Wealth management is a must-have for any expat. Your financial condition might be drastically altered by variables such as a change in culture, tax regulations, or social status.

But if you are a Muslim, this comes with very significant restrictions. Managing wealth as a Muslim expat following Sharia can be more challenging compared to conventional wealth management due to the adherence to Islamic principles.

Sharia-compliant wealth management requires avoiding interest-based transactions (riba), investing in permissible industries (halal), and following ethical guidelines.

This can limit investment options, as conventional banking products like interest-bearing savings accounts and certain types of investments are prohibited.

Instead, Sharia-compliant wealth management focuses on ethical investments, such as real estate, commodities, Islamic bonds (sukuk), and Islamic mutual funds.

Additionally, Islamic wealth management emphasizes profit-sharing and risk-sharing models, such as Mudarabah (partnership) and Musharakah (joint venture), which require closer involvement in investment decisions and potential risks.

Overall, managing wealth in accordance with Sharia principles requires a deeper understanding of Islamic finance and can involve more active participation in investment decisions compared to conventional wealth management. However, it also offers the advantage of aligning one’s financial activities with religious beliefs.

In this article, we will explore the key factors that Muslim expats should look out for when it comes to wealth management. From adhering to Islamic principles to finding investment opportunities that align with your beliefs, we’ll provide valuable insights to help you make informed decisions.

As a Muslim expat, it’s crucial to find financial advisors and institutions that understand and cater to your specific needs. From halal investment options to ethical banking services, we’ll guide you on what to look for to ensure your wealth management strategies are in accordance with your religious beliefs.

If you want to invest as an expat or high-net-worth individual, you can email me (advice@adamfayed.com) or use these contact options.

What Islamic finance principles should you remember as a Muslim expat?

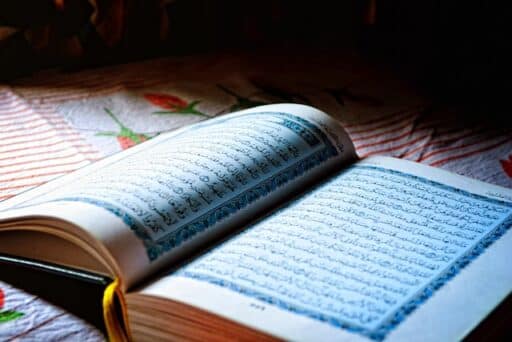

Islamic finance principles play a vital role in wealth management for Muslim expats. These principles are based on the teachings of the Quran and aim to promote financial activities that are ethical and socially responsible.

One of the key principles is the prohibition of riba (interest), which means that earning or paying interest is not allowed.

In addition to riba, Islamic finance also prohibits investments in industries such as alcohol, gambling, and pork.

Instead, it encourages investments in halal sectors such as real estate, healthcare, and technology. By understanding these principles, Muslim expats can ensure that their wealth management strategies are in line with their religious beliefs.

It’s also important to note that Islamic finance offers alternative financial instruments that comply with Shariah law.

These include Islamic banking products such as Islamic savings accounts, Islamic mortgages, and Islamic insurance. By utilizing these products, Muslim expats can manage their wealth while adhering to their faith.

How should you manage your wealth as a Muslim expat?

Muslim expats face unique challenges when it comes to wealth management. One of the main challenges is finding financial advisors and institutions that understand Islamic finance principles and can provide appropriate advice.

Many traditional financial institutions may not be familiar with the specific needs and requirements of Muslim expats, which can make it difficult to find suitable investment options.

Another challenge is the lack of awareness and availability of halal investment opportunities. While some countries have a wide range of halal investment options, others may have limited choices.

Muslim expats need to research and identify investment opportunities that align with their religious beliefs and offer attractive returns.

Furthermore, tax considerations can be complex for Muslim expats. Different countries have different tax laws, and navigating these laws while ensuring compliance with Islamic finance principles can be challenging.

