Investing in the US stocks from Nigeria part 1 – that will be the topic of today’s article.

Nothing written here should be considered as financial advice, nor a solicitation to invest.

For any questions, or if you are looking to invest as an expat, you can contact me using this form, or via the WhatsApp function below.

It remains my view that private banks usually offer poor value compared to do-it-yourself (DIY) or services like our own.

Introduction

The question of how many people currently live in Nigeria is a matter of controversy; The numbers vary widely, but it is estimated that there are about 175 million people living in Nigeria. At the time of the last census, there were about 250 different ethnic groups in Nigeria with different languages, customs, and religions. Because of this rich ethnic diversity, the Nigerian identity is very heterogeneous.

The three largest ethnic groups are the Hausa and Fulani, the Yoruba, and the Igbo. These groups make up a total of 68% of all people living in the country. As far as religions are concerned, the rule of thumb is that the majority of people in the North are Muslims (sharia law is in force in some regions), while those in the South are mostly Christians. The numbers are almost evenly divided, with 50% and 40% of the people living in Nigeria being Muslims and Christians, respectively.

The diversity of languages far exceeds the ethnic diversity, with over 500 languages estimated to exist in Nigeria. The three main indigenous languages, as well as the ethnic groups, are Hausa, Yoruba, and Igbo. Nevertheless, a lot of ethnic groups are capable to talk in more than one language. Although English is the official language of Nigeria, fluency cannot be expected from every native Nigerian. However, expats in Nigeria’s major cities such as Lagos or Abuja should have no problem communicating in English with the locals.

Foreign population in Nigeria

Since the country is home to many international corporations, especially in the oil industry, people of countless different nationalities choose to live abroad there. There are large diasporas of British, American Americans, East Indians, Japanese, and Greeks; there is also a strong presence of people from Arab countries such as Syria and Lebanon, and many expatriate Chinese are helping to improve daily life in Nigeria by improving the country’s rail links.

Infrastructural challenges for Nigeria

Life in Nigeria is highly dependent on many of the country’s infrastructural problems. Expatriates have to get used to frequent power outages during their stay in Nigeria. Only about half of all Nigerian households (48%) have access to electricity, and even then, often for only a few hours a day. Even in the most prestigious areas of Lagos and Abuja, diesel generators are commonplace. Telephone and then Internet connections are very heterogeneous. This is why cell phones are very popular among the population of Nigeria (73 cell phone subscribers per 100 people).

Existential problems of the Nigerian people

However, there are even more pressing issues for many people living in Nigeria such as lack of drinking water and high prices for many consumer goods. For the 70% of the population living below the poverty line, the imported food that Nigeria depends on is simply too expensive. Nationwide, only three out of five households (64%) have access to clean freshwater, which sometimes makes life difficult in Nigeria. Even in cities, this figure rises to just four out of five (79%).

Nigeria is a country full of extremes, and as is often the case in emerging economies, the vast wealth of a minority comes at the expense of the masses, especially in rural areas. Many infrastructural problems, including the quality of roads (see p. 2 of this article), place a heavy burden on the country’s economic potential. Ultimately, they also affect the cost and quality of life in Nigeria.

Cost of living in Nigeria

The 2014 Mercer Cost of Living survey ranked Lagos and Abuja as the 25th and 36th most expensive cities in the world for expatriates. InterNations’ own Expat Insider Survey ranks Nigeria as the most expensive country for expats (out of 61 countries).

If you want a Western standard of living, you have to pay for it. Rent, food, and imported goods tend to be the most expensive, while gasoline, local beer, and cigarettes are some of the cheapest. Help around the house is also inexpensive, as are utilities, just don’t expect uninterrupted power or water.

Considering the cost of living in Nigeria, income inequality in the country is high. As mentioned above, seven out of ten Nigerians live on no more than $1.25 a day. Poverty is probably the biggest problem for Africa’s second-largest economy.

