In this article, we will review Ethex, a UK-based online investment platform.

If you have been proposed this option and want a second opinion, you can email me (advice@adamfayed.com) or contact me here.

Who is Ethex?

Ethex is a not-for-profit organization that provides investment opportunities with a positive social impact. It operates as a company limited by guarantee, and it’s not obligated to obtain authorization from the Financial Conduct Authority (FCA) for providing investment information or arranging deals. This is due to Ethex being classified as an Enterprise Scheme, exempting it from regulatory requirements related to arranging certain financial transactions.

Ethex presents investment options from ethical for-profit organizations with a social mission. Ethex then puts them in touch with investors, giving them the resources they need to combat climate change, alleviate poverty, and strengthen their communities.

When you invest with Ethex, you’ll have access to professional guidance, user-friendly products, and a curated selection of promising prospects.

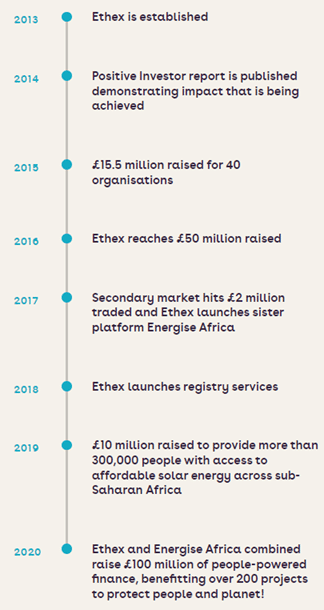

Below is a snapshot of the history of Ethex:

Ethex Investments

Learn about ethical investment options with the Ethex platform alongside the detailed review of Investors Trust S&P 500.

Ethex offers a range of investment opportunities, including investments in renewable energy projects, organic farms, fair trade businesses, and social housing initiatives.

As of the time of writing, there are five projects that are open for investments on the platform, with projected returns of up to 5%.

Among the closed offers, 23 were able to hit or exceed their investment targets, while seven missed their funding goals.

The most over-subscribed project, Low Carbon Hub (withdrawable shares), received more funding than it originally intended to raise. Specifically, it raised 201% of the intended investments, which is more than twice the original mark worth 1.5 million pounds. There were 774 investors who funded the project, which offered a projected return of 5%.

On the other hand, the most under-subscribed project, Wenea South West (Fixed Rate Unsecured Ten Year Bonds), only raised 31% of its goal of 2.1 million pounds. The IFISA-eligible offering closed with 193 investors participating.

Who is eligible to invest via Ethex?

High net worth individuals, sophisticated investors and restricted investors can invest with Ethex. During the registration process, you will need to classify yourself as one of those.

If you are residing outside the UK, you might have the opportunity to invest in certain offers on Ethex, subject to the policies and preferences of each organization regarding overseas investors.

Organizations may refuse investors due to the extra administrative expenses involved in making interest payments into foreign bank accounts. To determine whether your investment will be accepted, please contact help@ethex.org.uk before proceeding with the investment.

If the organization is willing to accept your investment from outside the UK, please be aware that certain countries may have restrictions on their citizens investing abroad, and you may need to obtain consent or pay taxes in your home country. When deciding to invest from outside the UK, it is your responsibility to be aware of any restrictions imposed by your country of residence, and Ethex cannot be held liable for any such restrictions.

As part of the registration process, Ethex will also ask for a scanned copy of the primary page of your passport and proof of your address, which can be a bank or investment account statement, or an insurance company statement issued within the last three months.

Additionally, the FCA mandates that potential investors must exhibit a sufficient level of understanding of the offered investment types. To fulfill this requirement, the Appropriateness Test has been designed to aid in comprehending the risks involved in making such investments.

What are the investment fees?

A fee of 0.9082% of the investment amount plus a fixed cost of 0.05 pound will be imposed on all debit card investments. The fees will be charged to you and tallied on top of the amount you invested, rounded up to the nearest pound. Please note that this fee is separate from your investment amount and will not affect it.

Bank transfers are free of charge.

Are there tax benefits?

Ethex investments may be eligible for a variety of tax breaks. The Enterprise Investment Scheme (EIS), the Seed Enterprise Investment Scheme (SEIS), the Social Investment Tax Relief (SITR), and the Ethex Innovative Finance Individual Savings Account (IFISA) are some of the options available to investors.

You should always double-check your individual tax situation to see if you qualify for any such relief or advantages before making any investments. You are not shielded from the possibility of experiencing a loss of capital if you invest via an IFISA.

Can I acquire and sell investments in the secondary market?

Yes, you can. Only those companies whose shares are up for sale will be shown on the secondary market site.

To buy, just select a company. After that, you will be required to study the Offer Document, which will include specifics on the terms as well as the dangers associated with this investment. When the download is complete, select Buy or Buy IFISA, and you will be brought to a selection of bonds that are for sale.

Meanwhile, you can sell your interests in qualified offers directly from Your Portfolio. You’ll be prompted to enter the quantity and selling price. In case you change your mind and no longer wish to sell, you can just delete the ones you put up for sale in the secondary market.

Bear in mind that if no bid is made within 90 days, the selling offer will be deleted automatically.

Does the Ethex Secondary Market charge any fees?

Yes. A 20 pound transaction charge will be applied to secondary market sales and acquisitions.

Stamp duty may be required on investors buying shares in Ethical Property Company or Cafedirect if the transfer price is more than 1,000 pounds.

What happens to my money if a fundraising goal is not met?

Investors will be informed that the project is cancelled and their money will be refunded to their bank account or Ethex ewallet if the minimum fundraising objective is not met before the closure date of the offer.

How can I create an Ethex IFISA account and invest?

