Last updated on January 9, 2022

DBS Vickers Securities review – that will be the focus of today’s article.

This evaluates financial services, juxtaposed with the insights provided in St. James’s Place Review 2023.

DBS Vickers Securities is a broker, with strong links to the Asia-Pacific region. A few readers have asked me to review their solution which I have done on the article below.

For questions about investing you can email me (advice@adamfayed.com) or contact me on the WhatsApp function below.

For those that prefer visual content, I have summarised the content below in the following video:

Who are DBS Vickers and where are they sold?

DBS Vickers is connected to DBS Bank. With a HQ in Singapore, and local offices in Thailand, Malaysia, Hong Kong, the UK, the US and Indonesia, DBS is focused mainly on the Asia-Pacific Region.

DBS offers a wide range of stocks, funds and other financial instruments. They also offer multiple accounts including Cash Account, Young Investor Accounts and a Supplementary Retirement Scheme

Which markets do they invest in?

Global but most customers are investing in the Hong Kong, Singapore, UK, US, Australian, Japanese and world and emerging markets.

DBS have clients all around the world, although American citizens are now restricted.

How about the fees?

The fees depend on two things; which DBS you are invested through (DBS Singapore and DBS Hong Kong are slightly different) and which markets you are trading on.

For example, if you live in Singapore, and are trading on the Singapore stock exchange, the minimum commissions are 0.18%-0.375% depending on whether you trade online or by phone.

In comparison, if you invest in the US stock exchange from DBS Singapore, there are the following fees:

- SEC Charge of 0.00207% of trading principal. This is for sale transactions only though.

- A minimum of $25 or 0.18% of trading principle. This raises to $35 by phone.

For DBS in Hong Kong and other locations, the fees vary. There are currently no upfront fees for opening up accounts.

What are the benefits?

The main benefits associated with DBS is:

- The costs are reasonable.

- You have reasonable access to different trading accounts, markets and investment vehicles.

- The account opening process is fairly simple and can mainly be done online.

- Unlike many other banks, they don’t steer investors to their own investment funds.

- There is bilingual English and Chinese support available.

- You can trade in multiple currencies.

What are the negatives?

The main negatives associated with DBS is:

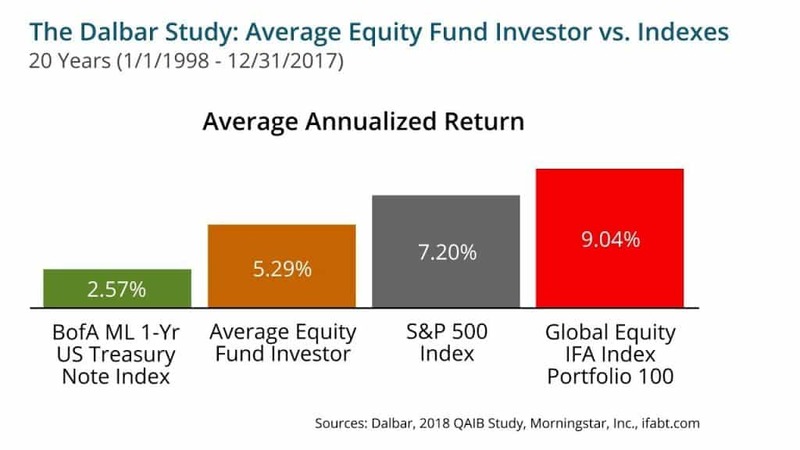

- There is no advice on the platform. This means many investors trade on emotion which leads to results like this:

- It isn’t clear how portable this solution is. In other words, if you are a Singapore expat, this solution will probably work if you move to Hong Kong or Thailand. However, if expats move to certain locations, DBS could close your account, which isn’t convenient or tax efficient.

- The online system is pretty basic.

- There are many mixed customer reviews about the customer service, ease of use and so on.

- As they are a big brokerage, it is likely you will get a lot of “customer service answers” to complex questions. This is more a generalists platform than a specialist platform. Therefore, the more basic your means, the more you will be happy here. The more specialised, the less likely you are to be satisfied.

