases.

It’s also important to note that there are no inactivity fees with Hargreaves Lansdown. However, when dealing with different currencies, a currency conversion fee applies, which is tiered based on the amount, ranging from 1.00% to 0.25%.

Understanding these fees will help you make informed decisions about whether to transfer in-specie or liquidate your holdings.

Choosing Between In-specie Transfer and Liquidation

In-specie transfers involve moving your investments as they are, without converting them to cash. This method preserves your current market positions and avoids potential sell-off impacts.

However, consider any transfer fees and the compatibility of your current investments with the regulations and tax structures of your new country.

Impact of Liquidation on Your Portfolio

Alternatively, liquidating your portfolio converts your investments into cash, which can then be transferred and reinvested.

This option might be simpler but could incur capital gains tax and potentially miss out on market gains during the transfer process. It’s also important to remember that Hargreaves Lansdown does not charge withdrawal fees, which could make liquidation a more cost-effective option in certain scenarios.

Step 3: Selecting a Suitable International Broker

When moving shares and ETFs from Hargreaves Lansdown to an international broker, it’s crucial to thoroughly research your options.

Start by identifying brokers who offer access to the specific international markets you’re interested in. Major exchanges in Europe and Asia and emerging markets worldwide are key considerations.

Also, evaluate each broker’s expertise in dealing with clients moving abroad from platforms like Hargreaves Lansdown.

Look for brokers experienced in handling such transitions, ensuring they understand the unique challenges and opportunities that come with international investing.

Consider the broker’s reputation, reliability, and the range of services offered. A broker with a strong track record, positive user reviews, and comprehensive services can be a more reliable choice for managing your investments abroad.

Comparing Fees, Services, and Regulations

Understanding and comparing fees, services, and regulations is a critical step. International brokers often charge various fees, including trading fees for foreign stocks, which are typically higher than for US-listed stocks and ETFs.

These fees can vary significantly between brokers and may include foreign transaction fees, currency conversion fees, and possibly inactivity fees.

Services are equally important. Assess the range of tradable assets offered by the broker, as you might want to diversify beyond stocks and ETFs.

Many brokers provide options to trade bonds, mutual funds, forex, and even cryptocurrencies. Regulations and compliance are crucial, especially when moving from a UK-based broker like Hargreaves Lansdown.

Ensure that the international broker complies with the regulatory standards of both the country you’re moving to and the UK. This compliance is essential for the safety and legality of your investments.

The Importance of a User-Friendly Platform

The platform’s usability plays a significant role in your trading experience. Opt for brokers that offer user-friendly platforms, which include web, desktop, and mobile trading options.

The ease of use is particularly important if you are not a seasoned trader. Platforms should be intuitive, straightforward, and offer real-time market data to facilitate informed trading decisions.

Additionally, evaluate the broker’s portfolio management tools and resources for reporting and tracking investment performance.

These tools are vital for effective management and reporting of your investments, especially during the transition from Hargreaves Lansdown. Lastly, don’t overlook the importance of customer support.

Trading in foreign markets can be complex, and reliable customer support can greatly ease the process. Check the availability and responsiveness of the broker’s support team, especially in handling queries related to international transfers from Hargreaves Lansdown.

Step 4: Executing the Transfer

Transferring your investments from Hargreaves Lansdown to a new broker when moving abroad requires careful coordination. The first step involves initiating the transfer process through Hargreaves Lansdown’s online platform.

You need to have the account reference or client ID of your current provider ready. This process allows for the transfer of both stock and cash held in accounts to the Hargreaves Lansdown platform.

It’s crucial to ensure that all individual investments transfer exactly as they are, maintaining the integrity of your portfolio during the transition.

As part of this coordination, you must also engage with your new broker. This involves setting up an account (if you don’t have one already) and informing them of the impending transfer.

It’s essential to provide your new broker with all relevant information about your investments with Hargreaves Lansdown, including the types of assets, quantities, and any specific instructions for the transfer.

