There was a time when investing as a US expat wasn’t much different than for any other nationality. Times have changed though. Since the Foreign Account Tax Compliance Act (FATCA) was passed in 2010 and was imposed on payments made after year-end 2013, investing for American expats has become more difficult.

Most would decide to invest in tax-efficient offshore investments, designed for expats, and heap the tax rewards of such investments.

This article will explain FATCA, investing options for American expats, and answer some frequently asked questions (FAQs).

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

FATCA for US Citizens Living Abroad

The FATCA law requires all non-US financial institutions to search their databases for US clients and to disclose certain data to the International Revenue Service (IRS) per year.

The IRS’ capacity to collect the tax owed on income made by US citizens via non-US investments or accounts has been improved as a result of FATCA.

FATCA affects not only banks but also broker-dealers, clearing organizations, hedge funds, insurance firms, private equity funds, and trust companies.

The goal of FATCA is to eradicate tax avoidance by American people and businesses that invest in, conduct business in, or generate taxable income outside of the United States.

It is not against the law to keep an account in a foreign country; nevertheless, it is unlawful to fail to reveal such an account to the IRS.

This is due to the fact that the United States government taxes its residents on their worldwide income and assets.

The rules of FATCA compel taxpayers in the US to make a yearly report for any financial assets kept outside the country and settle any relevant taxes that are owed on those assets.

Who needs to comply with FATCA?

Certain taxpayers in the US who hold financial assets outside the country with a combined value of $50,000 or above are required to report those assets to the IRS using the Statement of Specified Foreign Financial Assets or Form 8938.

These assets might be held in a bank account, or they might be invested in stocks, bonds, or any other type of financial instrument.

The FATCA requirement is in addition to the long-standing obligation to disclose foreign financial accounts through the Report of Foreign Bank and Financial Accounts (FBAR), also known as FinCEN Form 114.

There are a few notable exceptions to this rule. The exemption of assets that are kept in a foreign unit of a US institution or a unit in the US of a foreign institution is one of the most significant exemptions.

FATCA Reporting Thresholds for Individuals

Under the following conditions, taxpayers who reside in the US are required to submit Form 8938 to the IRS:

- You do not have a spouse and the aggregate amount of your designated foreign financial assets is in excess of $50,000 on the final day of the tax year or in excess of $75,000 at any point within the tax year.

- You are filing your income taxes as a married couple and the aggregate amount of your designated foreign financial assets is in excess of $100,000 on the final day of the tax year or in excess of $150,000 at any period within the tax year.

- You are filing your income taxes separately albeit being a married couple and the aggregate amount of your designated foreign financial assets is in excess of $50,000 on the final day of the tax year or in excess of $75,000 at any period within the tax year.

Taxpayers who reside outside of the US are required to file Form 8938 with the IRS if any of the following conditions are met:

- You are filing a joint income tax return as a married couple, and the aggregate amount of your designated foreign financial assets was in excess of $400,000 on the final day of the tax year, or in excess of $600,000 at any point within the year. Even if just one of the spouses lives outside of the country, these thresholds are still true.

- You are not a married individual filing a joint return on income tax and the aggregate amount of your designated foreign financial assets was in excess of $200,000 on the final day of the tax year or in excess of $300,000 at any period within the year.

FATCA Reporting Requirements for Foreign Financial Institutions

In order to demonstrate compliance with this law, foreign financial institutions must report the names of American expat who hold accounts at their institutions as well as the total worth of the assets held in such accounts to the IRS.

If the foreign payees are not in compliance with FATCA, the foreign financial institutions that have reached a deal with the IRS to report on their American expat accounts may be obliged to withhold 30 percent of certain payments made to those payees.

FATCA also imposes a 30% withholding tax on US-generated revenues of any financial institution that doesn’t reveal the identities of US account holders, within a specific period of time.

FATCA Rules for US Financial Institutions and Entities

If a financial institution or other type of withholding agent in the US cannot document a foreign entity for the sake of FATCA, then the institution or agent is obligated to withhold 30 percent of certain payments made from the United States to that foreign entity.

The financial institution and agent in the US are also required to submit data on certain non-financial foreign bodies that have significant American Expat owners to the IRS.

Who are FATCA reportable persons?

Under FATCA, the term ‘US person’ is broadly defined. Reportable persons include:

- A US citizen or resident

- A domestic partnership or corporation

- Any estate besides a foreign estate

- Any trust if a US court can execute primary oversight over the administration of the trust, or if one or more US persons are authorized to control all significant decisions of the trust

- Any other person not deemed foreign

Who Isn’t a FATCA Reportable Person?

