This article will discuss what are the best investment options for UK expats living overseas, rather than non-British expats living in the UK, although there will be some commonalities in the analysis.

In particular I will focus on three options you have whilst living abroad

- Expats investment in your country of residence

- Investing back in the UK

- Investing in a third country meaning not in the UK or your country of residence.

Whilst it is impossible to speak about every country in the world, given the 180+ places where British expats reside, I will try to generalize, based on the evidence and my experience as a Brit living overseas.

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

Expats investment options in your country of residence

Regardless of whether you live in Spain, Dubai, Hong Kong or Singapore, you can do Expats investment in that country.

These options include local stock market investments, real estate and bank deposits. This section will go through each option:

Local stock market

If you are living in a place with a quality stock market, which has had 100-200 years of great performance, like the US Stock Markets, it makes sense to invest with a local brokerage firm.

Likewise, some countries, make it very difficult from a tax point of view to invest overseas. Again this is especially the case in the US where they make overseas investing tax inefficient for American tax resident.

So if you are a British tax resident in the United States, it almost always makes sense to invest locally, from a tax point of view.

In comparison, if you live in a place like China, Colombia or any other place with a stock market which is quite unstable, you are taking a lot more risks investing locally.

I met so many British expats whilst I lived in China, that got caught up with the whole “China growth story“, forgetting that GDP and stock market growth aren’t connected.

It is of course possible to have a brokerage account in country A, and it is focused on investing in stocks in country B.

For example, you can open up an investment account in most countries, which allows you to trade on the US, UK and Mainland European stock markets.

The problem with this is if the investment platform or brokerage is too localized, it might not allow you to continue to invest if you leave that country.

As an expat, especially if you are moving from country to country, it makes sense to have a portable option, which can ensure that your accounts continue to function if you leave the country.

Not only that, but unless you are living in a 0% capital gains environment, you can be hit by very high taxes, if you automatically invest in your country of residence.

Investing Option 1: Real estate in the UK

Another option is local real estate in the UK. In general, this makes sense if you plan to stay in that location long-term.

In effect, this means using the house as a home, rather than as a pure investment.

In terms of pure rental properties, there are obvious risks involved with buying an illiquid asset which can be hard to sell, in a non-English language environment.

This is the case for British expats, unless you are living in a native English language environment.

In addition to that, valuations have moved upwards in the last 10-15 years in most emerging markets, relative to the UK housing market.

Before 2007-2010, you got huge discounts buying in emerging markets, to compensate you for that risk.

These days, some emerging market property, is more expensive than back home in the UK.

Some of the more developed markets overseas have also increased in value relative to back home.

Investing Option 2: Banking in the UK

We all need to bank for daily needs,so having a banking in the UK can make sense, and indeed is often automatically set up by HR departments if you get a job overseas.

Again though, there are considerable benefits of banking with third country solutions rather than banking in the UK.

These include, greater choice in terms of currency, and ease in getting money out of countries.

Many expats in China, Vietnam and other places where sending money overseas can be difficult, are well served if they can get a proportion of their money paid to a bank account in Hong Kong or elsewhere.

In general, bank deposits aren’t an investment though. In almost every country in the world, bank deposits either pay below inflation or if they pay more, you are taking a big risk keeping your money in that currency.

It is true that you can get 10% or more banking locally in some emerging markets, but the currency and inflation risks are huge.

Expats Investing in the UK

This section will discuss options for investing in the UK as an expat living overseas.

Expat Investment Option 1: UK stock market investments and ISAs

You can send money home to the UK, and indeed this makes sense, if you are only on a short-term assignment lasting a few months.

However, if you are a permanent expat, there are several disadvantages to this.

The main drawbacks are that there aren’t the same tax benefits as for UK residents.

ISAs are not allowed for expats, so your gains can get taxed considerably.

Added to that, it can complicate your tax situation in extreme cases. The UK tax authorities HMRC, now have a “ties” test.

In effect, the more ties you have to the UK (family, businesses, real estate, pensions etc) and the more days you stay in the UK, you could be considered tax resident in the UK, even if you don’t live locally.

In other words, the days of being automatically considered non-resident for UK tax purposes because you spend less than 90 days a year locally, is gone.

Whilst this is a small risk, many UK expats have also said that countless British banks and stock broker have also questioned why they are continually sending money back to the UK, despite living overseas.

Often times, they have been asked for anti-money laundering documents, like pay slips, to prove where the money has came from.

These brokers and banks, are in turn, sometimes legally required to inform HMRC of these money movements as well, if the transfers exceed a certain amount.

That doesn’t mean you are doing anything wrong, legally speaking, by sending considerably amounts of money to a UK bank or stocks and shares account as an expat, but merely that it can make your life more complicated.

Expat Investment Option 2: UK real estate

Many British expats are interested in rental properties in the UK. This has became significant more difficult as the years have gone on as I mentioned in this article.

The issues are now that the UK government has progressively made it more tax inefficient for a non-resident, including a UK expat, to buy property.

Only a matter of months ago, the Conservative and Labour Party both went into the 2019 election, pledging more taxes on overseas buyers.