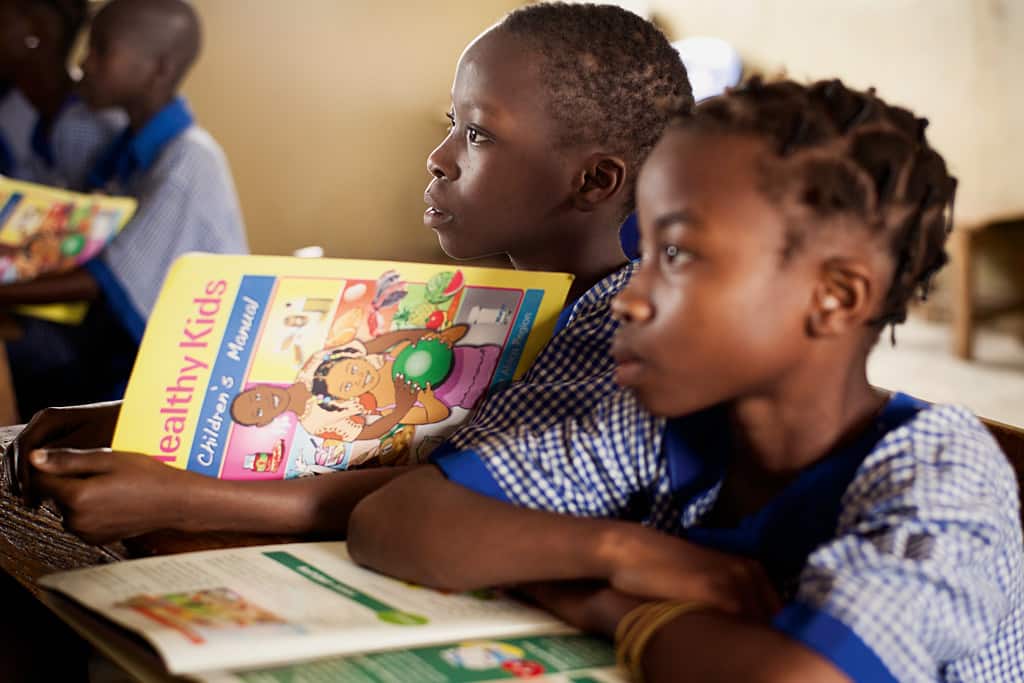

Education in Nigeria

Nigeria‘s education system was introduced during the colonial era by the British and is still heavily influenced by the British system. Six years of primary education is compulsory in Nigeria. From the age of six, students are taught mathematics, English, religious studies, natural sciences, and one of the three main languages of the country. High school, another six years, is offered by various federal, state, and private institutions. Higher education is available from many universities and polytechnic colleges in Nigeria.

The reality of education in Nigeria, however, is less rosy. Due to insufficient funding and insufficiently motivated staff, the condition of many schools and the overall quality of education leaves much to be desired. According to the World Bank’s 2014 World Development Indicators, about 76% of children in Nigeria complete primary education, but only two-thirds of Nigerians aged 15 to 24 (66%) can read and write. These figures are as much as 20% lower than in other countries of a similar level of development. Many wealthy Nigerian parents tend to send their children to international schools in Nigeria or boarding schools abroad.

Expats with children may want to enroll their children in one of the country’s international schools, which are fairly common in popular expat areas.

Healthcare

The weak healthcare system in Nigeria makes it difficult for people to get the best healthcare possible, and it’s no secret that Nigerians prefer to travel abroad for treatment rather than fixing a diseased system. Access to public hospitals means long, winding lines and prepayment before receiving treatment. However, there are a number of private hospitals with fully equipped facilities. Proper health insurance is a must in Nigeria to receive decent health care.

Investing in the US stocks from Nigeria

Local or expat investors looking to invest overseas are getting a lot of attention these days. In addition to existing foreign funds, several international mutual fund schemes have recently been launched to diversify their domestic portfolios.

On the other hand, buying foreign shares is not as difficult as it sounds. Owning some of the top US stocks like Facebook, Apple, or Amazon, including recent growth leaders like Salesforce, Visa, American Express Co., Costco Wholesale Corp., Expedia Group, etc.

But where to start and how to invest in the US stocks from Nigeria? Later in this article, you can find information on how to make your investment from Nigeria and the reasons you should start thinking about making your first step towards it.

Where to start?

You probably know that the exchange market is nowadays electronic, where you can trade while your device is connected to the Internet. The process will require an intermediary, that is either a brokerage company that has a license for stock trading or a bank. Before you start your research, it will be necessary to be aware of a few very important points.

