Updated January 17, 2021

Is Dimensional Fund Advisors better than Vanguard in 2021?

I have been reading a lot of things online recently concerning people comparing Vanguard with Dimensional Fund Advisors, iShares and BlackRock index funds.

This article will compare all of these options, and answer some frequently asked questions, including what smart beta funds are in human terms.

If you prefer video content, the content below summarizes the article.

For those that are interested in investing you can email me at advice@adamfayed.com or use the WhatsApp function.

Firstly, who are Dimensional Fund Advisors and Vanguard?

Many people know who Vanguard is. They are one of the biggest financial services groups in the world, with $5.6trillion USD assets under management as of 2019.

Founded by the late Jack Bogle in 1975, they are most famous for their index funds, which track a specific index, such as the S&P500 or MSCI World.

They do also offer actively-managed funds as well, although those funds have typically lagged their main index funds.

Less people have heard of Dimensional Fund Advisors (DFA). Headquartered in Texas, and founded in 1981, they have over $600billion USD assets under management.

With offices in over 13 different locations, they are fast growing. However, in terms of size, Vanguard is still much bigger:

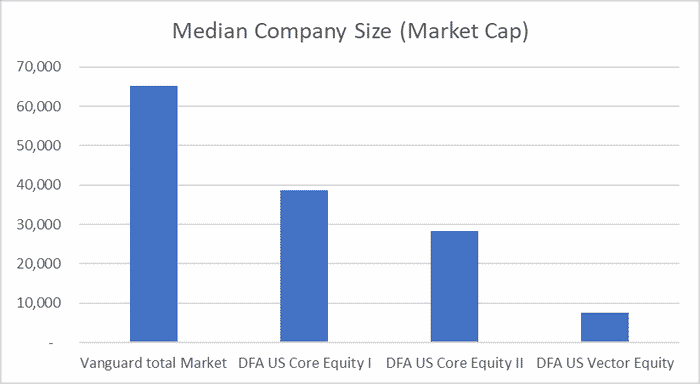

Both firms focus on passive investments. The main difference is that DFA focuses more on value and small caps, and claim to use superior technology.

This is sometimes known as a “smart beta ETF” or index funds. It follows an index, so is passive, but also considers many factors in picking stocks within the index.

What is Smart Beta then in human terms?

This article doesn’t have enough time to discuss the difference between active, passive and smart beta in all of its complexity, but I will summarise the basics here.

Traditional fund managers (“active managers”) try to beat the stock market by picking specific stocks or sectors that will outperform – they are seeking alpha.

In other words, they charge you more than index funds, to try to beat the index.

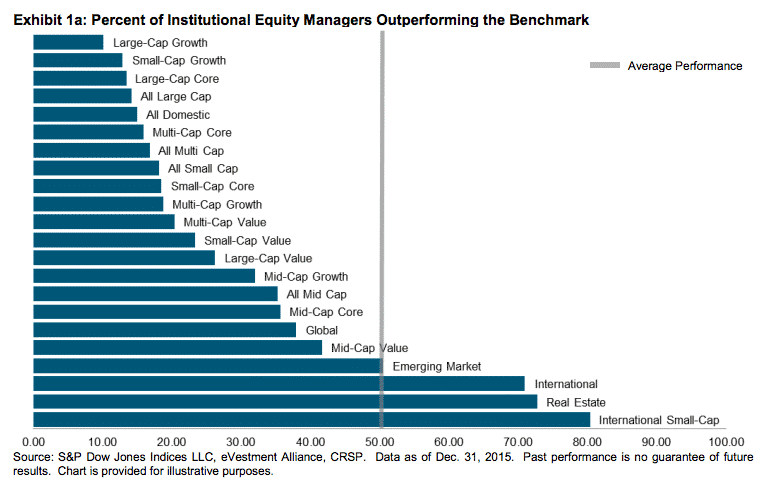

Most active funds have historically failed in this mission, at least in the long-term. Many active managers can, and do, beat the S&P500 over a 2 or even 5 year period, but struggle over 20 years or more.

The few areas of outperform remain in areas like small caps, as the chart below shows.

In comparison, index funds, or passive investment funds, are merely trying to get the market average – a small cost for getting access to that fund.

So for example, last year the S&P500 went up by about 28%. So passive funds would give you 28% – costs (about 0.1% for holding the funds).

Smart Beta, in comparison, is somewhere in the middle. It is also relative cheap like the passive funds, but isn’t quite as passive as pure index investments.

However, they are different in that it uses computer algorithms to try to take advantage of market inefficiencies. So beating the market, not from the human touch, but with technology.

