Updated January 19, 2021

(A quick note before we begin. For anybody interested in investing, you can email me at advice@adamfayed.com or use the WhatsApp Function below).

How can you invest in Vanguard index funds from Singapore, Dubai or beyond?

I have had many questions from readers over the years, but this has been one of the most common ones.

Whether it is readers from Singapore, India, New Zealand, Australia, Hong Kong, Dubai, the UK or Qatar, this question has come out again and again.

I would make two quick points on this issue. Firstly, whilst Vanguard are good funds, there are countless equivalent funds that will perform in the same way.

Vanguard was the original for this type of fund, but countless other firms (including 3-4 large ones) have close to identical index/tracker funds. Similar costs, portfolio and performance. In fact, almost identical.

Some people do engage in analysis paralysis. Whether you invest in fund A for 0.09% per year, or fund B for 0.08% per year, that tiny difference really won’t make a huge difference.

Second, Vanguard can’t take clients directly from many countries around the world. However, numerous platforms can accept Vanguard and equivalent funds as I have pointed out here.

The videos below also have brief explanations:

For people living in blacklisted countries or places where investments are restricted, the following video would be useful.

Frequently asked questions

This section will answer a few FAQs:

Is now a good time to invest?

- Now is always the right time to invest if you are long-term

- Nobody can time markets but these lower valuations does appear to lower a great opportunity if you happen to be liquid

- The crisis related to the pandemic, shows that many people can’t DIY invest. Not technically but emotionally. I have lost count of the number of people that have panic sold during this period.

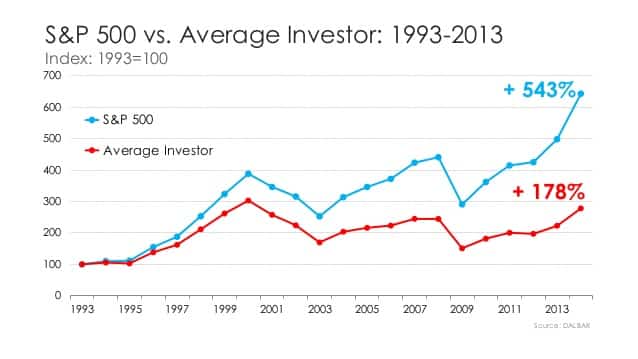

- Point 4, could help to explain these figures below. Too many people buy high (1999) and sell low (2008, 2020):

5. This crisis also shows, once again, the benefits of buying and holding both stock and bond indexes. Bonds don’t beat stocks long-term but usually rise during periods like 2008 and any crisis.

Is there a big difference between index-linked ETFs and index funds?

Not if you are a buy and hold investor and the costs are similar. ETFs can just be sold more quickly which isn’t always a benefit.

Does Vanguard accept directly in most countries?

Vanguard only accepts directly for a certain number of countries. In general, it is better to have access to a platform which also gives you a wider range of investment choices.

Do you offer access to Vanguard, iShares or BlackRock index funds or ETFs?

Yes I do. Minimums are $100,000 or currency equivalent. Fees are 1%, 0.75% above $500,000 and 0.5% above $1million.

Some restrictions might be placed depending on your country of residency.

Additionally, I can set up “80:20 portfolios” which combine indexes with higher net wealth assets which you usually can’t get access to directly yourself.

If you are looking for more specific guidance about this, you can book a consultation with me here.

Thanks, so what are the options to invest in US ETF from Europe ?

I’ve struggled to find options when opening a brokerage account to be able to invest in US ETF (Vanguard, etc.).

Thanks !

There are countless. Many brokers allow it. I have emailed you anyway.

Hi i am based in Dubai and not able to find the correct broker to buy monthly 1000 SIP for Vanguard index funds, i saw the option like intective brokers and robinhood but to send 1000 usd monthly bank charges USD 50 so it becomes expensive, what ate the other options you suggest

Hi Zahir – I will email you.

can you please send me the same email ?

Same question here

i i am based in Dubai and not able to find the correct broker to buy monthly 1000 SIP for Vanguard index funds, i saw the option like intective brokers and robinhood but to send 1000 usd monthly bank charges USD 50 so it becomes expensive, what ate the other options you suggest

I will email you.

Am new I will love you to guide me thanks

Please send the same email

Can you please send me the same mail I am based in Dubai.

Hello can you help me finding some good options to invest in Vanguard ETF Funds from Singapore?

how much the smallest amount to invest?

on which option? some have no minimums but that can have its own issues due to fees.

can you guide me with countless other firms (including 3-4 large ones) have close to identical index/tracker funds. Similar costs, portfolio and performance. In fact, almost identical.

I am living in UAE and want to invest in index funds. Thank you

Did you find anything?

Hi Mohammed I just email you

Hi please email me too, looking to invest in funds from UAE

I’d like to know which firms can I invest in in the UAE as well.

Want to invest in.US STOCKS INDEXFUND

Hi,

Please suggest a few options to invest in Vanguard funds from Dubai.

Thank you

thanks emailed you

Would you mind shooting me the same? Based out of Dubai. Thanks.

