Dual citizenship for US citizens describes the legal status of a person who is a citizen of both the United States and another country.

Given the complex legal considerations at play here, there are advantages and disadvantages to be aware of.

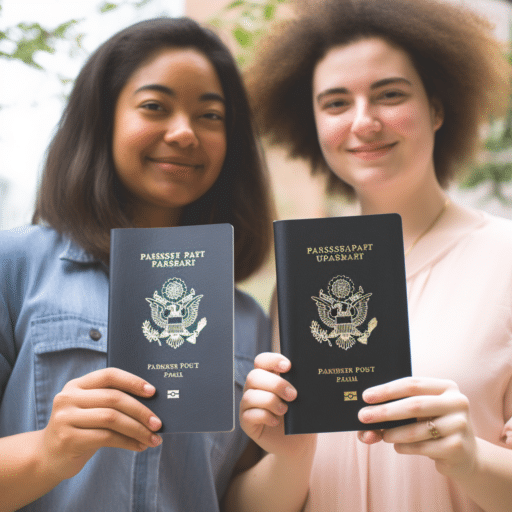

One perk of having dual citizenship that is usually cited is the opportunity for an individual to possess two passports. One potential drawback, however, is the possibility of being twice taxed.

The second country you apply for citizenship in will decide if you are allowed to become a dual citizen based on its own set of rules.

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

What is Dual Citizenship for US Citizens

The United States is a unique nation in that it permits its residents to simultaneously hold citizenship in both their home country and another country, making it one of the few countries in the world to offer dual citizenship.

Obtaining dual citizenship can be the result of specific circumstances, such as when an individual is born within the territorial boundaries of the United States to parents who retain residence in a foreign nation.

Another example is when an individual is born within the geographical boundaries of the United States to parents who maintain residency in Canada.

It is common practice for a child to earn United States citizenship in addition to any citizenship they may inherit from their parents, with the sole exception of situations in which the child’s parents are foreign diplomats serving in the United States.

In a similar vein, if a child is born outside of the United States to parents who are citizens of the United States, then there is a potential that the kid may automatically acquire citizenship in both the United States and the country in which the child was born.

This is known as dual citizenship. However, it is essential to keep in mind that the laws of the particular nation in issue will determine whether or not this situation may be put into practice there.

Some legal processes, such as the naturalization of a foreign national as a citizen of the United States, can also result in a person obtaining dual citizenship for themselves and their children.

In the circumstances at hand, the person in issue would be eligible for citizenship in both countries, provided the individual’s country of birth does not permit dual citizenship.

To become a citizen of the United States through the process of naturalization, an individual who is not a native-born U.S. resident must first satisfy the requirements for permanent residency, then pass the citizenship test administered by the United States, and finally meet any extra qualifying requirements.

Private banking offers personalized financial services, tailored to clients with dual citizenship, providing a strategic approach to wealth management for US citizens.

What are the Benefits of Having Dual Citizenship for US Citizens

Political Rights

Individuals who possess dual citizenship can actively engage in the political affairs of each country in which they have citizenship.

This encompasses the entitlement to participate in electoral processes by exercising the right to vote and run for public office, as well as the privilege to contribute financial resources to political candidates.

These rights are just one of the benefits for US citizens having dual citizenship in another country.

Property Ownership

One of the benefits of having dual citizenship is the capacity to buy property and have ownership in either of the respective countries.

Certain nations impose limitations on land ownership only for their inhabitants. Individuals who hold legal citizenship in two countries have the privilege of acquiring real estate in either one or both of these nations.

For those who engage in regular travel between two nations, the concept of property ownership may be particularly advantageous, as it might potentially provide a cost-effective means of maintaining residences in both locations.

Social Services

Individuals who hold dual citizenship have the opportunity to avail themselves of the advantages and prerogatives provided by both countries in which they hold citizenship.

As an example, individuals may engage in cross-border travel to access medical care or procedures that are not accessible within their nation of origin. International students are also able to obtain an education at a comparable cost to that of domestic students.

Work and Travel

In contrast to individuals of foreign nationality, dual citizens are exempt from the need to get a visa or permit to travel to the countries in which they hold citizenship.

Moreover, they possess the privilege of an indefinite stay duration within these nations. In addition, individuals also possess the entitlement to pursue employment opportunities in both nations, but non-nationals are required to undergo an extensive procedure to obtain a work permit.

Additionally, overseas businesspeople are not subject to any limitations.

Cultural Education

As an individual with dual citizenship, one can enjoy the advantages of being fully engaged in the cultural experiences of both countries.

Certain government officials exhibit a favourable disposition towards dual citizenship, perceiving it as a means to enhance the country’s reputation as a premier tourism destination.