Advocates of smart beta claim it is the best of both worlds; the low costs of passive funds but the “brains” of an active fund.

So unlike iShares, BlackRock and other index funds which often are almost identical to Vanguard in terms of fees and performance, there is a reasonable difference between Vanguard and DFAs.

DFA tends to charge about 0.15% more per year for the funds, as compared to Vanguard or iShares.

Do these differences affect performance?

DFAs haven’t been around for a long enough time to make any concrete conclusions. In another 30 years, we will have a better idea about the reality of their claims to offer over -performance.

However, in the last 10-12 years, Vanguard has often beaten DFAs marginally. Even where DFA has came out on top, the difference is marginal, and only for a few years.

Take the DFA U.S. Large Company Portfolio, which is similar to the S&P500 Vanguard Index. As per the stats below, DFA has beaten Vanguard some years, and trailed during other periods:

| Year | Index -benchmark | DFA Large Cap | Vanguard S&P |

| 2019 | 27.6% | 27.59% | 27.56% |

| 2018 | -4.38% | -4.43% | -4.42% |

| 2017 | 21.83% | 21.73% | 21.78% |

| 2016 | 11.96% | 11.90% | 11.93% |

| 2015 | 1.38% | 1.38% | 1.35% |

| 2014 | 13.69% | 13.53% | 13.63% |

| 2013 | 32.39% | 32.33% | 32.33% |

| 2012 | 16.00% | 15.82% | 15.98% |

| 2011 | 2.11% | 2.10% | 2.09% |

| 2010 | 15.06% | 15.00% | 14.91% |

| 2009 | 26.46% | 26.62% | 26.49% |

In some ways as well, the above figures are not a completely fair example, because the DFA fund tilt their focus to small caps, which have done better in recent years, compared to larger cap indexes.

So DFA large cap vs Vanguard S&P500 isn’t an exact apples vs apples comparison. It is more like apples vs apples and with some oranges in the same basket!

If we extend the category search to small caps, international large caps and other categories of funds, we find that Vanguard slightly beats DFA with lower expense ratios, and also lower volatility.

From 2009 until today, I found Vanguard has a slight 0.13% per year advantage across a wide-range of the most popular funds.

Hardly a huge advantage, but it does show that beating Vanilla index funds isn’t easy on a consistent basis.

Frequently asked questions

This section will answer some frequently asked questions (FAQs) that haven’t been covered already in the article.

What are some of the arguments in favour of smart beta that hasn’t been covered already?

In addition to the arguments mentioned above, supporters of these funds claim that smart beta gives investors a better risk-adjusted performance.

In effect that they won’t always beat the market, but they will give you a better performance relative to the volatility of the fund. In other words, they might fall less, when the general market is down.

Another argument is that the US market is very weighted in favour of the biggest firms by capitalisation such as Apple, Amazon and Netflix, that have super high valuations.

So according to proponents of smart beta, they can add value by strategically picking, weighting and rebalancing the stock picks that are built into the index.

So it isn’t a purely weighted index fund, and this can reduce risks.

Can you buy dimensional fund advisors online?

You can’t currently DIY invest DFM investments. You need to go through an advisory firm. The reason is to stop “hot money” coming in and out, like what happened to Vanguard in 2009, and during previous stock market crashes.

DFM want people to buy and hold, which they assume is more likely to happen through advisory firms.

There is certainly some degree of truth to this statement. Various studies have shown that investors that are in index funds, still try to time the markets.

This contributes to results like the ones below:

I have personally lost count of the number of people I have met, that have stopped investing due to Trump, Brexit and various other political events.

How about Vanguard in comparison to iShares and other index funds?

What is most interesting is, if we compare Vanguard with iShares ETFs, the performance is also very similar. The same is true with BlackRock or HSBC (UK) index funds.

Ultimately most index funds these days, are relatively similar, with the exception of these “smart beta” ones like from DFA.

So investindo with Vanguard over iShares won’t give you a huge advantage.

What does Jack Bogle think about smart beta?

The father of low-cost investing Jack Bogle, was unimpressed before his death with the idea that Vanguard, Dimensional Fund Advisors or any other firm, could beat the traditional index fund with smart beta tactics.

He commented that value and small caps will outperform during certain periods of time, but that doesn’t make over-performance over the long-term likely.

If smart-beta is winning, dumb-beta is losing, by the exact same amount. Meaning strategy A might work for investor A, but strategy B might not work for investor B.

What is most interesting about Bogle’s analysis, is that he contends that these funds don’t help improve risk-adjusted performance in the long-term – one of the key arguments proponents of smart beta use.

