If you are a British resident, you might need to open a Lifetime ISA. Here’s everything you need to know about it.

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

This article isn’t formal advice, and the facts might have changed since we wrote it.

What is Lifetime ISA?

One kind of ISA is a lifetime ISA (Individual Savings Account). It is a savings and investment account with favorable tax treatment that was created especially to assist British residents in saving for your first home and/or retirement.

The chancellor’s budget announcement from April 2017 had the initial mention of the rollout of Lifetime ISA. The news, however, didn’t exactly go down well, and it appears that most people have now rejected the plan.

The program was started in an effort to address the problem of people under 40 finding it difficult to reconcile saving for retirement with trying to save for a down payment on a house, which is now a difficult task.

Who is Eligible for a Lifetime ISA?

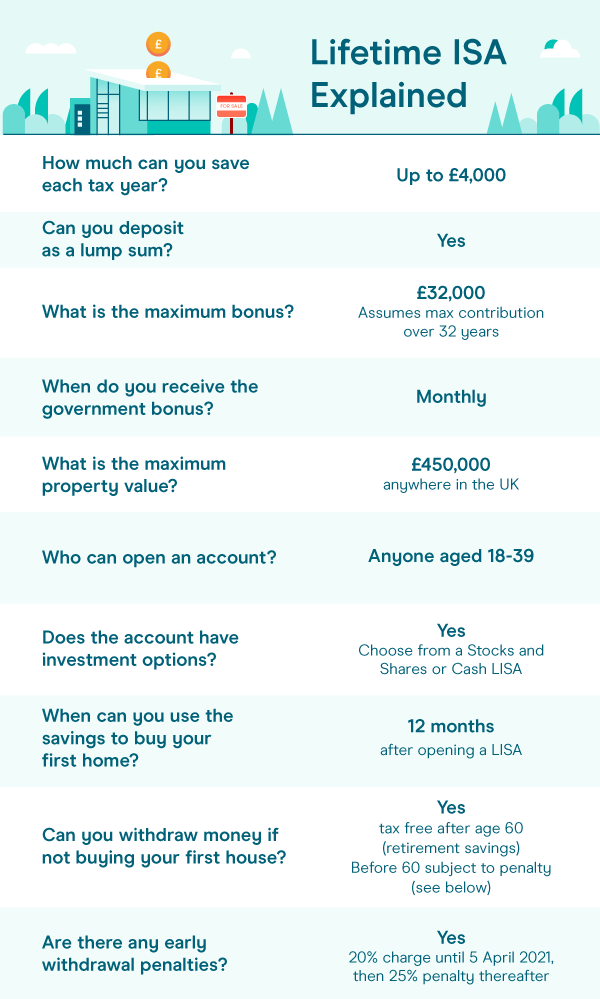

To be eligible for a Lifetime ISA, you must be:

- a UK resident

- aged 18 to 39

Once you have a Lifetime ISA, you can continue to make contributions until you reach the age of 50.

If you already have a Lifetime ISA, you can create another one, but you can only pay into one each tax year and earn the bonus on one Lifetime ISA at a time.

Lifetime ISA Rules

- Depending on the contributions made to other types of ISA, you are allowed to save up to £4,000 into your Lifetime ISA each year. Your lifetime ISA is included in the £20,000 annual allowance limit for all individual savings accounts.

- If you utilize your savings to purchase your first house or to fund your retirement, the government will add an additional 25%. (from the age of 60). The government will add £1 to every £4 you save, up to a maximum of £1,000 each year.

- After turning 60, withdrawals that aren’t for retirement or a first-time home purchase are subject to a 25 percent withdrawal fee, which means you can get back less than you put in.

- To avoid a 25% government withdrawal fee, your Lifetime ISA must be open for at least 12 months before it may be used to purchase your first house.

- Lifetime ISAs can be invested in stocks and shares or kept in cash. Stocks and shares have a higher long-term growth potential, but they also entail a higher risk that the value of your investment may decline. Because OneFamily’s Lifetime ISA invests in stocks and shares, its value can fall as well as rise, meaning you may get less than what you paid in.

- A cash ISA, stocks and shares ISA, or Matured Child Trust Fund can be transferred to a Lifetime ISA if the amount is £4,000 or less. The same holds true for everyone under the age of 40 who has a Help to Buy ISA.

What is the Difference of Lifetime ISA from Other ISAs

Lifetime ISAs, unlike other ISAs, are only available to savers between the ages of 18 and 39. Once a Lifetime ISA has been opened, an investor is able to make subscriptions up to the day before their 50th birthday.

In cases when an investor makes the maximum subscription of £4000, the government further offers a 25% bonus depending on the amount contributed, up to a maximum of £1000.

Withdrawals from a Cash, Innovative Finance, or Stocks and Shares ISA are not subject to a penalty, while withdrawals from a Lifetime ISA are – unless the investor is purchasing a first property or is over 60 – subject to a 25% penalty.

A Lifetime ISA can invest in the same kind of assets as a Stocks and Shares ISA, which is intended to invest in eligible securities and/or cash.

How to Use a Lifetime ISA

For First-Time Buyers

When you buy your first house, you can withdraw all or a portion of your Lifetime ISA amount, but there are a few crucial factors to take into account:

- Before buying your first house, you must save for at least a year in the account.

- You cannot purchase a buy-to-let property; the house you buy must be for your personal use.

- You must use both a mortgage and a Lifetime ISA, and the house you purchase must be valued at £450,000 or less.

- The home must be located in the UK.

For Retirement

You can take a portion of your savings—up to all of them—after you turn 60 without being penalized or subject to tax. The availability of tax benefits is dependent on your specific situation and subject to future modification.

- A Lifetime ISA may be preferable than a corporate pension if you are self-employed. Despite not offering the same advantages as pensions, a lifetime ISA may be a beneficial method to boost your retirement savings.

- An independent financial adviser might be able to help you if you currently have funds or are confused about whether a pension or Lifetime ISA is the correct choice for you.

When is Your Money Available for Withdrawal?

After a year, you can use money from a Lifetime ISA to purchase a first house up to £450,000 in value. You must use a mortgage to pay for your house.

Alternatively, following your 60th birthday, you will be able to withdraw all of your Lifetime ISA funds tax-free for use in retirement.

A Lifetime ISA may be used at any time for any purpose, just like a regular ISA, but if you don’t utilize it as described above, you’ll have to pay a withdrawal charge of 25% of the amount you take, which is the government bonus plus a 5% penalty.

This withdrawal charge, however, will not apply if you cash out your account during the first 12 months of its commencement.

Final Thoughts

If you wish to utilize your Lifetime ISA to save for both a home and retirement, once you’ve purchased a home, you’ll be able to continue contributing into your Lifetime ISA as before. You will continue to earn the government contribution bonus until you reach the age of 50.

Remember that the Lifetime ISA is intended to supplement your retirement savings rather than replace pensions, so if you can afford it, it may be worthwhile to maximize both pension and Lifetime ISA allocations.

Keep in mind that investments’ values can go up as well as down, and you can get back less than you put in. The tax laws may alter in the future. Your unique situation will determine how they affect you.

Please remember that this article is intended mainly for general informational purposes. If you’re unsure, get a professional financial advice from a qualified financial advisor.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.