What Are The Effects Of Inflation On Investments.

Understanding the effects of inflation on investments helps you mitigate risks and adjust global investment strategies for long-term growth.

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Introduction

The first step in safeguarding your assets from any negative consequences is to understand the effects of inflation on investments.

You probably regularly hear experts and economists debating the economy’s inflation rate if you pay any attention to financial news, even simply the evening news.

While they might make it seem worrying, they typically don’t take the time to explain the fundamentals, such as how inflation can impact your attempts to save and invest.

This article will clear things up by outlining how inflation could affect your investments.

What is Inflation?

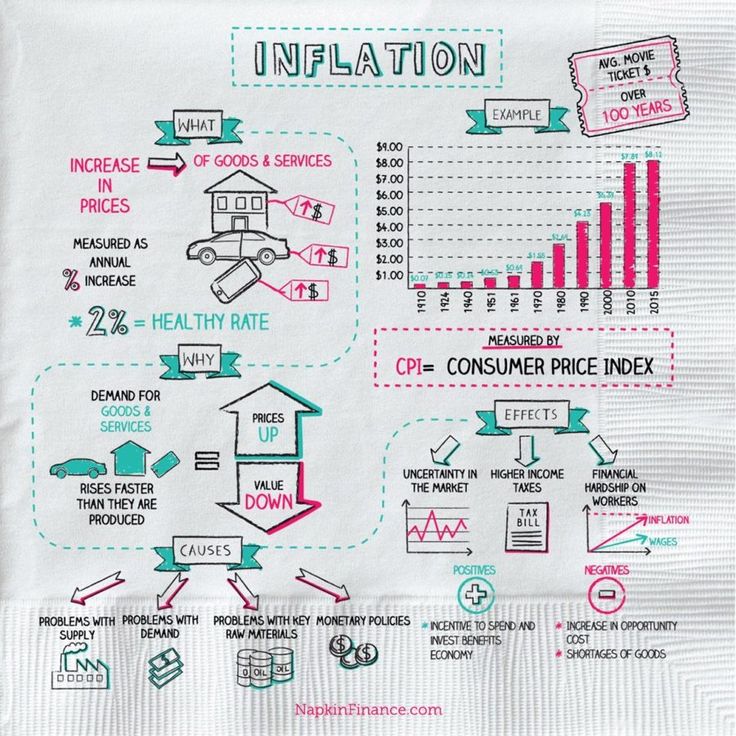

Inflation is the rapid increase in the average cost of goods and services. The Bureau of Labor Statistics gathers data to calculate the Consumer Price Index (CPI). The CPI compares the prices of consumer goods and services such as fuel, food, clothes, and vehicles across time to determine the total growth in consumer prices.

As an example, the cost of living rose by 7% in 2021 as measured by the CPI. Overall, prices grew by 7% during the year. This indicates that a vehicle that cost $20,000 in 2020 would cost $21,400 in 2021.

Inflation is heavily influenced by supply and demand. Prices tend to rise when demand for an item or service increases but supply for the same good or service decreases. Many variables influence supply and demand on a national and worldwide scale, including the cost of commodities and labor, income and goods taxes, and credit availability.

Causes of Inflation

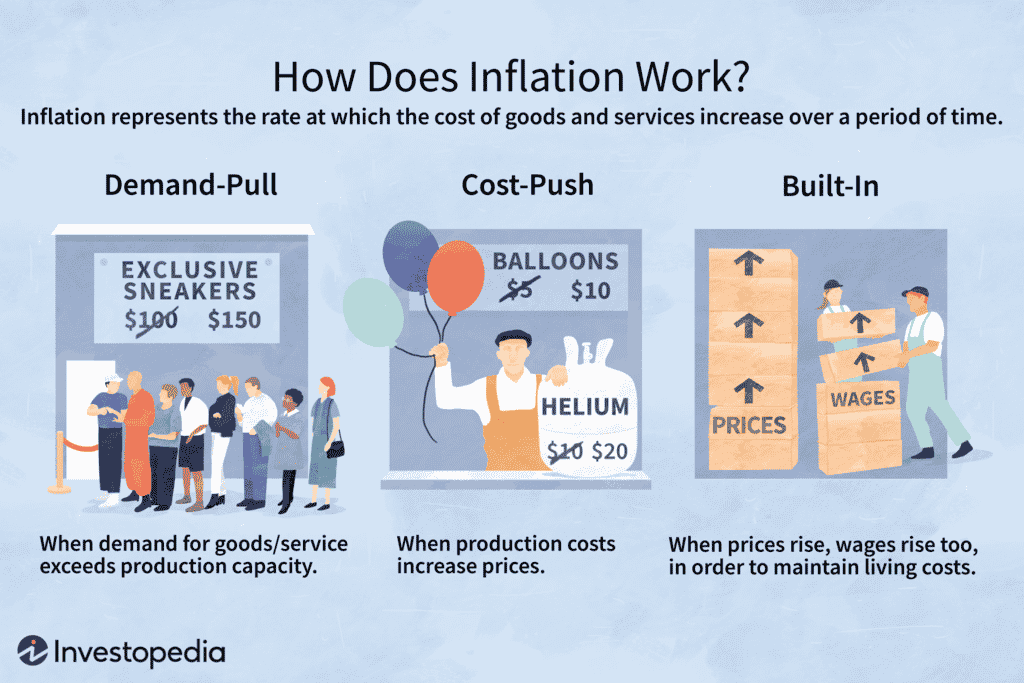

Inflation is caused by three major factors: demand-pull inflation, cost-push inflation, and built-in inflation.