It’s important for Muslim expats to seek professional advice to ensure they are fulfilling their tax obligations while adhering to their faith.

When it comes to managing your wealth as a Muslim expat, finding a financial advisor who understands Islamic finance principles is crucial.

A knowledgeable advisor can guide you through the process, help you identify suitable investment opportunities, and ensure that your wealth management strategies align with your religious beliefs.

When searching for a wealth management advisor, look for professionals who have experience working with Muslim clients and have a deep understanding of Islamic finance principles.

They should be able to explain complex concepts in simple terms and provide customized solutions that meet your specific needs.

It’s also important to ask for references and testimonials from other Muslim expats who have worked with the advisor. This will give you a better idea of their track record and the level of service they provide. Don’t hesitate to ask questions and clarify any doubts you may have before making a decision.

What halal investment options are available for Muslim expats?

As a Muslim expat, it’s important to invest in halal opportunities that comply with Islamic finance principles. Halal investments are those that are permissible according to Shariah law and do not involve prohibited activities such as interest-based transactions, gambling, or alcohol.

Some common halal investment options include real estate, stocks of Shariah-compliant companies, Islamic mutual funds, and Islamic bonds (sukuk). These investments offer the potential for growth while ensuring compliance with Islamic finance principles.

Investing in real estate can be an attractive option for Muslim expats, as it provides a tangible asset and potential rental income. However, it’s important to ensure that the property is financed through halal means, such as Islamic mortgages.

Stocks of Shariah-compliant companies are another popular investment option for Muslim expats. These companies operate in sectors that are permissible according to Islamic finance principles, such as healthcare, technology, and renewable energy.

Islamic mutual funds and sukuk can also provide diversified investment options that comply with Shariah law.

What about tax, estate planning, or inheritance?

Tax considerations can also be complex for Muslim expats, especially when it comes to managing their wealth. Different countries have different tax laws, and it’s important for Muslim expats to understand their tax obligations and ensure compliance with both local tax laws and Islamic finance principles.

In some countries, there may be tax incentives or exemptions for certain halal investments. It’s important to explore these opportunities and take advantage of any tax benefits that may be available.

Consulting with a tax advisor who has experience working with Muslim clients can be helpful in navigating the tax landscape. They can provide guidance on how to structure your investments and manage your wealth in a tax-efficient manner while ensuring compliance with Islamic finance principles.

Estate planning, meanwhile, is another important aspect of wealth management for Muslim expats. Islamic inheritance laws differ from country to country and may be different from the laws of the country where you reside.

It’s crucial to understand these laws and ensure that your assets are distributed according to your wishes and in accordance with Shariah law.

One way to ensure compliance with Islamic inheritance laws is to create a will that is in accordance with Shariah principles. This will help ensure that your assets are distributed as per your wishes and in a manner that is fair and equitable.

It’s also important to review your estate plan periodically, especially if there are changes in your family situation or financial circumstances.

Consulting with a professional advisor who specializes in Islamic estate planning can provide valuable insights and help you create a comprehensive plan that aligns with your religious beliefs.

What about retirement?

Muslim expats should prioritize retirement preparation as part of their overall approach to wealth management.

If you want to have a comfortable retirement, you need to start saving as soon as possible. When planning for retirement, Muslims living abroad should take into account their preferred retirement lifestyle, healthcare costs, and inflation.

One option for retirement planning is to contribute to a Shariah-compliant retirement account or pension scheme. These accounts are designed to comply with Islamic finance principles and offer attractive benefits such as tax advantages and employer contributions.

It’s also important to diversify your retirement portfolio and invest in a mix of asset classes that align with your risk tolerance and investment objectives.

Again, consulting with a financial advisor who specializes in retirement planning for Muslim expats can help you create a customized plan that takes into account your specific needs and goals.

How should you approach wealth management as a Muslim expat?

Financial education is crucial for Muslim expats to make informed decisions about their wealth management strategies. There are various resources available that provide guidance on Islamic finance principles, halal investment options, and wealth management strategies for Muslim expats.

