We will look into the RL360 Oracle investment offering in this article. RL360 has many products, and I previously reviewed some of them like RL360 Quantum Savings Plan. If you are interested in offshore bonds, keep on reading.

If you have any questions or want to invest as an expat or high-net-worth individual, you can email me (advice@adamfayed.com) or use these contact options.

This includes if you have a policy which you aren’t happy with, or are thinking about investing in it.

RL360 Background

RL360 is an Isle of Man-based firm that caters to local and international clients by providing them with offshore banking, insurance, and investment services. RL360 operates in Asia, Africa, the UK and the Middle East.

RL360 extends its services to 70,000 policyholders in 170 countries. Separating from Royal London in the UK a few years ago, RL360 is now a wholly owned subsidiary of International Financial Group or IFGL.

What is the RL360 Oracle Bond?

According to the terms of Your Policy Schedule, Oracle is an offshore bond issued by RL360 Insurance Company Limited on the Isle of Man in the form of a Policy of Life Assurance or Capital Redemption. Once issued, the plan cannot switch between the two options.

It’s meant for a prolonged period, and it allows you to invest a lump sum in a variety of ways without incurring unnecessary taxation. This plan lets you invest a moderate lump sum with the potential for medium- to long-term gain.

The plan is essentially an investment and savings plan that provides participants with access to various funds. These funds can be purchased on a self-invest basis or an advising basis, with the latter option requiring the participant to hire an investment adviser.

Oracle is a no-hassle strategy that eliminates the need to maintain separate cash and dealing accounts. Individuals, businesses, and trustees with modest finances who are keen to venture in the investment world and take advantage of the potential growth given by a specialized selection of top-tier funds are the primary target audience.

Life Assurance Plan

You will receive your policy with a life assurance clause. This means that your plan can have up to six lives assured associated with it at the time of issue, who usually are the same people as the owners. Although this isn’t always the case.

Until you withdraw money from the plan or the final life assured dies, the money will stay invested.

The currency chosen in the application process must also be the currency used in the plan. An RL360 Oracle plan allows you to add or remove a life assured so long as you are not a UK resident.

Who are eligible to invest in this offshore bond?

Qualified individual and institutional investors can purchase this offshore bond. Anyone over the age of 18 can purchase this bond, as can businesses and corporate trustees.

At the time the plan is issued, at least one of the lives insured must be under 65 years old. The ensured lives you choose to include could, for instance, be your offspring. As the plan’s owner, you can be older than 65.

Capital Redemption Plan

Under the capital redemption option, you will select your plan payment terms. Once it ends, your plan will stay invested until you withdraw money or it reaches its maturity date, whichever comes first.

The maturity period is 99 years from the plan’s inception. At maturity, the plan will expire and the full value, plus 100 British pounds, will be distributed to you.

Your plan won’t immediately stop if you die. It will stay invested and treated according to your policy terms and conditions.

Who can subscribe to this plan?

You must be 18 years old to get a policy under this option.

RL360 Oracle Investments, Withdrawals, and Cancellations

How does investing work?

Funds inside your plan can be bought and sold at your discretion, so long as you’ve done the necessary research and chosen wisely. You can choose the most suitable fund for your investing needs from the choices provided by the RL360 Oracle fund range.

You can hire an investment advisor to research potential investments and give the firm orders to purchase and sell stocks, bonds, and other securities on your behalf.

Before choosing this structure, examine fees with your financial advisor.

Is there a minimum to invest?

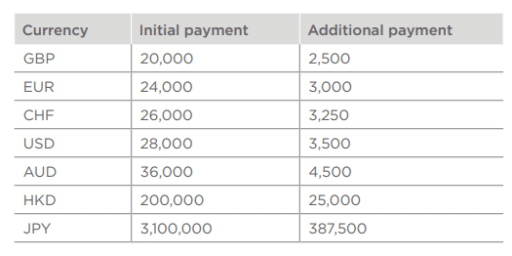

A minimum of 28,000 USD is required for the initial payment, while any top ups need at least 3,500 USD.

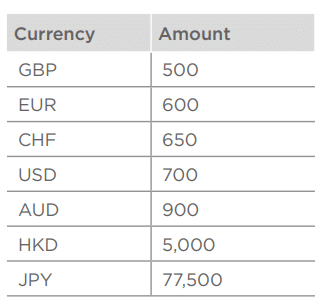

The plan’s minimum investment in any given fund is 700 USD.

How to begin investing

A conversation with a reliable financial advisor should be the first stop for anyone eager to start investing. Before purchasing any RL360 product, it is highly recommended that you consult with a professional. These experts can give you individualized recommendations on how to adjust your RL360 Oracle plan so that it fits your goals and risk tolerance. The firm only works with clients who have been referred by financial advisors.

Individuals who select an RL360 Oracle plan are free to select either a capital redemption or life assurance basis. They can choose from more than 350 funds overseen by some of the best fund managers in the world and pay no upfront fees. There is no need for mirror funds because RL360 provides access to direct funds.

The ability to exchange currency without incurring fees is another perk of the RL360 Oracle plan. Individuals can freely shift their investments across industries and topics, allowing them to better suit their changing needs and goals.

RL360 accepts payments from investors via telegraphic transfers and checks.

What currencies are accepted?

The product supports multiple currencies including Pound sterling, euro, Swiss franc, Japanese yen, and US, Australian, and Hong Kong dollars.

Can I withdraw my funds?

Withdrawals from the RL360 Oracle plan can be scheduled in advance or made on an as-needed basis, giving participants maximum control over their financial situation. Such withdrawals are free of charge. However, the individual’s bank may impose fees for processing the transaction if it must be conducted electronically.

In addition, participants can decide to receive payments in a currency other than the plan’s base currency. Keep in mind that the value of the plan could be impacted by fluctuations in exchange rates for any currency conversions.

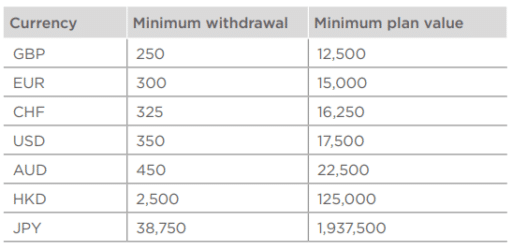

The minimum withdrawal amount is 250 pounds or its equivalent in one of the other six supported currencies. When requesting a withdrawal, it’s vital that you fulfill a few requirements. Withdrawals can be made after the plan value is at least 12,500 pounds or its currency equivalent, or 10% of the total payments paid to the plan.

Do I have the right to cancel my investment?

A notice explaining your ability to revoke consent and the cancellation procedure will be sent to you after the plan commenced. You have 30 days to decide after receiving the plan summary.

If you cancel the plan within the grace period, you will receive a refund of your initial contribution less investment losses. The resulting return may be lower than the initial payment made.

If you opt to terminate coverage before the full establishment amount has been paid, an early exit fee will be assessed. As a result, the amount refunded could not equal the whole amount spent.

RL360 Oracle in Trust

Combining Oracle with a trust might be very advantageous when planning one’s financial future. The ideal trust solution is within easy reach, whether for tax purposes or to ensure a smooth transition of ownership.

Beneficiary Trust

Among the several trusts RL360 offers that are compatible with RL360 Oracle is the Beneficiary Trust. Those who are not UK residents but yet want their beneficiaries to receive their pension benefits after they pass away can utilize this trust.

UK residents are not excluded to use the trust. You should be aware, nevertheless, that doing so will not help you save money on UK Inheritance Tax (IHT).

The Beneficiary Trust won’t kick in until the passing of the ‘Relevant Person’ who is the individual upon whose death the plan’s benefits are to be paid out. People who want the plan to remain in their name during their lifetime but be transferred to a trust upon their death may find this option particularly appealing.