Dual citizenship provides individuals with the unique chance to acquire knowledge about the historical contexts of both countries, develop proficiency in two or more languages, and immerse themselves in another cultural milieu.

Two Passports

Individuals who possess dual citizenship have the privilege of holding passports from both nations.

For instance, those who hold dual citizenship in the United States and New Zealand can experience enhanced travel convenience when commuting between these two nations.

The possession of a citizen’s passport obviates the necessity for long-stay visas and any inquiries regarding the purpose of one’s journey during the customs procedure.

Moreover, possessing dual citizenship ensures the individual’s entitlement to unrestricted entry into both the United States and New Zealand.

This can prove particularly advantageous for individuals with familial ties in both nations, as well as for students or business professionals engaged in academic pursuits or commercial activities in both countries.

What are the Disadvantages of Having Dual Citizenship for US Citizens

Dual Obligations

Individuals who hold dual citizenship are subject to the legal frameworks of both nations in which they possess citizenship.

As an illustration, if an individual holds citizenship in the United States and resides in a nation where compulsory military service is enforced, there exists the possibility of forfeiting their U.S. citizenship under specific conditions.

One such case arises when the individual assumes an officer position within a foreign military entity that is actively involved in hostilities against the United States.

In a broad sense, the policy of the United States acknowledges the potential legal requirement of dual citizens to execute military duties in foreign countries.

It is worth noting that many dual citizens can fulfil these commitments without compromising their status as U.S. citizens.

However, it is crucial to conduct thorough research and analysis for each specific circumstance.

Double Taxation

The United States enforces taxation on persons who hold dual citizenship with the U.S. and another country, requiring them to pay taxes on their worldwide income.

Individuals who reside in a country other than the United States, but maintain dual residency, may find themselves subject to tax obligations from both the U.S. government and the country in which their income was generated.

Nevertheless, income tax treaties established between the United States and other nations function to successfully mitigate or eradicate an individual’s obligation to pay taxes, so preventing the occurrence of double taxation. What are double taxation agreements?

As an example, a bilateral treaty between the United States and New Zealand supersedes the respective income tax legislations of both nations, thus mitigating the issue of dual taxation.

However, it is important to note that individuals with dual citizenship may be obligated to submit tax returns to the United States, even if they reside in New Zealand and generate income there.

Due to the intricate nature of tax legislation and its potential for annual modifications, individuals confronted with such circumstances must seek guidance from a certified tax accountant.

United States citizens are obligated to disclose their money received abroad, regardless of their status as foreign citizens.

The Foreign Generated Income Exclusion provision enables individuals who hold U.S. citizenship to deduct a maximum amount of $112,000 in income generated from foreign sources from their tax obligations in the year 2022.

This exclusion threshold is set to increase to $120,000 in the subsequent year, 2023.

Some Employment Limitations

The potential drawbacks of dual citizenship may vary depending on one’s chosen professional trajectory.

If an individual is pursuing work inside the U.S. government or their occupation necessitates access to information designated as classified by the U.S. government, possessing dual citizenship may impede their ability to obtain the requisite security clearance for such employment.

Individuals who are born with dual citizenship may experience fewer challenges compared to those who actively pursue dual citizenship.

Investment funds present an avenue for US citizens with dual citizenship to diversify their portfolio, tapping into global opportunities and mitigating risks through a well-managed and internationally focused fund.

Complicated Process

In many cases, dual citizenship may be acquired by individuals without any deliberate action on their part, such as when a child is born in the United States to parents who are citizens of another country.

In many instances, however, the duration of the process may span several years and entail significant financial and logistical complexities.

The potential deterrent effect of this policy may dissuade certain individuals from pursuing dual citizenship.

Best Countries for Dual Citizenship for US Citizens

Malta

The Malta Permanent Residency Program (MPRP) is one of the investment options available under the Malta Golden Visa Program.

The MPRP requires an investment of US$140,000 in exchange for a permanent residence card in Malta and the possibility of citizenship after five years.

The ‘Citizenship by Naturalization for Exceptional Services by Direct Investment’ scheme, which is the Malta Citizenship by Investment program, provides Maltese citizenship after three years of residency.

There is a more expensive expedited route to citizenship that can be completed in only one year.

Luxury investors pay close attention to the European real estate mortgage lending, and rental industry, which is dominated by giants like Janus Henderson Group plc (NYSE:JHG), Altisource Portfolio Solutions S.A. (NASDAQ:ASPS), and Airbnb, Inc. (NASDAQ:ABNB).

Switzerland

Switzerland is one of the easiest countries for US citizens to obtain dual citizenship.

The process of naturalization for Swiss citizenship might take upwards of ten years. If you want to become a citizen of Switzerland, you must be physically present in the country for at least 183 days per year, with the full 365 days in the year before your application.

