Sitemap: Personal financial planning > Expat tax > Low tax countries

Knowing what are the low tax countries can help expats legally leverage their tax policies to their advantage.

Because tax rules and regulations are subject to change, it’s smart to contact tax experts before making any decisions that could be affected by such adjustments.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

This page will talk about:

- Low tax countries

- Countries with no income tax

- Countries with no taxes

- Countries with highest taxes

Low Tax Countries

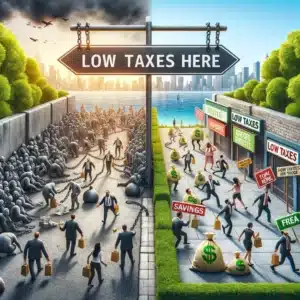

Low tax countries attract individuals and businesses worldwide with their favorable tax regimes. These jurisdictions, often referred to as tax havens, offer low or zero tax rates on income, capital gains, inheritance, and more.

Individuals and companies can retain a larger portion of their earnings thanks to reduced tax liabilities. This increased net income can improve living standards, provide more opportunities for investment, and facilitate wealth accumulation.

For businesses, lower taxes mean improved profitability and competitiveness, enabling them to reinvest savings into expansion and innovation.

Beyond the financial advantages, countries with lowest taxes usually offer political stability, robust legal systems, and a high quality of life, making them attractive destinations for relocation and investment.

Countries with No Income Tax

Several income tax free countries stand out for not imposing such levy on their residents, making them especially appealing to those looking to minimize their tax burden. Notable examples include:

- Bahrain: Offers zero income tax for individuals, making it a popular destination for expats.

- Monaco: Known for its affluent lifestyle and absence of personal income tax, attracting wealthy individuals from around the globe.

- Bahamas: Besides no income tax, it boasts a relaxed lifestyle with stunning natural beauty.

- United Arab Emirates: Home to a booming economy and zero personal income tax, it’s a magnet for professionals and entrepreneurs.

These countries provide not only tax benefits but also diverse opportunities for business and leisure.

However, potential residents must consider other factors such as living expenses, residency requirements, and social services, which can vary widely between these jurisdictions.

Countries with No Taxes

Countries like the Bahamas, Monaco, and the United Arab Emirates epitomize the allure of living or establishing a business in a no-tax jurisdiction. These nations do not impose personal income taxes.

Moreover, they offer competitive advantages for businesses with low corporate tax rates, no capital gains taxes, and no inheritance taxes, thereby fostering a thriving economic environment.

Living in low tax countries offers more than just tax savings. It often comes with a high quality of life, advanced infrastructure, and robust financial services sectors.

For instance, the United Arab Emirates and Monaco are renowned for their luxurious lifestyles, world-class amenities, and strong privacy laws, making them not just tax havens but also desirable living locations.

Countries with Highest Taxes

Contrasting low tax countries with the highest taxed countries that offer extensive social services and public amenities in exchange for higher individual and corporate tax rates.

Here is a list of some of the countries with highest taxes in 2024:

Personal Income Tax Rates

- Ivory Coast: Levies 60% personal income tax, the highest in the world.

- Finland: Second highest taxes in the world with a top marginal tax rate of 56.95%.

- Belgium: Highest marginal rate at 79.5%.

- Portugal: Marginal rate of 64%.

- United Kingdom: Marginal rate of 63.25%.

Corporate Tax Rates

- Brazil: Corporate tax rate of 40%.

- Suriname: Corporate tax rate of 36%.

- DR Congo: Corporate tax rate of 35%.

Sales Tax Rates

- Bhutan: Highest sales tax at 50%.

- Hungary: Standard sales tax rate of 27%.

- Denmark, Norway, Sweden, Croatia: Tied at a standard sales tax rate of 25%.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.