Sitemap: Living abroad > Living in Ireland

For natives and expats, Ireland’s lifestyle balances the vibrant streets of Dublin and the peaceful countryside. Moreover, the stable economy and business-friendly climate attract astute investors and expats to Ireland.

In this page, we’ll discuss about various topics pertinent to investing and living in Ireland as a foreigner, including:

- Is Ireland in the UK?

- Is Ireland a good place to live?

- Cost of Living in Ireland

- Living in Ireland pros and cons

- Where to live in Ireland

- How to move to Ireland: Visa, residency, and citizenship

- Investing in Ireland

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (hello@adamfayed.com) or WhatsApp (+44-7393-450-837).

Is Ireland in the UK?

Ireland is not part of the UK, but rather consists of two distinct countries: the Republic of Ireland, a sovereign nation, and Northern Ireland, a constituent part of the UK. Prior to 1922, Ireland was a single country within the UK, but historical events led to its division into two separate jurisdictions, establishing the Republic of Ireland as a sovereign entity.

Is Ireland a good place to live?

Ireland currency

There was an official currency known as the Irish pound (punt) in the Republic of Ireland until the euro was introduced in 2002.

Related content: The Highest Currencies in the World 2023

Ireland weather

- The Atlantic Ocean contributes to Ireland’s mild maritime climate. The country is famous for its warm and unpredictable climate, which experiences frequent showers all year round.

- On the whole, winters are rather moderate. While snow and extremely low temperatures are unusual, frost is typical in the interior.

- Summers are pleasantly cool. Ireland is not typically associated with hot weather, but it can reach higher temperatures on occasion.

- Ireland experiences a substantial quantity of precipitation all year round. A lot of rain is likely, and the weather can shift drastically. It rains more frequently in the west than in the east of the country.

- Ireland is frequently battered by strong westerlies because of its position in the North Atlantic. Particularly in coastal places, this might cause windy conditions.

- Cloudy skies are a usual occurrence. The weather might change from one day to the next, and there are times when it’s sunny.

Ireland population

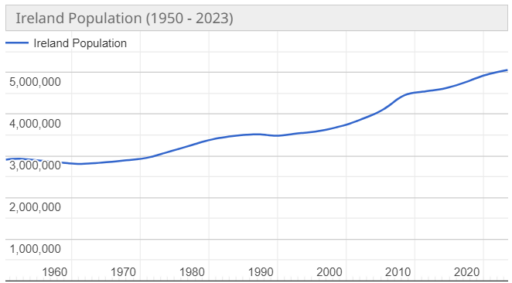

According to the most recent data compiled by Worldometer from the United Nations, the population of Ireland is nearly 5.1 million as of December 2023.

Ireland language

Everything from everyday life to business and government in Ireland is conducted in English, as the country is largely spoken by English speakers. Nevertheless, Irish is the official language of Ireland and is taught in schools.

Even though English is more widely spoken, particularly in cities, Irish is nevertheless pushed for cultural and preservation purposes because it is an integral part of the country’s history. Irish may be spoken as a community language in some localities and communities.

Ireland citizenship

The application process for Irish citizenship requires completing qualifying requirements and choosing between naturalization, descent, or marriage.

Foreigners in Ireland who want to become citizens often naturalize. Eligibility usually needs legal residency for a certain period, good character, and other Irish Naturalisation and Immigration Service conditions.

The descendants of Irish-born grandparents can claim Irish citizenship. Marriage to an Irish citizen can lead to citizenship, but it requires legal documents.

Fortunately, Ireland OKs dual citizenship, allowing people to become Irish citizens while maintaining citizenship in another nation. Before seeking for Irish citizenship, the individual’s country of nationality must be checked for dual citizenship regulations.

Naturalization requires three years of marriage and cohabitation and 12-month legal residency in Ireland.

Being born to immigrant parents, being born outside of one’s home country to a citizen of that country, becoming a naturalized citizen, or regaining citizenship in one’s first country can lead to dual citizenship.

Ireland culture

Ireland has a rich history and diverse art. Irish life revolves around festivals and celebrations, with St. Patrick’s Day taking center stage worldwide. Beyond this renowned event, Bloomsday and the Galway Arts Festival showcase Ireland’s literary and artistic talent.

Historical structures, monasteries, and cathedrals in Ireland show Catholicism’s influence. The country’s cuisine features Irish stew, colcannon, and soda bread. Pubs are beloved places for chat, music, and Guinness.