- Demand-pull inflation occurs when there are insufficient items or services produced to meet demand, leading prices to rise.

- Cost-push inflation, on the other hand, occurs when the cost of manufacturing goods and services rises, causing businesses to raise their prices.

- Built-in inflation (also known as a wage-price spiral) arises when employees seek greater compensation in order to keep up with growing living costs. As a result, firms boost their prices to cover growing wage expenses, creating a self-reinforcing cycle of salary and price rises.

Indicators of Rising Inflation

Aside from the three causes of inflation mentioned above, there are three factors that might contribute to an increase in inflation, sometimes known as “reflation.” These factors are more specific and obvious.

- Monetary policies of the Federal Reserve (Fed), including interest rates. The Fed is now dedicated to maintaining interest rates low. This can encourage low-cost borrowing, hence stimulating economic activity and increasing demand for products and services.

- Oil prices. Because oil is required for the production and transportation of products, its demand is intimately tied to economic activity. Oil prices have climbed over the last year as a result of increased economic activity and demand, as well as tighter supply. A rebound in producer supply is expected to match rising demand, dampening future oil price gains.

- Regionalization is the process of lessening reliance on imported products and services. Over the last decade, the goal of outsourcing manufacturing has been to find the lowest-cost provider. Because manufacturing is returning to the United States, the cost of production, including commodities and labour, is expected to rise, causing inflation.

How Inflation Affects Investments

Many investors carefully evaluate how their portfolios perform in relation to inflation since inflation monitors how rapidly the prices of goods and services rise. Inflation may have an impact on the value of future returns and is thus an important factor to consider when making investment decisions.

Increased inflation, for example, would cause some asset classes exposed to fixed, long-term payment flows to underperform since the buying value of such future cash flows depreciates over time. On the other side, assets with more flexible cash flows may outperform and provide inflation protection.

The Consumer Price Index (CPI) is the most often used inflation measure. Most wealthy countries aim for an annual inflation rate of roughly 2%. Central banks have the ability to limit inflation by establishing interest rates; if prices begin to grow faster than expected, they will respond by raising base rates.

Inflation impacts various types of investments differently. Those with fixed long-term cash flows, for example, will have their buying power reduced, whereas assets with more changeable cash flows may prosper.

Cash and cash equivalent items, as well as fixed income, are often victims of greater inflation. Commodities, physical assets such as real estate or infrastructure, and some stocks have the ability to outperform in an inflationary environment.

The Effects of Inflation on Investments

When inflation rises, assets with fixed, long-term cash flows perform badly because the buying value of those future cash payments declines over time. Commodities and investments with changeable cash flows (for example, property rental income) fare better in the face of rising inflation.

Effects of Inflation on Savings

Even if you’ve put your money in a savings account with a low interest rate, inflation can eat away at your savings.

When you work, your wages should, in principle, stay up with inflation. When you live off your savings, such as in retirement, inflation reduces your purchasing power. In order to guarantee that you have enough assets to endure through your retirement years, you must consider inflation in your retirement funds.

Effects of Inflation on Bonds

Bonds and other fixed-income securities are generally at the lower end of the risk spectrum since they provide a steady income stream in the form of coupon payments and the initial investment returned at maturity.

Even yet, since bonds usually have fixed interest rates until maturity, the buying power of coupon payments decreases as inflation increases. As a result, bond prices often decline in response to rising inflation.

Effects of Inflation on Fixed Income Investments

Investors often purchase fixed-income investments such as bonds, treasuries, and CDs in order to get a consistent income stream in the form of interest payments.

However, because the interest rate on most fixed-income assets remains constant until maturity, the buying power of the interest payments falls as inflation rises. As a result, as inflation rises, bond prices tend to decline.

One reason for this is that most bonds pay fixed interest or coupon payments. Rising inflation depreciates the buying power of a bond’s future (fixed) coupon income, lowering the current value of the bond’s future fixed cash payments.

Accelerating inflation is much more damaging to longer-term bonds because it results in less buying power for cash flows received in the future.

When inflation is rising, riskier high-yield bonds often produce more income and hence have a wider cushion than their investment-grade counterparts.

Effects of Inflation on Stock Investments

Stocks have outperformed inflation over the previous 30 years, according to a study conducted by the US Bank Asset Management Group. In principle, a company’s revenues and profitability should rise in lockstep with inflation. This means that your stock’s price should grow in tandem with the overall price of consumer and producer products.

Over the last 30 years, US stocks have tended to grow in value when inflation has accelerated, while the association has not been very strong.

Larger firms have a greater association with inflation than mid-sized firms, while mid-sized firms have a stronger relationship than smaller firms. When inflation rose, the price of foreign equities in developed markets fell, and the price of emerging market stocks fell even more.

In somewhat increasing inflationary conditions, larger US company stocks may bring some advantages. However, in more severe inflationary circumstances, they are not the most successful investing option.

Effects of Inflation on Real Estate

According to a research conducted by the US Bank Asset Management Group, real assets, such as commodities and real estate, have a positive link with inflation.

Commodities have always been a reliable means for anyone looking to hedge against increasing inflation. Inflation is determined by following the prices of goods and services that typically directly include commodities, as well as items that are closely tied to commodities.

Oil and other energy-related commodities have a particularly significant correlation with inflation (see above). When inflation accelerates, industrial and precious metals prices rise as well.

Commodities, on the other hand, have significant drawbacks: they are more volatile than other asset classes, do not provide income, and have historically outperformed stocks and bonds over longer time periods.”

As it comes to real estate, property owners may frequently raise rent payments when the cost of products and services rises, which can lead to increased profits and investor payouts.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.