Vincent Deluard, also has some strong arguments, as per the video here. As he mentions, specific smart beta funds, can outperform for a short period, but that isn’t a good reason in isolation to invest.

What is particularly interesting about his analysis is what will happen if interest rate rise in the future.

What does Beta measure?

Beta measures the volatility of an asset. For example, if the S&P500 is used as proxy, the beta is one.

A stock that has a beta of 3 has a return which changes by three times as much as the general market – whether positive or negative.

Don’t small caps usually beat large caps?

Small caps have beaten large caps over the last 100 years, however, it depends on which time horizon you pick.

For example, small caps drastically beat large caps in the Great Depression, but have also trailed large caps during other periods.

Why is it easier to beat a small cap index than the S&P500?

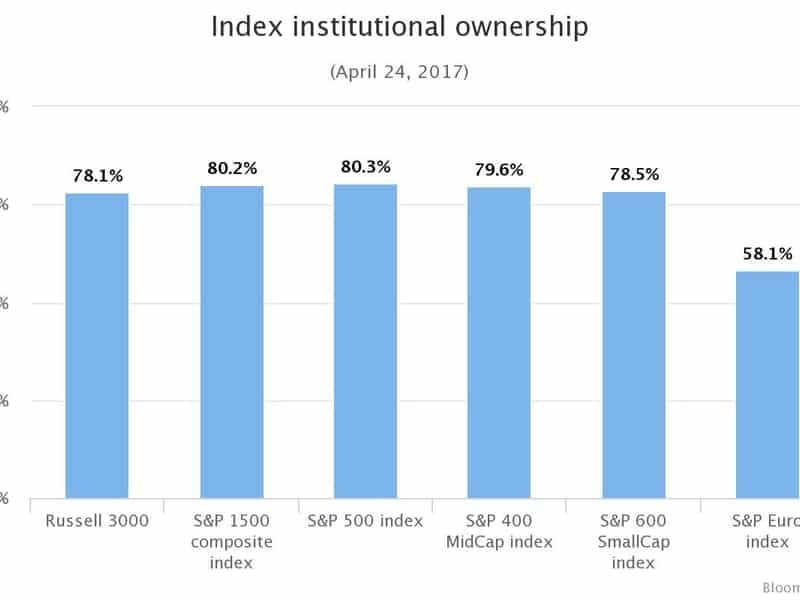

The S&P500 is mainly institutional money. That wasn’t the case in the 1950s or 1960s when the average investors were teachers, doctors and other individuals that often traded on emotions.

Now most owners are institutional – including banks and hedge funds. Small caps, especially in emerging markets, have less institutional investors.

That doesn’t mean in the US and UK, the small cap indexes are vastly different to the larger markets like the S&P500.

As per the graph below, many small cap indexes are also being driven by institutional money these days:

So beating a small cap index might be slightly easier than a large cap one, but has also gotten more difficult.

This trend has also lead to a situation where even great investors, like Warren Buffett, are struggling to beat the market.

Are most smart beta funds alike?

Not all smart beta funds are the same. Dimensional Fund Advisors is just one option.

Each smart beta fund has its own methodology, bias and smart beta index to track.

Is this a bubble?

I have wrote elsewhere to be cautious about this hype surrounding bubbles. Neither of these investment strategies has reached bubble levels yet.

How about performance during the 2020 bear market?

It is too early to say whether Vanguard or DFA will do better during moments of market downturns.

As DFA are more focused on small caps, they will probably fall further but recover quicker as well, compared to Vanguard.

Many of the large caps have global revenue like Amazon, Netflix and Apple, and are better suited at adapting to a remote and digital world.

In fact, Netflix and some of the large caps are seeing increased revenue, as more people stay at home, during the lockdown.

As 2020 is coming towards an end, it appears that dimensional funds haven’t beaten more traditional index funds, even on a risk-adjusted basis.

Conclusion

There are many good things about some of these smart beta funds, including dimensional fund advisors.

It is true, for example, that the statistics show that DIY investors in Vanguard and iShares, lose to the general market they are tracking. They, all too often, buy high and sell low.

The fact that DFA only accept through advisors might place a check and balance against this.

There isn’t enough evidence yet, however, to ascertain that DFA are a superior way to invest. They have thus far failed to beat Vanguard, iShares and other index funds.

They are good funds, but that doesn’t mean the technology will help you beat an iShares or Vanguard Fund.

In reality, whether you buy a Vanguard, iShares, BlackRock or HSBC fund (for UK investors) really won’t make much difference in terms of performance.

The key thing are investing for the long-term, how much you invest, for how long and asset allocation.

