Investment from Qatar has become increasingly popular in recent years as more and more individuals and institutions look to diversify their portfolios and tap into the growth potential of global markets.

However, investing abroad can be complicated and tedious, especially for those unfamiliar with other countries’ legal and regulatory landscape.

This blog aims to provide tips and insights for mastering investment from Qatar, covering everything from research and due diligence to risk management and diversification.

Whether you’re a seasoned investor or just starting out, this article is the perfect resource for anyone looking to expand their investment horizons and achieve financial success.

If you want to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Why should you invest abroad from Qatar?

Investing abroad from Qatar can offer several benefits and advantages.

One of the main reasons to invest abroad is to diversify your investment portfolio. By spreading your investments across different countries, sectors, and asset classes, you can reduce the risk of a portfolio downturn due to a single event or market.

This can increase the stability and long-term growth potential of your portfolio.

Another advantage of investing abroad is access to new markets and industries. Countries and regions around the world have different economic and political climates, which can affect the performance of different sectors and companies.

By investing abroad, you can tap into these different opportunities and potentially achieve higher returns than you would by investing solely in your domestic market.

Additionally, investing abroad can offer the potential for higher returns. In some cases, foreign markets may be growing faster than domestic markets, offering more opportunities for growth and higher returns on investment.

Investing abroad can also help to hedge against currency fluctuations. When you invest in a foreign currency, you are exposed to the risk of currency fluctuations.

However, by investing in a diversified portfolio of foreign assets, you can potentially offset the impact of currency fluctuations on your overall portfolio returns.

What are the factors to consider before making an investment from Qatar?

When considering investing abroad from Qatar, there are several factors that should be taken into account to ensure a successful investment.

Firstly, evaluating the political and economic stability of the country where you are considering investing is important. This includes assessing the current political climate, economic conditions, and long-term outlook for the country.

Unstable political and economic conditions can create uncertainty and increase the risk of investment losses.

Secondly, currency exchange rates and the potential for currency fluctuations should be considered.

The exchange rate of the country’s currency in relation to the Qatari Riyal can have a significant impact on the value of your investment. As currency fluctuations can be difficult to predict, it is important to have a clear understanding of the potential risks and opportunities.

Thirdly, the legal and regulatory environment of the country where you are investing should be evaluated. This includes understanding the laws and regulations that govern foreign investment, as well as any restrictions or limitations that may apply.

It’s important to be aware of the potential risks, including regulatory changes that could negatively impact your investment.

Fourthly, it is important to consider the tax implications of investing abroad.

Different countries have different tax laws and regulations, which can affect the returns on your investment. It is important to understand how taxes will be applied to your investment and how they may impact your overall returns.

Lastly, reliable financial information and resources should be considered.

Access to accurate and up-to-date financial information and resources is crucial when making investment decisions. This includes researching the companies or assets you are considering investing in, as well as monitoring performance, and staying informed about any relevant news or events that may affect your investment.

What are the popular investment options for Qataris investing abroad?

There are several popular investment options for Qataris investing abroad. These investment options come with their own set of risks and rewards, which should be evaluated before making any investment decisions.

Real estate

Real estate investment can include buying properties in foreign countries for rental income or as a long-term investment.

This type of investment can provide a steady stream of income and the potential for capital appreciation.

However, it’s important to keep in mind that real estate investment can be complex and involves many risks, such as market fluctuations, currency fluctuations, and legal and regulatory issues.

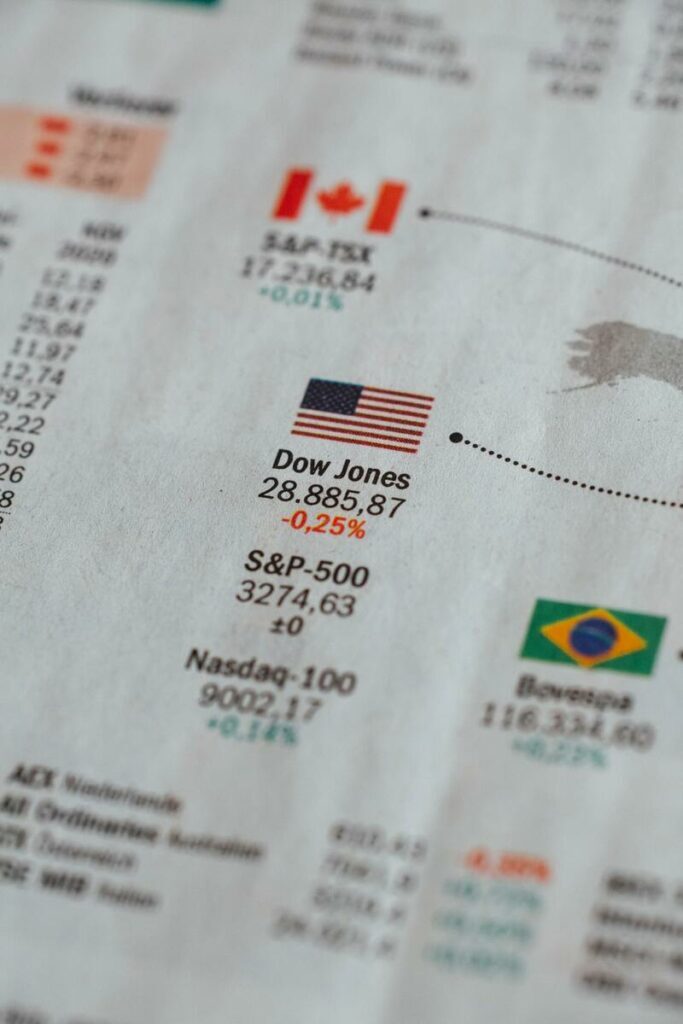

Stock markets

Investing in foreign stock markets can provide access to a wider range of companies and sectors, potentially providing higher returns than the domestic market.