Under FATCA, non-US citizens and residents, along with foreign corporations, partnerships, trusts, and estates, are not considered reportable persons.

- You are an individual who is not a US citizen or resident (i.e., foreign national with no US tax ties)

- You are a foreign corporation, partnership, trust, or estate (i.e., your entity is organized outside the US and not controlled by US persons)

- You are any person or entity not deemed a US person under FATCA definitions

What is the penalty for FATCA?

If you are required to file Form 8938 but do not, you may be subject to the following fines: a penalty worth $10,000, up to $50,000 for persistent failure to comply even after the IRS notifies you of the requirement, plus a 40 percent fine on an understatement of tax attributable to assets that are non-disclosed.

All of these penalties can be avoided by filing the form in a timely manner.

If you avoid mentioning more than $5,000 worth of a certain foreign financial asset from your gross income, the statute of limitations is stretched to six years after your tax return is filed. This applies even if there are reporting thresholds or exceptions.

The statute of limitations for the tax year is prolonged to three years after the time you give the necessary data, if you miss to file or fully disclose an asset on Form 8938.

If there was a good basis for the failure, the statute of limitations will only be stretched for the item or items that are directly related to the failure, and not for the whole tax return.

If you can demonstrate that any such failure to report is in account of reasonable cause and not because of deliberate neglect, then you won’t be penalized for failing to file Form 8938.

However, if you can’t make this demonstration, then you will be penalized. The existence of reasonable cause is evaluated on a case-by-case approach, taking into account all of the pertinent facts and conditions.

FATCA and FBAR Difference

The main difference between FATCA and FBAR is that FATCA (Form 8938) requires reporting a broad range of foreign assets, while FBAR (FinCEN 114) is limited to foreign bank and financial accounts over $10,000.

FBAR (FinCEN 114):

- Must be filed if you have financial interest in or signatory authority over foreign accounts exceeding $10,000 in aggregate.

- Applies to individuals, trusts, estates, and domestic entities.

- Covers foreign bank accounts, brokerage accounts, and accounts with signatory authority.

FATCA (Form 8938):

- Requires US citizens, residents, and some non-resident aliens to report specified foreign financial assets.

- Includes equities, securities, interests in partnerships, hedge funds, and private equity funds.

- Thresholds are higher than FBAR and depend on filing status and residency.

Some assets must be reported on both FBAR and FATCA, some only on one.

What effects does the passage of FATCA have on investing options for American expats?

For American expats, therefore, investment options have become more limited. Countless Americans living overseas, who aren’t lucky enough to have someone help them with the tax implications of investing abroad, end up confused by the paperwork and other requirements.

The costs of complying with FATCA were estimated in 2017 at about $200 million and “potentially hundreds of billions of dollars overall” for each foreign bank, according to a House Hearing.

The cost of the regulation means that many non-US financial institutions no longer accept Americans as clients, including insurance companies, if those insurance companies offer insurance with a saving and investing component.

In addition to that, many US individuals have had their American brokerage accounts closed, since they moved overseas.

FATCA affects US connected persons and not just Americans.

The following people are considered US connected persons:

- Green Card holders

- Other visa holders living in the US. Although this can get complicated. H1B visa holders, for example, are only sometimes considered US connected persons.

- US taxpayers

- You were born outside the US but have one US parent

- You were born in the US, even if you left as a child

Also note the passport you have is irrelevant if you were born in America.

This affects American expats living and working overseas in any country as well as US-specified persons.

The majority of American expats live in Mexico, Canada, New Zealand, The UK, Germany, Sweden, Australia, UAE, Singapore, Israel, Costa Rica, France, Brazil, Colombia, Philippines, Mainland China, India, Hong Kong, Japan and South Korea.

There are, of course, American expats all around the world, including numerous places in Central and South America.

Investing Options for American Expats – what are the realistic choices?

There are many investing options for American expats, including:

1. Putting the money in your partner’s name – although it may not be the most sophisticated option, having the money in your spouse’s name (assuming they are non-Americans) is one simple option to overcome FATCA. This comes with various risks, of course, if you break up. This is especially risky in countries without a developed legal system, if divorce ensues.

2. Another option is to continue contributing to your existing accounts in America, assuming they are open to American expats, which often isn’t the case. This does come with risks though, such as currency exchange fluctuations, and various banking fees.

