Inheritance Tax in Hong Kong Explained

Hong Kong inheritance tax is a common point of confusion for both residents and international investors. Although Hong Kong abolished its estate duty in 2006,

Hong Kong inheritance tax is a common point of confusion for both residents and international investors. Although Hong Kong abolished its estate duty in 2006,

Exploring how to invest in S&P 500 Shariah is an increasingly appealing subject to Muslim investors and ethical investors worldwide. As interest in Islamic finance

Understanding South Africa inheritance tax is essential for anyone who holds assets in the country or expects to inherit from a South African estate. But

Managing money across borders can be challenging. Offshore bank accounts for non-residents provide a flexible solution for individuals who live, work, or invest internationally. In

The 5 year rule for non-residents in the UK plays a crucial role in determining your tax liabilities, especially for expats and former UK residents

In recent years, Malaysia has emerged as a strategic location for high-net-worth individuals seeking to manage their wealth efficiently. The increasing complexity of global financial

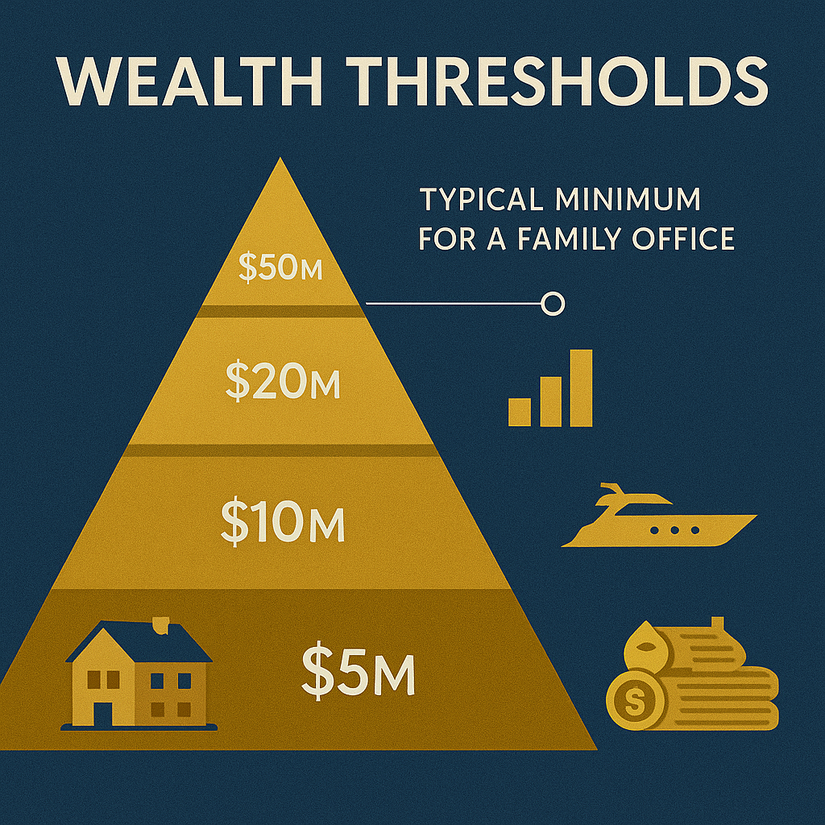

A family office refers to a privately held company that handles investment management and wealth management for a wealthy family. According to Deloitte’s Family Offices

If you’re wondering how is inheritance tax calculated in Japan, it’s important to know that the country imposes one of the highest inheritance tax rates

The pitfalls of buying property in Portugal are often underestimated by international buyers eager to invest in this increasingly popular market. With its attractive climate,

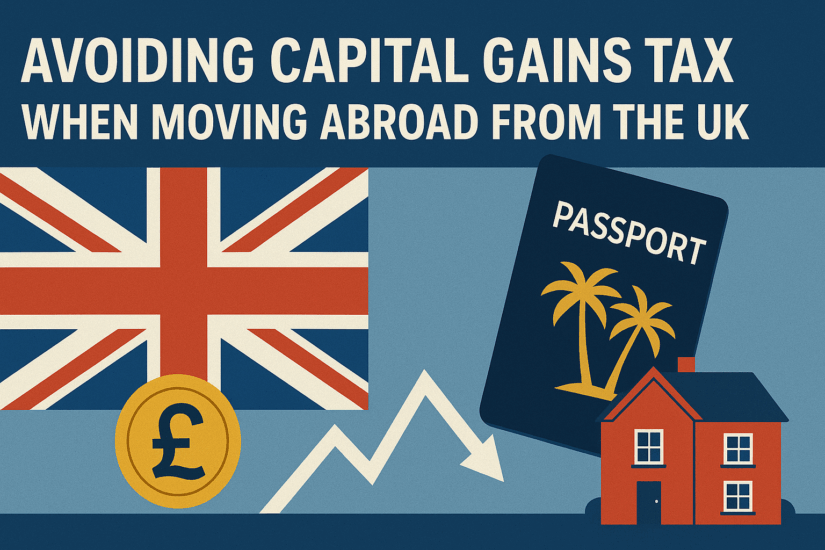

Avoiding capital gains tax when moving abroad is a priority for many high-net-worth individuals and expats planning to leave the country. Living abroad presents unique

When moving abroad as a UK tax resident, many wonder: Does HMRC know if you move abroad? What is the HMRC’s role in this? It’s

The infrastructure sector offers a unique opportunity to align portfolios with long-term economic development. This post is your guide to infrastructure investments, providing an overview

Disadvantages of a discretionary trust can arise even for high-net-worth individuals and expats who seek flexibility in wealth transfer and asset protection. While these trusts

CitizenX is a Swiss platform that provides services and tools to help people secure residency, add more passports, and effectively handle second citizenship-related procedures. In this

The Peninsula Global Bonds offering is an investment vehicle with fixed income. It is intended to provide dependable revenue, flexible terms, and an alluring yearly

The goal of Peninsula Capital Trust is to offer investors options outside of the usual asset classes of stocks and bonds. That’s why the firm

Bonds known as converter bonds have the option to be converted, at a predefined conversion ratio, into shares of the issuing company. In this review,

The Balqis bond is a fixed-income investment that provides access to the litigation finance market. Due to the increasing number and value of class action

To move assets out of the US — especially non-financial ones like real estate, vehicles, art, or personal belongings— requires careful coordination. Many individuals do

Egyptian passport visa-free countries have become a key topic as travel freedom grows increasingly important for business, tourism, and relocation. The Egyptian passport provides moderate

With growing global interest in second passports, many are asking whether Lebanese citizenship by investment is a viable option in 2025. If you are looking

SUBSCRIBE TO ADAM FAYED JOIN COUNTLESS HIGH NET WORTH SUBSCRIBERS

SUBSCRIBE TO ADAM FAYED JOIN COUNTLESS HIGH NET WORTH SUBSCRIBERS

Gain free access to Adam’s two expat books.

Gain free access to Adam’s two expat books.

Get more strategies every week on how to be more productive with your finances.