This review will show you how to get the the VBank app and how to utilize it. The discussion will consider the App’s design, user experience, usability, new features, and overall performance.

If you want to invest as an expat or high-net-worth individual, which is what i specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Introduction

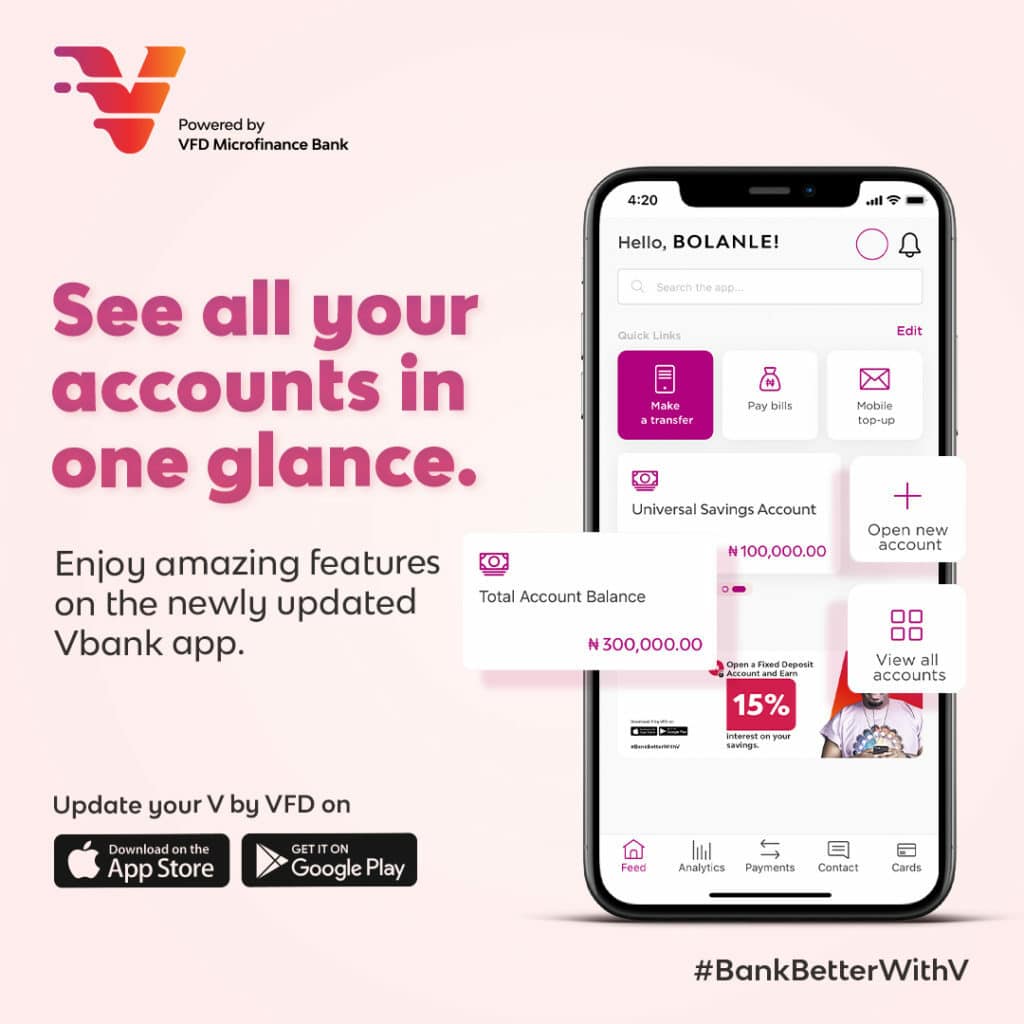

VBank, a banking app owned by VFD microfinance bank and launched on March 8, 2020, is Nigeria’s first fully digital bank. It has upgraded its software to provide additional features to its consumers while also increasing operational efficiency.

The VBank app allows users to securely access their accounts in order to automate recurring bills, send and receive funds using a unique QR code, manage multiple cards from different banks, track spending, buy airtime and data, generate virtual cards for online payments, fix deposits, and make free transfers, all within a sleek, responsive, and user-friendly interface.

Signing Up with VBank

The following details are necessary for signing up as a user on the VBank app:

- Sign up for an account by installing the VBank app and creating one.

- On the app, enter your BVN-linked phone number and birth date.

- To confirm your identity, take a photo with a white backdrop.

- Input your BVN number into the app to verify your identity, or utilize your current bank account.

- Finally, a signature and a four-digit pin password are required for validation.

VBank is available on the Google Play Store and the Apple App Store under the name V by VFD. Visit www.vbank.ng for further details.

The VBank App

The app has several amazing features that are pretty unique. Let’s go through all of the features as well as the experience setting up and completing various transactions.

The VBank App Interface

The VBank dashboard is the first thing you see once you log in or join up, and it’s very impressive. The user interface and interactions are fantastic. Under the analytics area, the usage of colors and components is basic and elegant.

Transfer Money with Proximity Payments and QR Payment Features

Users of VBank may now quickly send and receive money using the proximity or QR payment capabilities. Using the proximity payment feature, you may send or receive money from a nearby VBank app user. Click on the proximity payment icon and begin looking for a nearby user to pay. While accepting money, wait for the user to begin looking.

Recipients that use the proximity payment option must have their phones within close proximity.

Another innovative technique to initiate a quick transfer is to scan the QR code of the person who will be receiving the payment.

Each user must produce a QR code, which will be scanned while making a transfer to receive a payment.

The QR payment function is truly unique in that it allows users to send or receive payments from both nearby and remote places. The only prerequisite is that you have a QR code to scan for payment.

Intelligent Mobile Top-Up Feature

People constantly want to surprise folks with airtime or data, and most of the time they have the cellphone number but not the network provider. The VBank app has an intelligent mobile top-up function that automatically recognizes each network provider based on the phone number. You don’t need to phone the receiver and ask for his network provider; the software will do it for you.

Cardless Withdrawal Feature

Carrying a wallet or handbag with ATM cards is not always convenient or secure. Using the VBank app, you may make a reckless withdrawal without your ATM cards by creating a code. The app also assists you in identifying the nearby ATM facilities for your reckless withdrawal. This function is both convenient and secure.

Multiple Fund Transfers at Once Feature

Imagine Burna Boy’’s exhaustion after compensating each of his giveaway winners individually. It’s tiresome, but the VBank’s new multiple beneficiary function takes care of it for you. With only one transaction, you may send money to up to five recipients.

Spending Tracker Feature

The Analytics dashboard features a visually appealing interface that displays total inflow (payments received) and entire outflow (Amount withdraw or debited). This provides you with a visual representation of your income and spending.

Users may track their expenditure by category, such as online/POS, utility, mobile, and family. On a monthly basis, consider employment, lifestyle, food, utilities, transportation, and other factors. This function allows you to see unhealthy spending habits and make changes to improve your financial situation.

Manage Multiple Cards from Various Accounts

Managing numerous cards from various accounts is one of the App’s newest capabilities.

We asked for a new virtual card, which cost 500 Naira ($1) and had a three-year expiration date. VBank physical cards may also be requested and activated via the app. Users may now add ATM cards from other bank accounts to the app, and all debit cards can be handled under the cards area of the VBank app.

Automated Recurring Transactions Feature

Depending on the type of service requested, the new functionality allows consumers to automate recurring transactions weekly, monthly, or annually. Your DSTV bill may be paid on a monthly basis without difficulty.

You may also be interested in the following features:

- There are no hidden transfer/transaction costs while making free transactions.

- The VBank App allows you to create a goal savings account, a fixed deposit account, or a joint account.

- Make a loan request.

- Use the app to communicate with a customer service agent.

- Invite your friends and earn money.

- Make money by becoming a Veelager.

Conclusion

VBank app is well-designed for both new and experienced digital banking customers. The software makes it simple for users to navigate and conduct transactions. It’s a terrific alternative for anyone seeking for a flawless digital bank because of the design interface and user experience.

Everything is now achievable with only a few clicks on a cell phone, thanks to technological advancements. We anticipate a voice-activated virtual assistant function in the upcoming edition of the app.

VBank customers will benefit from the VBank app’s innovative and advanced digital banking capabilities, which will help them manage their money effectively, spend wisely, and conduct transactions quickly and securely.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.