This also isn’t an option for Americans who have lived overseas for 25 to 30 years, who no longer have US bank and brokerage accounts in many cases. Another risk is that your US brokerage will eventually follow in the footsteps of many others and close your account.

3. Tax-compliant investment services overseas. There are a limited number of platforms that can accept American expats overseas, which are FATCA-compliant, which I, and some other firms, can utilize.

One of the benefits of this approach is that the capital gains tax are slim (0% to 20% depending on many short and long-term factors), whereas non-compliant US investments can be taxed up to 37%. This approach also makes tax filing and compliance as easy and as convenient as possible.

4. Giving up your American Green Card or Citizenship. This might seem like a big step, but more and more are doing it, including Facebook founder Eduardo Saverin.

In a CNBC report last year that cited a survey from Greenback Expat Tax Services, it was said that one in four American expats seriously considers or intends to relinquish their citizenship.

FATCA and double taxation on higher incomes have contributed to this situation. However, there is an exit tax for giving up your Green Card. Whether you pay the taxes depends on your immigration status and financial assets.

Note that in recent years, the US increased what it charges to renounce one’s citizenship by 422%, according to an article published by Forbes. However, it can change in the near future. Although it is not yet a done deal, it appears that the present rate of $2,350 may be lowered to $450 as a consequence of a lawsuit regarding the injustice of the fees, Forbes said.

As a generalization, if you have lived lawfully in the US as a permanent resident, regardless of whether on a green card or as a US citizen, for eight out of the 15 years ending with the expatriation year, could mean that you are subject to exit taxes.

If your income is above $160,000 per year, and/or your net wealth is above $2 million, you are also more likely to be charged an exit tax. If you don’t meet these two criteria, and you have correctly filed for the last five years, then you are less likely to be hit by the exit tax.

If you haven’t filed your tax forms correctly, the penalties can be severe. For instance, the penalty for not having filed the FBAR or the form 8938 can be up to $10,000 per form per year.

In such situations, a taxpayer should consider entering into an IRS tax amnesty program to clean up the past and minimize penalties.

Giving up US Citizenship is a big step, with tax and personal implications, so shouldn’t be taken without huge amounts of research and professional advice sought.

In general, option 3 is the best option for most Americans living overseas.

Frequently Asked Questions

These sections will cover some FAQs related to investment options for American expats wanting an in-depth knowledge of what choices are available when needing to allocate funds as a US expatriate.

Can a US citizen living abroad invest in Vanguard or other mutual funds?

Vanguard used to be able to accept American expats, but this is no longer the case.

However, some of the US tax-compliant platforms can accept various low-cost funds and other investment options.

Most passive funds work in similar ways these days in any case, so many ‘Vanguard-like’ funds exist in the market.

Who is considered a US person under FATCA?

Under FATCA, you may be treated as a US person or specified US person if you meet certain conditions, such as:

- Holding a US Green Card

- Having a US birthplace

- Using a US residential address

- Sending instructions from a US bank or address

- Granting power of attorney to someone with a US address

How does FATCA treat joint accounts?

If a joint account has one US person and one non-US person, FATCA reporting still applies. The account is treated as belonging to the US person for reporting purposes.

The only way FATCA wouldn’t apply is if the account were placed 100% in the non-US partner’s name.

Do accounts opened before FATCA need to be reported?

Yes. Even if you opened a financial or insurance account overseas before FATCA took effect in 2013, it still needs to be reported if you’re a US person. All accounts, old or new, must be reported if thresholds are met.

Pre-FATCA accounts are not grandfathered, so you should seek tax advice to ensure compliance.

Does a cash gift from family count as income under FATCA?

Money sent out of the US will not trigger FATCA withholding. In comparison, money sent into the US, and income earned in a US account, may be subject to FATCA.

Will FATCA be repealed?

There was a speculation that The Trump Administration would roll back or repeal FATCA reporting. But that was just pure speculation and never really pushed through.

Laws can always become less, or more, strict with time. A rational investor can only make decisions based on the information he or she has available to them.

Does FATCA affect health, life and other insurance products?

Many health and life insurance providers, such as AXA, also provide investment products. Many of these providers can no longer accept Americans.

Providers that only provide non-investment-linked insurance products, in comparison, can usually still accept American expatriate clients.

How are foreign mutual funds taxed?

The IRS considers foreign mutual funds as Passive Foreign Investment Companies (PFIC), and these are subject to high taxes.

