This article was updated on January 26, 2021

Last year I started to take fitness and lifestyle more seriously. Quite a few experts I know talked about diet being more important than exercise.

As exercise makes us feel hungrier, and it isn’t realistic to sustainably try to starve yourself, I was told most fitness coaches tell their clients they need to change eating habits.

Therefore, 70%-75% of the progress people make in terms of their weight will be down to diet, and only 25%-30% relates to exercise. This surprised me a bit, and I am sure surprises many people.

It got me thinking. One of the things I have noticed since being in the finance industry is that many high-income individuals aren’t wealthy.

I know numerous people who are worth $2M on an income of $50,000 and others have close to zero wealth but are on huge expat packages.

One person I know has consistently made $15,000 per month after tax for about 20 years in South East Asia, and yet has only about $100,000 to his name.

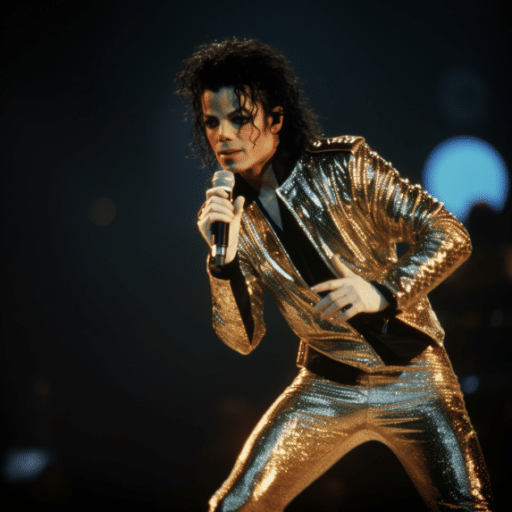

How can this be true? Well, the truth is good spending habits are actually the biggest source of wealth, compared to earning more. Michael Jackson was close to bankrupt despite earning around a billion dollars in his careers.

That is not to mention the effect of compounding. Even though markets historically go up and down, on the whole, they tend to increase over time. The US Stock Market, the S&P, has averaged a return of 10% before inflation and around 6.5% after inflation. This benefits people who are consistently disciplined and start investing at a young age.

Take a simple example of somebody who starts investing at age 22 for 40 years. Let’s say they save on average $100. If they get average historical returns, their account will be worth about $264,000 in today’s money when they are 62.

If they save $500, the account will be worth $1.3M and $1,000 would lead to $2.6M in today’s money at the age of 62. In reality, even a very well-paid person who has had bad spending habits will struggle to accumulate $1M-$3M if they start investing in their 50s.

Consider an even more startling statistic. Let’s compare two people who are investing $500 a month and they both get an unexpected lump sum of $100,000 due to inheritance.

Person 1 invests only $500 per month but spends the 100K, whilst person 2 invests the 100K and the $500 monthly. In 30 years, person 1 would have around $588,000 in today’s money. Person two would have $1,350,000 in today’s money…..a difference of $750,000 in real terms by delaying consumption and well over $1M if you don’t factor in inflation!

Perhaps it is unsurprising that many reports suggest that the rich are less likely to buy luxury goods.

The above is a sample from the 6 steps to financial freedom book.

September 16 update – I will be having a client event on November 2 with Dragon’s Den star Kevin O’Leary. To have the chance to attend, click here. All existing clients will automatically be invited.

Pained by financial indecision? Want to invest with Adam?

Get started today

Adam is an internationally recognised author on financial matters, with over 214 million answers views on Quora.com and a widely sold book on Amazon.

Adam,

I am a recent grad about 4.5 months into a new, real world, job. I want to begin investing in small amounts but don’t know where to start but love the idea of putting money away now and letting it compound greatly.

Thanks!

James

Hi James

Sure, where are you based by the way? I did a post on online brokers you may find interesting. Your location will determine which brokers can accept.

Adam

Can you put the link in below

New York City. Can you provide a link to the post?

