It is a way of protecting wealth and avoiding losses from huge unexpected healthcare bills.

With that being said, health insurance isn’t an investment. You don’t get rewarded by investing more. Therefore, you should get the most covered for the least possible cost.

Countless of my clients have needed to withdraw money from financial accounts to cover unexpected medical emergencies.

So today I will review one of the most up-and-coming health insurers in the market, Regency for Expats, and tell you how to apply for discounts through me.

If you want to invest or get insured as an expat or high-net-worth individual, you can email me (advice@adamfayed.com) or use these contact options.

We can offer discounts on Regency compared to the stated online price, which could save you hundreds or even thousands of dollars.

Regency for Expats Background

Who is Regency for Expats?

Regency for Expats is an insurance company that focuses on health insurance for corporate customers and expats in particular, who are in over 120 nations. They have an office in Dubai and numerous other countries.

Regency for Expats is under financial services and insurance provider Regency Assurance, which is controlled by the Financial Services Regulatory Commission.

When compared to other companies that offer international insurance plans, Regency for Expats stands out as particularly exceptional as it honors almost all of the claims that are submitted (99%) versus the average in the sector which is somewhere around 80%.

Where is Regency for Expats sold?

Worldwide, but typically in parts of the world with high concentrations of expats. Examples include Singapore, Thailand, Dubai, Qatar, Abu Dhabi, Vietnam, China, Hong Kong, Peru, Argentina, Brazil and numerous countries in Latin American.

What’s new with Regency for Expats’ health insurance?

Regency for Expats gives you the option to select from one of four distinct types of global health insurance plans, each of which provides a specific level of coverage, spanning from Standard to Major Medical to Comprehensive to Fully Comprehensive.

In addition, Regency for Expats is now giving its customers the option of purchasing coverage for evacuation and repatriation on top of the company’s collection of global health insurance policies. This option is available to clients as an upgrade.

When expat clients purchase health insurance from Regency for Expats, they have the option of acquiring additional coverage worth up to 100,000 US dollars.

Can Regency for Expats be used for visas for places like Thailand?

Immigration departments will have different rules – it can vary from country to country.

Currently my Thailand-based clients have had no problem showing the Thai immigration department their health insurance certificate, to meet visa requirements.

The very basic Regency package isn’t always accepted, however. Moreover, in March 2020, Regency announced that they would be providing confirmation letters to all Thailand policyholders, to help them with the visa issue.

Would this be helpful in Thailand for the mandatory health insurance for visa?

New rules were announced recently that all non-Thais applying for a one-year permit to stay on an O-A visa must have health coverage for up to 40,000 Thai Bhat for outpatient services. This is in addition to 400,000 Bhat for inpatient services

Therefore, the basic package would not be sufficient, as it only covers impatient, but most of the higher packages meet the minimum requirements for immigration purposes.

Regency for Expats Health Insurance

What Coverage Is Provided by Regency For Expats?

Do the plans cover dental?

Yes, they do, on the two most expensive plans. Often times, however, the standard plans offer better value for money.

Paying out of pocket for dental is usually cheaper than going for a comprehensive package.

What if I move countries?

You can relocate anywhere in the world, except the United States of America, and your coverage will still be applicable.

If I want to upgrade or downgrade my policy in subsequent years, is this easy to do?

Very easy. It can be done upon renewal of the policy.

Can I pick which hospitals and doctors treat me?

Yes, you can. Again, the United States of America is an exception.

How about for American expats?

American expats and their families, can take out the policies, whilst they remain overseas.

What about terrorism coverage?

Terrorism is covered, on all plans, including the cheapest ones. That is assuming that the condition you are being treated for, is covered, and that depends on which plan you pick.

Is there a usage limit, per category?

Yes, as per the benefits schedule, each category has a limit. These are yearly limits, unless stated otherwise.

Does this cover travel?

Yes, you can get treatment anywhere, apart from in the US. So, if you get sick whilst you travel, you will be entitled to coverage, even though this isn’t “travel insurance” per see.

How about evacuation benefits?

If you want to add evacuation, this is an extra $250 per year, per year. This only makes sense in countries without great medical facilities.