Should I contribute to my employer’s scheme?

Many employers offer excellent schemes, where they contribute $1 for every $1 you contribute. However, this is only a good idea if the scheme is US tax efficient; otherwise, you will still have tax issues.

Do American expats pay US taxes on income?

All Americans living overseas need to file a tax return. However, most Americans do not pay income tax in the US, unless they are earning over $120,000 per year.

Are US wills valid in other countries?

Your US estate plan, including wills and trusts, may not be viewed the same way in your country of residence, as in the US. If you have these plans in place, therefore, it makes sense to contact an expert in this space.

What’s the best brokerage accounts for US expats?

There is no best option per see, just that some are tax-compliant and reasonably priced, and some aren’t. Brokerage accounts for US citizens living abroad that are tax and price efficient are few and far between, but exist.

Should I use a financial advisor in the US or abroad?

A US-based advisor isn’t always necessary. Many expat financial advisors abroad already understand US tax and investment rules.

The key is to choose an advisor who:

- Specializes in US expat matters.

- Understands the unique financial challenges non-residents face.

Are non-US investment accounts expensive?

Not always. Some options in the overseas market are cost-efficient and are available with low account minimums.

In the US, it is normal for financial advisors to only accept larger accounts. Many advisors have account minimums of $250,000 a year, or even higher.

In the overseas market, getting advice through an advisor, at a reasonable cost, is often more accessible.

What are some of the key mistakes I have seen when it comes to expat retirement planning?

An even more common mistake than making bad investments is deciding to not save and invest at all because the process seems too complicated.

Most expats, and non-Americans alike don’t have access to local social security and pension programs, which means that poverty can await in retirement.

This is especially the case if expats move from country to country. Expats who stay in numerous European countries for 30 years plus are often entitled to reasonable local pensions.

Over-reliance on your country of residence is another key mistake for American and non-American expats alike.

It can be difficult to say no to local stocks and real estate when you regularly go to dinner parties or bars where everybody is talking about it.

However, most emerging markets are very high-risk. I have seen many expats get caught up in the mania. Furthermore, tax laws are always changing, so it is important to ask your accountant and investment advisor to be up-to-speed.

As a final note, it is always prudent to get independent tax advice.

What should I do if I want to contact you?

You can apply for my services here. I have set up many tax-efficient accounts for Americans living overseas.

Please note, however, that I am not a tax advisor. I can just help with tax-efficient investment structures that make filing more convenient.

What are your account minimums?

$100,000

What documents are needed to open up an expat investment account?

Typically proof of identity (passport or ID card), and address dated in the last 3 months (utility bill or bank statement), plus an online or paper application form.

I have seen applications approved in hours, and some take months. A week is normal.

What are the minimum contribution periods overseas?

Just like back home, that depends on the product provider. In general, lump sum accounts are quite liquid if you need the money.

However, with market-investments, it is always best to be long term. Time in the market reduces risks of losses dramatically.

Can you invest in US Markets like the S&P500 from outside the US?

Absolutely. You can invest in the US Markets, without the money being held in the US.

What average returns could I expect?

Just like back home, nobody can predict what will happen to markets short term. I have seen clients and associates make 30% 1 year and 0% the next year.

In general, however, the long-term market average return is 8% to 10% per year. That average merely gets distorted by the good and bad times.

1985-1999 and 2009-2017, for example, regularly gave 15%+ yearly returns, whereas the US markets produced 0% from 2000 to 2009.

Is now the right time to be in the markets?

The academic evidence shows there is no “right time” to get in the markets – it is best for investors to buy and hold and have a diversified portfolio.

Market timing is pretty much impossible. There are too many unknown unknowns and known unknowns to know when to get in, and out, of markets.

That isn’t to mention that market timing isn’t very cost-efficient due to the taxes and trading costs.

As most investors should want to invest in a diversified portfolio, moreover, this will insulate you from some of the market falls.

In 2008-2009, as an example, government bonds increased when stock markets fell.

This allowed investors to rebalance their portfolios. It took barely 3 years for stock markets to regain their value.

Does politics affect the stock market?

Stock Market have gone up, and down, during various periods of geopolitical calm and risks.

Markets rose during some previous geopolitical crisis, such as North Korea, China and the Cuban Missile Crisis.

They have also panicked, however, such as in the days following the 9/11 attacks in 9/11.