Irish culture values Gaelic football and hurling, which promote community and pride. Ireland produces successful athletes in rugby and soccer, which are particularly popular.

Irish people are warm and kind, creating a welcome atmosphere. Hospitality is a cultural trait that makes residents and visitors feel welcome.

Is Ireland safe?

Many visitors and locals consider Ireland a secure place, yet like any country, there are concerns. Tourist zones can have pick-pocketing and purse snatching. So, always be careful and secure your belongings.

Although the prevalence of major violent crime is moderate, it is nonetheless wise to remain cautious in busy areas and watch one’s things closely. For added peace of mind, stay away from parks and other places that don’t have enough light.

When it comes to getting around, the roads are usually in good shape and safe to travel on. But, roads in rural areas, in particular, can be narrow, rough, and winding, which can be dangerous in bad weather. In less populated areas in particular, drivers should be extra careful and adjust their habits appropriately.

Ireland healthcare

The Irish government usually provides public health care to expats at no cost or at a reduced cost. Both the publicly funded public healthcare system and the privately run system are available to expats in Ireland, with the latter requiring full payment of all fees.

Anyone who can prove they are a legal resident of the nation, such as those with work permits, asylum seekers, or students planning to remain for over a year, can apply for a medical card or a general practitioner visit card. Free public healthcare services are available via the Medical Card, while GP Visit Cards provide free general practitioner visits.

Individuals can choose from a variety of providers to get private health insurance if they want extra coverage. Expats should check with private hospitals in Ireland to see if their foreign health insurance is approved.

The villages and cities of Ireland are dotted with pharmacies. However, visits to the emergency room may cost more for those who do not have a medication card. Expats in Ireland can secure the medical treatment they need by understanding their options for public and private healthcare systems, as well as any mix of the two.

Ireland jobs for expats

Job opportunities for expats abound in many fields, including web development, nursing, education, customer service, interpreting, SEO, supply chain management, and nursing. There are also hospitality and tourism, interior design, communications, and IT jobs for American expats and English speakers.

Many other fields are open to expats in Ireland, including construction, accountancy, finance, creative design, and business, among many others.

As of January 1, 2023, Ireland minimum wage for 20-year-olds is €11.30 per hour, according to WageIndicator.org.

- People under the age of 18 make €7.91 an hour.

- The minimum wage for those above the age of 18 is €9.04 an hour.

- The hourly rate for those aged 19 is €10.17.

In addition, the administration is still thinking about increasing the minimum wage. For an individual working a typical 39-hour week, the Low Pay Commission has recommended a new wage of €12.70 per hour, an increase of more than 12%.

People making the minimum wage will see an extra €54.60 in their pockets every week as a result of this change. The government’s attempt to bring wages up to speed with cost of living and economic circumstances is reflected in this planned increase, the Irish Times said.

Banking in Ireland

Depending on the bank or provider, it is feasible for an expat in Ireland to create a bank account. If you are not a resident of Ireland, you can open an account with certain banks like Bank of Ireland.

While most banks will ask for a passport and proof of address from expats, specific documentation may be required by certain institutions. It may take some time for the account to activate, so expats in Ireland should have some other funds on hand during this time.

You may use a foreign card at most of the ATMs in Ireland, and they are extensively located in the towns and cities. Although there may be a lack of card facilities and ATMs in more rural regions, credit cards are generally accepted across the nation.

Many Irish banks, like their UK counterparts, provide customers with the option to bank online or through mobile device, in addition to the more traditional branch hours of 9 am to 4 pm, Monday through Friday.

Related content: 10 Best Banks In Ireland

Money transfer in Ireland

Traditional bank transfers are common in Ireland. Online banking allows users to move funds domestically and internationally at most banks. This technique is convenient, although international wire transfers may entail costs and exchange rates.

Many people and companies use online payment systems like PayPal since it’s a safe way to send and receive money. Be advised that there may be transaction fees, especially for international transactions.

You can facilitate international transactions with specialized money transfer providers like TransferWise (now Wise), Western Union, or MoneyGram. You can find competitive exchange rates and maybe even lower fees with these services than with regular banks.

One safe way to send money within Ireland or abroad is using a postal money order, which are available through An Post, the country’s postal service. One alternative for people looking for a solid and physical way to transmit money is to buy a money order at the post office and mail it to the receiver.

