Investments in Qatar for foreigners offer a diverse range of opportunities for individuals looking to grow their portfolios in a thriving economy.

In this comprehensive guide, we will explore the top seven investment avenues in Qatar and provide insights into each option. Whether you’re interested in real estate, stock market investments, infrastructure projects, tourism and hospitality, renewable energy, or startup ventures, Qatar has something to offer. Let’s delve into each of these investment options.

If you have any questions or want to invest as an expat or high-net-worth individual, you can email me (advice@adamfayed.com) or use these contact options.

Real Estate Investments in Qatar for Foreigners

Investments in Qatar for foreigners often revolve around the real estate sector, which offers a booming property market and favorable investment regulations. Foreigners are permitted to own freehold properties in designated areas, making real estate an attractive proposition for investors.

Residential Properties

Investing in residential properties in Qatar presents an excellent opportunity for long-term capital appreciation and rental income. The country’s growing population and influx of expatriates contribute to a robust demand for housing, ensuring a steady stream of potential tenants.

Foreign investors looking to enter Qatar’s residential real estate market can consider areas such as The Pearl-Qatar, West Bay, and Lusail City. These locations are renowned for their luxury properties, high rental yields, and desirable amenities. Conducting thorough market research is crucial to understand market trends, property values, and rental rates. Additionally, it’s advisable to seek assistance from reputable real estate agents who specialize in the Qatari market. They can provide valuable insights, guide you through the purchasing process, and ensure you make informed investment decisions.

Commercial Properties

The commercial real estate sector in Qatar is experiencing significant growth, fueled by the country’s ambitious development plans and diversification efforts. Investing in commercial properties such as office spaces, retail outlets, and warehouses can be highly lucrative.

Qatar’s vibrant business environment and the presence of multinational corporations contribute to a steady demand for commercial spaces. The country’s strategic location, world-class infrastructure, and business-friendly policies make it an attractive destination for companies looking to establish a regional presence.

Before venturing into the commercial real estate sector, it’s essential to familiarize yourself with local regulations, lease agreements, and potential tenant profiles. Understanding the specific requirements and preferences of commercial tenants is vital for maximizing returns on your investment. Working with reputable real estate agencies that specialize in commercial properties can provide valuable guidance and help you navigate the intricacies of the market.

Stock Market Investments

Investments in Qatar for foreigners extend to the stock market, offering an opportunity to participate in the country’s economic growth and capitalize on its thriving capital market. The Qatar Stock Exchange (QSE) serves as the primary platform for stock trading in Qatar and welcomes foreign investors.

Qatar Stock Exchange (QSE)

The Qatar Stock Exchange (QSE) is a well-regulated and transparent stock exchange that lists a wide range of companies across various sectors. It plays a crucial role in Qatar’s financial landscape and provides a platform for investors to buy and sell shares of publicly traded companies.

Investing in Qatari stocks through the QSE can yield potential capital gains and dividends, allowing investors to benefit from the country’s economic development. By investing in the local stock market, foreigners can actively participate in Qatar’s growth story.

To make informed investment decisions in the Qatari stock market, it is essential to stay updated on sector-specific trends and closely analyze company fundamentals. This involves monitoring financial reports, industry news, and market indicators. Seeking guidance from financial advisors who specialize in Qatari markets can provide valuable insights and help navigate the intricacies of the local stock exchange.

Exchange-Traded Funds (ETFs)

Exchange-Traded Funds (ETFs) offer a convenient investment option for foreign investors seeking diversification and exposure to multiple Qatari stocks. ETFs pool investments from multiple individuals and track specific indexes, sectors, or themes.

In the context of investments in Qatar for foreigners, Qatar-specific ETFs are available that provide exposure to the QSE and prominent sectors within the country. These ETFs allow investors to gain broad market exposure without the need to directly purchase individual stocks.

One of the advantages of investing in ETFs is the liquidity they offer. As ETFs are traded on the stock exchange, investors can buy and sell shares throughout the trading day at market prices. This flexibility provides ease of trading and allows investors to react to market conditions efficiently.

Additionally, ETFs offer diversification benefits by encompassing a basket of securities. By investing in Qatar-specific ETFs, investors can spread their risk across multiple companies and sectors, reducing the impact of individual stock fluctuations.

Both novice and experienced investors can consider ETFs as part of their investment strategy in Qatar. However, it’s important to conduct thorough research and understand the composition and performance of the specific ETFs available in the market. This includes analyzing the underlying indexes or sectors tracked by the ETFs, expense ratios, historical performance, and any associated risks.

Infrastructure and Construction Projects: Lucrative Opportunities for Foreign Investors

Investments in Qatar for foreigners have found a promising avenue in the country’s ambitious infrastructure projects. With its rapid development and visionary plans, Qatar offers lucrative opportunities for those looking to invest in the construction and infrastructure sectors.

Infrastructure Development Initiatives

Qatar’s commitment to transforming its infrastructure is driven by the goal of becoming a global hub for business, tourism, and sports. The country’s strategic location as a regional hub and its emphasis on diversifying its economy have paved the way for significant infrastructure investments.

Qatar’s strategic location in the Middle East, along with its growing trade volumes, has fueled the expansion of ports and airports. The country aims to bolster its logistics capabilities to facilitate the movement of goods and people. Foreign investors can explore opportunities in port expansions, airport developments, and logistics facilities to capitalize on the increasing demand for transportation and trade services.

Transportation and Logistics: A Promising Sector

Qatar’s strategic location as a regional hub, situated between Asia, Africa, and Europe, positions it as an attractive investment destination in transportation and logistics. The government’s proactive approach in developing world-class transportation infrastructure and expanding logistics facilities further strengthens this sector’s appeal.

Investing in logistics companies and related services offers foreign investors steady income streams and potential capital appreciation. Qatar’s growing trade volumes, increasing imports and exports, and the country’s role as a regional logistics hub contribute to the sector’s promising outlook.

Foreign investors can explore opportunities in areas such as freight forwarding, supply chain management, warehousing, and customs clearance. By establishing partnerships with local logistics players or investing in startups focusing on innovative logistics solutions, investors can tap into the growing demand for efficient and reliable logistics services.

Qatar’s commitment to enhancing its transportation infrastructure provides investment opportunities in areas such as roads, rail networks, and public transportation systems. The country’s extensive transportation projects aim to improve connectivity, reduce travel time, and enhance the overall transportation experience for residents and visitors alike.

Investors can consider investing in road and rail construction projects, urban transport systems, and innovative transportation solutions. Collaborations with local construction companies and infrastructure developers can help navigate regulatory frameworks and ensure successful project execution.

Government Initiatives and Partnerships

To identify viable investment avenues, it is crucial for foreign investors to stay updated on government initiatives, expansion plans, and potential partnerships in Qatar’s infrastructure and construction sectors. The Qatari government actively encourages foreign investment through various incentives, streamlined regulations, and public-private partnerships.

Qatar has embraced the concept of public-private partnerships (PPPs) to accelerate infrastructure development. Through PPPs, the government collaborates with private entities to finance, construct, and operate infrastructure projects. Foreign investors can explore PPP opportunities, particularly in sectors such as transportation, utilities, and social infrastructure.

The Qatari government has launched several initiatives to attract foreign investment in infrastructure and construction projects. These initiatives include creating investor-friendly regulations, offering tax incentives, and providing favorable financing options. By keeping abreast of these initiatives, foreign investors can take advantage of the favorable investment climate and maximize their returns.

Tourism and Hospitality: Unlocking Investment Potential

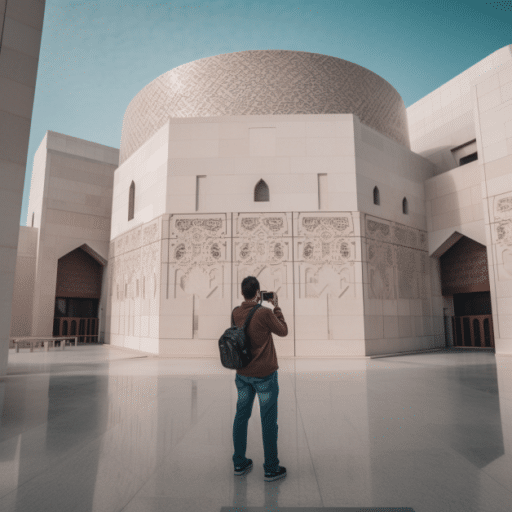

Qatar’s tourism industry has experienced significant growth in recent years, driven by the country’s vision to become a leading destination for both leisure and business travelers. With the upcoming FIFA World Cup 2022 and numerous other major events, the demand for hospitality services has soared, creating substantial investment potential for foreigners looking to capitalize on Qatar’s thriving tourism sector.

