This article gives a review of the Kuda Bank app. Learn about the Kuda Bank’s USSD code, app, and transactions fees.

Explore the Kuda Bank App and its features alongside the RL360 Quantum Savings Plan.

If you want to invest as an expat or high-net-worth individual, which is what i specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Table of Contents

Introduction

Kudi Money, Nigeria’s first free digital bank, revolutionized the banking industry. The London-based firm, which operates with a microfinance license and offers mobile banking services, was renamed Kuda Bank in 2019. The Central Bank of Nigeria (CBN) has approved the bank as Nigeria’s first mobile-only bank.

The bank was founded by two young Nigerians, Babs Ogundeyi and Musty Mustapha in 2016, and has since grown to become one of the country’s top fintech enterprises. It was reportedly appraised at $500 million, making it Nigeria’s eighth most valuable bank.

The fintech startup began with a business concept centered on offering banking services to consumers who also had accounts with commercial banks, and now has over 1.4 million registered users. Kuda Bank is the leader in Africa’s Neobanks/ fintech generation, providing banking services that allow consumers to complete all of their banking transactions without needing to visit a physical branch.

Kuda Bank USSD Code

The USSD code for Kuda Bank is *894.

You may also use USSD codes to deposit money from GTBank, Zenith Bank, and Polaris Bank accounts into your Kuda bank account.

Instead of memorizing your other Nigerian bank’s USSD code, you may use the Kuda app to select your Nigerian bank, account, and the amount you wish to transfer. You dial the USSD code generated by the program. Following that, the transfer should begin.

Kuda Bank App Review

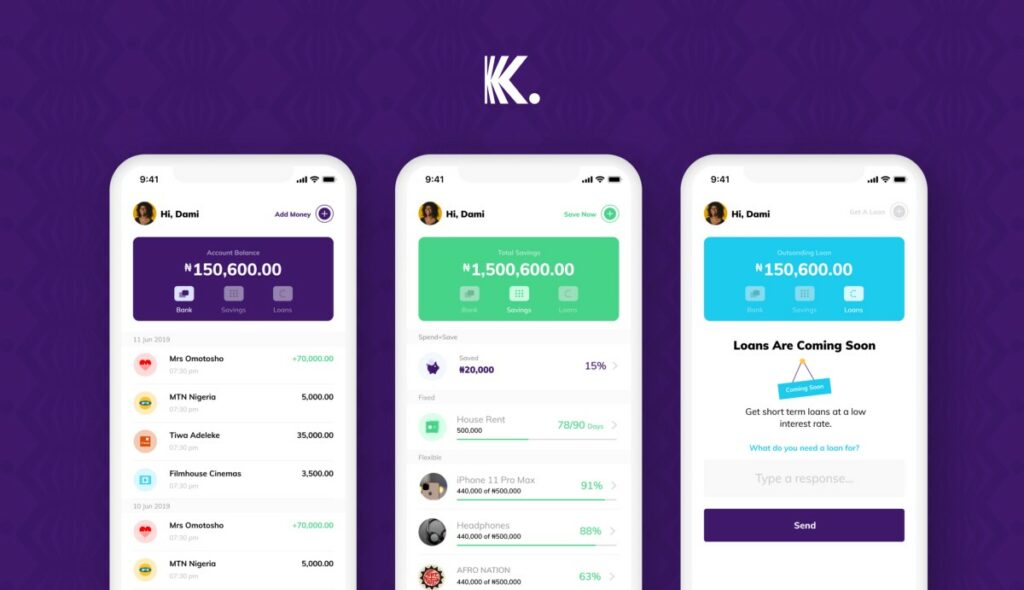

The Kuda Bank app is among the top finance apps accessible in Nigeria. Clients will benefit initially from an interest savings rate of up to 15% per annum.

Their ‘Save + Spend’ function was created to make it simple for you to save money. When you use your account or your debit card to make a purchase, Kuda can put a portion of the money into a savings account for you. You only need to enter your chosen percentage rate in the ‘Save + Spend’ options.

Take a look at the following list to get a better idea of the wonderful features that come with Kuda’s well-designed app:

- There are no fees for maintenance, transfers, ATM withdrawals, or bill payment;

- Save money and earn up to 15% yearly interest;

- Use the app to apply for a short-term overdraft;

- Set savings goals on a daily, weekly, or monthly basis to help you build wealth;

- Use a real card, a virtual card, or your Pay ID to make a purchase;

- Make personal guidelines to help you save money wherever you can;

- Sort your purchases into categories and keep track of them.

Combined Review Score of Kuda App on App Store & Google Play Store

On both the Apple app store and the Google Play store, customers have given Kuda Bank a combined rating of 4.3/5 stars. Kuda Bank has received a four- or five-star rating from over 77,000 consumers.

Positive Customer Reviews of Kuda App

- Budget and money management made easy with this app.

- The 25 free transfers each month are frequently praised.

- Instant transfers and transactions are possible with this modern software.

Negative Customer Reviews of Kuda App

- Customers have reported that emailing customer service is difficult.

- When it comes to establishing accounts, clients have complained delays and problems.

- Shipment of physical debit cards might take up to three weeks.

Transaction Fees and Exchange Rates

The Kuda App is absolutely free to download, and opening a bank account is also completely free. Kuda Bank app features a simple pricing structure with no monthly or hidden expenses.

Money Transfers

If you join up with your Bank Verification Number (BVN), Kuda Bank app will provide you 25 free transfers each month to any Nigerian bank. There is a transfer fee costing 10 naira for each transfer beyond the first 25. Every month, your transfer limit is renewed.

The maximum transfer limit set by Kuda Bank is 50,000 naira per transaction. It also imposes a 50,000 naira deposit cap per deposit. The total amount of your account is limited to 300,000 naira. By validating your identification using the app with appropriate documents, you may upgrade your Kuda bank account and increase these limits.

Kuda Bank app does not have a feature that allows it to receive international transfers or receive international remittances. To handle foreign money transfers, you must contact a conventional Nigerian bank.

ATM Withdrawal Fees

Kuda Bank app has teamed up with over 3,000 ATMs throughout Nigeria to provide you with free cash withdrawals. Three free withdrawals will be given to you each month. For the remainder of that month, ATMs will charge you 35 naira for every withdrawal.

Microfinance Loans

Kuda Bank app has the legal authority to lend money to clients in Nigeria as a fully licensed bank with the Central Bank of Nigeria. If you use the Kuda App frequently and have a solid credit history, you may be eligible for a short-term loan. Before lending you money, Kuda Bank will conduct a credit check.

The app allows you to apply for a loan without having to fill out any documents. A daily interest rate of 0.3 percent is applied to their basic loans. Such loans (also known as overdrafts) are designed to be short-term loans that are repaid in a matter of days or weeks, as opposed to 1-year or 5-year loans.

Kuda Bank has the right to levy additional costs for defaulting and to seek legal action if you do not repay the loan by the Maturity Date.

How to Contact Kuda?

Kuda Bank does not have any physical branches because it is a digital bank. You may contact the customer support staff in the following ways if you have questions or issues regarding your account:

- Live Chat: Get in touch with customer service right from the Kuda app.

- Kuda’s website: Go to help center page where you may get answers to commonly asked issues.

- Phone: To talk with a representative, dial 01 633 5832.

- Email: Kuda Bank may be reached by email at help@kuda.com.

Conclusion

Being the first digital bank in Nigeria, Kuda Bank has delivered one-of-a-kind financial services based on cutting-edge technology and infrastructure since its inception. Talk to a financial advisor to discuss if this bank is best for you depending on your goals.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.