Pension system in Ireland

Three main types of pensions support the Irish retirement system for foreign workers: public, occupational, and private.

First, there are the state pensions in Ireland. The major parts of this system are the contributing state pension and the non-contributory state pension. Workers who have accrued sufficient social insurance contributions might receive the Contributory State Pension. This benefit can be available to expats who have paid into the system and typically reside in Ireland. Those who have put in too little or no contributions can apply for the means-tested Non-Contributory State Pension.

Another significant aspect of Ireland’s pension system is the many occupational pension systems. In order to help its employees save for retirement, several companies provide various schemes. The Pensions Authority oversees these occupational pension systems, which may be accessible to foreign nationals working in Ireland.

Private pension plans are another option available to foreign nationals living in Ireland. Individuals have the option to supplement state and occupational pensions with these plans offered by financial companies.

According to the regulations of the nation where the pensions are domiciled, expats who return to Ireland may also be allowed to transfer their private or work-related pensions to the country.

Related content: How to Retire in Ireland

Cost of living in Ireland

An estimated €3,279 per month is spent by an individual, compared to €5,643 by a family of four.

Among Western European countries, Ireland is the second most costly. In comparison to the rest of the globe, 94% of nations have a higher cost of living than Ireland, as per Expatistan.

Cost of living in Ireland vs US

Compared to the US, the cost of living in Ireland is over 4% greater.

The projected monthly expenses for a family of four in Ireland amount to $5,981, while the estimated cost for an individual is $3,613.

Nearly every country in the globe has a lower cost of living than the US.

Living in Ireland pros and cons

Pros

- Discover Ireland’s diverse cultural landscape, where modern and traditional elements coexist in a dynamic tapestry of history and tradition. The eclectic blend that residents encounter reflects the nation’s diversified heritage.

- One characteristic that stands out about the local experience is the kindness and hospitality of the Irish people. The Irish are very welcoming, and it’s often said that expats feel right at home among them.

- Ireland’s beautiful countryside, attractive seashore, and lovely villages are its most notable features. Residents can enjoy several outdoor activities at these natural treasures, connecting them to the country’s stunning scenery.

- With its many esteemed educational institutions, Ireland’s education system is one of the country’s marketing points. As a result, the nation is a great choice for families who want their children to have a good education and for students who want to attend top universities.

- Plus, expats benefit even more from the fact that English is the most widely spoken language in Ireland. The language environment provides a sense of belonging and accessibility for all citizens, whether they are native English speakers or just starting to grow in their proficiency.

- Residents of Dublin, Cork, and Galway live thriving urban lifestyles. These cultural hubs host many events, festivals, and social activities, ensuring that city life appeals to varied interests.

- Much of Ireland’s economic environment is influenced by its status as a worldwide center for commerce. Inviting global companies to set up shop in the country has resulted in a surge in employment and strong economic growth.

- Irish bars are a defining feature of Irish culture and society, thanks to their welcoming interiors and regular live music. These businesses help create a welcoming and active neighborhood by bringing people together and enhancing the quality of life for locals through regular social events and interactions.

Cons

- Foreigners living in Ireland should consider various factors. Housing, transportation, and daily expenses are expensive, especially in cities.

- For individuals used to warmer climates, Ireland’s unpredictable and frequent rainfall may be difficult.

- It might be difficult to locate affordable homes in major cities due to competition.

- Drive times and convenience are affected by urban traffic, especially during rush hours.

- The public healthcare system in Ireland may be unfamiliar to expats, and private treatment is expensive.

- Expats may have trouble finding work in competitive labor markets.

- Bureaucratic and time-consuming, the immigration procedure for non-EU expats requires cautious navigation.

- A shortage of rental houses in some locations increases demand and rents, complicating the housing situation. These issues should be considered when moving to Ireland.

Where to live in Ireland

Here are some of the best Ireland cities to live for expats contemplating a move:

- Dublin, the capital, is bustling and cosmopolitan. It has a vibrant nightlife, cultural scene, and historical sites. The city offers numerous jobs, especially in technology and finance.

- Cork has a vibrant arts and music scene due to its friendly attitude and cultural events. Residents like it because of its burgeoning IT industry and lovely scenery. On the west coast of Ireland, Galway is known for its festivals and young community.

