What is Asset Correlation and Why is it Important.

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

This article is not formal tax, legal or any other kind of advice, and the facts might have changed since we first wrote it.

Table of Contents

Introduction

The relationship that exists between two stocks and their respective price fluctuations is referred to as asset correlation.

It may also refer to the relationship that exists between stocks and other asset types, such as bonds or real estate. Even if you’ve delegated control of your investments to an investment advisor, it’s a good idea to learn the fundamentals of stock correlation.

Read on to know more about asset correlation.

What is Asset Correlation?

Stock correlation, in general, refers to the relationship between the movements of different stocks. While it is possible to describe the relationship between asset classes in general terms—positively or negatively—we can also measure correlation.

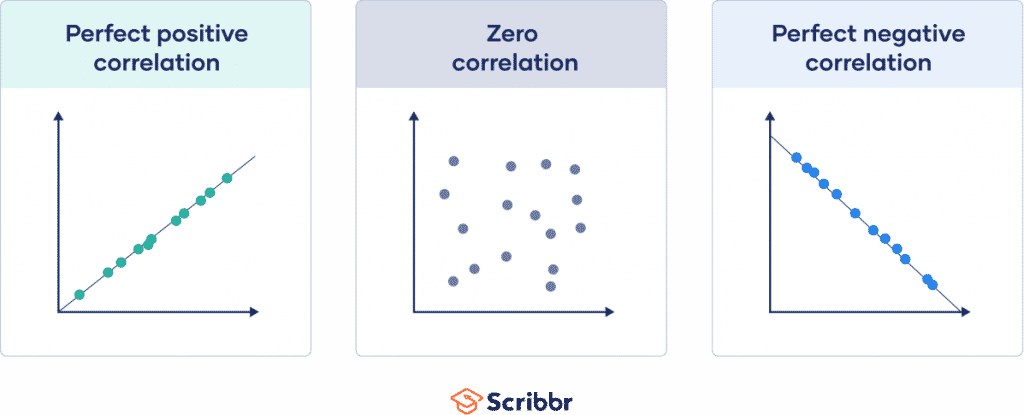

A pair of stocks are compared over time to determine their average movement, and the result is used to compute stock correlation, which ranges from -1 to 1.

Correlation should be measured over months or years, not days, to get a sense of how two or more stocks move. An investor can determine how two stocks are related by observing how one exceeds or underperforms its average return over time.

Positive Correlation

A correlation in the same direction is called a positive correlation. If one variable increases the other also increases and when one variable decreases the other also decreases.

An iron bar, for instance, will grow longer as the temperature rises.

Negative Correlation

Negative correlation refers to a correlation in the opposite direction. If one variable rises, the other falls, and vice versa.

For example, when the pressure rises, the volume of gas reduces, and as the price of a commodity falls, the demand for that commodity rises.

No Correlation or Zero Correlation

The two variables are said to have no correlation if there is none such that when one variable’s value changes, the other variable stays the same. The returns on assets are totally uncorrelated when the correlation is 0. The price movement of one asset does not affect the price movement of the other asset if two assets are said to be non-correlated.

How to Calculate Asset Correlation?

You may calculate stock correlation using internet calculators, but you can also do the math on your own. You must first determine the average price for each stock in order to determine the correlation between them. Select a time frame, then sum up the daily prices for all the stocks throughout that time frame, then divide by the total number of days. That is the typical cost.

Then, for each stock, you’ll compute a daily deviation. The deviation is the difference between the stock price on a given day and the average price. So, if the average price of a company is $25 per share and the daily price is $26.50 on a given day, the variance is -$1.50. This calculation will be performed for each day of the time period being measured for each stock.

The final stage is to put everything together. This is when things can become a little confusing. The square of each daily variation for each stock should be found first. Once you’ve completed that for each day in the period, take the square daily deviation related to the first stock for day one and multiply it by the square daily deviation for the second stock for day one.

Three sets of numbers should result from doing this:

- all of the squared deviations for Stock 1;

- all of the squared deviations for Stock 2; and

- the third group of all the numbers you obtained from multiplying the squared daily deviations for each Stock by one another.

In order to find the square root of the total, add up all of the squared daily variances for stock 1. The standard deviation is shown here. For stock two, repeat the process. Then add together the standard deviations for the two stocks, and set this result aside for the time being.

The final step is to add all the numbers in set three, which are the results of multiplying the two squared deviations from each day by one another, before taking the square root. Then multiply this result by the product of the standard deviations of the two stocks.

