What are the main signs that you will be financially successful? Below is a list of some of the key things I have observed:

1.You associate with people who are better than you are

Most people want to be the smartest person in the room, but if you are the least smartest person in any room, you have more chances to learn from other people.

People move in the direction of the people closest to them. So if you want to get fit, it is better to associate with fit and healthy people. If you want to improve financially, it is preferable to spend more time with people that aren’t broke.

2. You are open-minded

If you are open-minded to change, adapt and learn from others, you have an incredible advantage over those that have a fixed mindset. You can play the numbers game and try loads of different ideas, and aren’t petrified to fail.

3. You are patient

Delaying gratification is one of the easiest ways to succeed financially. If you invest $500 a month for 30 years, and your friend does it for 40 years, you will likely lose out by over $1m, just because of the compounding effect.

4. You finish things and keep to your word

People that keep to their word, and actually finish what they started, are much more likely to succeed compared to procrastinators.

5. You are trusting

Survey after survey has shown that trusting people, who see the value in co-operating with others, are much more likely to succeed, compared to those that think the world is a dangerous place. That doesn’t mean being naive, however.

6. You are always learning

Buffett reads for 3 hours a day or more, and so does billionaire Mark Cuban. Most people claim they are “too busy to read”, which is more about priorities, than anything else.

7. You invest rather than save money

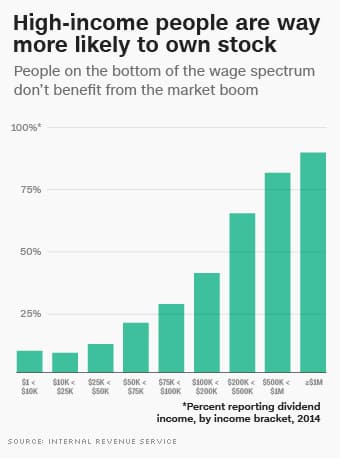

It isn’t realistic to improve your situation, in an era of 0% interest rates, by saving money. Financially successful people are more likely to invest, rather than save money:

8. You work on your strengths and delegate the weaknesses

It is fashionable to say that working on your weaknesses is as important as your strengths, but you will never get as much “bang for your buck” focusing on your weaknesses as doubling down on your strengths. Many wealthy and aspiring wealthy, are busy, so delegate their investing and legal affairs, to experts.

9. You are as motivated by the potential of gains as the fear of losses

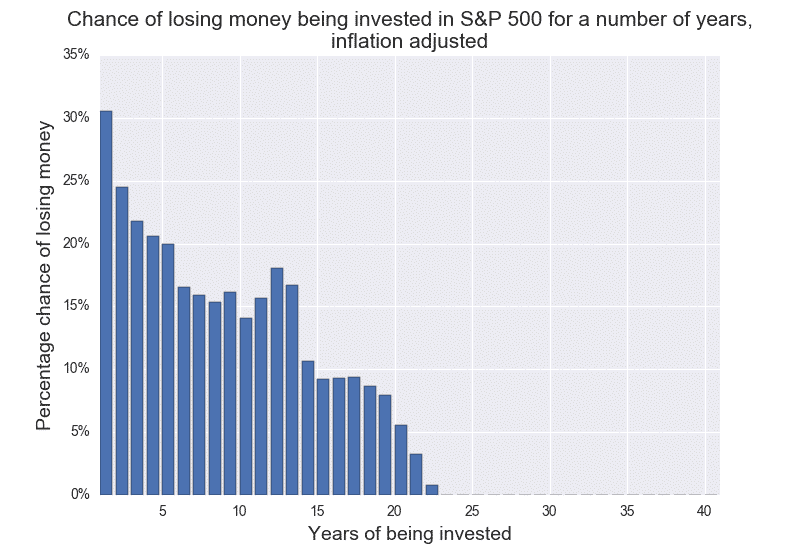

Most people are petrified of “losing” something. Losing a friend, is more depressing to most people, than gaining a friend. Likewise, in investing, the fear of “losing money”, stops many people from investing, despite the fact this is very unlikely if you hold for the long-term as the figures below show:

Wealthier people are more likely to see the benefits of taking calculated risks.

10. You can see beyond your culture

It is human nature to be reassured by familiarity. That is why many Singaporeans and Brits buy property, or why many Indians buy gold as an investment. As you get further up the income and wealth scales, however, you find wealthy people are more skeptical of following “cultural norms” and for that matter “industry norm” in their day job.

Further reading

good advice