Start by calling vanguard or fidelity or another company of your choice. Tell them what you’d like to do and they will help you set it up. Start with something like an s &p index fund and do automatic monthly deposits. You’re on your way.

Where can I invest?

Would like information

Compound interest is the 8th wonder of the world, he who knows it earns from it and he who doesn’t know it pay it – Albert Einstein

Let’s do business

Denying yourself and possibly a young family the luxuries while you are fit and in good health to build up a nest egg for an unpredictable future might be reflected on with regret in time to come.

Sadly some even find the need to save becomes compulsive and never get to enjoy spending their nest egg and end up passing it on as an inheritance.

I feel there is a balance that has to be reached. Scrimping and sacrificing to make savings can come at a cost. Moderation and not obsession is key.

Sure a balance is needed. Something too extreme isn’t good. But most kids are just as happy with a toy train as a $1,000 toy car, so beyond a certain level of comfort, it doesn’t seem to make a difference to happiness.

Sir, kindly email me the same information you sent to Mr Rich via his email.

Regards

Good one

I’m with you on this one. I’m heading into my 50’s soon and I’ve met very wealthy folks in their 30’s – 40’s who don’t travel, dine out, date their spouse, upkeep their home for the sake of saving for retirement (unknown). A friend of the family just passed away at 70+ and left a 2million+ inheritance who also hardly ever enjoyed any of his money. Be careful how you balance your life.

I think no serious person doubts that balance is key. Too many people don’t balance things the other way though and spend money on things they don’t need, with money they don’t have, to impress people they don’t even like.

I am 23 years old and I am working as an IT professional for about more than a year , and I can’t increase my savings or don’t know how to invest my earnings for the future.

Can anyone guide me ?

Hi Nishul

I would recommend:

1. Reading and listening to the evidence

2. Personalizing it for yourself

3. Implementing it.

Thanks

Adam

I live in South Africa, Johannesburg. 57 years old. Have never been introduced to investment. However, I’m beginning to realise the importance of investing. Where do I start, and where can I go ?

Hi.

Have you been able to find out any new info on investing long term safely in South Africa?

If so please email and share with me

I would like to learn so that I practice.

Hi adam,

I am 28, working professional in INDIA, I still don’t believe in investing in stock market. But I want to start saving early (preferably not in banks). Can you please guide me, so I can start investing at the right place.

Regards

Hi Pankaj

I would do the reading first as per the reading list and you will see the benefits of long-term investing but I would keep your exposure to the Indian markets are 5%-10% of your total portfolio.

Adam

Hi

I think that many people are unaware of the investing in the stock market, especially Asians. As a Sri Lankan, I think that many people are unaware of or unsure about the stock market.they just put their money in the banks.

That is true, there is a misconception that it is risky.

Hi Adam

Hope you are well! I am 58 years old and need some pointers regarding investing having just inherited £90000 A lot of the commentators say invest for 30 years plus, but what if you are my age what then?

Hi Rich

I emailed you.

Regards

Adam

I’m in the same position as Rich. Can you email me what you sent him?

Thanks,

Jay

Hi Jay – sure.

Could you email me the same info? Thanks

Which information Angelica?

please email me also thanks a lot for the info

Hi there!

Would you please email me the same information?

Thank you so very much!

Samantha

Hi I owe my property. I am 52yrs old with no savings an have two kids under 12yrs old. I have no other debts except my family. Any suggestions.

Thx

Jeremy

Just emailed you Jeremy

Please email me this info… thank you so much.

Pls I have a huge sum of money and I would love to invest it put I don’t know how to go about it

Greetings Adam,

I have about 35k saved and would like to know how to invest and make my money grow for me. I am 47 years old and have no debt with the exception of rent, cell, car insurance etc. however no credit card bills or outstanding debts out there. Please assist me with information moving forward. Thank you so kindly.

