15 Mistakes To Avoid When Investing In Bonds

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

Table of Contents

Introduction

What are the mistakes to avoid when investing in bonds?

Most investors have at some point in their lives purchased or sold a publicly traded common stock. The procedure is very clear-cut and easy to comprehend.

Typically, stocks have very small commissions, fairly deep trade volumes so that an investor’s transaction won’t skew the market for the stock, and very tight bid-ask spreads, or the price difference between where the current market will buy and where it will sell the stock.

Investors can check the price of a stock at any time, and it will be an accurate reflection of the stock’s current market value or closing price from the most recent trading day.

The majority of stocks trade on some type of stock exchange, whether it be real or virtual, and all brokers have sophisticated systems designed to direct your transaction to the most effective execution site.

The bond market does not fall under any of these circumstances.

More unique bonds are available for purchase than there are available unique common stocks. When compared to its 1200+ different dollar-denominated bonds, a company like General Electric has just one common stock that trades in US dollars.

Those bonds don’t all trade as frequently as common stock, as might be expected. And again, a corporation; this is just an example.

Additional bond types are numerous. Some common bond investment types include US Treasuries, Mortgage-Backed Bonds, Municipal Bonds, and Asset-Backed Bonds.

Just envision an investment universe that is, in terms of the number of securities and total market value, materially larger than the combined size of all global bourses.

The majority of these bonds are traded in “over the counter” or OTC markets rather than on exchanges. OTC market transactions take place when two parties directly negotiate a deal without the oversight or clearing services of an exchange.

Where a security was last traded may not affect where it is traded next. You lack the transparent information exchanges that are typically available (depth of market, short interest, updated float, etc).

The bond market is mysterious. In essence, institutions, not people, control the bond market. This is not to say that people cannot invest in bonds; it is just to say that they must be informed, cautious, and aware of market nuances.

Due to their predictable cash flow, lower price volatility, and predetermined time frame for capital return, bonds have historically had a place in diversified investment portfolios. Volatility and disproportionate returns are possible with many bonds.

Consider the well-known collateralized debt obligations (CDOs) and structures backed by subprime mortgages that were cited as the primary causes of the global financial crisis in 2008; however, they were merely the canary in the mine.

It is reasonable for the majority of investors to make mistakes when buying bonds because there are so many unknowns and there is so much opacity. Let’s examine some of the most typical errors and some potential fixes.

15 Mistakes To Avoid When Investing In Bonds

1. Placing Large Bets On High-Yield Bonds

Putting an excessive amount of reliance on high-yield bonds is one of the mistakes to avoid when investing in bonds. High-yielding (junk) bonds do appear to be a good deal because they have historically provided high returns, but there is still a drawback to them.

When interest rates have recently dropped or are low, investors frequently turn to high-yielding bonds. They might also be looking for higher returns than their current investments are offering.

The bonds in a portfolio, however, serve as a strong brace or foundation, so it’s crucial to keep this in mind.

And while we don’t discount the value of interest payments (yields) from bonds—they unquestionably are a crucial factor—you should think of your bonds as a reliable source of income for times when your other investments (like your stocks) experience market downturns.

Junk bonds, however, are unable to give your portfolio this stability.

Junk bonds frequently decline along with the rest of your investments when the economy is weak and stocks suffer. Investment-grade bonds, like Commonwealth Government Securities (CGS) and high-quality corporate bonds, typically have the resilience to withstand challenging economic turbulence and may even increase in value when things are tough.

Avoid being seduced by higher yields provided by bonds with poorer credit ratings. Don’t forget that a bond’s yield is just one of the many factors an investor should take into account when buying one, and that a bond with a higher yield carries a higher risk.

2. Not Keeping Track Of The Claim Status

There are various kinds of bonds. Senior notes have priority over other debt obligations in the event of bankruptcy and liquidation and are frequently backed by collateral (such as equipment). Subordinated debentures are another option.

They have a lower claim preference than senior debenture holders but still rank higher than common stock. It is crucial to know what kind of debt you currently hold, particularly if the security you are purchasing carries any element of risk.

