Here are reasons why buying property in Laos is a bad idea.

If you want to invest as an expat or high-net-worth individual, which is what i specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Introduction

Laos is one of Southeast Asia’s most rapidly developing nations. Setting up a business or investing in the Laos property market may appear to be a fantastic choice at first look.

In 2020, the nation was able to maintain positive GDP growth because to strong development in the export and service sectors. Granted, Laos’ GDP only grew by 0.2 percent that year, but the great bulk of the world’s economies were in recession.

Going forward, the Asian Development Bank anticipates substantially greater GDP growth through 2022 and the rest of the century.

Meanwhile, Laos is seeing a surge in international investment. Especially from its considerably larger neighbor, China.

China’s One Belt One Road plan is pouring vast sums of money into Asia’s rising economies. Laos is one of the most significant benefactors of China’s pet project.

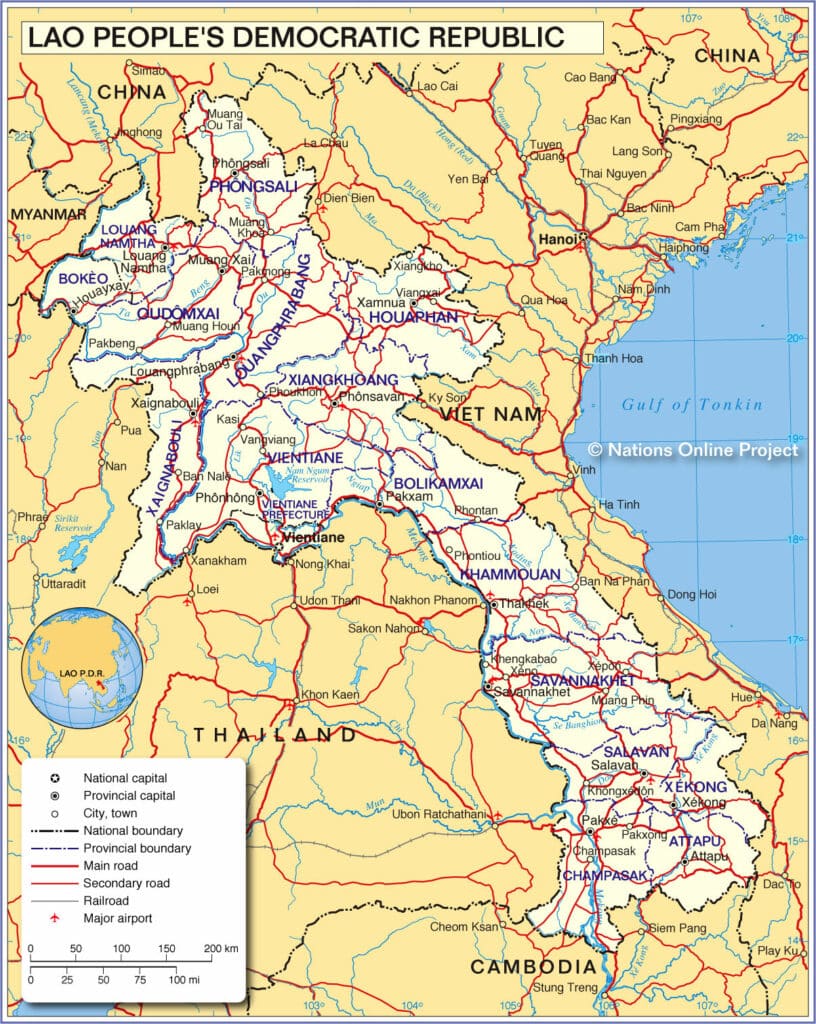

Laos has the potential to be a transit center for the whole ASEAN area due to its shared land borders with five other countries, including China.

The recently completed high-speed rail route connecting Vientiane, the Lao capital, with Kunming, in southern China, is an excellent example. It was funded by Lao PDR’s bigger northern neighbor.

The high-speed rail system was finished in 2022 and would eventually connect Laos with Thailand and the rest of Southeast Asia, allowing for increased commerce and communication.