I just turned 50 years old. I’m in a similar situation as Rich. Can you please send me the advice? Also, once you reach retirement age, what is the percentage of your investment should you rely on for living?

Hi Lisa sure. In retirement, 4% of your pot is safe for withdrawal. So $500,0000 = $20,000 a year. $1M = 40k a year and so on.

I am 17 years old, and I want to start to invest in an early age to retire by the age of 34.

Can you please do me the favor of emailing me the the right way to get through this, so we can go though this together?

Hi Gaurav you can email me – advice@adamfayed.com

Hi Adam,

I am 26 year old person and want to accumulate enough wealth upto 45 years of age. Can you suggest something?

Will email you Tanmay

I began saving at around 30 yo after divorce. I didn’t make much then and saved what I could, and I knew nothing about the stock market. The company matched up to 6% and in time I increased it from a mere 2% to 10%. I saved $500 in bank IRAs when I could and some cash in credit unions, but nothing could compare to the company’s match, and Fidelity did the investing in stocks, bonds, etc. I am comfortably retired and still remind myself to control my spending by habit. My sister-in-law swears by Vanguard and states she pays low fees and her earnings are great. I told my grandchildren, if you don’t save it when you’re younger and able, you won’t have it when you’re older or possibly disabled; with social security, you won’t get it out if you don’t put it in; and lastly, the more you make the more you’ll get from social security and company retirement funds (depending on which type and what percentage is deducted). Many companies have 401Ks, 403Bs, etc., types of retirement plans. The best advice is don’t wait until you have more money, do it NOW, make a free appointment with Fidelity or Vanguard, etc., and figure out where you’re going to be when you retire. It’s all common sense, right? And Good Luck!!

One last comment. There were times I saw thousands of dollars disappear and I just closed my eyes and said ‘let it ride’ because that’s the advice I was given. There were days I wanted to take all the remaining money out before there was nothing left, but I’m so glad I never did. The stock market has ups and downs. I stopped looking at it for a while and when I went back to see if all was lost, I was pleasantly surprised to find it was all back… and then some! Money really needs to be in long term to realize the best gains. Just my opinion.

Hi Dianna – very good points

Please I have a question. How do I invest in the Nigerian stock market, a lot of our companies are hard to trust. It’s even more difficult to understand as the future of the country is not looking good.

Thanks

You mean locally? I would mainly focus on buying the whole market with ETFs including an international stock ETF

Hi Adam,

Thank you for helping us all out!

Where can I find the books you’re mentioning?

Hi Ricky

Thanks for your message. You can find a list here – https://adamfayed.com/goodinvestingbooksforbeginners/

Regards

Adam

I live in South Africa, Johannesburg. 57 years old. Have never been introduced to investment. However, I’m beginning to realise the importance of investing. Where do I start, and where can I go ?

I emailed you.

I am in the same position as Rich and Jay, can I get an email too. Thanks for the very insightful write up

Thanks I have emailed you

Hello, I do realize that it’s been quite sometime since this post. I happen to find myself in similar circumstances as described above. Are you able to write me the advice the others in this situation have received from you? Many thanks!

Just emailed you Audrey.

One doesn’t even need to sacrifice all his earnings in the name of investing for the future. The most important thing is to start early and be consistent with it.

I’m in a somewhat similar situ as Rich so send me the email too.

Cheers!

Only thing to remember is, compounding formula has (number of years) in power position and principal amount in Multiplication. Now just calculate who is contributor.

Hello, I will be 26 this year from Lagos Nigeria. I want to know great Investment options I can take. I am an executive trainee in a Commercial Bank

OK I just sent you an email

Hello Adam.

I live in Lagos, Nigeria.

Kindly pass me the information you gave to Teaty.

Thanks.

Can you inform me of various in investment platforms for a new employee

So you $$ave / Invest all your life, not buying luxury stuff etc. As a result, at 65 you’re a millionaire and die the next day: what’s the point??