The outcome would be a number between -1 and 1, which would represent the correlation between the two equities.

What Asset Correlation Means to Your Portfolio?

According to what is known as modern portfolio theory, investing in non-correlated asset combinations can lower overall risk in a portfolio of investments and even increase returns overall. In other words, you possess assets that don’t often move simultaneously in the same direction.

Modern portfolio theory (MPT) is an investing approach that explains how investors should strive to optimize their return based on the level of risk that they are comfortable with.

Correlation is a crucial measure in this portfolio management approach, which admits that higher risk is an inherent aspect of higher gain.

By diversifying their portfolios in accordance with their risk tolerance, investors can apply the modern portfolio theory to maximize their return on investment. Investing in non-correlated assets, which have a score between -1 and 1, can help investors lower the risk in their portfolios.

Two assets with perfect positive correlation would provide a reading of +1, whereas two with perfect negative correlation would show a reading of -1.

Investors can gauge how unique an asset is by looking at the correlation ratings, which range from -1 to +1, even though perfect positive or negative correlations are uncommon.

Owning assets with varying correlations to one another allows you to retain relative performance in the market without the rapid peaks and deep dips that come with owning only one asset type.

When one sort of stock is performing well, your gains may not be as big as your neighbor’s who is completely invested in that asset, but your losses will be less severe if that same asset begins to decline.

Why Investors Should Care About Correlation?

Even while you could be concentrating on how each stock in your portfolio responds to the market on its own, understanding how they move in tandem with other equities might help you see your portfolio as a whole.

Stock correlation is vital because it can help investors realize that their portfolios might not be as diversified as they believe. Even though your stocks may be in several industries, diversity offers very little protection to your portfolio if all of your stocks’ returns are based on the same factor, such as the state’s economy.

Risk management is accomplished through diversification. Basically, it means to avoid putting all of your eggs in one basket. Your portfolio can be protected from unavoidable market volatility by having a variety of stocks, mutual funds, bonds, and other investments.

The market changes are significantly more noticeable in portfolios that are “overweight” in a single stock or industry. You can prevent that by being aware of stock correlation.

Investors might be startled to hear that their portfolio may only be driven by a handful of fundamental elements. Knowing the correlation between your stocks will enable you to examine the variables influencing the portfolio, making you a better investor.

Stock correlation might be evident at times. Two stocks in the same industry or sector, such as banking or health care, are more likely to move in the same direction and respond to the market in the same way. Correlation may be more difficult to detect in your portfolio if you buy equities in a mutual fund or an exchange-traded fund.

For example, if you hold stock in an energy firm, you may invest in an ETF that invests in many sectors, including energy. If the ETF invests in the same or a comparable firm, there may be overlap in your portfolio, thus raising your risk factor if you are overweight.

Market Volatility and Asset Correlation

Following the 2008 financial crisis, correlation has shifted.

With a few exceptions, average absolute correlation was quite steady until 2008. Needless to say, circumstances have shifted.

Despite the fact that correlation can change, assets and asset classes are getting more correlated, particularly as the market gets more volatile. International stocks and bonds, for example, used to move in the opposite direction of US stocks and bonds, but they now interact more swiftly than ever before.

Investors may have more difficulty diversifying their portfolios in the future to guard against market downturns, even while increased correlation has been demonstrated to disappear again following a market crisis as financial markets and economies become more fundamentally interconnected.

The modern investor might structure their investment selections by using correlation as a measure. If you are a novice investor, you can calculate correlation measures on your own, but you should get the advice of a financial expert to confirm correlation before investing any money.

Using Correlation for Your Portfolio

Stock correlation can be used, for example, to compare various stocks to market indices. Index funds employ this tactic. Aiming to replicate an index’s performance, such as the S&P 500 or the Nasdaq, is what index funds do. Just be careful not to choose index funds that own a significant number of the same stocks, as this can undermine your efforts at diversification.

Another approach to explore is holding stocks with a negative correlation; this is commonly referred to as “hedging,” and it balances out the positively linked equities in your portfolio to manage risk.

For example, historically, there has been relatively little connection between real estate and equities. Bond prices are also inversely tied to the stock market, which is why many investors purchase bonds to diversify their portfolio and reduce risk. The disadvantage of this type of hedging is that it may impair your investment results over the duration of market cycles. When one stock or investment does well, the negatively associated one you purchased as a hedge may underperform.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.