So for now I would avoid the hype surrounding “smart beta ETFs”.

Even if they have a slight chance of outperform long-term, my money would still be on a tiny over-performance for more vanilla Vanguard and iShares index funds.

If you are curious, you could try having a small allocation linked to DFAs, and see how they perform relative to Vanguard long-term.

Further reading

My content on Quora and YouTube gets hundreds of millions of views.

Which pieces of content outperformed in 2020? One answer I spoke about was the coronavirus.

What would have happened if stocks would have collapsed like during the Great Depression?

Here is a preview of the answer:

This answer might shock you because it will show why investors during the Great Depression, actually could have made a profit barely a few years later……but more on that below.

Firstly, a good investor should imagine they are controlling a catapult.

You need to load it with “balls”. The more balls you loads into the catapult, the better for your “attack”.

This is what an investor often needs to do. In your working years, you need to fill the catapult with units, and then “fire” (sell) these units in retirement.

The lower markets get, during the virus, means the more units you can “fill up on”.

So take the Vanguard Total Stock Market ETF (VTI) as an example.

The price now is $123.31. So if you have $15,000 to invest today, you can buy 121.64 units.

In comparison, imagine the price was $62 – about half of what it is now.

In that case you can buy 241 units. So rationally speaking, a young investor should want markets to fall, and somebody approaching retirement should want them to rise, as they will want to be net sellers.

I will give you a simple example of somebody profiting from the Great Depression.

Let’s say somebody bought the Dow Jones in 1929 right at the outset of the biggest financial crisis ever – I know index funds weren’t available in 1929 but stay with me while I illustrate a point.

Let’s keep this simple and say they invested $10,000 a year (adjusted for inflation) from 1929 until 1960 when they retired.

They would have made an absolute fortune. More than if markets had kept going up in a straight line!

In fact, they would have made about 12x-14x more than they put in, despite all of the deflation of the 1930s.

Why? The markets had a brutal 90% fall from the absolute peak to the absolute bottom and stayed low for years.

So during those years that young investor (or even middle aged person) in the early 1930s, could have “loaded up” his balls for the catapult for a few years.

What about somebody with a lot of money already invested?

You might say, the last example only works because somebody who invested $10,000 a year (inflation adjusted) from 1929 until 1960, only invested during a few “awful years” when they had less invested.

In other words, it wasn’t as if they had 100k invested on day 1. They were only getting started during the worse of the crisis.

So let’s look at another example:

“Person 2” had a 100k lump sum (inflation adjusted again) invested in 1929 + they add 12k a year in each subsequent year.

How scary you might say! They invested 100k just before a 90% decline!

So how many years would it have taken their portfolio to recover?

1930 = 112k contributed. Account value = 76k. A big drop

1931 = $124k contributed. Account value = 54k. A massive drop

1932 = 136k total contribution. Account value = 54k. An even bigger drop!

1933 = 148k contribution. Account value = 90k. Green shoots!

1934 =160k contribution. Account value = 98.7k

1935 = 172k contributed. Account value = 150k

1936 = 184k contributed. Account value =……….232k!

So the account is up substantially within 6–7 years of a Great Depression…..despite having a decent sized lump sum at the beginning!

The reason is simple. Markets might have declined 90% from the very top to the very bottom, but by patiently investing during this down market, this investor has “filled up their catapult with units”.

And that isn’t factoring in:

- Deflation which was huge in the 1930s

- If you rebalanced from bonds the figures above would be huge

- Of course if this investor would have carried on for 10–20 years more, the returns would have been bigger.

A more recent example – The Nasdaq

From 1995 until 2018, the Nasdaq produced about 12%-13% per year for a lump sum investor but from 2000–2002, it fell by 76%!

Yet somebody who bought extra units during that period would have gotten even higher than 13% returns for obvious reasons.

Why? The Nasdaq was 900 in 1995. 5,050 before the crash in 2000.

It hit 1,200 at the bottom in 2002 and stayed low for years, before hitting 10,000 1–2 months ago, before the recent fall. It also fell a lot in 2008.

So somebody who rebalanced from bonds into the Nasdaq from 2000–2002 and 2008–2010, and monthly invested via their salary, could have made up to 15% per year, by taking advantage of the lower valuations.

I am not implying that people should focus on the Nasdaq over the S&P500.

I am merely saying an investor shouldn’t fear big falls if they rebalance and/or are young enough to deal with the volatility.

So surely an investor should just wait for the right time to get into the markets?

It isn’t that simple. Nobody can predict what will happen to markets, even though they have always historically came back to hit record highs.

To carry on reading, click below