Added to that, you have the issue of more mortgage lenders refusing to give mortgages to expats.

It is still possible to get expat mortgages.

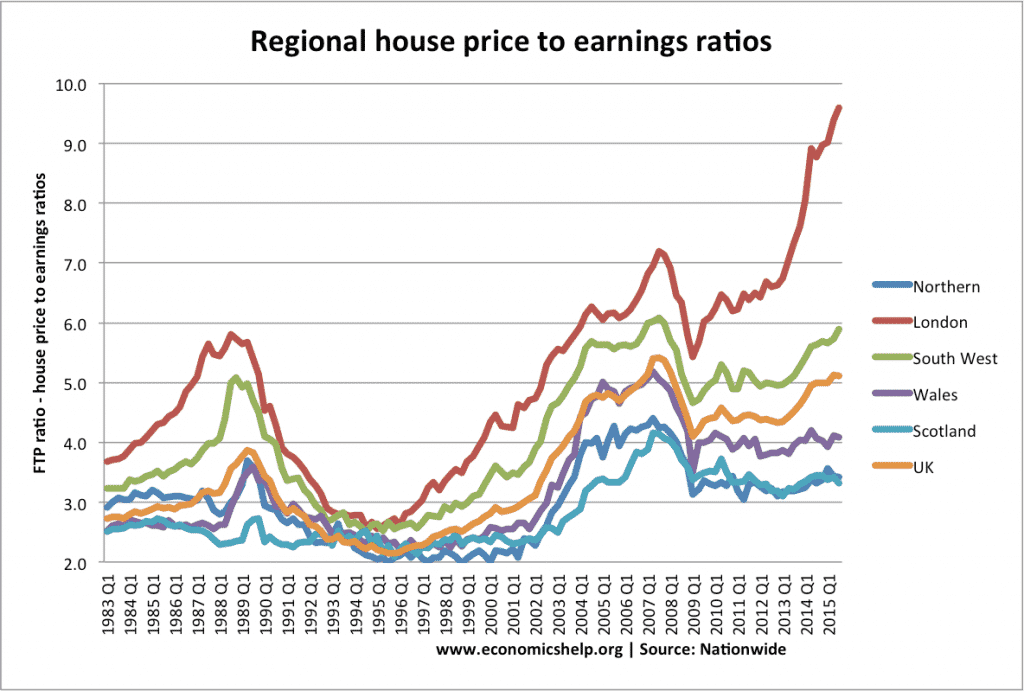

With that being said, valuations in the UK are better these days, relative to other markets.

This is especially the case in the North and Midlands, where property prices remain lower than 15 years ago, adjusted for inflation, as per the chart below

So if you can find an excellent buy, buying a UK property isn’t the worst option.

It is merely just much more difficult compared to the past, to do it profitably.

Expat Investment Option 3: UK bank deposits

As per the section on UK stock brokers, it doesn’t usually make sense to send large amounts of money to a UK bank account.

Small amounts of money to pay bills is a different matter of course. It also makes sense to at least keep UK bank accounts open, with small balances, in case you ever return to the UK.

This also allows you to keep a UK “correspondent address” whilst living overseas.

Investing in a third country

This section will discuss investing in a third country, meaning neither the UK or your country of residence.

Examples of third countries could include Luxembourg, Isle of Man (technically part of the UK but with different regulatory environments), Bermuda and any other 0% capital gains country.

International stock market investing from a third country

There are many advantages to expats investing with a third country solution.

The main one is having an expat focused account in Isle of Man, Bermuda, Luxembourg or another popular jurisdiction for people living overseas, is tax-efficient and more likely to be portable.

By portable I mean that as many international providers are specialised in the expat market, they allow customers to simply update their details online, if they move from country A to country B.

The only exceptions tends to be if you move to the US, or a country which is under US-sanctions, like Iran or Venezuela, which isn’t the case for 99% of British expats.

From a tax point of view, it is quite essential to be invested in a 0% capital gains environment as well.

Taxes on capital gains can be hundreds of thousands or more, especially if you are a long-term investor.

Many people don’t consider how important taxes are to the cost equation, especially if they are only starting with a small investment.

Small monthly investments soon add up over the years though. The biggest reason stopping people from investing in the stock market is fear.

Typically after a negative news story about an election, virus or the economy, people worry and try to time the market – meaning decide when the best time to invest is.

This is almost impossible to do. At a recent client event, the Shark Tank (previous Dragons Den) star Kevin O’Leary admitted that he had tried and failed to time the markets:

If somebody worth an estimated $400million can’t do it, then very few people (if any) can.

International real estate

Buying property in a third country does have some of the same risks as investing in property in your country of residence.

It is still an illiquid assets, and you may be operating in a non-English language legal environment.

The increasingly high valuations in countless places, also makes this an increasingly risky option, unless you pick very wisely.

There are several benefits to buying in a third country. The main ones are you can “shop around” for the best deals.

You don’t need to pick America, Australia, Canada, Bulgaria, Romania or any other country.

You can merely speak to a property expat, look objectively at valuations and rental yields, and make your decisions, based on those factors.

In addition to that, there are many residence by property schemes. In other words, you can get a second residency, in return for property ownership.