- Redevelopment and revitalization are underway in Limerick. Medieval building shows its rich history, and it’s cheaper than Dublin. Belfast, Northern Ireland, offers a unique blend of history and contemporary, with a developing cultural and culinary scene and industry prospects.

- Ireland’s oldest city, Waterford, has a maritime background and is becoming a digital and pharmaceutical hub. Affordable housing is available. Before moving, visit these places, examine their areas, and consider employment markets, cost of living, and lifestyle choices. Each city has its own benefits and appeals to different tastes.

How to move to Ireland: Visa, residency, and citizenship

Visa in Ireland

- Working in Ireland requires a work visa from the Irish immigration office. Visas for labor include employment, investment, and student.

- Foreign students studying in Ireland need a student visa. The visa application process and requirements differ by course and country.

- Ireland offers 90-day tourist visas. Some countries require an Irish entry visa before visiting Ireland.

- Non-EEA citizens who intend to stay in Ireland longer than three months must register with the Garda National Immigration Bureau and apply for a Family Reunion Visa before staying.

- Retirement visas are available to anyone 50 or older who can support themselves without work or government assistance.

Irish Residency

A person must have lived in Ireland for at least five years in order to qualify for permanent residency, among other criteria.

Irish citizenship

Irish citizenship can be earned through naturalization, birth, or descent, each with conditions.

Naturalization: Applicants for Irish citizenship must have resided in Ireland for at least five years out of the last nine years. Applying requires proof of residency and meeting eligibility requirements including good character and patriotism.

Birth or Descent: Those who were born in Ireland prior to 2005 are immediately deemed citizens of Ireland. The birth of either parent or grandparent in Ireland can also grant non-Irish nationals the right to vote and hold public office in Ireland. Those who fall within this category can apply for Irish citizenship by entering their birth details on the international birth registry.

Refugee Status: Anyone given refugee status in Ireland may also be entitled to petition for Irish citizenship. Individuals must meet particular residency and paperwork criteria and keep their immigration registration updated to be eligible. When they fulfill the requirements, refugees can apply for Irish citizenship through this route.

Investing in Ireland

Ireland economy

While the Irish economy has experienced some ups and downs, the forecast for a recovery in the second half of the year is rather hopeful. While economists predict expansion to persist, they hint that it might slow down a bit.

A number of important sectors are driving growth in Ireland’s economy. Medications, meals, gadgets, money, and farming are all part of this category. One of Ireland’s most remarkable achievements is the influx of investment and businesses from other countries. The economic life of the nation has been greatly influenced by both domestic and multinational firms, both of which are rather big.

Particularly noteworthy among Ireland’s economic drivers is the technology sector. A vital cog in the wheel of economic expansion and maintenance, the technology sector accounts for more than half of the nation’s exports of services. The strong success of this sector demonstrates that Ireland is a desirable location for investments in technology and that the country can effectively use innovation to boost its economy.

Ireland government

Ireland is a constitutional parliamentary democracy.

Irish presidents are ceremonial. Citizens elect the President for seven years and can re-elect him once. Presidents fulfill ceremonial obligations and can submit measures to the Supreme Court, but their position is mostly symbolic.

President-appointed Prime Minister leads government. The PM usually leads the party with the most Dáil seats. The PM and his Cabinet, made up of ministers, have executive power.

Can foreigners buy property in Ireland?

Yes, foreigners are allowed to acquire Ireland real estate. Irish property ownership is open to all EU and non-EU citizens.

Foreigners have equal property rights in Ireland, and buying property is easy.

The Irish real estate market is resilient in 2023, with stable prices and strong demand for good-quality residences. Experts predict this tendency will continue in 2024, indicating a healthy future for the Irish real estate industry, per the Irish Times.

Related content: Guide to Buying Property in Ireland

Investment Options in Ireland

- Savings accounts are a popular savings option for consumers seeking low-risk savings. Ireland offers child and first-time homebuyer savings accounts.

- Invest in a diverse portfolio of stocks, commodities, property, and bonds for long-term savings though managed funds.

- Investments in stocks and shares offer higher returns than savings accounts, but carry higher risk. Investors should consult a financial counselor before buying equities.

- Pensions are a crucial investment component in Ireland. Occupational and private pensions are offered.

- Peer-to-Peer Lending is more recent in Ireland. It facilitates online financing to people or corporations.

Ireland offers many investment options, and a financial advisor can help choose the right one for your goals and risk tolerance.

Related content:

Interactive Brokers Ireland Review

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.