Despite being a relatively new contender in the industry, KOHO does seem promising. Find out just why in this KOHO review.

Discover if KOHO is a good option alongside the HSBC Expat Review 2023.

If you want to invest as an expat or high-net-worth individual, which is what i specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Table of Contents

Introduction

KOHO Financial Inc., or KOHO for short, is a fintech company founded in 2014. However, it was officially launched a couple of years later in 2017. They offer financial solutions to Canadians, allowing them to spend and save with no hidden fees.

Although not being a bank in itself, KOHO has partnered with Visa and Peoples Trust. This gives users the security that they look for in a bank. At the same time, it broadens the reach of where and how they can use their KOHO account.

How does KOHO work?

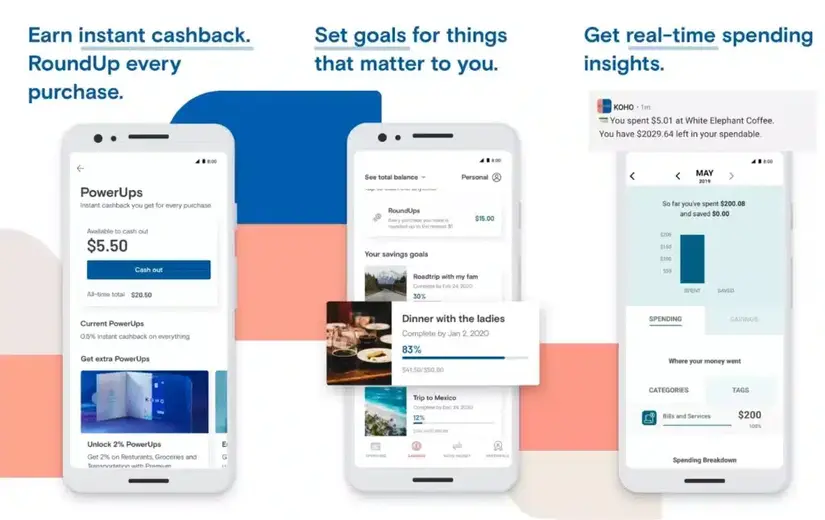

By opening an account with KOHO, you will be given access to the features on its mobile app and a reloadable prepaid Visa Card. The card is not just issued digitally. Rather, a physical card will be delivered to your doorstep within 10 days. Your KOHO account can be used to help you manage your finances, make online and in-store purchases, and save money.

Your money in a KOHO account can be categorized into “Spendables,” “RoundUps,” “Savings Goals,” and “Vault.” This means that you can easily allot a specific amount of money to each type of balance. Doing so will enable you to organize your finances in a way that suits your needs.

What are the types of accounts that I can open in KOHO?

KOHO offers three different types of full-service accounts.

1. KOHO Account

The KOHO account is the most basic one being offered. Opening this type of account will come at no cost to you. At the same time, there are no fees to be paid in order to maintain the account.

It also has a “RoundUps” feature, which is intended to help you save when you make a purchase using your KOHO card. You have the option of choosing the nearest amount to which the purchase will be rounded to. Specifically, you can choose among $1, $2, $5, or $10.

For example, you choose a “RoundUp” amount of $2.00. Then, you purchase an item that costs $1.50. With this, KOHO will automatically save an extra $0.50 from your purchase. It will be credited to your savings, which you can cash out at any time later on. You can either add it to one of your “Savings Goals” or “spendable balance.” Take note that this does not mean that you will pay $0.50 less on your purchase. Rather, there will be an internal transfer of funds between your “spendable balance” and your “RoundUps.”

KOHO has also partnered with select merchants so you can earn cash back when you buy from them.

Lastly, it also has the convenient feature of being able to lock your card in-app. This is very useful if you were to lose your card. Simply go to the app and lock the lost card yourself. There will be no need to panic and wait in long lines for customer service over the phone.

2. KOHO Premium Account

The KOHO Premium account comes with a fee of $9 per month or $84 per year. But they offer a free trial that runs for 30 days. This would be a good way to see if the KOHO Premium meets your savings and spending needs.

With this account, you can earn 2% cash back on expenses incurred for transportation, groceries, and restaurants. Those who conduct non-Canadian transactions should also take advantage of what the KOHO Premium account offers. Specifically, no foreign transaction (FX) fees are charged for such purchases. This can help you save a lot of money, especially since other credit cards often charge 2–3% in fees.

Not only that, KOHO also does price matches. You can send receipts of your recent purchases to KOHO. Then, they will scour through resources to check if the items that you bought have either decreased in price or have been sold cheaper by another establishment. If they find a difference in price, they will credit that amount to your account. This feature is only applicable to specific transactions.

