How can you prepare for a recession?This article will go over the obvious, and not so obvious, ways you can do that.

Before doing that, if you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Table of Contents

1. Have some cash…….but not too much

It is always a good idea to have some emergency savings in the bank, especially if your job is insecure.

The number of insecure jobs goes up during a recession. It is therefore best to have a few months worth of savings in the bank for an emergency.

Cash is not an investment though. Interest rates might be increasing, but “real interest rates”, the difference between inflation and the interest rate the bank gives us all, has never been wider.

Inflation is running at around 9%-10% per year in many countries, and interest rates are only 2%-3%.

That is a bigger loss to inflation than when interest rates were 0% and inflation was running at 2% per year.

Added to the huge currency risks British Pound, Euro and even Japanese Yen investors now face.

2. Be greedy in a sensible way

Most people get greedy when other people are feeling greedy. We saw that in 2020-2021 with NFTs, cryptocurrency and some other assets.

People often bought just because they expected the price to go up. The same thing happened with the GameStop mania.

Fewer people want to be greedy when others are fearful, as per Warren Buffett’s famous advice.

It is easier said than done. So many people say “i wish I would have invested in 2009 when valuations were so low”, but few remember how extreme the media was during the Great Recession in 2008

Below is a video from that time, which is from YouTube.

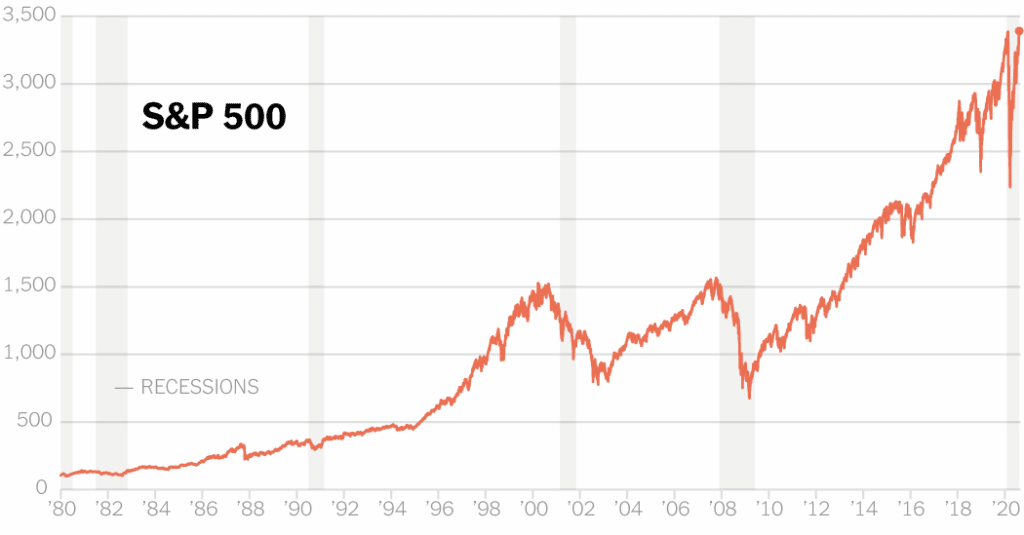

Between the content on that video being made and last year, investors got a 600% return in the US stock market.

Likewise, every $1 invested in the Nasdaq in 2002 grew to $11 last year, due to how depressed valuations were.

Being greedy doesn’t mean being silly. It certainly doesn’t mean putting 100% of your wealth in a coin, or one small-cap stock.

It does mean stocking up on assets which are cheaper, and look like good long-term bet.

3. Switch off the media

The last point alluded to a basic issue. The media, for the most part, isn’t here to educate us. They need to put bums on seats.

Whatever bleeds, leads. Fear sells even more than greed. Therefore, if you watch too much media, you will always think the world is about to end.

The founder of Forbes said it best himself:

As I mentioned on this article, academics have worked out that you wouldn’t have beaten the stock market by listening to media pundits.

Nobody who watched the media in 2002 would have bought tech stocks after the Nasdaq crash of 2000-2002, which resulted in a 76% decline in the market.

Few would have bought any stocks, or indeed assets, in 2009. And yet on both occasions, the return on investment (ROI) would have been incredible.

It is better to base decisions on long-term fundamentals and not anything happening short-term.

That is easier to do that we aren’t consuming too much media.

4. Pay down some kinds of debt

Credit card interest rates charge 15%-20% per year. Even the best investments have only yielded over 10% per year as a long-term average.

In an environment of raising interest rates, it makes sense to pay down certain kinds of high-interest debt.

Even in more normal times, avoid credit card debt.

5. Ask yourself some basic questions

I was speaking to a friend a few weeks ago. He has about $500,000 invested in the stock market.

He has around $100,000 in cash but is worried about investing it into the markets. I asked him, “so do you want to sell the 500k”?

He responded “of course not”. I said why? He said that he has made good money on it in the long-term, and even if he hadn’t, he expects it will recover from the recent falls, as markets always have done historically.

He is correct. The Dow Jones was at 60 in 1900. It was at 36,000 in January. The S&P500 has averaged 10%-11% since 1945, but has regularly fallen 25%-50%, before recovering.

Yet the fact he is right on the second point, points to a logical fallacy.

If he is worried about investing the 100k because he thinks markets will never recover, then logically he should sell out of the 500k and any money he has invested in a pension.

Even if he thinks markets will go down another 25% before recovering, he should sell out, provided the taxes aren’t too high, and then buy again in a few months.

The fact that he, and so many like him, want to stay invested with existing money but don’t want to add extra money, shows it is a emotional decision.

People can’t predict the future direction of stock markets. All we can know is that markets have always recovered historically.

If you have a long-term horizon, it shouldn’t matter if you invest and markets increase or decrease in the short-term.

6. Get creative with diversification

As you get closer to retirement, you might want to get more creative with diversification. With bonds and cash paying so little, you might want to consider alternative assets.

These assets can include hedge funds, private equity and investing in indexes but with some downside-protection.

The way the later works in practice is that you can get 70%-80% of the upside of the market, but protect yourself if markets fall.

These kinds of instrument are usually only available to certified high-net-worth investors, and advised clients, so you can reach out if you want to know more about that.

In conclusion then, see a recession as an opportunity as much as a threat. Recessions create more millionaires than during normal times.

Remember, the 2008-2009 crisis saw a record number of new millionaires created over a five-year period.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.