Bondholders are entitled to the first claim on a company’s assets in the event of bankruptcy. In other words, if the underlying company fails, they have a better chance of being made whole, at least theoretically.

You should, if at all possible, check the certificate to find out what kind of bond you own. The term “senior note” or some other description of the bond’s status will probably appear on the document.

If not, that information ought to be available from the broker who sold you the note. If the bond is a new issue, the investor can review the prospectus or the 10-K, which are financial records of the company that issued the bond.

3. Not Being Familiar With Markups

Actually, institutional investors should be the ones trading bonds. A minimum of $5,000,000 to $10,000,000 is the typical transaction size.

Smaller sizes are unimportant to large institutional dealers, and even in the event that they did, the traditional business would be handled by a different department.

This size of dealer business is served by numerous smaller dealer firms. As your business grows smaller, intermediaries’ influence grows as well, just like in any distribution business. Think of a manufacturer, a wholesaler, a big-box store, or a little local shop.

As a result of the need for each level to generate a profit, end-user prices are typically higher. the bond market and investing are both approached dynamically.

A lot of dealer trading desks also don’t hold a lot of securities in stock; instead, they act as brokers who try to connect buyers and sellers.

There are several people who need to be satisfied, including your salesperson, that firm’s trader, a potential middleman for another firm’s trader, that other firm’s trader’s salesperson, and the final purchaser or seller of your bond. As a result, markups can add up.

If an individual investor doesn’t have a $500 million base, what should they do? After all, even $5 million is a sizable allocation to one bond for the majority of high-net-worth investors. Bonds should only be purchased when they are first issued as a good solution.

You can rest assured that you aren’t sacrificing yield by paying markups because at the time of initial issuance, every buyer receives the same price. Additionally, bonds are meant to be conservative allocations in a portfolio; buy bonds from high-quality issuers (governments, corporations, or municipalities) with reasonable maturities (within 10 years) and hold the bonds until they mature.

An investment portfolio that is well-diversified and has a nice range of maturities will generate consistent annual cash flow.

Hiring a fee-only investment advisor with extensive institutional experience is another option for guiding your portfolio through the complex web of risks and dangers. In all honesty, if your background is in exchange-traded markets, there is no way to acquire such experience.

4. Overreacting To Changes In Interest Rates

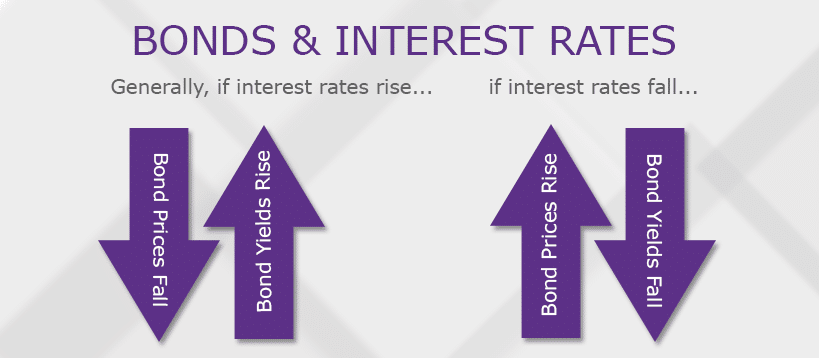

Overreacting to interest rate movement is one of the mistakes to avoid when investing in bonds. Bond prices and interest rates are found to be inversely related.

This indicates that bond prices fall as rates rise and vice versa. If you decide to invest directly in bonds, you should be prepared for fluctuations throughout the bond’s term due to shifting interest rates.

The price volatility in the run-up to a bond’s redemption on its maturity date is something that many investors neglect to plan for.

Is there a way to avoid this price volatility after all this? No, is the answer. However, there is a silver lining to this: keep in mind that equity investments reward patience. The full nominal value of a bond will be paid out if it is held by an investor until it matures.

You should be ready to hold onto your position up until the actual date of redemption because of this. If you have to sell your investment before it reaches maturity, you might lose money if the interest rate changes in your favor.

5. Taking A Company At Face Value

It is not a given that you will receive a dividend payment or that the bond will ever be redeemed just because you own it or because it is well-regarded in the investment community. Investors appear to consider this process standard practice in many ways.

