Updated September 23, 2021

Bupa Global, often referred to as Bupa International, is health insurance offered to expats around the world.

It is especially popular in Thailand, Singapore, Australia, UAE and other places with many expats.

In this article I will review Bupa and answer some frequently asked questions (FAQs).

Who are Bupa?

Bupa are a health insurance firm, headquartered in the UK, which serves over 30 million customers in around 190 countries.

Bupa mainly focuses on health insurance, but also deals with travel and other forms of insurance.

In some countries, Bupa trade under different names. For example, they are called Oman Insurance Company in the UAE.

They are also called Bupa Global Latin America in the South American region.

How many plans does Bupa have?

Bupa Global currently has four plans:

- Major medical. This has a 2million GBP annual limit, a mandatory 5,000GBP deductible and it covers most major/serious medical issues. This plan covers people worldwide.

- Select health plan – This has a 1million GBP coverage and it just covers you for the Europen region. It doesn’t cover home nursing, unlike major medical, but it does offer extra benefits like health tests and diagnostics.

- Premier health plan – This plan covers you worldwide and has a 1.5millionGBP limit. Even though the limit is 500,000 GBP less than the major medical, it does offer more comprehensive coverage. It covers things such as vaccinations, dental and physiotherapy.

- Elite global health plan- this is the most comprehensive plan. It has 3million GBP annual coverage limit and covers maternity, 2 children subject to underwriting and dental, alongside a whole host of other illnesses.

In addition to the 4 plans, in the UAE, business plans are available. Within the business plans, they also have 4 sub plans (select, premier, elite and ultimate)

Just like on the personal plans, different prices levels and deductibles are available.

How much does Bupa typically cost?

It depends on your age and benefit levels. It is possible for younger people to get insured for $1,000-$2,000 a year, depending on which insurance option and deductible you pick.

For older people, the premiums can get prohibitively high – $10,000+ per year for some of the more comprehensive options.

What does deductible mean?

If your deductible is 2,000 GBP, that means that you need to pay for the first 2,000 GBP worth of coverage.

In other words, if your medical bills are 10,000GBP for 2020, you need to pay 2,000GBP and the insurer pays 8,000GBP.

The deductible is a yearly limit, above which, your insurer pays the bills, assuming they are covered.

What are the positives of the plans?

- They do offer some of the most comprehensive healthcare plans in the market

- They have access to almost all healthcare medical networks in the world

- You can review the status of your claims online

What are some of the negatives of Bupa?

Firstly Bupa is quite expensive and beyond that:

- Benefit levels can vary from country to country. This complicates the process

- They aren’t as quick as some of the smaller firms. Size often equals slowness and you are ultimately just a number to Bupa. It is a huge mistake to assume “bigger is safer”.

- They have a good history of paying out claims, but no better than some of the smaller healthcare firms

- Compared to the UK version, there are more customer complaints about waiting times and general procedures, although Bupa is always trying to improve its processes.

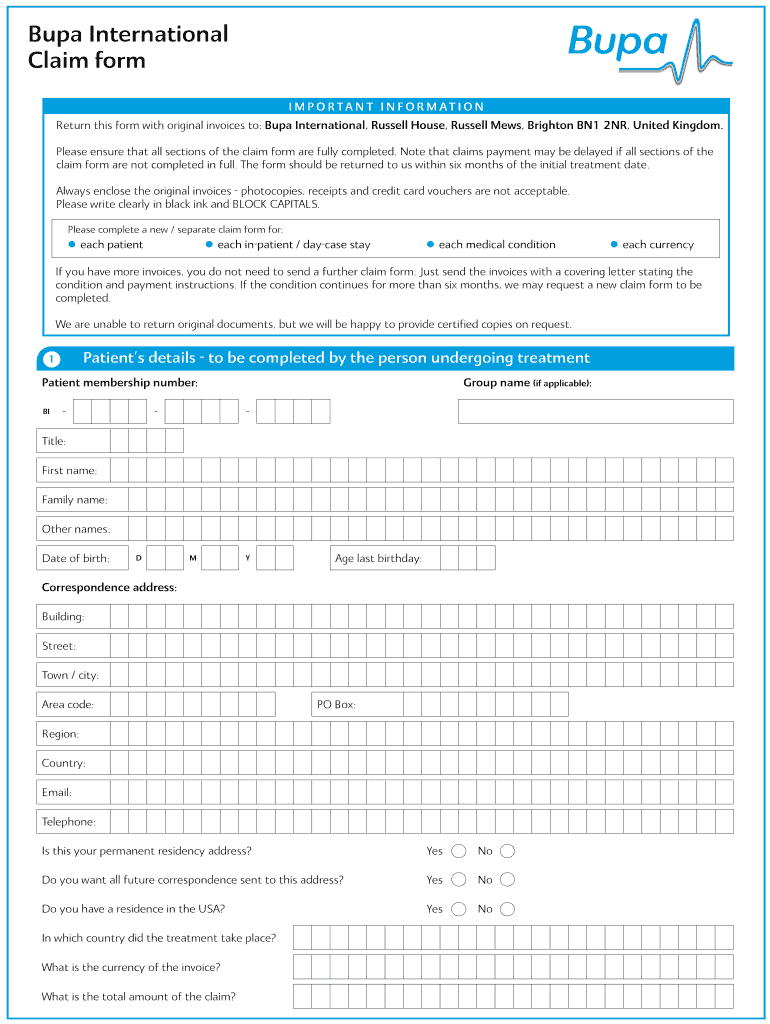

How do you claim?

In general, the hospital claims for the service, on behalf of you, but it does depend on the hospital and what type of claim you are making.

If the hospital can’t settle with Bupa directly, payment times varies, depending on the illness.

The claim forms look like this:

What exclusions exist?

Pre-existing conditions are often excluded. This does depend though, as Bupa do underwrite all health insurance applications.

So sometimes they exclude them, and sometimes they hike the premium. It is easier to get pre-existing conditions covered on corporate plans.

Beyond that vasectomies, conflict and wars are typically not covered.

On company plans, can I add a member?

You can, if your sponsor (usually your company) will allow it. The medical underwriters will underwrite all new additions to the insurance.

How about adding USA coverage?

On both corporate and individual plans, you can usually add USA coverage. To do so, you can apply at any point, following your original date of acceptance.

However, USA-specific restrictions may apply.

Can I transfer to a personal plan if my group plan is cancelled?

If your group policy ends, you can apply for a transfer to a personal Global Bupa plan.

How can the plans be cancelled?

The plans can be cancelled through your broker or via writing to Bupa.

How about evacuation?

Bupa Global does offer evacuation benefits.

Do you provide health insurance options?

My main services are investment advsisory and financial planning. However, I do offer health, life and income protection insurance to expat and local clients.

How do you get a quote?

You can get a quote online or through your broker.

What are your contact details?

My main contact details are adamfayed@hotmail.co.uk and adamfayed@int-amg.com.

Conclusion

Bupa isn’t a bad health insurance option, especially for people with more comprehensive health care needs.

However, the premium:quality ratio isn’t the best in the market. There are cheaper options which cover almost as much, or even just as many conditions, as Bupa.

Further reading

- Read offshore savings strategies explored in Zurich International Vista Savings Plan Review.

- The article below articles another health insurance option which is available globally: