One of my most viewed articles is investing vs speculation – how you can get rich investing. It argues why it is possible to become wealthy slowly on a middle-income via investing.

Many people understand this point and the past returns of the stock markets as shown by these returns:

Yet one of the main questions I get asked is “stock markets have historically performed really well. I know nobody can predict the future for sure, but do you think markets will do so well in the future?”.

In this article, I will look at some of the reasons why asset prices could exceed historical norms and other reasons why they might not.

Reasons for

1. Interest rates/QE

We have to remember that we are living in unique times. Interest rates are at 0%, or close to zero, in most parts of the world.

Bonds aren’t paying much better. As Warren Buffett recently said on the video below, stocks look cheap now, because interest rates to stock markets are like oxygen or blood is to the human body.

When big companies can borrow money at close to 0%, and invest for growth, that is very good for the markets, as is the lack of any real alternative apart from maybe real estate which is a hassle.

In comparison, when interest rates are super high, fixed income becomes more attractive relative to stock markets.

For example, in 1999/2000, interest rates were 3%-5% in many developed countries, and government bonds paid up to 6%.

When there was an easy and “safe” alternative, people were more likely to take some money off the table.

Of course, interest rates won’t remain at 0% forever, although they are looking like they will in Japan and some parts of Europe.

Yet the days of high-interest rates seem a long way off. We haven’t been there for at least 13 years already. Another 13 years or more of near 0% interest rates doesn’t seem so unlikely now.

Quantitative easing (QE), which is often mistaken for money printing, is also more likely to result in asset price inflation (stocks in particular), rather than general inflation, as the video below explains.

Third industrial revolution

In the grand scheme of things, why does the stock market go up? In simple terms, this was innovation 100 years ago:

Now this is innovation……

Human society doesn’t just stand still, regardless of all the doom and gloom out there. Just in the last few weeks, we have seen the “billionaire space race” between Richard Branson and Jeff Bezos, which could herald the beginnings of a new industry (mass tourism out of earth).

We are also seeing technologies like AI and others play a bigger part in our lives. These technologies can allow the biggest firms to be more profitable over time.

Netflix wasn’t even on the stock markets in 2010. Now it is one of the biggest firms in the world. By 2030 or 2040, I am sure there will be new firms on the stock market which haven’t even been invented today.

CAPES in Europe and Asia look great

Many skeptics say that stocks look expensive. What they forget to mention is that stock markets outside of the US, and especially in Europe and Emerging Markets, look cheap.

The CAPE ratios in these markets are so cheap that US stock markets have only hit such levels twice in the last thirty years.

What is more, this is a long-running trend since 2006.

That isn’t to mention the aforementioned point on the historically low-interest rates, together with the model of the technology companies.

There is a good argument to suggest that we can’t judge technology companies on the same price:earnings and CAPE ratio as traditional firms.

Most technology companies reinvest profits, so sales growth can be more vital than p/e ratios. Look at Amazon. For years it looked overvalued, but often the profitability was just catching up with the sales growth.

Comparing technology firms to oil&gas companies, or manufacturers isn’t a great comparison.

We have been through periods of stagnation like 65-82 and 2000-2010

So, let’s say the skeptics are right, and US stock markets in particular go through a lost decade. This would be great for any young or relatively young investor.

Why? A good investor should consider himself/herself to be as an artist.

An artist wants to collect as many paintings as possible. A good investor should want to collect as many units as possible until they retire.

Let’s give a simple example. Investor A and B both invest $1,000 a month for thirty years. Investor A gets 15% per year for the first 15 years, as they started to invest during a great time for stocks such as the 1982-2000 period.

However, the returns are only 2% per year from years 16-30. In comparison, Investor B gets 0% per year from year 1 until 15, similar to the stagnation of 1965-1982.

However, returns are 13% from years 16 until 30. What is the end result? Person A has $1,095,381.59 after thirty years, and had $656,609.67 at the halfway mark of 15 years,

Person B only had $180,000 after 15 years, but had $1,673,829.49 at the end of the thirty years. The reason? The second investor received those 13% years when his/her account was worth more.

In comparison, the first investor received 15% returns in the early years when the account was worth less. Many people might say “yes but Investor 3 could be in other investments for 15 years and then come in during the best moment”.

Yet to paraphrase Vangaurd Founder Jack Bogle “I have never met anybody who has successful market timed. In fact, I have never met who knows anybody who has successful market timed”.

At least long-term, it is impossible to time the market.

Reason against

There is, however, one group of people who might need to get used to lower returns. That group is those who want to be in stocks, but also fixed-income.

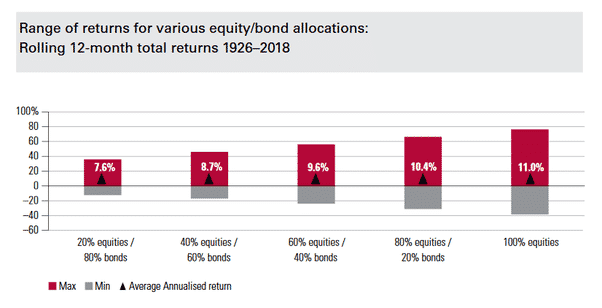

Historically 100% in stocks has always beaten a mixed portfolio but the difference hasn’t been huge as the below information from Vanguard shows:

With interest and bond rates being so low, I doubt a 60%-40% or 50%-50% portfolio will do so well. What is more likely is that a very aggressive portfolio, like 100% in stocks or even 80% stocks-20% bonds, will do just as well as historical norms.

The bottom line is, nobody knows for sure, and analysis paralysis can cause more losses than anything else. Getting the investment process started is often half of the battle.

To quote Woody Allen “80% of success is just showing up”.

September 16 update – I will be having a client event on November 2 with Dragon’s Den star Kevin O’Leary. To have the chance to attend, click here. All existing clients will automatically be invited.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 287.4 million answers views on Quora.com and a widely sold book on Amazon