Hotels and Resorts: Meeting the Rising Demand

The influx of tourists and business travelers necessitates a robust hospitality infrastructure. Investing in hotels and resorts allows foreigners to tap into the increasing number of visitors seeking accommodation options in Qatar.

When considering hotel investments, popular areas such as West Bay, The Pearl-Qatar, and Souq Waqif stand out as prime choices. These locations offer proximity to key attractions, business districts, and amenities, making them highly desirable for both leisure and business travelers.

Location plays a crucial role in the success of hotel investments. Proximity to airports, major transportation hubs, and tourist hotspots enhances the appeal of a property. Additionally, considering brand reputation and the latest tourism trends can help investors make informed decisions about potential investments.

Tourism-Related Services: Diversifying Investment Portfolios

Beyond hotels and resorts, Qatar presents various investment opportunities in tourism-related services. These include ventures such as tour operators, travel agencies, cultural experiences, and unique attractions.

Qatar’s rich cultural heritage and its focus on creating memorable experiences for visitors make it an ideal destination for investments in tourism-related services. Collaborating with local partners who have a deep understanding of the market can provide valuable insights and enhance the potential for success.

Investing in tour operators allows foreigners to cater to the growing demand for curated travel experiences and unique itineraries. By offering specialized tours that showcase Qatar’s cultural and natural treasures, investors can tap into the increasing interest in experiential travel.

Similarly, investing in travel agencies can help meet the needs of visitors seeking assistance with booking flights, accommodations, and organizing their travel itineraries. Collaborating with local agencies and leveraging their expertise can provide a competitive advantage in this sector.

Moreover, Qatar’s emphasis on developing unique attractions and cultural experiences opens up investment possibilities in ventures such as museums, art galleries, entertainment venues, and culinary experiences. These offerings not only contribute to Qatar’s tourism appeal but also provide potential for profitable returns on investment.

Foreign investors can leverage Qatar’s position as a regional travel hub, with Hamad International Airport connecting numerous international destinations. Qatar’s strategic location and excellent air connectivity position it as an ideal gateway for visitors exploring the Middle East and beyond.

Renewable Energy: Expanding Qatar’s Sustainable Future

Qatar’s commitment to sustainable development and renewable energy opens up compelling investment opportunities for foreigners. The country recognizes the importance of diversifying its energy mix and reducing reliance on fossil fuels. Investing in renewable energy in Qatar not only offers potential financial returns but also contributes to a greener and more sustainable future.

Solar Energy: Harnessing the Power of the Sun

As part of its sustainability goals, Qatar has been actively investing in solar power projects to tap into the abundant solar resources available in the region. Solar energy offers a clean and renewable source of power, aligning with Qatar’s vision of reducing carbon emissions and environmental impact.

Investing in solar farms, infrastructure, or solar energy companies can provide stable income streams for foreign investors. Qatar’s favorable investment climate, government incentives, and supportive policies make it an attractive destination for renewable energy investments.

Government Incentives and Regulatory Frameworks

Qatar’s government has implemented a range of incentives to encourage renewable energy investments. These incentives include favorable feed-in tariff rates, tax incentives, and financial support for solar projects. Foreign investors can take advantage of these incentives to maximize their returns and mitigate risks.

Moreover, long-term contracts are offered to ensure stability and predictability for investors in the renewable energy sector. These contracts provide secure revenue streams, making renewable energy investments in Qatar more appealing for foreigners.

The regulatory framework in Qatar supports the development of renewable energy projects, ensuring a transparent and efficient process. The country’s commitment to sustainability is reflected in its regulations, which facilitate the establishment and operation of renewable energy ventures.

Sustainable Technologies: Driving Innovation and Investment

Qatar actively promotes research and development in sustainable technologies, creating investment opportunities in various sectors. Entrepreneurs and investors interested in energy efficiency, waste management, water conservation, and other green initiatives can explore Qatar’s innovation landscape.

By forming partnerships with local research institutions, startups, and government-backed initiatives, foreign investors can tap into the vibrant ecosystem of sustainable technologies. These partnerships provide avenues for investing in innovative solutions and technologies that address pressing environmental challenges.