However, the investor should examine the company’s financials and look for any indication that it won’t be able to fulfill its obligation before assuming that the investment is sound.

They should carefully review the income statement before calculating the annual net income and including all back taxes, depreciation, and other non-cash expenses.

This will enable you to calculate the ratio of that amount to the annual debt service amount. In order to feel confident that the business will be able to pay off its debt, there should ideally be at least two times coverage.

6. Not Knowing The Transaction Prices For Your Bond

When you are tracking a publicly traded common stock, you can easily discover where it is trading online at any market portal, such as Yahoo! Finance, Google Finance, The Wall Street Journal, or Bloomberg.com.

For current trading levels, previous price action, and related data, simply enter the company’s ticker symbol.

For 99.9% of the bonds that are currently on the market, there is no equivalent ticker symbol, so this process is useless for fixed income securities.

The most common identification key for bonds is a CUSIP, a nine-digit alphanumeric code, as opposed to a ticker symbol. Committee on Uniform Security Identification Procedures is known as CUSIP.

You can share that bit of information at your next cocktail party.) It’s not as classy or straightforward as a ticker symbol, but it is a recognizable mark. If you have a bond portfolio, the CUSIP ought to be listed in the security description somewhere on your monthly statement.

The Financial Industry Regulatory Authority must be notified of any bond transactions involving US government, corporate, or municipal securities (FINRA).

With this information, you can visit the FINRA portal, select the “Search” tab, enter the 9-digit CUSIP of your bond and the appropriate bond category, and obtain information on the trading history of the aforementioned bond. GE, for instance, has a 0.85% payment due on October 9, 2015. 36960BE2 is the CUSIP.

7. Focusing Too Much On The Yield Curve

During a flat yield curve, some investors switch from long to short maturities, which is one of the mistakes to avoid when investing in bonds. The same error is made when the yield between the long-term and short-term bond rates is nearly equal.

This investment plan appears to be very logical at first glance. If long-term bonds don’t offer higher yields, why tie up your money and deal with the added risk?

Bond investors with limited perspective frequently commit this error. Even when the yield curve is flat or inverted (i.e., short-term bonds pay higher returns than long-term bonds), which thankfully doesn’t happen often, longer-term bonds still have a place in your portfolio.

As was mentioned earlier, you must keep in mind that bonds in your investment portfolio offer stability when the majority of your other assets are declining.

There’s a good chance that a sizable amount of capital will flow into long-term, high-quality bonds if the economy weakens (which is typically when an inverted curve appears).

Interest rates will decrease, and investors will seek out long-term investment grade bonds. Then you’ll experience buyer’s (or seller’s) regret and long to have been present to realize the gains.

8. Getting The Market’s Perception Wrong

Bond prices can and do change, as was previously mentioned. The way the market views the issue and the issuer is among the main causes of volatility.

The price of the bond will decrease in value if other investors dislike the issue, believe the issuer won’t be able to fulfill its obligations, or if the issuer suffers a setback to its reputation. The opposite is accurate if Wall Street has a favorable opinion of the issuer or the security.

A helpful piece of advice for bond investors is to look at the issuer’s common stock to see how it is regarded. If it is disliked or there is unfavorable public research on the equity, it will probably spread and show up in the price of the bond as well.

9. Trying To Find Yield

These days, it’s very challenging to become enthused about bond yields. Since nominal yields are at historic lows, investors might take on more risk in an effort to increase yield.

Most investors are aware of the straightforward strategies for increasing yield: purchase debt with longer maturities or debt with a lower rating. There are other ways, though, for investors to unwittingly take on significant risk in exchange for a small increase in yield.

By not fully appreciating a bond’s structure, investors may be deceived into believing they will receive additional yield. Bond valuation is essentially about risk and assigning a numerical value to a return expectation that is proportionate to that risk.

If options are embedded in the bonds, not all yields are created equal.

10. Ignoring Inflation

The interest payments on your bonds can easily be significantly reduced by inflation. Therefore, investors need to pay attention when reports of inflation trends are made. Ignoring inflation is one of the mistakes to avoid when investing in bonds.