Those who wish to become citizens of Switzerland must also comply with Swiss tax law.

Candidates must demonstrate both oral and written fluency in one of Switzerland’s official languages (A2 and B1, respectively).

Passing a citizenship test is a requirement in the citizenship process.

Citizenship laws in Switzerland are also set at the federal rather than the federal cantonal level.

Keep in mind that several Swiss cantons have very particular standards and strict criteria for Americans who want to acquire Swiss citizenship or residency while still maintaining their U.S. citizenship.

United Kingdom

The United Kingdom passport is one of the most sought-after options for dual citizenship due to its high standards. This is due to the United Kingdom being one of the easiest countries for US citizens to get dual citizenship.

American citizens can take advantage of the country’s thriving economy, elite educational institutions, and historic landmarks.

The UK’s cities, notably London, are global centres for banking, business, and creative sectors. There are openings in fields including IT, healthcare, and the media in this country.

Norway

One of Norway’s numerous benefits is the quality of its passport. The country provides its residents with a high quality of life, beautiful scenery, and a robust social safety net.

The energy industry, the maritime industry, and the technological sector all play significant roles in Norway’s economy.

The country is an innovator in renewable energy and a champion of environmental protection. The capital, Oslo, is well-praised for its progressive outlook and high standard of living.

Luxembourg

Luxembourg’s strong economy and well-known finance industry make it a desirable location for anyone seeking dual citizenship.

Luxembourg is a thriving hub for banking and finance thanks to its high standard of living in areas such as healthcare, education, and infrastructure.

This prosperous climate extends to the mortgage and loan industries, as well as the rental market, providing enticing investment prospects, especially for HNWIs.

Major participants in this field include Altisource Portfolio Solutions S.A. (NASDAQ:ASPS), Janus Henderson Group plc (NYSE:JHG), and Airbnb, Inc. (NASDAQ:ABNB).

Iceland

The tourism, energy, and technology industries have become increasingly important to Iceland’s economy over the years.

The country has become a global pioneer in the generation of clean energy thanks to the successful harnessing of its abundant renewable energy resources, particularly geothermal and hydropower.

Those who wish to become full members of Icelandic society can do so through residence and naturalization programs.

Canada

Many U.S. citizens who are interested in obtaining dual citizenship choose Canada since it is one of the countries where it is easiest to do so.

Opportunities in fields like healthcare, technology, and finance are available in Canada because of the country’s solid economy, immense natural beauty, and multicultural population.

The quality of life and employment opportunities in its major cities are well-known.

Australia

Australia permits dual citizenship, enabling the keeping of US citizenship while attaining Australian citizenship.

Permanent resident visas can be obtained through a variety of channels, including skilled migration, family sponsorship, business investment, and humanitarian programs, but all applicants must first apply for one.

Citizenship in Australia can be applied for after four years of continuous residency in the country on a permanent resident visa.

In addition, you’ll need to prove your identity and moral rectitude, demonstrate your loyalty to Australia, and pass a citizenship test to meet the criteria.

New Zealand

Citizens of the United States may apply for dual citizenship with New Zealand. Dual citizenship with New Zealand is one of the best dual citizenship for US citizens.

The process usually involves meeting residency requirements, filling out an application, maybe taking a citizenship exam, and paying related expenses.

It is important to highlight that New Zealand does not require its residents to renounce their American citizenship.

Denmark

Americans interested in obtaining dual citizenship often choose Denmark because of its high passport rating and appealing way of life.

The country has a robust social safety net, first-rate medical care, and an environmental commitment.

Cities in Denmark, notably the capital of Copenhagen, are well-known for their high standards of living, stunning architecture, and cutting-edge businesses in fields like clean technology, medicine, and design.

Belgium

Citizens of the United States can become citizens of Belgium without giving up their US citizenship.

Dual nationality is possible for anyone who voluntarily acquires Belgian citizenship through naturalization or a declaration of citizenship, allowing them to continue to be citizens of their home country in addition to Belgium.

Notably, individuals holding dual citizenship in Belgium are not required to file any paperwork with federal or state agencies or foreign embassies.

Sweden

Sweden is home to numerous successful startups, top-tier educational institutions, and a generous social safety net.

Technology, manufacturing, and the healthcare sector are among the country’s most important economic drivers. The capital city of Sweden, Stockholm, has a growing tech industry and an innovative business climate.

Final Thoughts

When a person has dual citizenship, they are entitled to all of the rights and privileges that are associated with being a citizen of two different countries at the same time.

Dual citizens can freely travel in both countries, as well as work, conduct business, own land, and participate in other activities that may be limited to outsiders.

On the other hand, dual citizenship is not without its drawbacks, as dual nationals may be subject to additional taxes or even mandatory military duty.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.