Assessing Viability and Market Demand

When considering investments in sustainable technologies, it is crucial to assess the potential scalability, market demand, and long-term viability of the projects. Conduct thorough market research, evaluate the competitive landscape, and analyze the economic feasibility of the proposed investments.

Qatar’s focus on sustainable development and its ambitious goals in the renewable energy sector create a favorable market environment for investors. However, it is essential to stay informed about the latest developments, upcoming projects, and industry trends. Engaging with industry experts and consultants will help assess potential opportunities and make well-informed investment decisions.

Startups and Innovation: Unleashing Potential in Qatar’s Thriving Ecosystem

Investments in Qatar for foreigners extend beyond traditional sectors, as the country’s thriving startup ecosystem presents a wealth of opportunities for investors seeking high-growth ventures. With its supportive policies and a commitment to innovation, Qatar has become an exciting destination for those looking to capitalize on the dynamic startup landscape.

Qatar Science & Technology Park (QSTP): Nurturing Innovation and Entrepreneurship

At the heart of Qatar’s innovation ecosystem lies the Qatar Science & Technology Park (QSTP). Functioning as a catalyst for innovation and entrepreneurship, QSTP provides a conducive environment for startups to flourish. QSTP offers a range of support programs, state-of-the-art incubation facilities, and funding opportunities tailored to startups across various sectors.

Support Programs and Incubation Facilities

QSTP’s support programs are designed to equip startups with the necessary tools and guidance to succeed. These programs provide mentorship, training, and access to a network of experts and industry professionals. By actively engaging with these programs, entrepreneurs can enhance their business acumen, refine their strategies, and navigate the challenges of starting a company.

In addition, QSTP’s incubation facilities provide startups with fully-equipped workspaces, cutting-edge research infrastructure, and access to a collaborative community. The vibrant ecosystem fosters knowledge-sharing, cross-pollination of ideas, and potential collaborations, further fueling the growth and innovation of startups.

Funding Opportunities and Investment Landscape

QSTP recognizes the importance of financial support in fueling entrepreneurial ambitions. Through various funding initiatives, QSTP helps startups secure the necessary capital to scale their businesses. These funding opportunities include grants, seed investments, and access to venture capital networks.

Investments in Qatar for foreigners can be channeled into QSTP-backed startups, which undergo a rigorous selection process to ensure their viability and growth potential. By aligning your investment goals with the QSTP ecosystem, you can identify promising startups that resonate with your interests and investment strategy.

Investment in Technology Startups: Unleashing Qatar’s Technological Potential

Qatar’s technology sector is experiencing rapid growth, with startups emerging in key areas such as fintech, e-commerce, healthtech, and smart solutions. This surge in entrepreneurial activity presents enticing investment opportunities for those seeking high returns and groundbreaking innovations.

Assessing Market Potential and Scalability

Before investing in technology startups, it is crucial to assess the market potential and scalability of the business models. Conduct thorough market research, evaluate the competitive landscape, and analyze the startup’s value proposition. By actively assessing these factors, investors can make informed decisions and identify startups that have the potential to disrupt their respective industries.

Collaborating with Incubators, Accelerators, and Angel Investors

To navigate Qatar’s innovation-driven economy successfully, collaboration with incubators, accelerators, and angel investor networks is paramount. These entities play a pivotal role in nurturing startups, providing mentorship, and connecting them with potential investors.

By actively engaging with these support networks, investors gain access to a pipeline of promising startups, receive due diligence support, and tap into the expertise of experienced professionals. Furthermore, these collaborations foster a supportive environment that fosters growth and propels Qatar’s technological advancements.

Investments in Qatar for foreigners can contribute not only to financial gains but also to the overall development of the country’s startup ecosystem. By investing in technology startups, you play a crucial role in stimulating innovation, creating job opportunities, and shaping Qatar’s future as a knowledge-based economy.

Conclusion

Investments in Qatar for foreigners encompass a wide array of opportunities across real estate, stock markets, infrastructure projects, tourism, renewable energy, and startups. Qatar’s robust economy, favorable investment climate, and visionary development plans make it an attractive destination for investors seeking growth and diversification. Before making any investment decisions, conduct thorough research, seek professional advice, and stay updated on the latest market trends. By leveraging the unique advantages Qatar offers, you can navigate the investment landscape and potentially unlock significant returns.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.

I wanna becomes a rich so can u be my mentor on this because now I’m still studying and we have not have good life