You may want to explore investing in Laos because of its positive economic history and the possibility of even brighter days ahead.

However, you should avoid purchasing stocks, real estate, or any other asset in Laos. There are several causes for this.

Reasons Why Buying Property in Laos is a Bad Idea

1. Foreign Ownership in Laos is Difficult

Despite a fast rising economy, it is difficult for foreign investors to move money into Laos to acquire houses or equities.

A country’s great economic performance means nothing if you can’t get real estate or other business possibilities there and benefit from them.

In Laos, the state officially owns every piece of land. Land can only be leased for up to 30 years by foreigners. In Laos, you can buy and own houses and other forms of real estate, but not the land on which they are constructed.

Are you really sure about buying a property in Laos even if it’s on someone else’s land?

Laos, like other frontier economies, has a stock exchange that is barely functional. The Lao Securities Exchange allows you to trade just seven firms. The state-owned oil company and the power supplier are examples of quasi-public enterprises.

As a result, the only viable way for a foreigner to invest in Laos is to start a business. In a nation where foreign ownership is prohibited and there is no stock market, there are few possibilities.

Simply put, neighboring nations are among the most accessible areas in the world for international investors. Laos is among the most difficult.

2. Laos is a Landlocked Country

Nobody can alter geography. However, a country’s location on the map has a significant impact on its ability to expand.

Natural resources, proximity to maritime routes, and fertile land are all important aspects in a country’s long-term economic success.

Laos is landlocked, which means that it is bordered by five other countries.

It is typically beneficial to exporters to share borders with as many nations as possible. In the case of Laos, however, land connection comes at the cost of having totally no access to the ocean.

Because Laos is landlocked, exporting its goods to the rest of the world will always be a challenge. They can’t ship since they don’t have access to water.

Laos is always constrained by its geographical position. To preserve a thriving Lao export industry, investors and foreign governments from adjacent countries with maritime borders, like as Thailand and Vietnam, must work together.

This is not only inconvenient, but also costly for Laos. Thai tariffs, for example, apply to Lao products that are exported through Thai ports.

As a result, the Lao sector is noncompetitive, and the country faces severe developmental hurdles in the future.

Laos is also tough to navigate. Mountain ranges and hills cover over 70% of the nation, and hundreds of rivers stream through it.

Foreign businessmen and Lao nationals alike find the country’s lack of navigability expensive and cumbersome.

To simply travel across the country, taxpayers must spend money on infrastructure, such as bridges and tunnels. Laos lacks the resources to construct extensive highways over a flat plain.

As a result, Laos’ infrastructure is more expensive and will likely remain below global norms for some time. This problem is exacerbated by a number of additional problems discussed in this article (the most of which are self-imposed) and will prevent anyone interested in investing in Lao stocks, real estate, or businesses.

In the future, Laos could be able to change its position from a disadvantage to an asset. Because Laos is otherwise situated on a strategically positioned piece of territory, a rail link may someday transport both goods and people between China and Southeast Asia.

Of course, this will take a lot of time, money, work, taxes, and collaboration with Laos’ neighbors.

3. There Are Better Foreign Investment Options

Nothing in this article implies that you can’t earn from investing in real estate, equities, or enterprises in Laos.

Many multinational corporations, especially those controlled by foreigners, are flourishing in this country. Smaller businesses have also been successful in Laos.

However, there are greater possibilities just across the border in Laos. The stock market in Vietnam is fully operational, making doing business considerably easier. Meanwhile, international real estate ownership is permitted in Cambodia, and practically anybody can obtain a long-term visa.

When economies like Thailand and Vietnam are only across the border, there’s no reason to bother yourself with paperwork, tension, and bureaucracy in Laos.

Both of these countries are expanding at a similar rate as Laos. However, when it comes to purchasing real estate or other sorts of assets in Laos as a foreigner, they have significantly fewer disadvantages.

Asia is the world’s most dynamic continent. If you’re going to invest in this location, make sure you do so appropriately and don’t sell yourself short.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.