One option is to attend seminars and workshops conducted by Islamic financial institutions and organizations.

These events often cover topics such as Islamic finance principles, halal investment options, and retirement planning. They provide an opportunity to learn from experts in the field and network with fellow Muslim expats.

There are also numerous online resources available, such as blogs, podcasts, and websites, that provide valuable information on wealth management for Muslim expats.

These resources cover a wide range of topics, from basic financial concepts to advanced investment strategies. They can help you stay informed and make educated decisions about your wealth management.

Managing wealth as a Muslim expat comes with its own set of challenges and considerations. From adhering to Islamic finance principles to finding suitable investment options and navigating tax and inheritance laws, the journey can be complex.

However, with the right knowledge and guidance, Muslim expats can effectively manage their wealth while staying true to their faith.

By understanding Islamic finance principles, finding knowledgeable advisors, and exploring halal investment options, Muslim expats can create a robust wealth management strategy that aligns with their religious beliefs.

It’s important for Muslim expats to continuously educate themselves and stay informed about the latest developments in Islamic finance and wealth management. By doing so, they can make informed decisions and empower themselves to achieve their financial goals while staying true to their faith.

Remember, wealth management is a lifelong journey, and it’s important to regularly review and adapt your strategies as your circumstances change.

By staying proactive and seeking professional advice when needed, Muslim expats can navigate the world of wealth management with confidence and achieve financial success while upholding their religious values.

What is wealth management, anyway? Why should you consider it?

The necessity of financial management is often overlooked by expats. It is not just about having a lot of cash on hand; wealth also includes things like real estate, investments, and strategic tax preparation.

Managing one’s wealth, obviously, is referred to as wealth management. Making money is important, but so is maintaining it.

Planning for the future and safeguarding one’s assets are important tenets of wealth management. It is a way to build a safe financial future for yourself by considering your wants, needs, and the advice of experts who can help you make the right decisions and invest wisely.

Everything you need to know about wealth management as an expat is covered in this essay.

The phrase “wealth management” is used to describe a wide range of financial services aimed squarely at clients with large financial resources.

During consultations, financial advisers, planners, and wealth managers gather information from their customers that they then utilize to craft unique plans that may employ a wide variety of financial tools.

A holistic approach is frequently used in the process of wealth management. The extensive range of services available allows for the satisfaction of even the most nuanced customer requirements, including investment advice, estate planning, accounting, retirement, and tax services.

Wealth management fees are often determined as a fixed amount rather than a percentage of the client’s total assets.

Moving abroad without enough financial preparation might have devastating implications.

As a result, people may struggle to make the most of their financial resources or understand the nature of the investment opportunities accessible to them in the current climate. Bad judgment resulting from this can end up costing a lot.

If you want to make sure your finances are in order before relocating abroad, it is crucial that you speak with a professional first. This will reduce the likelihood of any unpleasant surprises down the road.

Investing advice is only one part of wealth management. It has the capacity to cover all element of a person’s monetary life.

High-net-worth individuals are more likely to gain from a united strategy than from attempting to incorporate the advise and products of several experts.

This is how wealth managers make sure their customers’ assets are being managed in a way that accounts for their present and future requirements, such as estate and business succession plans.

Although many wealth managers are capable of handling any facet of the financial sector, some opt to specialize in cross-border wealth management or wealth management for expats. The wealth manager’s expertise or the industry they work in may play a role.

Successful wealth management often necessitates coordination between the adviser and the client’s other service providers (such as an attorney or accountant) and other financial experts. Some wealth managers also provide banking and charitable giving assistance.

If you are an expat, why do you need wealth management?

Expats have unique difficulties in wealth management, like the following:

Poor availability of banking services

Because of their location or immigration status, many expats face barriers when trying to use traditional banking services. Expats are limited in their capacity to create bank accounts and acquire loans overseas due to the restrictions imposed by their passports and visas, in contrast to local citizens.