Many people in Cambodia and Burma/Myanmar, decide to add this feature.

How about digital nomads’ health insurance?

Regency for Expats isn’t really the best option for this, as compared to firms that offer specific insurances targeted at location-independent nomads.

Will this insurance cover illnesses such as the coronavirus?

The packages do cover the virus, especially if you get seriously ill from it. However, there is one or two exclusions.

Exclusion 34 states that costs and expenses incurred where a member has traveled against medical advice.

In other words, you have voluntarily traveled to China, Korea or other areas with a lot of cases, despite advice to the contrary.

So, if you get seriously ill from the virus, and haven’t done anything which is excluded in the terms and conditions, the insurance will cover the virus.

Unless you are on the higher packages, you shouldn’t expect minor symptoms and testing to be covered

Health Insurance Claims

How do you make a claim?

For Outpatient Consultation

You are able to file a claim for medical treatment that was obtained as an outpatient, without having to inform Regency for Expats before the receipt of such treatment or consultation. In this case, you also are not required to get pre-authorization for the treatment.

What you should do is to bring a claim form with you to your appointment so that your healthcare provider can fill it out. After your appointment, you must send the completed claim form along with receipts for the money you spent on medical care to claims@regencyforexpats.com.

Be aware that in the event that you file a claim for outpatient services, scanned copies of both your claim form and receipts will be used to process your claim; nevertheless, you are required to keep the originals because the company could request for them any time.

For Inpatient and Outpatient Surgeries

Before you can receive any kind of treatment covered under your Regency for Expats health policy, you need to secure pre-approval for planned inpatient or outpatient surgical care.

Pre-authorization can be obtained via your broker and Regency for Expats. Therefore, Regency can speak directly with the healthcare provider to gather the relevant invoice and pay for the approved costs directly, which means you don’t need to pay out of pocket.

The forms are very easy to fill out, and look like this:

Regency for Expats has the right to deny payment for any claim that is related to inpatient or outpatient surgical treatment that have not secured pre-authorization from the firm.

It is good to have an excellent relationship with your broker, so he or she can also help you with any additional questions and help with claiming, although Regency is very quick in replying to customers.

How about in emergency situations though?

In some situations, you can’t get pre-authorization and are unable to notify Regency for Expats beforehand. For example, you have a heart attack or stroke.

In this case, you will need to notify Regency for Expats or your broker as soon as possible so bills can be paid.

Price and Payments

Does it get more expensive as you age?

In general, your insurance premiums increase as you age, for obvious reasons. However, there are some low claims discounts, on renewal.

Due to medical inflation, the plans can get more expensive due to normal increases over time.

This is typical of other insurers though, and 2020 rates have remained stagnant.

How about paying for treatment directly?

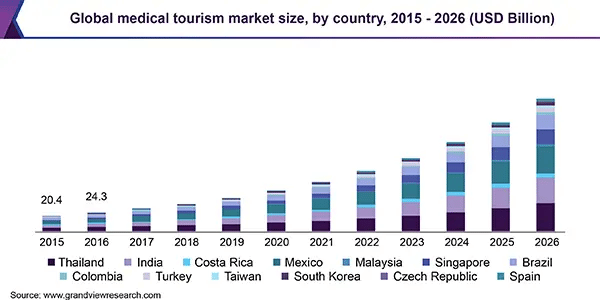

It is certainly true that medical tourism is growing globally, as the stats below show:

In general, being without insurance in many countries can be risky though.

Does Regency for Expats also offer life insurance?

Yes, in the event of an unexpected passing, you, your employees, and their family members can all be financially protected through the purchase of a life insurance policy from Regency for Expats. These policies are designed to be a part of your long-term financial management and can provide financial protection at an affordable cost.

Regency for Expats’ life insurance policies provide a significantly broader range of benefits, such as the repatriation of mortal remains, a death benefit, child chaperones, grief counseling, geographic extension, upfront payments, and, of course, round-the-clock assistance on a global scale.

While the majority of life insurance policies have geographical limitations attached to them, Regency for Expats’ life insurance does offer a geographic extension as part of its policies. This feature enables the provider’s policies to be geographically transferred to other locations.