What we do know, is “market timing” just doesn’t work. Buying and holding, through thick and thin, makes sense.

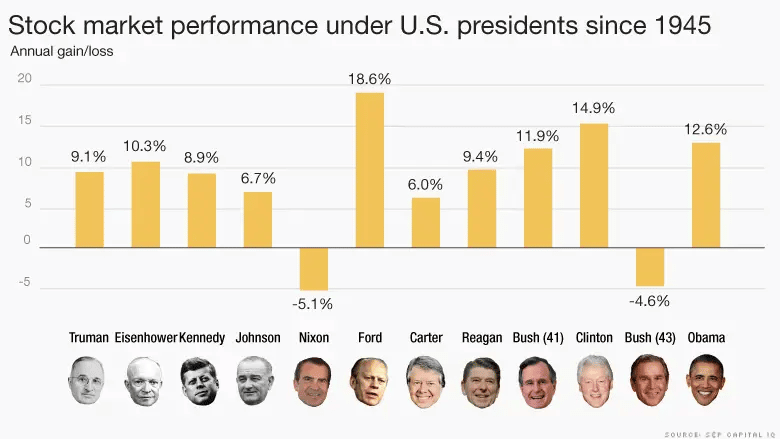

Do elections affect the stock market?

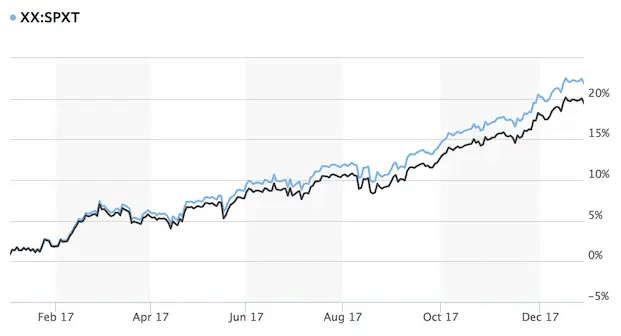

One point I could have made in the last section is Trump’s election victory in 2016.

Few people, both his supporters and opponents, expected markets to increase by 20% in his first year in office.

That is neither due to Trump, or because of Trump. Markets tend to rise, long-term, under most presidents, but can do so at random times.

The point is, most people overestimate the effects politics can have on the market long term.

As Vanguard’s founder Jack Bogle said, “short-term the market is dominated by speculators speculating about what other speculators are speculating about”.

Long term, markets are driven by business earnings and innovation.

Since first writing this article, US Stock markets did very well after the disputed US Election of 2020.

This was the opposite of what the media predicted, and once again shows that nobody can time markets.

Since updating this article, the election came and went with US stocks……..doing fantastically well in November 2020! Despite this, I have no doubt some people will be worried come 2024!

What are some trends for expats to consider?

For expats of all nationalities, not just Americans, the days of the “career expat” are largely over.

There was a time when expats would settle in 1 to 2 cities, such as Hong Kong, Singapore, Dubai or Qatar, and not move for long periods of time. This has changed.

With the exception of expats setting up their own businesses for 20 to 30 years, most are moving from country to country every few years rather than staying in the same place.

This means that it is important to have financial solutions that are transportable and online, so you don’t need to experience many hassles when you move locations.

It is so much easier to just change your address and card online, with a few clicks of the button.

So, it is important expats don’t place too much importance on local solutions – such as local banks in the country you are residing in.

By definition, this means needing to change every time you move, as opposed to seeking an online solution.

Have you got any case studies involving US expats?

I have been living overseas 8 years myself, and I am often approached by US expats living overseas.

Usually, they are looking for tax efficient investment structures and are worried about recent US tax changes.

One of my US clients, called Tom, living in Germany, spoke about his experience in this audio.

What about taxes on the local side?

Of course, this article doesn’t have enough space, to speak about 200 countries in the world!

In general, however, most countries do not make it difficult for expats to invest in a tax efficient manner.

It also needs to be remembered that the main taxes are capital gains. By definition, this happens at the end of the investment.

Therefore, it is tax-efficient to buy and hold an investment, as opposed to buying, selling and buying again.

It also has to be remembered that these rules can always change. Right now, there are various proposed rule changes in the European Union and beyond.

However, the rational investor can only make a decision based on the information that is available to him or her at the time of making the decision.

It is easy to get into analysis paralysis and never make a decision, and thereby leaving your money in the bank, earning below inflation.

How about 401k rollover?

The video below explains 401k rollovers:

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.