How To Invest 2 Million Dollars For Income

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Introduction

You recently reached your savings goal of 2 million dollars. You’re now trying to figure out how to invest 2 million dollars for income.

If two million dollars are carefully invested, they can provide a lifetime income stream.

Therefore, if you have been able to accumulate such a quantity of money—whether via wise money management, winning the lottery, or inheriting money—you need give careful consideration to an investing strategy that will transform your funds into a dependable income stream.

How can you make even more money for yourself with that 2 million dollars? A financial advisor may assist in creating an investment strategy that does that. Let’s walk through each step of how to turn that money into a reliable source of income.

How To Invest 2 Million Dollars for Income: 9 Investment Options

1. Annuities

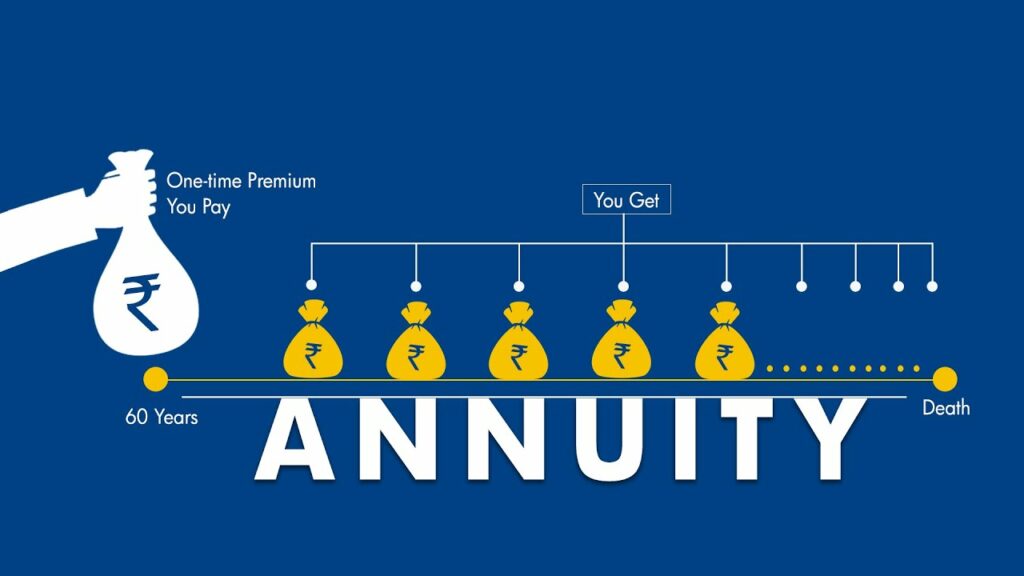

An annuity is a kind of insurance policy in which you pay a one-time premium or a recurring premium in exchange for receiving monthly payments immediately or over the course of a predetermined amount of time in the future.

The payments might continue right up until your death or for a set amount of time. Since there are several types of annuities, everything depends on the one you have.

This is a fantastic choice for you if you’re seeking for a low risk but low growth investment.

2. Bonds

Bonds are a type of structured debt that are offered by businesses, the federal government or one of its agencies, and municipal governments. The interest on these bonds is frequently tax-free.

They are viewed as an addition to stocks because of their stability and interest payments. A bond note is paid off over a number of years, after which the bond is deemed mature and the borrower is required to repay the entire amount of the loan, which is normally the bond’s face value.

Either directly or via funds, you can invest in bonds. In the latter case, investors may sell bonds whenever they choose rather than having to wait until they mature. Interest rates, maturity period, and rating all influence bond and bond fund prices.

For instance, if you purchased a two-year bond with a par value of $10,000 and a 5% coupon rate, you would receive a return of $500 every year, which amounted to $1,000 in interest overall.

3. Dividend Stocks

Dividend stocks are an excellent option for investors searching for consistent income.

Companies that regularly pay dividends or give a portion of the profits made by a corporation to its investors are known as dividend stocks. By reinvesting their dividends to purchase further shares, some investors may decide to keep expanding their portfolios.

Companies with a solid track record are more likely to reward investors with dividend payments. Your investment portfolio may become more stable with this sort of investment, which is also often regarded as low risk.

It is crucial to remember that dividend payments might change depending on the company’s earnings as well as changes in share prices. Dividend stocks are also susceptible to double taxation since, typically, companies pay taxes on their revenues before paying out dividends, and then individual investors pay extra taxes on the money received.

The company’s board of directors often approves dividends before they are paid out, and they also have the authority to revoke payments.

4. Exchange-Traded Funds (ETFs)

Exchange-traded funds are collections of investments, such as stocks or bonds, that enable people to make simultaneous investments in a number of different securities. They come packaged as individual shares that trade on the stock market like a conventional stock.

ETFs operate in such a way that all of the underlying assets are still owned by the fund’s provider. Investors purchase shares from the fund provider, who also keeps tabs on their performance.

