In this article, we’ll go through setting up a company in Jersey.

If you want to invest as an expat or high-net-worth individual, which is what i specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Introduction

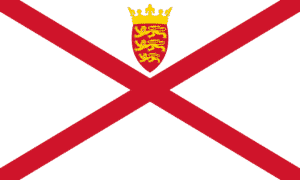

Jersey is a protectorate of the United Kingdom. Because of its low corporation taxation, it is seen to be practically self-sufficient for investors. Jersey’s financial services commission is regarded as stringent, with a major focus on the upper end of the offshore sector.

Benefits of Incorporating a Company in Jersey

- In order to function, a Jersey company must have a local registered office.

- A Jersey Company can issue registered and bearer shares when it comes to issuing shares.

- There is no set minimum amount of capital that must be invested.

- Although it is not required, most businesses use the official corporate seal.

- Jersey is thought to have developed and favorable corporation legislation, as well as a high percentage of well-educated citizens.

- There is no obligation for exempt corporations to maintain accounts or provide annual summaries.

Corporate Tax Rate

A company’s corporate tax rate when doing business in Jersey is 20%. Where actual or beneficial ownership does not exist, the tax rate does not apply, even if management and control are exercised on behalf of the non-resident.

Types of Companies That Can Be Incorporated

Single Member Company: A single-member firm is a company with a single shareholder that maintains the corporate veil.

Public Companies: The essential provision of a Jersey public company is that it must disclose in its memorandum of association that it is a public business.

Private Company: A jersey Private Company is one that is subject to extra conditions such as limiting the number of members to a maximum of 30, and so on.

Par Value Company: A par value company is one that offers shares with a nominal capital value. The corporation keeps its share capital as well as a share premium. Capital Redemption Reserve cannot be transferred, although it can be transferred to a share premium account from other accounts. The original authorized share capital and par value should be included in the Company’s memorandum of organization. Although there is no minimum approved or issued share capital requirement.

No Par Value Company: This is a company that offers shares with no nominal value. The proceeds of the share offering must be credited to the capital account. The shares must be listed in the Memorandum of Association even if they have no nominal value. Distribution from stated capital accounts with no par value is permitted in this form of corporation. This contributes to a great degree of flexibility, as owners invest with the intention of recovering capital. In the future, these firms may be eligible to be converted to par value and vice versa.

Guarantee Company: These firms have completely abandoned the notion of shares. The Guarantor pledges to contribute a specified sum in the case of the company’s liquidation in these sorts of corporations. It is frequently appropriate for philanthropic, social, political, or other non-trading goals.

Unlimited Company: Limited and unlimited liability companies can both be par and no par value companies. An individual who owns shares in an unlimited corporation has an infinite responsibility to contribute to the firm’s assets when the company is wound up. Members can successfully underwrite the Corporation’s obligations to the extent of their own assets in this sort of company. The legal personality of an unlimited business is maintained. Without the authorization of the court, these forms of corporations can reduce the number of their limitless shares. Regulatory and international planning factors lead investors to this sort of organization.

Process of Incorporating or Setting Up a Company in Jersey

First Step

The first and most important step is to choose a name. The name should not be identical to any others already in use. Furthermore, the name should not be deceptive or unfavorable. A limited company’s name should conclude with the words “Limited”, “Ltd”, or “Limited”. A public limited corporation, on the other hand, should have “public limited company”, “PLC”, or “plc”. The name must be approved by the registrar of companies.

- To form a limited business, you must first reserve a company name online using the Easy Company Registry (ECR): https://www.jerseyfsc.org/ECR/.

- If you do not already have an account, you must create one by clicking the’sign up’ button.

- To submit any papers, you must first generate an electronic signature after logging into the Easy Company Registry. See https://www.jerseyfsc.org/registry/register-or-make-a-change/how-to-submit-documents-using-easy-company-registry/ for further information on how to use the Easy Company Registry.

- On submitted papers, your electronic signature does not replace an original or digital signature.

- Return to your gateway home page after creating your electronic signature and select the ‘File a Form’ option on the left hand side.

- Choose ‘Name Reservation.’

- Select ‘R1 – Name Reservation’.

- Complete the name reservation document, making sure to include the words Limited/Ltd at the end of the name. Please see https://www.jerseyfsc.org/media/3517/a-guide-to-business-names-accept-brochure.pdf for our recommendations on name appropriateness.

- Explain in the’significance of name’ area whether you already have the same registered business name (RBN) that will be linked with the company you intend to incorporate. (If this is not the case, type “N/A” into the box.)

- Proceed with the application procedure by clicking ‘verify document’ and ‘proceed.’