To establish an ISA with Ethex, you must first register and finalize your account setup. After completing the setup, you will notice an IFISA section with the option to “Open a new ISA.” Then, consent to the terms and conditions of Ethex’s IFISA and provide your National Insurance number.

Investment product profiles on Ethex that qualify for an IFISA are marked with an IFISA tag.

Is there a cost to using the Ethex IFISA?

When you start an Ethex IFISA, make investments, send money out, or withdraw money, you won’t be charged any fees.

Ethex Raise Finance

Ethex allows social enterprises and purpose-driven businesses in various industries, such as renewable energy, affordable and assisted living, sustainable transport, biodynamic agriculture, and community development finance, to raise capital using the platform.

Eligible businesses can issue equity, debt, or a combination of both to raise funds. For equity, you can issue either transferable shares or withdrawable shares.

Transferable shares are the traditional form of equity, which can be bought and sold on the open market. When someone buys transferable shares, they become a part-owner of the company and may have the right to vote on company matters, as well as the potential to receive dividends or other payouts if the company is successful.

Withdrawable shares, on the other hand, are a type of share that can be offered by Community Benefit Societies or Co-operatives. These shares are not transferable and cannot be sold on the open market, but they can be withdrawn by the shareholder upon request.

Withdrawable shares are sometimes referred to as “community shares” because they are often offered to members of the local community who want to support a specific project or initiative.

In addition to equity, it is also possible to offer debt-based crowdfunding options, such as bonds or loan stock. When someone invests in debt-based crowdfunding, they are effectively lending money to the company or project in exchange for interest payments and the eventual repayment of the loan.

What are the qualifications to raise funds via Ethex?

Your organization must meet the following criteria:

- registered in the UK

- committed to creating positive social and environmental impact

- involve in activities that does not harm the environment or prohibit arms sales, pornography, tobacco or animal testing

have a strong record of human rights and employment rights - have a well-structured board

- have an acceptable policy on paying investment returns

- capable of reporting on the social and environmental benefits of your business

What are the procedures for fund raising on Ethex?

- To start the process, you need to complete the online application form and provide details about your business and the positive impact it creates. Additionally, you can upload relevant documents, such as your business plan.

- Following the review of your application, an Ethex staff will contact you to discuss the investment offer and determine if it’s apt for the platform.

- You will work with certain staff to create an initiative that targets and engages the ideal customers for your offer. As part of this service, Ethex create a profile for your company on its platform.

- Before launching your offer, Ethex will conduct a thorough due diligence review on the final version of your investment offer document. This review process, coupled with the creation of your online profile, will take approximately 4 weeks to complete.

- After launching your offer, the firm will promote your campaign to the appropriate audience and attract the investment you require. When your campaign ends, either after reaching your target or the designated period, you can discuss with them whether to close the offer or extend it to continue raising funds, subject to the provisions of your offer document.

- Ethex will then compile a list of investors for your Board’s review and approval after the offer closes. If your Board agrees with the list, the firm will send the funds raised to you.

Is there a minimum raise target?

Ethex sets a minimum investment raise of 120,000 pounds, with an average raise of roughly 400,000 pounds. Although the firm can accommodate discussions on investment raises of any size, it should be noted that the associated work of onboarding, due diligence, and offer material creation may result in fees that are not financially viable for raises under the minimum amount.

Ethex’s largest investment raise to date was 5 million pounds.

What are the fees to raise funds on Ethex?

There is a flat cost of 10,000 pounds plus 4.5% of funds raised. However, charities, community interest companies, community benefit societies and cooperatives get a discounted fixed charge of 5,000 pounds plus 3% of the amount raised.

What are the pros of using Ethex?

- Ethical investing: Ethex offers a range of investment options that focus on social and environmental impact, so investors can feel good about supporting projects that align with their values.

- Diversification: The firm offers a diverse range of investment opportunities, including equity, debt, and community shares, which can help investors to spread their risk across multiple investments.

- Transparency: Ethex provides detailed information about the projects and companies that are listed on its platform, including their social and environmental impact, financial performance, and governance structure, which can help investors to make informed decisions.

- Tax benefits: The potential tax advantages associated with investing through Ethex can be considered an advantage of the platform, as they can make certain types of investments more financially attractive for some investors.

What are the cons?

- Limited investment options: While Ethex offers an array of investment opportunities, the platform is focused on social and environmental projects, so investors who are looking for other types of investments may need to look elsewhere.

- Higher risk: Many of the investments offered through Ethex are in early stage or smaller companies, which can be riskier than more established businesses.

- Limited liquidity: Some of the investments offered through the platform are not easily liquidated, meaning that investors may have difficulty selling their shares or withdrawing their investment if they need to do so.

- Lack of regulation: The social and environmental projects offered through Ethex may not be subject to the same regulatory oversight as other types of investments, which can make it more difficult to assess the quality and credibility of the investment opportunities.

- Tax breaks and savings are not guaranteed: Ethex cannot guarantee that any tax reliefs or savings will materialize for investors, and it is important to note that tax laws and regulations can change over time. The tax benefits associated with any investment will depend on a range of factors, including the investor’s personal tax situation and the local tax laws.

Investing in any type of investment, including those offered on Ethex, carries some degree of risk. Before investing in any investment opportunity, it is crucial for investors to conduct a thorough risk assessment and weigh the potential rewards.

Additionally, it is advisable for investors to avoid investing an amount that exceeds their risk tolerance level and their financial capacity to sustain any potential losses. To further minimize risk, diversifying investments across various types of assets and sectors is recommended. This can lower the dependence on any one investment to succeed and decrease the likelihood of losing all of your invested capital in a single investment.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.