Few investment opportunities available

Many expatriates may not have as much access to attractive investment funds as they would at home unless they use one of the few platforms that specifically target them.

This leads to portfolios with less variety and may cause lost opportunities. Doubly so for Muslims who can only invest in halal investments.

Insufficient knowledge of financial instruments

Because their prior market experience is sometimes irrelevant in their new nation, many expats struggle to make sound financial decisions. This can lead to problems like investing without thinking about local tax implications or purchasing unnecessary insurance.

Ineligibility to file insurance claims

Private health insurance is often necessary for expats because they do not have access to the public healthcare system in their host country.

However, this comes with a price, and in many cases, non-residents of the country in question have a hard time claiming these benefits.

What factors should influence expats’ wealth management strategies?

Financial planning, investment management, and estate planning are the three key aspects of wealth management for expats.

The goal of financial planning is to maximize long-term gains while minimizing short-term losses so that your money can provide for your needs now and in the future.

Among these measures is reserving a sum of money in the event of a sudden financial crisis, such as the loss of a job or a serious illness.

Long-term money management based on careful preparation will help you achieve your goals and weather whatever storms life throws at you.

Success requires constant monitoring of the plan’s development and the implementation of necessary revisions.

Developing a feasible budget to achieve your financial goals begins with setting those goals. Your financial condition can be evaluated and examined after you have gathered all the relevant data. The next step is to fine-tune and implement your approach.

Management of investments entails determining which assets to invest in and how much of each type of asset (equities, fixed income, and real estate) to purchase.

You will also want someone to assist with periodic rebalancing of these allocations to make sure they are still reasonable in light of shifting market conditions or life events like marriage and having children.

An investment manager’s job is to ensure the health of your portfolio and prevent any unwanted surprises. You are responsible for the short- and long-term outcomes of your portfolio decisions, including purchases and sales of assets.

You may also want to include services like budgeting and tax preparation in your strategy. Focusing on the requirements of the people whose money you are managing is akin to wealth management.

Investment managers diversify their portfolios across a wide range of asset classes and markets in an effort to optimize returns while limiting risk.

“Estate planning” refers to the process of preparing one’s financial matters for the possibility of incapacity or death.

As part of your estate plan, you should think about things like the welfare of your minor children and pets.

When creating an estate plan, it is recommended that you speak with an attorney that focuses on estate law. Common elements of estate planning include making a list of assets and debts, checking financial accounts, and writing wills.

Making sure that your will, trust, and power of attorney documents are all in place before you pass away is an important part of estate preparation for expats.

Most companies that specialize in wealth management have experts on staff who can advise clients on a wide range of financial matters.

Consider a client with $2,000,000 to invest, plus a trust for their grandchildren and the estate of a recently dead business colleague.

A wealth management business would provide not only investment advice for a discretionary account, but also the will and trust services necessary for tax minimization and estate preparation.

Do not assume that your wealth manager is the same as everyone else’s. Wealth management advisers working for investment firms and those working for large banks may have different areas of expertise, with the former focusing on investment strategy and the latter on trust and credit management, estate planning, and insurance.

To sum up, businesses may have different levels of skill.

How do you find a good wealth manager?

When deciding on a supplier of wealth management for expats, there are several factors to take into account. This is especially important for Muslim expats.

Accessibility and proximity

When searching for a provider of wealth management services, expats should take their location into account. Someone who can meet with you often in person and advise you on local rules and regulations is probably what you need if you are living abroad.

Having your chosen financial advisor readily available is also important when deciding on a suitable service provider, as this will allow them to effectively fulfill their role by keeping you abreast of any relevant legislative or regulatory changes and assisting you in navigating any obstacles that may arise during your time abroad.

Independently or for a large financial institution or investment firm, wealth managers can work in a variety of settings. Depending on the organization, a wealth manager may also be called a financial consultant or advisor.

You, the customer, have the option of working exclusively with one wealth manager or tapping into the knowledge of the group as a whole.

