On this article I am going to speak about some of the common fears people have about investing and why you shouldn’t be worried about them.

- Which currency should I invest in?

This one tends to worry expats the most. It might sound incredible, but it doesn’t matter which currency you invest in.

If you buy the S&P500 in USD, or the S&P500 in British Pounds, it doesn’t make any difference. If the Pound collapses relative to the USD, your returns in Pounds will just be higher. That is because you are investing in the S&P500 and not the Pound or USD.

The returns in a common currency will therefore be the same. For example, if you move to the Eurozone and you previously invested 50,000 into the S&P500 in USD, and 50,000 in the S&P500 in GBP, the two returns will be the same in Euros.

- What if markets crash?

You don’t need to worry about stock markets crashing provided you are long-term and aren’t in individual stocks.

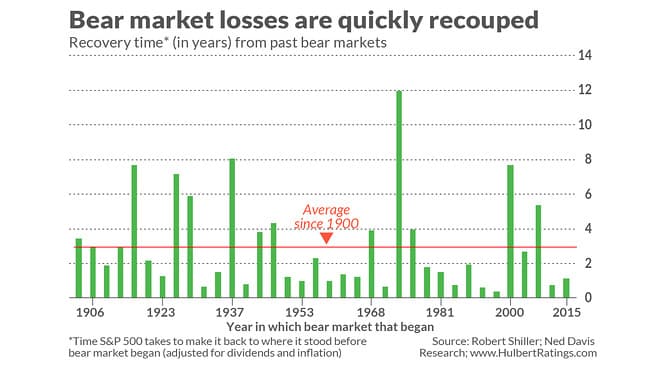

As the chart below from Marketwatch shows, the average length of bear markets is relatively short:

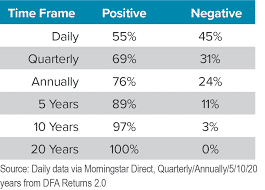

Given those facts, it is unsurprising that nobody has lost money if they have bought and held a market, such as the Dow Jones or S&P500, long-term:

A long-term investor who sees the stock markets crash can, therefore, be reassured that stock markets have always recovered and they can enjoy the lower valuations.

We often forget that lower stock market values for a period of time also gives investors an opportunity to use fresh money from a salary or business to add to the position.

Some people might respond that it is better to wait until stock markets crash before buying in.

The problem is, there is a lot of academic evidence that nobody can time the stock markets.

It is true that individual stocks, and indeed sectors, don’t always recover. The banks have never recovered since the 2008 crash.

If you buy individual shares or sectors compared to the entire market, and aren’t therefore diversified enough, that is an unnecessary risk.

- Dollar cost averaging vs lump sums

Many people come to understand the value of the previous point – timing the markets is pointless and worrying about crashes and volatility is equally futile considering markets recover.

