What are Non-Correlated Assets?

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Introduction

Non-correlated assets are those with no apparent relationship between them. Keep reading for more information on non-correlated assets and how it can influence your financial decisions.

What is a Non-Correlated Asset?

Prior to anything else, it’s important to understand the fundamentals of asset correlation. How investments move with respect to one another is gauged by asset correlation.

There are many levels of asset correlation.

- A positive correlation is a term used to describe the situation where assets move in the same direction simultaneously.

- A negative correlation occurs when one asset rises while the other falls.

- Non-correlated assets are assets that have no relationship with one another.

The issue is that many inexperienced investors are unaware of the degree of correlation in their portfolios. The same types of significant market occurrences have a significant impact on traditional assets like stocks and bonds. If one of your investments sinks as a result of significant news, your entire portfolio is likely to suffer unless you are adequately prepared.

Non-correlated assets are useful in this situation.

The returns on assets are totally uncorrelated when the correlation is 0. The price movement of one asset does not affect the price movement of the other asset if two assets are said to be non-correlated.

Broad market changes can affect any asset, including those seen as traditionally non-correlated, it is true. But generally speaking, some assets react to economic news and market volatility less quickly than equities do.

Types of Non-Correlated Assets

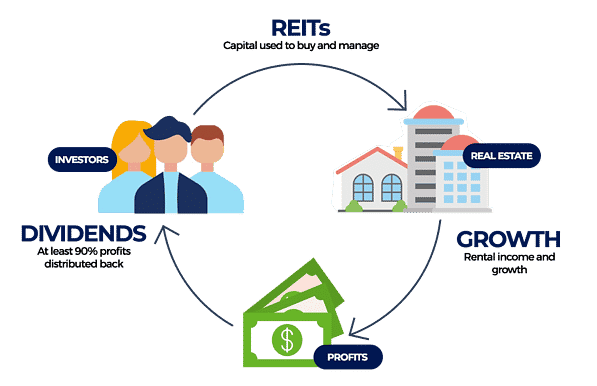

Real estate/REITs

Investments in real estate are less vulnerable to significant macroeconomic news than other sorts of investments. This is so because their prices are linked to things like long-term leases, for which they have a guaranteed stream of income and which typically aren’t affected by headline events.

People need homes no matter what else is going on. A correlation of about 0.6 exists between US real estate investment trusts (REITS) and the S&P 500, indicating a low correlation between them and the US stock market.

Additionally, REITs typically do well in inflationary circumstances, making them a solid inflation hedge.

Emerging Market Bonds

The connection between emerging markets and the S&P 500 is slightly stronger, at about 0.72 percent. Despite the fact that it consists of assets from different nations, the majority of investors still do not view this asset class as being highly connected.

These investments might be dangerous on their own, it is true (as any investment is). But even though they aren’t intimately related to American markets, they may nevertheless help you diversify and maybe reduce the overall risk profile of your portfolio.

Emerging market bonds are among the simplest methods to invest in this asset class.

Gold and Other Precious Metals

When the markets are in chaos, many people consider gold to be a safe haven investment. This is due to gold’s historically poor connection to the market as a whole (approximately 0.23 between 2006 and 2015).

The fact that gold’s correlation is known to fluctuate, however, provides it a special hedge in the market; in times of market boom, it correlates higher; in times of market bust, it correlates lower, making it more advantageous for investors in both circumstances.

Other Non-Correlated Assets

- Commodities

- Municipal bonds and other fixed-income

- Art

- Collectibles

- Wine

Risk of Non-Correlated Assets

Of course, it’s also important to keep in mind that, in comparison to investing in publicly traded assets like equities and bonds, accessing non-correlated markets like these has an additional degree of risk.

The first is a risk to liquidity. There is less liquidity in the market than with something like standard public shares because non-correlated are by nature restricted in the number of investors who may access them.

After all, only one individual at a time can own a specific painting or other limited assets. It’s possible that you won’t always be able to sell the shares you’re trying to.

However, because they are not subject to the same norms of reporting and transparency as public assets, information regarding these sorts of assets may be limited. Finding out about the underlying performance and long-term prospects of a non-correlated asset can be challenging for investors.

Building a Non-Correlated Asset Portfolio

Investors can diversify their portfolios in a number of ways by including non-correlated assets, such as:

- Investing across a variety of assets belonging to the same class. For example, stocks for businesses in various industries.

- Investing in a variety of asset classes such as stocks, bonds, mutual funds, high-interest savings accounts, and alternative investments.

- Investing into exchange-traded funds (ETFs) or mutual funds, which hold a variety of securities.

- Investing in non-correlated assets like art that are an alternative to more conventional assets like equities and bonds.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.