As a result, only a fraction of the ETF, not the underlying assets, are owned by the shareholders. A portion of the gains, such as interest or dividends, are due to shareholders on a regular basis.

ETFs are frequently exchanged more easily and have lower costs than other forms of products.

5. Master Limited Partnerships (MLPs)

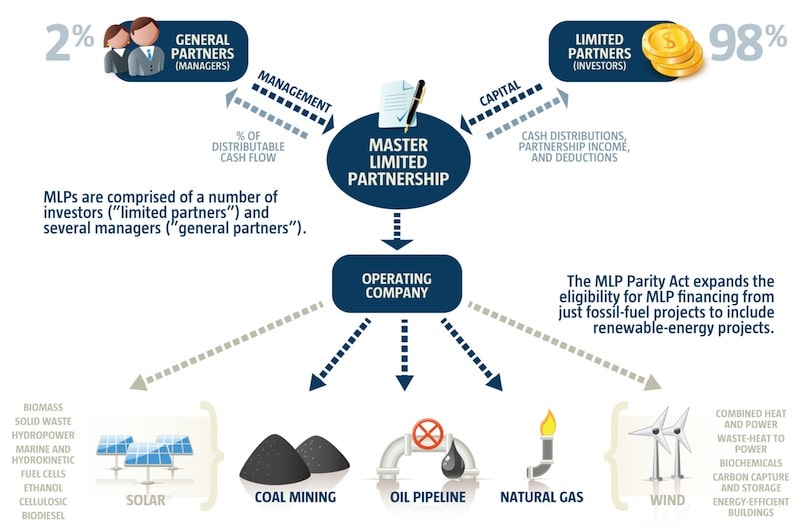

A publicly traded investment option on a market is a master limited partnership (MLP). MLPs combine the tax advantages of a private partnership with the liquidity provided by assets that are sold publicly, such as bonds and equities.

It’s also vital to keep in mind that MLPs are only available to businesses involved in the real estate and natural resource industries.

MLPs are an alternative to think about if you’re an investor searching for a high-yielding investment because the earnings are only taxed once. MLP distributions resemble dividend payments from stocks or mutual funds.

MLPs are available for direct or indirect investment.

6. Preferred Stocks

In contrast to ordinary equities, preferred stocks require preferred owners to receive dividend distributions first to regular stockholders. These payouts could strive to follow a certain benchmark, like LIBOR, or they might have a set interest rate.

Typically, this kind of stock contains both an equity component that might drive up the share price and a debt aspect that could pay a predetermined dividend amount. Investors who want the possibility of a steady future cash flow are drawn to this form of investment.

If you purchase a preferred stock for $38 and it has a 6% yield, for instance, you would receive $2.88 in dividend income each year.

7. Real Estate

Purchasing rental homes is another method to use $2 million as an income investment. You might be able to earn significant profits if you invest in the correct markets.

Let’s imagine, for illustration’s sake, that you spend just half of your funds to buy ten rentals with an average value of $100,000 each and rent each one for $1,000 each month.

Closing charges must also be taken into consideration; they may total $3,000 for each rental. After five years, this may reduce your profit to $120,000.

However, if the value of your rental properties rose by 3% year, you may accumulate an additional $150,000 in equity. You could have enough money to assist sustain your way of life thanks to your cash flow and the equity in your rental properties.

Due to the significant amounts of (mainly passive) income that real estate investment can produce, many investors see owning real estate as a crucial part of their financial strategy.

8. REITs

Think about a real estate investment trust, or REIT, if you don’t want the hassles that come with owning rental properties. These are businesses that either hold rental properties with income potential or are responsible for their mortgages.

REITs often concentrate on one type of real estate, such as residential or commercial, but hybrids with a mix of assets are also available. Shares in REITs can be purchased through an organization or a fund.

9. Peer-to-Peer Lending

Peer-to-peer lending is another option that you can consider when thinking about how to invest 2 million dollars for income. It is a type of borrowing where funds are provided by private investors as opposed to banks or other financial organizations. Typically, a website like LendingTree would connect lenders who are eager to lend money with borrowers who need it.

You will receive notes that represent pieces of several of the platform’s loans when you invest in a peer-to-peer lending platform. A $10,000 investment, for instance, may offer you tiny ownership in hundreds of loans.

However, the return might be significantly higher than that of other fixed-income investments. The range of interest rates is between 10% and 30%. Be aware of the risks: lenders may go out of business; there is no FDIC protection, and the underwriting requirements do not meet those of banks.

Final Thoughts

You have a wide range of possibilities if you have $2 million to invest in income-generating. While certain investments, like ETFs, are ideal for novices, others, like peer-to-peer lending, call for a greater expertise.

The risk and return associated with each investment type vary. Investors should think about how each investment may fit with their aims and how their asset allocation may affect their choice of investment before making one.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.