This type of investment can also provide a high level of liquidity and the ability to respond quickly to market changes.

However, stock market investments can be volatile and subject to market and economic risks.

Mutual funds and ETFs

Mutual funds and ETFs can provide a diversified portfolio of stocks, bonds, and other assets and can be an easy way to gain exposure to foreign markets and sectors.

This type of investment can provide a good balance of risk and return, but the performance of these funds is subject to the underlying assets and the fund manager’s strategy.

Bonds and fixed-income investments

Investing in foreign bonds and fixed-income investments provides a steady income stream and helps diversify a portfolio.

This type of investment can provide a lower level of risk than stocks. However, the value of bonds can fluctuate with changes in interest rates and credit risk.

What are the popular destinations for foreign investment from Qatar?

Over the years, Qataris investors have developed an interest in investing abroad. Among their top choices are Europe, Asia, and America, with each region offering various investment opportunities.

Europe is a popular destination for foreign investment from Qatar due to its stable political and economic conditions, developed infrastructure, and large consumer markets.

European countries offer a variety of investment opportunities, such as real estate, stock markets, and bonds. They also have a well-developed legal and regulatory environment, which can provide a higher level of protection for foreign investors.

Asia is another popular destination for foreign investment, particularly in countries such as China, Japan, and South Korea.

These countries have rapidly growing economies and large consumer markets, making them attractive for investment in sectors such as technology, manufacturing, and consumer goods.

However, the legal and regulatory environment and political stability can vary significantly between different countries in Asia. Hence, caution and heavy market research are advised.

North America is also a popular destination for foreign investment from Qatar, particularly in the United States.

The US has the largest economy in the world and a well-developed legal and regulatory environment, making it an attractive destination for investment in a wide range of sectors.

Investment opportunities in the US include real estate, stock markets, and bonds.

How to get started with investing abroad from Qatar?

To get started with overseas investments from Qatar, conduct thorough research on the markets, industries, and companies that you are interested in.

This includes analyzing economic and political conditions, as well as researching the reputation and financial health of the companies in which you plan to invest.

Then, find a reputable and experienced financial advisor who can provide valuable guidance and advice on foreign investment opportunities.

Choose an advisor who is experienced in international investing and who has a good reputation.

In order to invest abroad, you will need to open a foreign bank account. This will allow you to make transactions in foreign currency and to receive dividends and other income from your foreign investments.

Investing abroad can be complex, and there may be legal and regulatory requirements that you need to comply with. Make sure to understand the process and requirements for foreign investment in the country where you plan to invest.

Remember to check the legal requirements and regulations of Qatar Central Bank and Qatar Financial Center Regulatory Authority to ensure compliance with the local laws and regulations.

Lastly, diversifying your investment portfolio by considering a mix of investment options such as mutual funds, bonds, exchange-traded funds, and stocks can minimize risk and maximize returns.

What are the potential risks and drawbacks of investing abroad from Qatar?

While investing abroad from Qatar can provide access to new markets and industries, the potential for higher returns, and a diversified investment portfolio, some potential risks and drawbacks should be considered before making any investment decisions.

For one, investing in countries with unstable political and economic conditions can increase the risk of investment losses.

It is important to research and monitor the political and economic situation of the country in which you are considering investing.

Currency fluctuations can have a significant impact on the value of your investment. Potential risks and opportunities associated with currency fluctuations must be considered, as well as the hedging strategies to minimize the impact of currency fluctuations on your investment.

Investing in foreign countries can also involve navigating a complex legal and regulatory environment. Make sure to research and understand the laws and regulations that govern foreign investment, as well as any restrictions or limitations that may apply.

Understanding cultural and business practices is also important. Language, customs, and social norms can affect the economy and investment climate in a country.

And while technology and online platforms can make foreign investment more accessible by providing access to a wide range of information and resources, not all online platforms are trustworthy or reliable. Hence, caution is highly advisable when using these platforms.

To mitigate these risks, it’s important to consult with a financial advisor and do your own research before making any investment decisions.

Additionally, it is important to be aware of government initiatives and support for foreign investment from Qatar.

Qatar’s government has been actively promoting foreign investment through various initiatives, such as providing access to finance and funding, creating a favorable investment climate and regulations, and developing infrastructure and services to support foreign investment.

What are the best practices for managing foreign investment from Qatar?

To ensure that you get the most out of investing abroad from Qatar, it is important to spread your investments across different countries and sectors to reduce risk. Understand the country’s political stability, regulatory environment, and currency risk before investing.

Foreign investments are generally considered to be riskier than domestic investments, so be prepared for the potential for higher returns but also greater risk.

Foreign investments can also take longer to pay off, so be prepared for the long term and stay committed to your investment strategy.

Consider using currency hedging strategies to protect your investment against currency fluctuations and keep track of the performance of your foreign investments and be prepared to make adjustments as needed.

You must also be aware of the tax implications and regulations for foreign investments in your home country and the country you are investing in.

It is always better to consult with a financial advisor or investment professional who has experience in foreign investments.

Conclusion

Investing abroad from Qatar can offer a number of benefits, including the opportunity to diversify your investment portfolio, access to new markets and industries, and the potential for higher returns.

However, there are also potential challenges to investing abroad, such as currency fluctuations, political and economic instability, and legal and regulatory requirements.

Proper research and planning are essential before making a decision to invest abroad.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.