Well nobody knows when they will die. The 65 year old will probably die at 78-80 statistically. Besides if somebody starts early enough, they can get wealthy at 40-50, and luxury beyond a certain point doesn’t make people any happier. Try it. Tomorrow buy a $10 bottle of wine and the day after try a $50 bottle of wine. Won’t make any difference to your happiness.

Hey Adam, I’m a 16 year old living in California looking to invest long term for my future. Where should I start, or do you have any particular low risk stocks you could recommend? Or maybe some good books? Thank you !

Hi Allen – start with these books – https://adamfayed.com/goodinvestingbooksforbeginners/

Thank you! I will order them tonight !

Thank you

I am 64. Have about $75K in an IRA and want to retire at 66. My FRA. i will get about $2500 in Social Security. I have two pension. One for $168 a month and the other $148 dollars a montjh.How do I do that without running out of money in less than 10 years?

$2,500 a month Larry?

Hi Adam,

A student learning and preparing for exams. My mom is about to retire and will get lump-sum money. Could you please tell me, where can I invest the money so that it gets multiplied quickly?

Hi Ankush – the keys are stable growth and income from the lump sum, not multiplying quickly.

Pls I’m 20 and in Ghana how do I start??

I would pick a local provider.

Hi Ankush – the keys are stable growth and income from the lump sum, not multiplying quickly.

Any advice as to where to start for a 40 year old who hasn’t been worried about saving until now?

Start budgeting. Use cash more. Right down a budget with pen and paper. Then once you have better cashflow, invest the surplus.

Thanks! Would you suggest a monthly/yearly amount invested in something that doesn’t require a lot of maintenance, like the S&P 500?

Hi Adam,

Found your suggest concise and apt. I’m 37y old and I couldnt save much earlier due to some family issues. Right now in a good career and professionally doing a lot better than I was in my 20s. Whats your suggestion for people like me who are starting so late? Would love to hear back

Hi Seema – everything starts somewhere. You will never be younger than today. So start investing even small amounts of money. Write down a budget and keep to it. find some ways to earn more – like freelancer or upwork.com

I’m from India

Hi Adam,

I am 38 years old. I started investing in stocks and mutual funds since past 3 years or so. I invest about 30% of my income into mutual funds keeping a horizon of about 20 years and expect somewhere around 12% per annum return over a period of ~10 years on an average of investing.. do you think it is sufficient in terms of building enough wealth for my retirement?? I plan to retire by say 60 years age.. I don’t have kids, but just me and my wife.. do you think I need to invest in other options as well to keep my hard earned money safe? Additionally, I don’t have any real estate as an asset as of now… what do you recommend for me??

Thanks Navit I just emailed you

Hi Adam can you email me this too? Thanks!

Thanks much for all your advice, Adam. Could you please email me this info?

Thanks much!

Hi Adam,

I am 58 and a retiree for past 3 years. Been living on my savings since retirement, with virtually no income coming in now. Monthly pension is paltry and not even enough for basic living expenses. Savings have expectedly been depleting fast, and may soon be exhausted (couple of years or so at going rate) unless I begin to generate some earnings. I have a small family of 5 and we live a modest lifestyle. No extravagance. Have a couple of dependents as well. No opportunities yet for regular income. Live in own property and have another that would soon begin to bring in some rent (about US$7,000 per annum). Savings level are now in the middle five figures in USD. What do I do to remain afloat for a long time to come if God spares my life.

Is there any government help where you are based?

Would you try to include payment periods next time? 15000 after tax isn’t a lot if we are talking annually. If we are talking monthly, that is a different story, but you don’t ever clarify. Same as the savings rate for a 22 yr. Old for 40 yrs. Best

I meant monthly of course

It is important to find a balance.

It makes no sense working so hard, and living so frugally, for a future you’re not so sure of…(vice versa).