You can also have access to financial coaching services. Talk to an expert in the field about any concerns you may have about managing your money. They can even create a more in-depth plan just for you. Rest assured that the person guiding you through this process is an Accredited Financial Counselor in Canada.

Lastly, every month, you will be entitled to 1 free international ATM withdrawal.

3. KOHO Joint Account

KOHO also has an account for couples, family members, or whoever wants to open a joint account together. This allows you to share finances and goals with ease.

Using your KOHO joint account will earn you 0.5% cashback on all your purchases. But at select merchants, the cashback percentage can even go higher.

At the same time, you and your partner will receive real-time notifications when the account is being used.

Other Products of KOHO

Apart from the aforementioned accounts, KOHO also offers two more products.

KOHO Earn Interest

One of the main selling points of KOHO is its interest rate. All your money in a KOHO account, whether it be your savings or spendables, earns an interest rate of 1.2% per annum. This is paid out every month. In addition to this, you will receive a 0.5% cashback on all purchases made using a KOHO card.

To use this feature, you just have to set up a direct deposit into your existing KOHO account. The direct deposit can be obtained from your paycheque, government payment, or client invoice.

KOHO Credit Building

Individuals who want to build their credit history can register for such a service on KOHO. It costs $7 per month. Prior to approval of an account, KOHO will conduct a soft credit check to obtain your credit score.

How do I open an account with KOHO?

Only those who have reached the age of majority in their province (18 or 19 years old) can sign up for a KOHO account.

Then, to start enjoying what KOHO has to offer, you can sign up online or download their mobile app from the App Store or Google Play. It would not take more than 5 minutes of your time to sign up for a free account. Initially, you will just have to enter your email address and password.

Identity Verification

After that, they have to verify your identity to complete the process. There are different ways to go about this.

Automatic Verification

The verification process can be done automatically. This will only occur if you have an appropriate credit file that contains the same information (name, address, and date of birth) that you used to create a KOHO account.

Verification with Selfie

To do this, take a selfie while holding your valid government-issued photo ID. The following IDs are accepted:

- Passport

- Driver’s license

- National identity card

- Residence permit card

Manual Verification

If none of the above applies to you, then KOHO will manually verify your identity. You have to submit 2 documents to complete the process. The following are accepted:

- Canadian or provincial issued photo ID card, including the QC and BC health cards

- Work or study permit issued by the government of Canada

- Recent month’s utility, phone, or internet bill statement

- Bank statement

- Insurance policy

- Document from the Canada Revenue Agency (CRA)

These documents must be submitted online. Alternatively, you can also link a bank account to your KOHO account for identity verification. Only accounts at accredited banks will be acknowledged for this purpose.

The verification process will be completed within 1 to 2 business days from the receipt of the documents.

What happens if I end up not using my KOHO account?

Inactive accounts will be charged a $1.00 inactivity fee. This is applicable to users who have had a KOHO account for 13 months but have not performed any activity for 6 months. To avoid this, make sure to deposit money into the account or use it when buying.

I need help from KOHO. How can I contact them?

KOHO has an in-app chat customer service that is available throughout all days of the week.

Apart from that, you can send an email at team@koho.ca or support@koho.ca or call them over the phone at 1-855-564-6999.

Is my money safe with KOHO?

KOHO is not insured by the Canada Deposit Insurance Corporation (CDIC). However, this does not mean that all your money will be lost if KOHO fails. Given that the fintech company has partnered with the bank, Peoples Trust Company, up to $100,000 of your deposit will be insured. The bank will be responsible for returning your money deposited in KOHO.

Why should I open an account with KOHO?

- You don’t have to pay monthly fees and maintain a minimum balance

- You won’t be charged non-sufficient funds (NSF) fees. If the balance in your KOHO account is not enough to fulfill a purchase, you’ll just get a notification about it.

- Earn at least 0.5% cashback on your purchases. This will be credited to your account within 1 to 2 business days, which is faster than what other institutions offer.

- Foreign transaction fees are only 1.5% with KOHO. This goes down to 0% if you have a KOHO Premium Account.

- You can use your KOHO card to withdraw at any ATM

- You can send as many interac e-Transfers as you wish without paying any fees

- You can pay your bills with KOHO

What should I take note of if I plan to use KOHO?

- Unless you pay the $7 fee, using your KOHO account won’t help build your credit score.

- You’ll still most likely need to open a regular bank account, especially if you need to write paper cheques or receive money from non-KOHO accounts.

- You can only keep up to $40,000 per month in your total account balance. Amount limits for different transactions range between $300 and $40,000.

Conclusion

With this, KOHO provides a convenient way to spend and save at the same time. It is handy to have for everyday needs. Without having to pay many of the fees that a traditional bank charges, you can also keep more for yourself. Similarly, it allows you to monitor your income and expenses so that you can stay on top of your finances.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.