If inflation increased by 4% annually, for instance, it would require a 4% higher return each year to maintain the same level of purchasing power.

This is crucial, especially for investors who buy bonds at or below the rate of inflation currently in effect, as doing so practically guarantees that they will lose money on the transaction.

This does not imply that a buyer should stay away from a low-yielding bond offered by a reputable company.

However, investors should be aware that in order to protect themselves from inflation, they will need to earn a higher rate of return on other investments in their portfolio, such as bonds and common stocks with high yields.

11. Failure To Research the History Of The Company

An investor should review previous annual reports and a company’s past performance to see if it has a track record of reporting consistent earnings. Check to see if the company has ever paid all of its past obligations for interest, taxes, and pension plans.

A prospective investor should specifically read the management discussion and analysis (MD&A) section of the company for this information

Read the proxy statement as well because it contains information about any issues or past payment defaults that may exist. It might also point to potential dangers in the future that might compromise a business’s capacity to pay its debts or fulfill other obligations.

To feel more confident that the bond you are holding is not an experiment, you should complete this assignment. To put it another way, make sure the business has paid its debts in the past and is likely to do so in the future based on its past and projected future earnings.

12. Concern Over Rates Going Up Is Excessive

A lot of investors believe that rates “can only rise from here” in light of the current low interest rates. It’s true what you say. If you think fixed income returns are too unappealing, you could allocate capital to equities as a viable portfolio strategy.

Some investors, however, are reluctant to purchase bonds because they worry that their portfolio prices will fall even though they want the fixed income’s naturally conservative risk exposure. It is a mistake to worry too much about rising rates.

With longer maturities, all asset yield curves slope upward, indicating that rising future rates are already factored into the bond market

Consider what happens to your bond price in reality if you are still not at ease. Because of their foreseeable cash flows, bonds have historically had lower price volatility than stocks.

13. Choosing A Bond Fund Based On Recent Results

The performance of a bond over a short period of time (one to three years ago) might appear strong, but it might not mean much. The short-term performance of a fund typically has less to do with any particular investing skill than with the type of bond fund it is.

Let’s examine how a high-yielding bond performed in a prosperous year. Even a high-yielding but underperforming bond will probably see impressive numbers during these times. Foreign-bond funds would experience a rally if foreign bonds had a great year. Investors will think highly of all bond funds if interest rates have recently fallen.

So, don’t let the bright, immediate figures fool you. Not a bond’s “raw” performance, but rather how it performs in comparison to other funds is important. The performance of a bond over the long term, which can last up to five years or more, should be examined most importantly.

14. Failure To Examine Liquidity

A company’s website, brokers, market data/quote services, financial publications, and brokerage firms may have information about the issue’s liquidity that you hold. One of these sources may provide details about the bond’s daily trading volume, to be more precise.

This is significant because bondholders must be aware that, should they decide to sell their position, there will be willing buyers in the market.

Large, well-funded companies typically have more liquid stocks and bonds than do smaller businesses. Simple perception of greater ability to repay debts among larger companies is the simple explanation for this.

Is a particular amount of liquidity advised? No. But if the issue is regularly traded in large volumes, is quoted by the major brokerage houses, and has a relatively narrow spread, it is probably appropriate.

15. Overpayment Of Liquidity

Overpaying liquidity is one of the mistakes to avoid when investing in bonds. Despite having no immediate cash needs, many investors continue to maintain sizable amounts of capital in money market funds. Effectively 0% is the yield on money markets.

You can see that almost all fund asset yields flow to fund expenses rather than to investors by looking at a prospectus for a current money market fund. When there is no immediate need for liquidity, why keep large cash-like investments?

Basically, you’re paying too much for liquidity that you don’t require. A portfolio of short-term bonds or CDs with laddered maturities would be a better choice for an investor.

Your capital generates a return, your portfolio has periodic maturities that can be withdrawn from or reinvested, possibly in an environment with higher interest rates, and it has (at worst) modest sensitivity to bond price movements.

Final Thoughts

In general, bonds are more conservative and less risky than stocks. Contrary to popular belief, however, investing in fixed income requires extensive research and analysis. Failure to do your research could result in low or even negative returns.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.