I think you should ensure you’re saving enough to maintain your current lifestyle (in retirement for instance), and about 13-20% of your income is enough for this. Then live your life.

I also believe expanding one’s means is very important – this allows you to save more. (Side hustles and High income skills are necessary for this).

I am a Nigerian. Live in Lagos Nigeria. I am 52 years if age. What type of investment risk is adequate for me to guaranteed my financial independence at old age.

I have investment in stocks in Nigeria but mostly penny stocks.

I would invest in lower-risk options than penny stocks – index and bond funds. Adam

Forgive me for my comments which may not be of your liking.

I am 67, still working for living. I have no savings, no investment or any other security. But i am a happy man because i enjoyed every second of my life with pleasure and happiness.

Whatever i earned in my life, i spend to make myself and my family members and others happy. I gave them best education and best environment to live and they are all settled and happy.

I think, there is a big difference in having 1M at old age and having 1M at young age. At young age i can use every part of the money but at old age i can’t. We have only one life. Why should i spoil my whole life happiness just to save for old days? Biggest charming of life is when we are young and we should enjoy every part of it. I don’t know how much time is left for me but i want to be happy all the time. I will work till i die and i will enjoy my life till the last moment of my life.

Sure I understand your comment. And your comment works in 1 situation well and 1 situation only – if and only if you like/love your job and you maintain your health until a decent age. In that case, people have no regrets.

However, if you had lost your health at 52, I am sure you would have a different mentality. I have met countless 50, 60, and 70+ year olds who haven’t invested for retirement who regret it fantastically. I do agree with your comment about age though. If somebody is lucky enough to build up a $1m-$2m-$3m portfolio in their 30s or 40s, they can use the money to do things that most 75 year olds can’t do, like semi-retire or retire early.

Or volunteer, or travel the world. Not everybody can do that, but one reason the fire movement is getting big is people want choices. Everybody in an ideal world wants to be able to retire. Even yourself, I am sure you wouldn’t mind having the ability to retire tomorrow if your health goes or you stop enjoying your job.

I guess for me, I always wanted `f you money` – the ability to tell people where to go if I hate doing something. Older people who still need to work don’t have that luxury.

hi, can send me the link?

Which link are you referring to?

I think it’s ok to spend that $100k IF its on a house or down-payment because in 30 years you’d have actually saved, paid $540,000 in rents for $1,500 a tiny City studio apt. And that’s rare since cities are more than that, unless you get roommates.

So the money you’d pay on future rents could into savings or more investing or fixing up the cheap fixer upper home you bought @ wholesales or something

I have 10.000 pounds to invest but have no idea where to invest this. I don’t want to loose any of the money, how is the best way to make money on this for my future. I am 54 years old. Can you advise me please, thanks

Hi Adam,

I’m 18 years old and I’m filled with vision. I want to acquire great wealth by 30. Can you help me out.

Hi Adam, Could you send me the advice you’ve given for someone starting investing in their mid 40’s? UK based though.

Thanks

Hi Adam.

I am a 27year old Nigerian, I dropped out of the university years back due to family and drug-related problems. Now I am finally sober and I enrolled for Bsc in a totally new place (starting a new and independent life).

Knowing that most of my peers are now ahead of me academically and socially.

In order to catch up with my peers do I need to work twice as hard as they are working and save twice as much too?

I know it’s not going to be easy so please advise me on steps I could take to help improve my financial status in a long run.

Hola Perdona por las comas Las he desactivado por un fallo en el teclado. Y por cierto Hablaré en español. Mi nombre es Alex mi edad aunque a muchos les deba interesar son 21. Durante mi juventud reconosco que he pasado por varios lugares interesantes. Ahora mismo tengo planes de ahorro. Lidero mi casa. Lidero las cuentas de mis familiares y me conscidero una persona que aun no ha aprendido suficiente. Ahora mismo estoy interesado en copiar operaciones en eToro un publicidad que esta dando vueltas por las redes españolas. Considero que el dinero lo he de mover por que mi plan de ahorro es totalmente eficiente para cualquier gasto diario que tenga que ocupar dia a dia. Por eso no me preocupo.. lo que me preocupa es que cuando tenga mucho dinero. Ese dinero se quede completamente estancando en las mismas cifras. Sabrias guiarme? – Porfavor. Mandamen un mensaje a mi correo.