Costs and expenses

The budget must also be thought of. Advisors can choose from a number of different fee models. Some consultants charge on a per-hour, per-consultation, or per-year basis.

Commissions from investment sales are how some employees make their living. Fee-based financial advisors may earn additional compensation in the form of commissions on the investments they propose to their customers.

A poll of financial advisors conducted in 2021 found that the median advice fee (for AUM up to $1,000,000) was close to 1%.

However, the costs associated with hiring a financial advisor may be out of reach for people with little resources. Investors with greater balances pay a lower average AUM charge than those with smaller ones.

Robo-advisors provide an alternative, cheaper option for investing. Many of today’s completely automated robo-advisor platforms that are made to handle one’s personal wealth require an initial investment of less than one percent of assets under management (AUM).

Why should you get wealth managers and financial advisors?

Professional financial advisors offer a service called “wealth management” to their high-net-worth clients. Financial planning is the process of preparing for the future so that you can live comfortably both now and in retirement.

The advantages of money management for those living abroad cannot be overstated. The service can aid in budgeting, saving for the future, minimizing tax liability, and general financial management. It can also safeguard your assets by enforcing your final wishes for their distribution.

You should hire a wealth manager that has experience working with customers who reside overseas or have relocated abroad if you are an expat currently living abroad or preparing to move abroad in the near future.

By doing so, they will be in a position to offer sound guidance on how to handle your finances in a new country.

A wealth manager is a trained expert who can assist you in safeguarding your cash by investing it in line with your specific goals.

They can show you how to stretch your dollar further. By figuring out how to cut costs and boost earnings, they can help you achieve your financial objectives. They can also recommend investments that will help your money increase over time.

The wealth manager creates a plan to protect and grow the client’s wealth by first considering the client’s existing financial condition, goals, and risk tolerance.

To ensure the safety of a client’s wealth, it is essential that all areas of their financial picture, such as tax planning and wills and estates, operate together. Long-term financial planning and retirement savings may go hand in hand with this.

The manager then sets up periodic follow-up meetings with the client to examine and rebalance the customer’s financial assets and address any changes to the initial plan.

The objective is to keep working with the customer for as long as they need it, so they might look into whether or not any extra services are needed.

Where should you look for a reliable wealth manager?

Expats require a different approach to financial management than those at home. Foreign wealth managers may attract a different clientele than their domestic counterparts since they must comply with the tax laws and regulations of their customers’ home countries.

It is possible that some expat clients will want their wealth manager to take care of their investments on their behalf, while others will be content with only getting advice. There will be those who need assistance with tax matters and those who could care less about finances.

Finding a trustworthy wealth manager for expats is quite similar to looking for a good financial counselor. Several factors should be considered.

Check if the advisor has been designated as a fiduciary as a first step. If they say no, ask what steps they take to make accommodations for customers with your needs. Is it more important for them to make a sale than to provide you with good financial advice?

Second, you should find out if they have experience working with clientele like you. Reference checks are a great way to accomplish this.

Finally, you should investigate their experience, education, and credentials to make sure they are qualified.

It may take some time to find the perfect money manager for your needs. In order to find a reliable financial planner, you should contact investor and business associations in your country of residence, local government bodies responsible for regulating the financial industry, or online review sites.

The cost of financial planning might vary widely, depending on the complexity of your situation and the expertise of your chosen planner. The cost will increase proportionally with the difficulty of your case.

For example, if you have a large portfolio, are getting close to retirement, or have very intricate investments, you can anticipate to spend more.

Wealth manager vs financial advisor?

Although there are some parallels between financial advisors and wealth managers, the former tend to focus on major investments and other assets, whilst the latter also consider day-to-day expenses and things like insurance needs.

If you find it difficult to prepare for your financial future on your own, you can seek the assistance of professionals like financial counselors and wealth managers.

Both can be useful, but a wealth manager is more concerned with clients who already have considerable assets. By working with you to create a strategy and then managing your assets, a financial advisor can help you get where you want to be financially.