Bit late to the party, but could I possibly get my hands on that email also? Greatly appreciated.

Hello can you help me finding some good options to invest in Vanguard ETF Funds from Indonesia?

Thank you.

just emailed you

Hi,

I’ve hard times to find how to invest in index fund from indonesia.

Any advice? Thank you

Hi Budi – just emailed you

The same for me from Europe, please. Thank you!

Hi Adam,

Need your advice on how I can park some funds in Vanguard index portfolio. Unfortunately, unable to trace through the internet. Came across your article, hope you can help here. Thanks.

Hi,

can you help me finding some good options to invest in Vanguard ETF Funds from Kuwait?

Thanks.

I have been finding ways to portfolio into different asset class such as commodities, equities index, bond etc. However, it is problematic to have commodities portfolio as you pay margin financing. I could not find good ETF such as Vanguard ETF Funds from Singapore, TD ameritrade don’t carry too.

It is possible to do it from Singapore Jack, just your options are limited.

Hi Adam, I want to invest in Index Funds, I currently based in the UAE right now. Please do advice on how and what possible steps I can do to have access on such funds.

Hi Adam, what are my options to invest in ETF Vanguard or Fidelity funds from Singapore?

Keen to know how I can access these types of funds with low expense ratios from New Zealand. Any advice would be appreciated.

Hi,

Could you suggest a few options to invest in Vanguard funds from Hong Kong.

Thank you in advance.

Carina

How to invest in vanguard ETFs from Dubai ( non us citizen ).

Thanks

Hi,

Can you tell me the ways to invest in Vanguard ETF Funds from Indonesia?

Thank you

Hi Kevin – just emailed you

Hey,

Can you tell me the ways to invest in Vanguard ETF Funds from Vietnam?

Thanks!

Emailed you Trinh

Hi !

I am a Swedish citizen living in Thailand. Can you please advise I can go about to invest in a ETF such as Vanguard’s S&P 500 Index fund. Either Via Vanguard directly or some other broker – who deals in Vanguard funds – or via some other reputable broker who have similar types of funds (ETF Index funds = S&P 500) ?

Appreciate if you can help !

Hans

I will email you

Hi Can you please share your email about funds for expats living in Thailand. Many thanks!

I will email you Alex.

Can you please share the same from Romania or Turkey?

Thank you~

Just emailed you

Hi, would like to know how to invest in index funds from UAE. Thanks

Hi Adam. I am also trying to search for options on how to invest in Vanguard and other index funds from Dubai. Can you please share the information with me too? Thanks

Hi Adam, I am looking into how to buy Vanguard or Schwab Index Funds from Dubai (Non-Us Citizen). Can you please advice? Thanking you in advance

Hi Eli – I will email you.

Hi, can you please share those broker names. The link you have provided is not working. Thanks

Check now – https://adamfayed.com/onlineinvestingsites/

Same issue would like to invest in a variety of Vanguard mutual funds. It appears that is not possible from Turkey. Would appreciate some help!

Just emailed you

Hi Adam, your doing a great job helping people out.

I live in UAE (expat and A non US citizen) and I’m looking to invest in international stocks and index funds such as vanguard. Could you help me please. Thank you.

Thanks Ali, I will email you.

I am an Indian national living in Kuwait. I would like to invest in USA stocks and vanguard. please let me know the details

Hi Adam, thanks for writing this. Could you send me some ideas/options on how to invest in Vanguard index funds as a Singaporean citizen, staying in Singapore?

Thank you.

Sure Mark

Hi Adam. Please can you also send the same Vanguard S&P 500 info to me for investment in the US. Thanks. I am in the Philippines.

Hi Adam, thanks for writing this. Could you send me some ideas/options on how to invest in Vanguard index funds

Thank you.

John

Hi John do you want to DIY or use an advisor? That will affect the options available to you.

Thanks for your writing, you are doing a great job. can you please guide me,I am a pakistani national living in dubai. i want to invest in low cost index funds. what are possible options of brokers for me, and later if i want to return back to my country, will i be able to transfer my account to link with another bank?.

Will email you.

Hey Adam,

It’s good to finally come across someone who is helping out on investing in global market via ETFs / Low cost Index funds! Iam an Indian expat in Dubai keen on ETFs with 10yrs+ timeline..need your advice.

Thanks

Hello Adam, hope all is well! Which application or online broker do you suggest to purchase US index funds if I am not a US citizen? I tried eToro, although it only has the Vanguard ETF. Many thanks

Depends where you live and if you want to DIY or use an advisor. I would use a non-US platform which has access to American markets such as Swissquote.

Hi Adam, I am new to investment and am currently studying about the different type of invesments and i came across index funds. I want to know how can i invest in index funds from singapore, whether its worth investing and how much is a good starting value to start investing? thank you!

I will email you. Thanks

Hello, so happy that I found your website!!!! I am living in Dubai, resident of Dubai. I want to invest in low cost index funds. I would like to know step by step where to start and how. What are possible options of brokers for me. I heard a lot about Vanguard. Which application or online broker do you suggest to purchase US index funds if I am not a US citizen

Hey Nazgulya I will email you.