Same position as Rich can I get an email too

Same position as Rich, can I get an email too

I am an IT professional, l love saving and reinvesting in my business but my wife love spending too much especially on luxuries, what would i do to succeed and be successful in my business but still keep asset going ie my wife and my saving.

Iam 66 years old,in USA, is there a tax bracket yearly to aim for when taking money out of roths and iras and savings accounts

That is more pure tax advice.

Sure you’d have more than 2 milions dollars by 62 if you invest $1000 each month starting 22.

But this doesn’t work like that. $1000 is significant money for most people. If you are self made, say you study in computer science maybe for a master degree in a great university. You are going to get your first good salary not before 23-24 and you’ll have to pay for your student help… So maybe you’ll do it at 30, not 22.

And then because you know the last years of stock performance near 62 can destroy all your efforts, you are going to lower your expose before 62… That more than 2 millions dollars you would not get. You’ll only get 1 million most likely then.

What more by 62, you would have lived 3/4 of your life, have actually 15% chance of being already dead and likely another 35% to have less than 20 more years to live.

It is completely stupid to not ever enjoy that money before 62, strugle for most of your life just to have it at the end of your life.

So what really make sense is to spend a part of your income for instant pleasure and also save for the future. Doing both is what make sence. And I think that what most people do. They mostly save thank to real estate because that the easiest and more efficiant way to them, but they save anyway.

And they still enjoy the moment too.

So I agree that one should invest, likely also a part in stocks, but I also think that one should also spend right now. If one is making 15K$ right now. It make sence that is save 10K that would pay for itself with the revenue in generate so the real cost is more like 3-5K. So the person still enjoy a wealthy life right now of spending 12K$ for instant pleasure and also save 10K for future needs.

And this mean that a high income is really important. It doesn’t work to say, all that count is to save. Not at all. It is much easier to save with high income and it also provide the wealth right now instead of maybe when you are 70. You need both, there no ways arround that.

There is some degree of truth about your statement apart from when you say “most people do that”. If you live in some countries, most people do try to get the balance I mentioned on this article. However, in the US and UK, most people, even high income people, have close to 0. The point of the article is to mention that actually most middle-income people more than wealthy people, often to look rich. Now that really is stupid.

i am 54 and i have only 100000 rand in south Africa , where can i put the money for growth

that is $5,000. I would just find a local broker.

I would like to start investing even as a struggling father with my monthly income as a 9 to 5 worker taking care of my family of 4 and myself. We live in Nigeria and inflation has basically caught up with my income coupled with debts which has to cleared.

Your insight would be most appreciated.

Thanks Samuel I would find a local broker if the amount you have to invest is relatively small.

Hi Adam, I live in the Philippines and one of the thousands/millions of people displaced from work by the Pandemic (covid 19). Have never been introduced to investment. However, I’m beginning to realize the importance of investing. Where do I start, and where can I go ? Appreciate your advise, Thank you.

I would just start small. Everybody needs to start somewhere.

Hi Adam. I don’t know what and where to invest. And also how. I’m in Nigeria.

I will email you

Energy sector

I am in to stock market business and in full time employment, i am 36 years and would like to retire at age 50. How do I make enough money to sustain me and my family there after.

I’M IN NIGERIA AND MOST PEOPLE HERE BELIEVE IN BUILDING HOUSES AS A WAY OF INVESTING. WHICH OTHER WAYS CAN ONE INVEST? I DON’T KNOW HOW STOCKS WORK HERE

ETFs and funds.