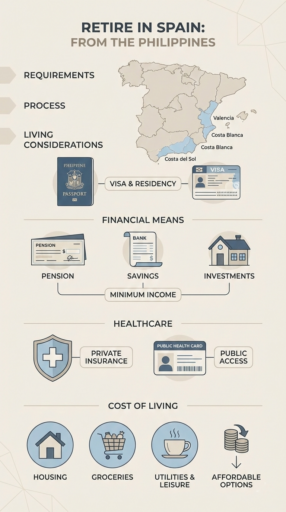

Retire in Spain from the Philippines by applying for a Non-Lucrative Residence Visa through the Spanish consulate.

This visa allows Filipino retirees to live long-term in Spain without working, provided they meet income, health, and documentation requirements.

Planning ahead is essential, as approval must be obtained before leaving the Philippines and ensures a smooth transition to permanent residency.

This article covers:

- Can I move to Spain if I’m retired?

- How do I move to Spain as a Filipino citizen?

- What is the minimum income for a retired person?

- What documents do you need when you retire to Spain from Philippines?

Key Takeaways:

- Spain does not offer a retirement visa, but the Non-Lucrative Visa is the main route.

- Proof of stable passive income is mandatory.

- Retirees gain access to Spain’s healthcare and Schengen travel.

- Taxes, bureaucracy, and housing costs require advance planning.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

How to retire in Spain for Filipinos?

Filipinos retire in Spain by applying for a Non-Lucrative Residence Visa, which allows long-term residence without working.

This visa is intended for retirees with sufficient passive income, such as pensions, annuities, rental income, or investment returns.

The application must be submitted through the Spanish consulate in the Philippines and approved before departure.

Applicants are required to show proof of income or savings, private health insurance valid in Spain, a clean criminal record, and a medical certificate.

Once approved, the initial residence permit is valid for one year and can be renewed for two-year periods, allowing Filipinos to establish long-term residency and eventually qualify for permanent residence.

What is the first step to moving to Spain?

The first step is deciding which Spanish residence route fits your situation, followed by preparing documentation in the Philippines.

For most retirees, this means:

1. Applying for a Non-Lucrative Visa through the Spanish Embassy or Consulate

2. Gathering financial proof, medical certificates, and police clearance

3. Securing private health insurance valid in Spain

The application must be approved before leaving the Philippines, as you cannot convert a tourist stay into a retirement residence permit inside Spain.

What is the minimum income to retire in Spain?

The minimum income for a Spanish retirement is enough to cover living expenses without working, typically around €28,000–€30,000 per year for a single applicant.

Spain requires proof of sufficient passive income to ensure retirees can support themselves without employment.

The benchmark used is the IPREM (Public Income Indicator). As a general guide:

- A single applicant must show income or savings equivalent to 400% of IPREM per year

- An additional 100% of IPREM per dependent

Acceptable income sources include pensions, annuities, rental income, dividends, or substantial savings.

How much does it cost to retire in Spain?

For Filipinos retiring in Spain, total living costs typically range from €1,800 to €2,500 per month, assuming a modest to comfortable lifestyle without employment.

This estimate aligns with Spain’s non-lucrative residency expectations and excludes major one-off relocation costs.

Expenses are generally lower in smaller cities and inland regions, while coastal and major urban areas increase housing and daily costs.

For Filipino retirees relying on pensions, savings, or investment income, Spain remains cost-competitive compared with other EU retirement destinations, provided housing choices and tax exposure are planned in advance.

What are the requirements to retire in Spain?

To retire in Spain, Filipino citizens must meet specific visa and residency requirements, including proof of income, health coverage, and legal clearance.

- Valid Philippine passport

- Proof of sufficient passive income or savings

- Private health insurance with full coverage in Spain

- Clean criminal record from the Philippines

- Medical certificate confirming no serious public health risks

- Proof of accommodation in Spain (rental or ownership)

Once approved, the initial residence permit is typically valid for one year and can be renewed for two-year periods thereafter.

What are the benefits of Filipinos in Spain?

Filipinos in Spain benefit from strong communities, accessible healthcare, affordable living, and long-term residency opportunities.

- Strong Filipino communities and support networks

- Cultural similarities rooted in shared history

- Access to Spain’s universal healthcare system after residency

- Affordable living costs compared to other EU countries

- Visa-free travel across the Schengen Area

Spain also offers a clear pathway to long-term residency and, eventually, citizenship, subject to residency duration and integration requirements.

What is the downside of retiring in Spain?

The main downsides of retirement in Spain are bureaucracy, tax exposure, and limited flexibility under retirement visas.

- High bureaucracy and slow administrative processes

- Language barriers outside major cities

- Restrictions on employment under retirement visas

- Rising housing costs in popular coastal and urban areas

- Worldwide income taxation once Spanish tax residency is established

Understanding Spanish tax obligations is particularly important, as retirees may become tax residents after spending sufficient time in the country.

Are there other ways to retire in Spain for Filipinos?

Yes there are other retirement options in Spain for Filipinos, but most alternative pathways are limited. The most practical retirement route remains the Non-Lucrative Residence Visa, which allows long-term stay without employment.

Other potential pathways include:

- Family reunification: If you have a spouse, parent, or child who is a Spanish citizen or legal resident, you may be eligible to join them under family residency rules. This is not a retirement visa per se, but it allows long-term stay in Spain.

- Work or self-employment routes: Some Filipinos enter Spain initially on work or self-employment visas and later transition to long-term residency before fully retiring. These routes require qualifying employment or business plans.

Spain officially ended its Golden Visa (investor visa) program for new applicants as of April 2025, so investment-based residency is no longer an option for Filipinos seeking to retire there.

Conclusion

Retiring in Spain from the Philippines is less about finding a special retirement program and more about aligning your finances, residency status, and long-term plans with Spain’s legal framework.

The process rewards preparation: those who understand income thresholds, tax residency implications, and renewal obligations early tend to experience a far smoother transition.

For Filipino retirees, Spain works best as a long-term lifestyle decision rather than a short-term experiment, making careful planning before relocation just as important as the destination itself.

FAQs

How much money do you need in the bank to become a resident in Spain?

There is no fixed bank balance requirement, but most applicants need to show at least €30,000 in accessible funds for a single person, with higher amounts required for dependents.

Can I still collect social security if I move to Spain?

Yes. Filipino retirees receiving foreign pensions or social security benefits can generally continue collecting them while living in Spain.

However, these payments may be subject to Spanish taxation, depending on tax treaties and residency status.

Why are so many expats leaving Spain?

Some expats leave Spain due to tax changes, administrative complexity, or rising costs in major cities.

Others find the slower pace of bureaucracy and strict compliance requirements challenging compared to more flexible retirement destinations.

How much money do you need to retire comfortably in Spain?

A comfortable retirement budget varies by location, but many retirees live well on €1,800–€2,500 per month outside major cities.

Coastal and central urban areas may require higher budgets, particularly for housing.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.