The stereotypical investor is a financier in an expensive suit who checks stock quotes every 15 minutes. But most real investors are ordinary people: they go to work, raise children, and are fond of not only finances. For them, investing is just another source of income and a way to secure a comfortable retirement.

Why to invest and when to start it?

You should not expect that here in a couple of years you can get billions and then sit back all your life. Set a realistic goal – say, to earn money for your old age or for your children to get a good education. For example, most of the affluent Western retirees we meet in resorts don’t travel on their government pensions at all. An important part of their income comes from once made investments.

Investments can be done at almost any age: there are even investors who are not yet 14 years old, and there are also pensioners. Huge amounts are not necessary here – sometimes just 10 dollars is enough to start.

Remember to create a personal reserve fund first: it is also called a “financial airbag”. This is the amount that will last you at least three months, and preferably six months. When there is such a reserve, you can begin to invest free money in securities to earn money.

The most common options:

- invest in real estate, then to sell or rent;

- buy stocks;

- put money on the deposit;

- buy and sell securities.

Each option has its pros and cons. For example, more risky, but potentially more profitable option is investing in securities. They are different, and their risk is also different. Take the bonds that the state and companies issue to borrow from investors. Government bonds are considered more reliable than corporate bonds – countries go bankrupt much less often than private businesses. If the economy is in good shape, then corporate bonds are also a good tool.

Another type of securities is share. This is a riskier type of investment than bonds. But it is also more popular with investors, because together with the risk they provide an opportunity to make really good money. If bond prices fluctuate quite a bit, then stock prices fluctuate more: it is very dependent on the state of the company, its earnings, and management quality, on good and bad news.

Stocks of stable and strong companies increase in value over the years, so you can make a good income by selling a share a few years after purchase. If the growth was rapid, then in a few months. In addition, shares provide an opportunity to earn more on dividends – this is part of the profit that the company shares with its shareholders.

1. Estimate how much you are willing to invest

Theoretically, you can start with any amount, even from 40 dollars, anyways this amount will not be enough to compensate for both the intermediary’s commission and the time spent on the trades. It will be better to start your investing career in the case where you are ready to risk several hundreds of dollars. And better for you, first imagine in advance the situation where you lost all your money, if you are ready to lose it, you can give it a try.

2. Consider how much time you are willing to spend on managing your investments

You have to be ready to get acquainted with the topic, study statistics and stock market reports, follow the charts during the day, and try to trade on your own. After these main steps, you will need to find a broker to act as your intermediary for accessing the exchange. You will have to make the buying and selling decisions on your own, and the broker will follow them.

In case you are not ready to spend much time and effort on this process, then you had better consider one of the forms of trust management. Here what you need to do is provide the funds and make some minimum of decisions, entrusting the further steps of trading to the professionals.

You can sign an agreement with the professional, transfer money to him, after what he will decide instead of you when and what assets to buy and when to sell. The main goal is to make investments with maximum benefits and choose the best level of risk personally for you.

Another option is to invest in mutual funds (mutual funds). These are ready-made sets of different securities or other assets.

3. Choose your strategy and assets

Decide what you will invest in. Stick to a specific strategy. What is strategy? It is a set of investment parameters that will help you determine your style of behavior on the exchange: which assets you want to trade, how often you sell them, what sources do you use as your guides when making decisions.

Here is the simplest outline of the strategy:

- assets;

- the period for which you want to invest;

- the maximum amount of losses.

Let’s say the assets are shares of a hospitality company, the investing period is 2 years, the amount of losses is 20%. In this case, you immediately sell assets if they have fallen in price by 20%, even if the year has not passed yet.

If you decided to pick the option of trust management, then you also need to pick a strategy. This is the only case, that will require your participation – choose one of the offers that are already on the market, or discuss an individual strategy with your trustee.

4. Find an intermediary company

Once you have a strategy, it will be easier to find a middleman. The most important point to consider while choosing a broker, trustee, or management company is to make sure that they have a license from the Central Bank of Nigeria.

If you have chosen to invest on your own, there is the following path to go:

- conclude an agreement with a broker;

- open and replenish a brokerage account;

- install a special program for trading;

- start buying and selling.

If you have chosen the option of a trust management company, then it will be enough to sign an agreement and transfer the money to the trustee or the management company of the mutual fund.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 361.7 million answers views on Quora.com and a widely sold book on Amazon