- The documents in your basket will subsequently be shown on a new page. Click ‘check out’ after checking the box next to your name on the reservation form.

- Once your name reservation has been properly submitted, you will receive email confirmation from Registry. This does not imply that your name has been reserved; you must wait until we send you another email confirming that your name has been accepted before incorporating your business. Within 24 hours of submitting your name, you will often receive an email saying whether it was approved or denied (Monday to Friday).

- If your name reservation is approved, you will receive a ‘CP’ (reservation) number, which you must provide on your incorporation documents (C2b and C3). If your reservation is denied, you will be informed of the reasons for the denial.

- There is presently no fee for reserving a company name, and if accepted, your name will be reserved for 6 months until you must resubmit your name reservation.

- The selected name must not be identical or similar to any existing business (even one established in another country, such as the United Kingdom) or deceptive in terms of the firm’s anticipated operations. A private Jersey company’s name should finish in ‘Limited,’ ‘Ltd,’ ‘avec responsabilité limitée,’ or ‘a.r.l.’ A corporation that uses any of the foregoing may lay out or use its name in full or in abbreviated form for any purpose under the Companies Law.

- If a name is found to be confusingly similar to that of an existing business, the name will be refused, and the Registrar will request information on the cause for the resemblance, as well as permission from the current firm to use the name.

Second Step

Memorandum and Articles of Association: they lay forth the fundamentals of the firm. The Memorandum and Articles of Association must include the following information:

- Whether the proposed firm is a public limited company or a private limited company

- Whether there is a par value or not,

- The primary goals of the firm

- The Corporation’s name

- The Company’s complete address

- The subscriber’s information, as well as any other information requested.

At least one subscriber must agree to become a shareholder in the company in order for the memorandum and articles of association to be signed. Multiple subscribers are possible.

The memorandum and articles of association, which are created at the time of formation, form a contract that binds the business and its shareholders. The Registry does not provide legal advice on memorandums and articles of organization; instead, you should seek independent legal assistance.

There is no legislative restriction on the company’s ability to conduct business transactions. However, if the objects are essential, they are likely to be limiting. The articles lay forth the norms and regulations that govern the Company’s internal management. The Memorandum and Articles of Association, as well as the incorporation fee and an application for incorporation, must be filed with the Registrar of Companies.

Under the Financial Services (Jersey) Law 1998, these documents must be signed by a person who is authorised to do company business. Investors have the option of filing the application in fast track mode as well.

Following that, within 2-3 days of filing the application and accompanying documents, a certificate of incorporation is issued.

Mandatory Requirements for Setting Up a Company in Jersey

- Income Tax—Jersey tax at 20% on its worldwide income

- Official language—English

- Business to be conducted Internationally—Yes

- Authorized Capital—Not required

- Share transfer tax—Not required

- Minimum number of Directors—One

- Nonresident Directors—Allowed

- Corporate Directors—Allowed

- Minimum number of shareholders—One

- Meetings of Directors/shareholders—Anywhere

- Corporate seal—Mandatory

- Auditing of Accounts—Not required

- Filing of Accounts—Not required

- Incorporation time—Around 1-4 days

Final Thoughts

An offshore corporation situated in Jersey is great for doing international financial services business and also dealing with the UK or France, thus investing in real estate is a good alternative. Incorporating an offshore company in Jersey allows you to become a regional or worldwide holding company and collect regular investment income such as dividends and management fees.

Generally, corporate global revenue in Jersey is taxed at 0%, with the exception of income from real estate inside the territory, which is taxed at 20%, and financial services, which is taxed at 10%. In terms of company tax rates, Jersey is rated first in the world. Capital gains are exempt from taxation in Jersey. As a result, Jersey is justifiably regarded as a country that has good, modern corporate and trust legislation.

It is also worth noting that it has a solid regulatory framework, which contributes to the greatest level of professional corporate trust and professional responsibility. Jersey is thought to offer a world-class professional infrastructure, as well as a diverse range of international legal and accounting firms to assist Jersey enterprises and trusts. As a result, people investing in the UK through offshore company and trust structures should consider using Jersey as their corporate or trust domicile.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.

Hi Team, We have a client who wants to setup a company and bank account in Jersy. Kindly share all requirements and cost.

Hi, I am investigating off-shore structures for asset protection and tex efficiency. can you please make a suggestion, advise on process and cost ?

Hi Paul I will email you.

Hi I’m a uk resident and tax payer-my business is changing and will be getting payments/commissions from oversea’s.

I am considering setting up a limited holding company in Jersey with 5 share holders-i will need a bank account to accept payments additionally this holding company would acquire properties-so will need to be able to send funds to the UK as well as pay dividends-i don’t envisage having any employee’s in Jersey-can you send me information if you can support?