A financial advisor is an expert in the financial sector who helps clients with a wide range of issues. Advisors typically assist clients with managing their investments and creating long-term financial plans. In other instances, though, advisors will offer one service but not the other.

It is vital to keep in mind that there is no single expert to whom the name “financial advisor” can be used.

A Certified Public Accountant (CPA) has demonstrated competence in public accounting by successfully completing a set of exams.

A chartered life underwriter or CLU is a professional who has demonstrated expertise in the areas of life insurance and financial planning for retirees. A certified financial planner (CFP) also works with clients to develop long-term financial strategy.

Furthermore, some advisers specialize in working with a certain demographic, such as the elderly or company owners. Reviewing a consultant’s experience and training might help you determine their strengths.

Wealth managers, a specialization of financial advisers, are found in that space. What sets them apart from other consultants is the quality of their clientele.

Wealth managers typically only work with extremely wealthy clients. They handle large sums of money on their clients’ behalf, as the name would imply.

In order to provide their clients with a comprehensive set of advisory services, wealth managers work closely with them. Some of the available services include investment management, tax preparation, financial planning, retirement planning, legal planning, charitable gift planning, and estate planning.

Each client of a wealth manager receives service that is customized to their unique situation.

Independent financial advisory businesses often offer wealth management as a supplementary service. Wealth management services can also be found at financial institutions like banks. Bank of America, Edward Jones, Merrill Lynch, and J.P. Morgan are among the most prominent but there are many more.

The people who hire a wealth manager are not the same people who hire a financial counselor. Some financial advisors will work with you one-on-one if you need assistance managing your finances. Only people with significant wealth are eligible to work with a wealth manager.

Remember that some financial advisors charge clients for their services. They may receive compensation if you invest in an asset they recommend.

Fiduciary financial advisors are obligated to put your interests ahead of their own notwithstanding the existence of potential conflicts of interest. Wealth managers, on the other hand, almost never receive commission.

Do you need a wealth manager as a Muslim expat?

The type of financial counselor you need depends on your individual situation. A wealth manager is a fantastic choice to think about if you have a considerable amount of wealth and desire experienced financial management.

There is an abundance of financial advisers who do not specialize in working with the extremely rich. If you need a financial planner who will take your overall circumstances into account, this may be the best option.

Some counselors are quite selective, while others are not. Some wealth management firms require a minimum deposit of $1 million, $10 million, or even more to create an account.

If there is a certain financial service you are looking for, you may want to consider looking elsewhere. It is possible that a Certified Financial Planner (CFP) or Wealth Management Specialist (WM Specialist) might be a better option.

Financial advisors provide services like budgeting and investment management to their clients. However, “financial advisor” covers a wide range of roles. It is possible that one counselor specializes in life insurance and another in estate planning.

A wealth manager is an advisor who focuses on serving high-net-worth individuals. When working with a wealth manager, customers benefit from having a single contact for all of their financial needs.

If you want to be sure you can maintain your financial standard of living as an expat, it is in your best interest to get some expert assistance.

When you add in the taxation laws, investment regulations, and other factors that vary from country to country, wealth management for expats becomes a complex topic.

As a Muslim following Sharia, it is advisable to have a wealth manager who specializes in Sharia-compliant wealth management.

A qualified wealth manager can provide guidance on investment opportunities that align with Islamic principles, help you avoid interest-based transactions (riba), and ensure your financial activities are in compliance with ethical guidelines.

They can also help you navigate the complexities of Islamic finance and make informed decisions about wealth preservation, estate planning, and charitable giving.

A wealth manager with expertise in Sharia-compliant finance can be a valuable asset in managing and growing your wealth in a manner consistent with your religious beliefs.

If you need assistance keeping track of your money, a wealth manager or wealth management expert can provide it. The goal of this impartial expert is to assist you in reaching your financial objectives through the selection of appropriate investments and the implementation of sound financial strategies.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.