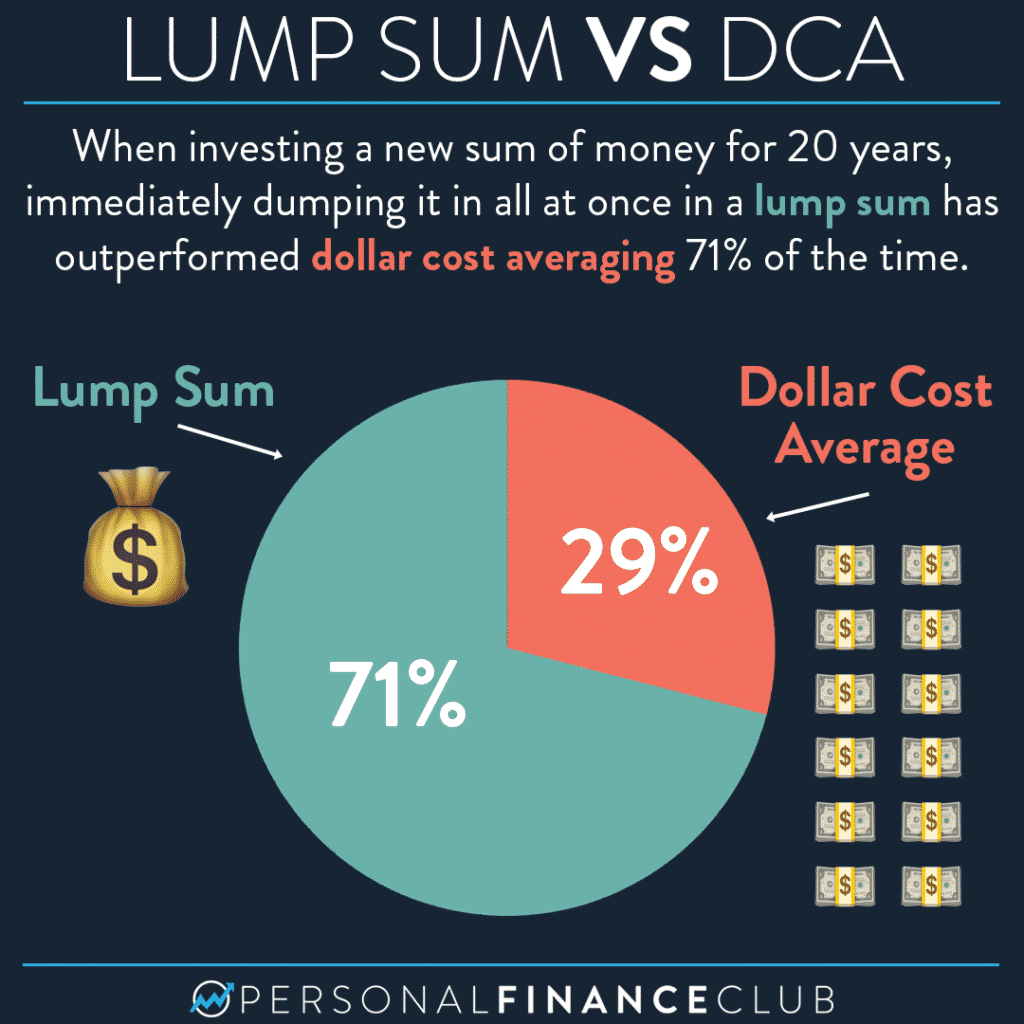

Yet a certain percentage of people worry about whether it is better to invest a lump sum or dollar cost average – in other words invest monthly.

We all need to dollar cost average at some points in our life, because most people are either salaried or have regular lump sums to invest from a business.

Yet the evidence shows that if you have a big lump sum, it is better to deploy it straight away.

Numerous studies, including from Vanguard, have found that dollar cost averaging only beats lump sum investing on 29%-34% of occasions:

- I read a bad online review!

As somebody who is guiding or advising clients, I use third-party investment platforms. I don’t personally hold the money.

A certain percentage of people are worried about negative online reviews associated with these third party providers.

This isn’t usually productive because many of these reviews are biased (usually from other advisory firms who are trying to poach clients who google a certain review term), and aren’t updated.

Barely a few weeks ago I was dealing with a client who was worried about a review from 2016, which is now full of factual errors due to the changes that have been made to that particular solution.

Moreover, only unhappy clients are likely to complain about a provider, and most of the happy ones are likely to recommend the advisor on LinkedIn rather than the product provider.

I have close to thirty online reviews, but none of them have recommended the third party holding the funds for obvious reasons.

I am not saying online reviews don’t have any credibility. My countless ones on LinkedIn and elsewhere have reassured many clients, but you shouldn’t be put off if a product provider has a few negative reviews.

It is only natural that a solution which has thousands of clients will have a handful of negative and positive reviews.

5. I am worried about the location where my money will be held

We are in 2021 and not the 1970s or 1980s. These days, there are proper investment protections in most major financial centres.

So, regardless of whether your money is being held in London, New York, Bermuda, Canada, Mauritius, Puerto Rico, Cayman Islands or Panama, the days of lack of transparency and few protections is long gone.

There is also a misconception about what the word offshore means. Investing offshore just means investing outside your country of residence.

If you are living in Italy, and invest in London, you are therefore investing offshore regardless of your nationality.

Again, the days of offshore being something dodgy are long gone with transparency rules like the Common Reporting Standard (CRS) created by OECD nations.

6. Future taxes

Nobody can predict the future, including what will happen to tax rates in the next few years or decades.

As the majority of taxes are usually applied on capital gains, and that is a future event, it isn’t something to worry about in most cases. At least not on day one.

There are some exceptions to this, like if you will be making income in the first year, for example from a rental property.

In general, worrying about things which we can’t control doesn’t make sense. The same is true concerning worrying about the future cost of living if you retire overseas.

We can’t control the inflation rate or currency movements, so planning for the worst case, but hoping for the best, tends to make more sense than worrying.