- Even though DBS are a reasonable DIY broker, they have been known to “move the goalposts”. They used to be cheaper, for example, but then dramatically increased their fees. Many people found it too inconvenient to change their broker.

- In some ways, like other banks, DBS are reliant on their brand name.

- Your mileage might vary. Reviews for DBS Vickers in Thailand and Hong Kong are very different.

What are the main mistakes you have seen people make on DBS Vickers?

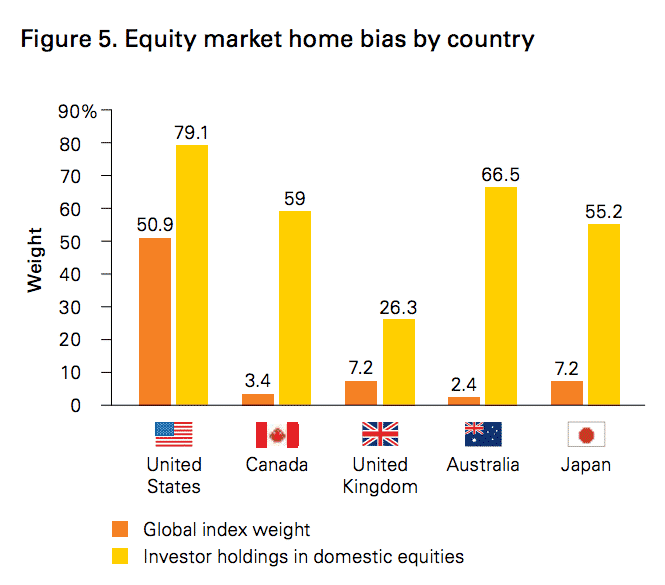

Home country bias is when investors naturally invest more in their home countries stock markets because it is more familiar.

It affects investors globally:

The issue with Hong Kong and especially Singapore, is that they are riskier markets than the US S&P500 or Dow Jones.

There are many reasons for this, including the fact that US corporations like Apple, Microsoft and Amazon are more international in scope than most other firms around the world.

So it makes sense for investors from the region, to diversify to US and international markets.

The issues with Mainland China, make this especially important for Hong Kong based investors.

Other issues include trading on emotion. Various studies have shown that investors that live closer to an Amazon warehouse are more likely to be shareholders, for the same reason as “home country bias” exists – being reassured by the familiar.

This isn’t a DBS Vickers specific issue but affects investors on all DIY platforms.

How about trading on US markets on this platform?

It is possible to trade on US Markets on this platform. However, remember that your beneficiaries could pay US estate taxes, if you die.

Often it therefore makes sense to buy the S&P500 domiciled in Ireland, the UK or Canada, rather than the S&P500 in the US.

How about with the current pandemic?

The pandemic happening across the world, and more specifically the actions that governments have taken to stop it spreading, has resulted in falling markets.

This is mainly happening due to the unexpected nature of the shutdowns, and the lack of business earnings that will result for the next few months.

This crisis will pass and markets will hit record highs again, as they always have in the past.

However, what has been interesting about this crisis, is once again, DIY investors have panicked.

Countless DIY platforms have reported huge outflows, just like in 2008.

This source of panic is one of the main reasons why DIY investors get lower returns than the market.

Often they are buying high and selling low.

Conclusion

DBS isn’t a bad platforms for locals and expats in South East Asia, but does have many negatives as well.

For complete beginners and those that can successfully DIY invest, it isn’t bad.

The lack of advice and “off the peg solution” often means those with more complex financial needs, struggle to find a solution here.

It can also mean that investors are essentially trading on emotion (speculating) rather than investing for the long-term.

Ironically, I have an associate who invested with DBS Vickers for years, only to stop in 2016, because he was quote “worried about Trump getting elected”.

Four years later, and with markets up considerably, he feels like a fool. This story does illustrate the issues many DIY investors face.

Further reading

How much do you need to invest to become a millionaire? The answer might surprise you and is the topic of the article below.

Like to set a DIY account here in Chiang Mai Thailand. I am a buy and hold dividend investor. I could follow the “Dogs of the Dow” investment procedure with the SET 30 or 50.

I would try Swissquote.