This implies that if you purchase insurance while based in one territory and later move to a different country or perhaps a different continent, your life insurance policy will still be in effect.

With life insurance from Regency for Expats, you can enjoy your time living abroad without stressing out about providing for your family financially, as you are protected regardless of where you may be.

How do you make a claim under Regency for Expats life insurance?

For Death Benefits

When you purchase a life insurance plan from Regency for Expats, the amount of the Death Benefit that you will be eligible to get will be detailed in the Certificate of Insurance that you will obtain. It is possible to get a portion of the Death Benefit as an immediate payment in the event of an emergency after the claim has been filed for it.

For Mortal Remains

The life insurance plan offered by Regency for Expats also covers the fees and charges involved with repatriating your remains to your country of origin after your death. The provider gives access to seasoned international funeral directors and releases funds, as well as takes care of certain administrative paperwork required.

Your beneficiaries will also be given access to a multilingual, round-the-clock helpline that can answer their questions and address their claim concerns, plus other related issues.

What are the positives and negatives about Regency for Expats?

Upsides

There are countless positives about the policies, including:

- Low premiums relative to benefits

- They can accept people with pre-existing conditions, but they don’t cover those conditions. For instance, if you had a heart attack before, you can still get covered, but you won’t get repaid if you have a heart problem.

- Great record in terms of paying out claims and accepting people quickly.

- No need to go for medical exams for health or life insurance.

- The application process is easy and straightforward. Usually takes 24-72 hours.

- 24-hour multi-lingual support

- Countless packages are available, so you can get basic coverage, which includes outpatient, and the cheaper packages that just include impatient.

- Policies can be transferred worldwide, if you move country, with the exception of the USA

- They can be excellent value for money when it comes to family health insurance compared to some other providers in the expat market in places like Dubai.

Downsides of Regency For Expats

- You can’t get covered after 70 years old unless you are an existing client.

- You can’t get covered for pre-existing conditions. You will get accepted, but the coverage will exclude those conditions. That shouldn’t affect claims for other illnesses, however.

- You don’t need to have a medical examination for life insurance below $350,000; however, you do for larger amounts.

- You can’t have a lower premium in return for a high deductible or co-pay. This is unlike some other insurance companies that allow you to have a lower premium, in return for paying thousands out of your own pocket.

Are some of the negative reviews correct?

The majority of reviews online are positive about Regency. There are always going to be some negative stories, with any product or service, so it isn’t anything to worry about.

Some of the negative reviewers, moreover, might have not known some key things beforehand as well, such as the fact Regency don’t accept pre-existing conditions.

On Getting Insurance and Discounts

Do you offer insurance?

My main service is financial services; however, I do help expat clients with financial planning more generally. That includes health and life insurance. You can apply here.

Can you offer any discounts?

Yes, often it is possible for me to provide discounts, making it cheaper than the prices you may receive online.

Can locals buy expat level coverage?

Yes, locals can usually buy the insurance. Country-specific rules may sometimes exist, however.

Are there discounts for larger groups?

Yes, there are. There aren’t discounts for families of say 3-4 people, though. So, the discounts are usually for group coverage.

Regency for expats is a great insurance option, for most people’s needs. The plans are easy to set up, for those that, like me, hate loads of paperwork.

It is easy to claim and renew. The only negatives are that it is hard to get significant amounts of life insurance, and coverage for pre-existing conditions isn’t included.

With that being said, getting covered for pre-existing conditions as an expat, isn’t easy, unless you are being covered as a group or want very limited coverage for those illnesses.

It offers much better coverage than almost all local options, in many expat destinations.

Most of the alternatives to Regency for Expats, are either:

- More expensive

- Similarly priced or lower, but worse coverage

- Very bad for paperwork and efficiency. The bigger insurers are typical examples of this. They tend to be slow and inefficient.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.

I am already a client of regency and am in process of renewing. I am covered only for catastrophic injury or something that would require a hospital stay. I am a US citizen living in Greece. I just want to see if I can get a better deal with you.

Hi Martha. Sure. I will email you.