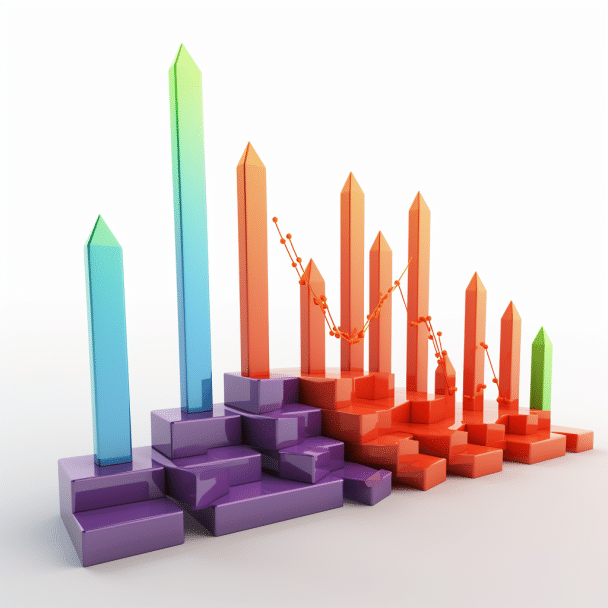

How High Net Worth Individuals Are Riding Out The Bear Market

Moving to St. Nevis and Kitts in 2023: A Guide for Financial Planning

11 Investment Options For Persons With High Risk Tolerance

What makes me different, and how does that benefit you?

Investment Options For High Income Earners

Estate Equalization 101: Complete Guide to Balancing Your Inheritance

Key Person Insurance: Safeguarding Your Business’s Most Valuable Asset

Collateral for a Loan: Leveraging Life Insurance

Investments in Mauritius: Top 10 Options

10 Steps to Investing Using a Debit Card

Opening 529 Account for Non-U.S. Citizens and Its Top Alternatives

Can you profit from inflation? Investment options to protect your money

This website is not designed for American resident readers, or for people from any country where buying investments or distributing such information is illegal. This website is not a solicitation to invest, nor tax, legal, financial or investment advice. We only deal with investors who are expats or high-net-worth/self-certified individuals, on a non-solicitation basis. Not for the retail market.

SUBSCRIBE TO ADAM FAYED JOIN COUNTLESS HIGH NET WORTH SUBSCRIBERS

SUBSCRIBE TO ADAM FAYED JOIN COUNTLESS HIGH NET WORTH SUBSCRIBERS

Gain free access to Adam’s two expat books.

Gain free access to Adam’s two expat books.

Get more strategies every week on how to be more productive with your finances.