As long as at least one of the selected trustees is still living when the last surviving plan owner passes away, they can avoid the expenses and delays associated with obtaining Isle of Man Probate.

The Beneficiary Trust has other perks, such as accepting preexisting plans and top-ups, accommodating up to two plan owners, and more. It’s a good option for people who don’t live in the UK but still want to make sure their beneficiary gets their retirement savings when they pass away.

Discounted Gift Trust

If you are a UK resident and would like to reduce the size of your estate subject to UK IHT, the RL360 Discounted Gift Trust (DGT) is a great option for you. Either a Bare Beneficiary or Discretionary Beneficiary arrangement can be made for this trust. The trust can hold two different types of funds: the Gifted Fund and an Access Fund.

The settlor has access to capital in the event of an emergency thanks to the Access Fund, which acts as a contingency fund. The settlor might gift this fund to the trust for their beneficiaries if they no longer need it. Since RL360’s DGT is based on a trust, the trustees have some leeway in how they manage the underlying assets.

The RL360 Discounted Gift Trust’s most notable characteristics are its adaptability to either single or joint settlors, its automatic designation of the settlor as trustee, its willingness to take contributions over the settlor’s lifetime, and its capacity to function as an Access Fund. As long as there is a living trustee after the final life assured on the plan dies, the trust can also avoid Isle of Man Probate.

People who are British citizens or who are considered British citizens for UK IHT reasons are ideal candidates for the RL360 Discounted Gift Trust.

It’s useful for those who want to reduce the size of their estate without sacrificing their current standard of living, who have the financial wherewithal to gift the appreciation potential of their existing capital, who are in good health, who need a reduction in UK IHT right away, who need access to regular capital payments from the trust, and who want to keep some cash on hand in case of emergencies.

Gift Trust

When a settlor distributes property or an investment bond to trustees for the benefit of beneficiaries, the arrangement is known as a Gift Trust and is considered the most basic type of UK Inheritance Tax planning. A Gift Trust should only be established if the investor does not need access to the funds at any time in the foreseeable future.

The RL360 Gift Trust has a few standard features, such as allowing for either a single or joint settlor to create the trust, preventing the settlor from becoming the trust’s automatic trustee, and preventing the settlor from receiving any benefits from the trust.

As long as there is a surviving trustee at the time of the death of the last life assured on the plan, the trust can be utilized for both new and existing plans, accept additions to the trust fund, and avoid the necessity for Isle of Man Probate.

Those who can afford to donate money without needing access to it in the future and who have UK domicile or are deemed UK domiciled for UK IHT purposes may be good candidates for the RL360 donate Trust.

International Flexible Trust

If you are not a UK resident but would still like to name a beneficiary to receive a death claim payout without going through Isle of Man Probate, you can do so using the International Flexible Trust. In addition, it provides benefits under UK Inheritance Tax for people who may one day be considered residents.

For non-UK nationals who may one day be considered UK domiciled, this trust offers similar advantages to the Isle of Man Probate Trust with more leeway for such individuals.

Due to the International Flexible Trust’s broad class of beneficiaries, which includes the settlor, it is not appropriate for UK domiciled individuals because they would be treated as a Gift with Reservation. Therefore, it would be included in their estate for UK IHT calculations.

The International Flexible Trust can include as many as two settlors, can be used with preexisting plans, and can receive contributions.

Important considerations include the fact that only non-UK domiciled persons should use this trust for UK IHT purposes. Those who have their permanent residence in the UK will incur a charged transfer and a Gift with Reservation if they establish a trust. For non-UK domiciled settlors, the trust can function as an Excluded Property Trust, and the settlor is still regarded a beneficiary.

If you are not a UK resident but still want your investments and retirement plan to go to a designated beneficiary after your death, the International Flexible Trust is the best option for you.