7. I don’t have enough to invest to be wealthy.

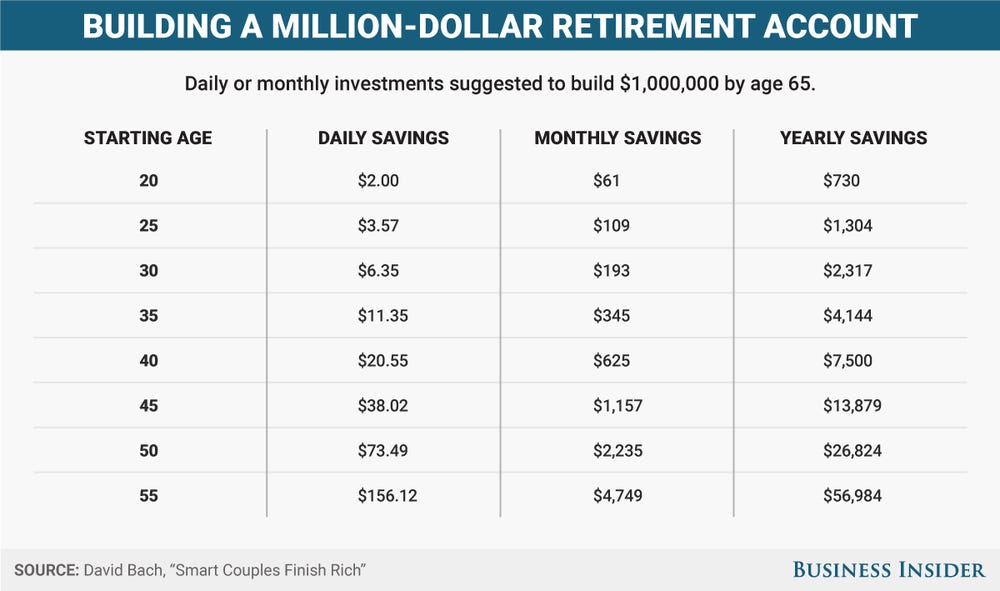

Most million-dollar portfolios start small. Small amounts naturally compound into larger ones if you invest for the long-term.

The S&P500 has produced 10% per year, on average, since 1945, with the Nasdaq and small caps doing about 12% per year.

Whilst this is merely an average, and some years and decades are better than others, it really builds up over time as the chart below illustrates:

I have made similar arguments in one of my most popular articles. Besides, even if you have started the investment process late and therefore don’t make the million dollar or pound threshold, you are unlikely to become less wealthy from investing compared to holding money in a 0% yielding bank account.

8. I fear missing out on X and Y asset

Most of the fears listed here aren’t linked to greed – the opposite emotion. Yet some people do become worried about missing out on assets like Tesla, Bitcoin and others.

The problem is, nobody can consistently predict what the next Tesla will be, if the stock will crash, outperform or underperform the market.

If you really can’t resist speculating rather than investing, use just 5%-10% of your portfolio to go for these positions.

- I am worried about the election, inflation or something else I heard in the news

The news is what is “new”. The business model works based on monetising sensationalism.

Study after study has shown that you won’t beat the market by listening to media pundits on channels like CNBC.

One of the biggest reasons for this is that stock markets can soar during the most unexpected time periods.

Markets did well after Donald Trump’s 2016 election victory, which came months after Brexit. They also did well after the disputed 2020 election between Trump and Biden, which also came during a second European lockdown.

Historically, stocks have risen during pandemics, such as the current one and Spanish Flu, which also happened during the same time as a world war.

There is also little or no correlation between GDP growth, unemployment and various metric and the stock markets.

The stock markets are a relatively small number of firms – thirty of the biggest ones in America (and the world) in the case of the Dow Jones and five hundred when it comes to the S&P500.

Those firms can do well, or badly, during all kind of time periods, which makes a lot of media analysis redundant.

Most of the media pundits who get one prediction right usually get the next one wrong, but the public tends to forget about it, as the founder of Forbes mentioned below. So, ignore most of the negative clickbait, focused on doom and gloom.

Source: Az Quotes

10. What if I die – what happens to the money?

Most investment providers allow you to nominate a beneficiary or rely on wills. Plenty also allow the beneficiary to take over the account if you die, or make it into a joint account if you become ill.

11. What if the financial institution “takes” my money?

Yes, this is something people worry about! Needless to say, in the modern world, it is impossible for a legitimate firm to just take your money.

The only exceptions to this are if a financial company make you send the money to a personal bank account, which is often illegal to begin with.

Pretty much 100% of financial advisory companies now don’t have direct access to your money. For example, investment platform A, who uses financial advisor B, banks with bank C (let’s say HSBC for example).

In which case, neither the advisor nor investment platform can touch your money. The advisor just makes the investment decisions, and the investment platform does the compliance and other key roles.

This structure also gets rid of another worry – what happens if my advisor dies, retires or the process doesn’t go well!

As he/she can’t access your money, and there are separations of power, you can always self-invest on the same platform or find another advisor if these things happen in the future.

12. I am worried about how the firm is regulated

In most cases, it really doesn’t matter if a firm is regulated as a investment platform, insurance company or bank.

There are exceptions to this. With the old-fashioned insurance contracts, most of the money is going towards insurance.

For example, if you invest $1,000 a month, $500 would go towards life insurance and only $500 towards the investment.

With most modern providers, that isn’t the case, and you are 100% invested, so that is more of a regulation issue.

13. What about myself?

In reality, unlike the first twelve points, the unlucky thirteen is something few people ask but should.

In reality, most of the previous points aren’t worth worrying about. The exception is if you yourself take the wrong actions.

For example, a stock market crash or pandemic isn’t a problem. It is a problem, however, if you panic sell and stop investing due to it.

As the famous saying goes, often the only thing to fear is fear itself.

As an aside, I made a video about what concerns most people have before becoming my client:

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 264.3 million answers views on Quora.com and a widely sold book on Amazon

Further Reading

The article below answers all frequently asked questions (FAQs) I get asked by clients, including whether we are likely to be well matched.

I like investment but i fear loosing my money now in Regarding like Cryptocurrency and Bitcoin binary or investment.Many are calling me to invest in their platform.Now how can i know that the platform is really because scammers too are there.What platform is the Tru one Confused at this point

Yes plenty of binary options and crypto investments are scams.

Stick to other kinds of investments.