Timing the Transfer for Optimal Tax Efficiency

Timing the transfer of your investments is crucial for tax efficiency. You should consult with a tax advisor to understand the implications of transferring your assets, especially if you’re moving to a country with different tax laws.

The transfer can be executed as either a stock transfer, where you stay invested throughout the process, or a cash transfer, where your investments are sold and potentially re-bought, which might have tax implications.

Consider the tax year and any capital gains that may be realized during the transfer. Also, remember that not all investments transfer at the same time; some holdings might arrive in your new account before others, and cash is typically transferred last. This staggered approach can have tax implications, so plan accordingly.

Handling Currency Exchange and Transfer Fees

When transferring investments internationally, you’ll encounter currency exchange considerations and potentially transfer fees.

Hargreaves Lansdown does not charge for transfers, but your current provider might. Additionally, if they need to sell any holdings before the transfer, this might incur dealing charges.

Always check for potential exit fees or any loss of benefits or guarantees when transferring. Regarding currency exchange, the rates can significantly affect the value of your transferred assets.

It’s wise to monitor exchange rates and plan the transfer when conditions are favorable.

Also, be aware of any currency conversion fees that might be applied by either Hargreaves Lansdown or your new broker. These fees can vary, so it’s important to understand them in advance.

Step 5: Adjusting Your Investment Strategy Post-Move

Re-evaluating Your Financial Goals in a New Context

When you move abroad, it’s vital to reassess your financial goals due to changes in your living circumstances, which might include a higher cost of living or different investment opportunities in your new country.

For Hargreaves Lansdown clients, this means taking a fresh look at their investment portfolios. Changes in tax and regulatory environments can greatly impact the performance and viability of your investments.

For instance, you may face higher taxes on investment income or different capital gains taxes than in your home country.

Additionally, your risk tolerance and investment goals may shift as you adapt to your new surroundings.

It’s crucial to align your Hargreaves Lansdown investments with these new objectives, possibly requiring a shift in asset allocation or the exploration of new investment vehicles more suitable to your current situation.

Adapting to Market Differences and Opportunities

Moving abroad opens the door to unique investment opportunities, but it also comes with challenges such as currency fluctuations, political and economic stability concerns, and different regulatory environments.

For Hargreaves Lansdown clients, adapting to these market differences is key. Currency fluctuations can significantly affect the value and purchasing power of your investments.

It’s essential to understand how the currency exchange rates in your new country will impact your investment returns.

Additionally, the political and economic stability of the country can influence the performance of your investments.

Hargreaves Lansdown clients need to stay informed about local market trends and investment products, possibly adjusting their portfolios to include local stocks, bonds, or funds that align with the economic dynamics of the new country.

Continuous Monitoring and Rebalancing

Continuous monitoring and rebalancing of your investment portfolio are critical, especially after moving abroad. Hargreaves Lansdown clients should regularly review their portfolios to ensure alignment with their revised financial goals and risk profile.

This might involve diversifying investments across various asset classes, industries, and geographic regions to mitigate risks specific to any market.

Additionally, staying informed about local regulations and tax policies is crucial. This knowledge helps in optimizing tax efficiency and ensuring compliance with local financial regulations.

Regular portfolio assessments allow for timely adjustments to maintain a desired asset allocation and respond to market changes effectively.

Conclusion

Adjusting your investment strategy post-move involves a comprehensive review of your financial goals, adapting to new market conditions, and continuously monitoring and rebalancing your portfolio.

Hargreaves Lansdown clients should consider these steps to ensure their investments remain aligned with their current needs and objectives in the new country.

Given the complexities involved, it’s highly advisable to consult with a financial advisor who specializes in international investments for personalized guidance and to navigate the unique challenges of investing abroad effectively.

This approach ensures that your investments continue to support your financial goals while you adapt to life in a new country.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.