This is especially popular for expats that have finished their work assignment but still want to live abroad.

Expat offshore bank account

Whilst it should be mentioned again that bank accounts shouldn’t be used as investments, having an expat bank account in a third country makes a lot sense.

There is a simple reason for this. If your banking provider knows that you are an expat, moving from country to country, you are less likely to have issues with account closures when you move on.

Best Investment Options for UK Expats: Final Thoughts

In general, it makes sense for expats to focus on “third country” options when it comes to investing and even banking as a UK expat looking for investment options internationally. This is especially the case for expats moving from country to country every few years.

The reasons are simple enough. It is usually more tax efficient and specialised in the expat niche.

The main exceptions to this rule are if you live in the United States, and/or you are only on a short-term expat assignment. If you are short-term, you are often still considered a UK tax resident in any case.

The fall in markets which has happened during March 2020, after the unexpected government shut downs globally, once again shows that nobody can predict stock markets. Therefore, having a long-term plan is always best, which you can follow, through thick and thin.

The recent interest rate increases will likely reverse in 2024, with interest rates falls expected.

Long-term, investing makes a lot more sense to keeping money in cash.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.

Further Reading

I am the most viewed writers on social media platform Quora for investing and personal finance, receiving over 218 million views in the last few years.

I regularly share answers from that platform on adamfayed.com. In the answers below, I answer the questions including:

- What does a beginner need to know in terms of investing in the stock market? More importantly perhaps, what things are often neglected by people new to investing.

- Is it possible to support yourself financially from a stock market investment portfolio? In other words, can you eventually stop working due to your stock investments? What do people get wrong when they think about “passive income”?

- If you want to become a millionaire investing in stocks, how much do you need to invest every month or year? Is it less or more than you might expect?

As a preview of the answers I have copied a section below:

The basics in any domain is key. If you want to get fit, the basics of good nutrition, exercise and posture is important.

The same is true in investing. It is a myth that you need to be very intelligent to be a good investor as the quote below says:

What people need is

1.Actually get started – 80% of success is just showing up. The same in investing. Just setting up that investing account sounds obvious, but it is key. Beyond that, simple tricks like investing one day after you are paid can increase how much you invest dramatically. Some studies have even shown that people are able to invest 3x more by investing at the start of the month, as opposed to at the end. Over time, how much you invest and for how long, will be even more important than compounded returns.

2.Time and patience – The easiest way to make money, with less risk, is to leverage time. Stocks are risky if you only hold them for a year. Even some of the bets ETFs and indexes are. If you hold them for decades, they aren’t. Don’t confuse volatility and risk.

3. Be diversified. If you hold stocks and bonds together, it is even safer:

4.Basic knowledge at the very least – Or outsource the process to somebody that does have that knowledge. Plenty of people make the mistake of investing without knowing that much about it.

5. Nobody can predict the future – Now sure, countless people can get one prediction right. Some can even get many right. Plenty have an excellent run at predicting things. Over a 40–50 year period, however, it is very unlikely that you will beat the market by making moves based on listening to the talking heads on the media. Countless academic studies have shown that people can’t beat the market by listening to CNBC, Bloomberg and many other media outlets. At least on a long-term basis.

6. Emotional control – This is the most undervalued point. Most people think that the bets investors are the most knowledgeable ones. Yet a very emotional and super knowledgable person doesn’t do well in investing. Every time there is a crash, they panic sell. Even some PHDs in portfolio theory have been found to have broken their own rules in investing.

With the last point, what’s more important is nobody knows how they will react to a stock market crash until they experience one.

Back in early 2020, the stock market hadn’t really crashed in a big way since 2008.

I personally know so many people who “pledged” to me that they would never panic sell like those “idiots” (to use their words) in 2008.

Then 2020 came along, the media screamed this time is different like they always do, and many of those people panic sold.

Another part of emotional control is not getting too excited during the good times or too depressed during the bad times.

Most people look at a stagnant stock market and think it isn’t worth investing in.

Few people wanted to invest in the S&P500 in 1982 after 17 years of stagnation.

Likewise, few wanted to invest in it in 2010 after a “lost decade” . Yet after both periods, stocks went on long bull runs from 1982–2000 and 2009–2020.

Likewise, people shouldn’t be put off by the fact that some markets like the FTSE All Stars has underperformed the US markets in recent times.

To read more, click below:

This is some of the clearest advice out there – a godsend to confused expats such as myself so many thanks!!!! Can you recommend any specific providers of the “portable” third party country, 0% capital gains investment accounts for expats that you speak of above in this article?? As it’s difficult to uncover them online if you use the wrong words to search for them, which I think I am doing.

Hi Kristen – thanks for your message. I will email you.

One of the key things is if you want to DIY invest or use an advisor. Swissquote and Saxo Bank are fine for DIY investing.

Excellent post. I just emailed you about investing

Thanks David I will email you.

British National been working overseas since 2005, still have bank account in UK to transfer money to to pay bills as you mentioned. Need some advice on how to boost pension and where and is it worth back paying NI stamps?

Hi Louise – thanks I will email you

the negative comments about Saxo bank on Trust pilot are a real turn-off.