Isle of Man Probate Trust

The settlor of an Isle of Man Probate Trust has lifetime access to the trust’s assets. The primary goal is to avoid probate on the Isle of Man. It must be stressed that no inheritance tax planning is involved with this trust.

The Isle of Man Probate Trust has a number of useful options for most people. It can be utilized for preexisting plans and can house up to two settlors. The trust can also take in additional funds, known as increments or top-ups.

With a plan based on a single life guaranteed, the proceeds can be distributed to the settlor’s estate without going through the probate process in the Isle of Man. If more than one life is insured under the plan, however, the settlor’s will or the laws of intestacy will determine who receives ownership of the plan upon the settlor’s death; no Isle of Man Probate will be necessary in this case.

For UK tax purposes, it is important to note that the establishment of this trust does not qualify as either a Potentially Exempt Transfer or a Chargeable Transfer. The settlor is the only person who can benefit from the trust, and after they pass away, the trust will be terminated.

When it comes to tax implications, the Isle of Man Probate Trust is the best option for those who don’t want to create a Chargeable Transfer or a Potentially Exempt Transfer but still need access to their investment after death.

Loan Trust

Individuals who are UK residents or who are presumed to be UK residents for UK IHT reasons can use the RL360 Loan Trust to make a gift of the interest or principal accrued on a loan while maintaining full access to the principal. For UK IHT purposes, the trust will ensure that any appreciation of the trustee’s investment will be excluded from the settlor’s inheritance. The loan can be repaid by the trustees through plan withdrawals.

The RL360 Loan Trust can have a single or joint settlor, and the settlor is not a beneficiary but is nonetheless entitled to repayment of the loan. It’s worth remembering that this trust can’t replace preexisting arrangements. Since no assets are transferred to the trust at its inception, the founding of the trust won’t be considered Potentially Exempt or Chargeable Lifetime transfers.

For UK IHT reasons, any increase in the value of the initial investment is automatically excluded. However, for Inheritance Tax reasons, any outstanding debt will be included in the settlor’s inheritance.

Those who are able to gift away future growth on their capital and are UK domiciled or deemed UK domiciled for UK IHT purposes may be good candidates for the RL360 Loan Trust. It’s designed for people who need immediate access to the full sum of money and want some leeway in how often and how much they pay back.

Those who would rather not make a Potentially Exempt Transfer or a Chargeable Lifetime Transfer can still benefit from this strategy.

What are the charges and fees for RL360 Oracle?

Establishment Charge

Within the first five years of the plan, an establishment charge of between 0% and 7.50% of payments may be levied. There is a quarterly deduction for this fee from the plan. Early termination of the plan before to the end of the first 5-year period will result in the payment of an early departure charge equal to the unpaid portion of the establishment charge.

Administration Charge

The administration fee is a continuous percentage of the total plan value. Based on the greater of the existing plan value or the payment, it can be anywhere from 0.60% to 1.20% per year. The administration money is taken out of the plan every three months, much as the setup fee. Before enrolling in an RL360 Oracle plan, it is crucial to explore the flexibility of these fees with your financial advisor.

Fees for Investment and Financial Advisors

The investment advisor charge is optional if you hire one. They may charge a monthly fee, either directly or through the plan.

Financial advisor fees are also negotiable. If applicable, your advisor will receive the fee straight from the plan.

It’s important to remember that RL360 might not be the one to impose the extra fees that apply to your plan. There could be fees associated with receiving funds from your plan or making withdrawals through a telegraphic transfer. For further information on these fees, contact your bank.

The fund manager may charge annual management fees and other expenses for the plan’s assets. Your financial advisor can provide you with specific details regarding these fees.

Final Thoughts

The RL360 Oracle investment bond is only made available through financial advisors. They can also evaluate your unique situation and make a personalized recommendation. They’ll take your goals and risk tolerance into account and advise you on whether or not to proceed with this investment strategy based on their in-depth knowledge and experience.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.