I’m a Canadian non-resident as I relocated to Jordan. I want to start investing in ETFs. Can I invest in ETFs Vanguard from Jordan as a Jordanian citizen? Thank you

I’m interested to start learning how to invest in ETFs. As a start I’m trying to figure out how much it will cost to invest in global ETFs to determine if it’ worth investing in after all fees and costs associated with brokers’ fees, custody fees, currency, taxes..etc. As a start can you please provide me with major elements of costs associated with buying global ETFs where I can start doing the research and do comparison. If you have also any links to reliable info, it would be much apricated. Thank you

Thank you so much for the valuable information. I live in Dubai and i wanna invest in Dubai stock market as well as in US Stock Market. I would like to know step by step where to start. i would like to know how to invest in vanguard total stock market( VTSAX) as well. and i am from Afghanistan. can you please guide me how to start . Thank you so much

I will email you.

Hi, i would like to invest Index Fund either in China or US from Singapore. Can you provide some good recommendations?

I will email you.

Hello,

Can you guide me with, “countless other firms (including 3-4 large ones) have close to identical index/tracker funds. Similar costs, portfolio and performance. In fact, almost identical”.

I am living in Dubai, resident of Dubai. I want to invest in low cost index funds. I would like to know where to start and how.

What are possible options of low cost brokers for me.

Do you want to DIY or use an advisor?

I would like to start by DIY, and try it out first.

Also I was referring to the likes of iSHares and Blackrock when I was saying identical options exist

Pls suggest me way to invest in Vanguard index from Singapore

Hi Adam, really nice article, thanks for sharing. I am an Indian passport holder residing in UAE. Instead of ETF can I invest in US mutual funds through IB? Or will this lead to tax implications?

It could lead to withholding taxes if you go for US domiciled investments – for example total stock market exchange would usually mean withholding taxes.

Hi Adam, Investing in US Stock Market from Dubai as an expat has some tax implications. You don’t pay tax on capital gains (when you sell your stock or ETF) but automatically will be taxed 30% on dividends (if companies are US ones). Did you experience anything different? I am thinking to invest from Dubai for growth and if i ant dividends will do it through my father in my home country as WHT is way lower. Any way how to avoid WHT from dubai ?

Hi Dumitru – i will invest in US index funds which are domiciled in the UK, Canada, Ireland or somewhere else offshore.

Hi Adam,Thank you for sharing your knowledge. I am a Kuwaiti citizen and resident and looking to invest in the stock market. Specifically looking into low-cost index funds like Vanguard e.g. Global funds like VSWST or even ETFs like Vanguard Total Stock Market. Thank you

No worries.

Hello Adam, as numerous comments above, I am also living in Dubai (Indian national). I want to invest in US stocks and low cost index funds. I would like to know where to start and how.

What are possible options of low cost brokers for me. thanks 🙂

Hi Mandeep I would use Swissquote or Saxo Bank if you are looking for pure DIY. Remember though that often doesn’t work – https://adamfayed.com/diyinvestingandplatformsforbeginnersdoesitwork/

Hi Adam, thanks for the article! I am an Indian national working in Singapore. I am looking to invest in US index funds. I feel doing it from Singapore would be better (compared to India) as there’s no capital gains tax on equity profits in Singapore. I understand that one option would be to open a trading account with some broker (eg. Saxo or Interactive Brokers) and purchase ETFs. However, will one be able to invest a fixed monthly amount (say $500 per month) in that case? If not, are there any other options?

Hi harry it depends. The problem with $500 a month is that most of the DIY platforms aren’t set up for that. Will you be staying in Singapore long-term?

Hi,

Could you suggest a few options to invest in Vanguard funds from South Africa.

Thank you in advance.

Hi Adam,

I’m a UK citizen living in the UAE. Kindly assist on how to invest in ETF such as Vanguard’s S&P 500 Index fund and Total Stock Market. Either Via Vanguard directly or some other broker – who deals in Vanguard funds – or via some other reputable broker who have similar types of funds (ETF Index funds = S&P 500).

Greatly appreciated.

Kelley

Can you tell me the ways to invest in Vanguard ETF Funds from Vietnam?

Sure I will send you information.

Hi Adam ,which is the best way to invest in Vanguard ETF Fund from Germany and which are the other firms that are similar and how safe are they.Thank you

Please suggest a few options to invest in Vanguard funds from Dubai.

Thank you

Hi i am based in Dubai and not able to find the correct broker to buy monthly amount 1000 usd for Vanguard index funds, i saw the option like intective brokers and robinhood but to send 1000 usd monthly bank charges USD 50 so it becomes expensive, what ate the other options you suggest

I will email you

Hi Investing in from Dubai and looking for guidance on DIY brokerage app to buy index funds like VOO but not have to pay the exorbitant fee of Wiring the money to IBKR and apps like etoro offer very limited options to invest in Index funds.

Hello Adam, can I trouble you for a copy of that same email, please. Thank you

David

Pl advise how to buy individual company shares/ US; and also the index funds. I am Indian citizen with permanent resident in Zambia.