A quick note before we begin. For anybody interested in investing, you can contact me. My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

We have helped countless expat investments put their money into Vanguard funds and ETFs.

Before we dig into how to invest in Vanguard Index Funds in Singapore, Dubai, and beyond, we will first get to know Vanguard and the products and services it offers.

The videos below also have brief explanations:

For people living in blacklisted countries or places where investments are restricted, the following video would be useful.

Who is Vanguard?

Vanguard is an investment management firm American investor Jack Bogle founded in 1975. The company specializes in offering low-cost index funds and exchange-traded funds (ETFs) to its clients, and has grown to become among the largest investment companies globally.

Because of the unique ownership structure of the company, which is owned by the mutual funds it manages, the business is able to manage its investments in a way that is beneficial to the fund shareholders.

The company has a strong commitment to transparency and investor education, and as part of that commitment, it offers a wealth of information and resources to its customers on its website. These tools include investment planning and tracking applications, in addition to educational materials on a diverse array of investment-related topics.

Vanguard is a well-known and highly regarded investment management company that has made significant contributions to the investment industry as a whole. In particular, Vanguard has been instrumental in advancing the concept of low-cost index funds as a viable investment option for individual investors.

What are the products and services Vanguard provides?

Vanguard provides its clients with a variety of investment products, such as mutual funds, ETFs, and separately managed accounts, that are designed to help individuals and institutions invest for the long term and achieve their financial objectives through a diversified portfolio of low-cost investments.

Mutual funds

Vanguard is known for its economical index mutual funds, which are designed to track specific stock and bond market indexes. These funds offer a diversified portfolio of stocks or bonds and are managed by investment professionals. Vanguard also offers actively managed mutual funds that seek to outperform their benchmarks.

ETFs

Vanguard provides a variety of low-cost ETFs that offer exposure to various asset classes, including equities, fixed income, and commodities. ETFs and mutual funds are alike but the former trade on an exchange akin to individual stocks.

Retirement Accounts

Vanguard provides a range of retirement accounts like traditional and Roth IRAs, SEP IRAs, and solo 401(k) plans. These accounts make it possible for individuals to prepare and save for their retirement as well as possibly trim their tax liabilities.

Brokerage Services

Vanguard offers brokerage services for investors who want to buy and sell individual stocks, bonds, and other securities. Vanguard’s brokerage platform also provides access to third-party research and tools to help investors make informed investment decisions.

Financial Planning and Advice

Vanguard offers financial planning and advice services to help investors develop and implement a personalized investment strategy. These services include portfolio management, asset allocation, retirement planning, and tax planning.

Education and Research

Vanguard provides a variety of educational resources and research tools to help investors make informed investment decisions. These resources include articles, videos, calculators, and market insights from Vanguard’s investment professionals.

Institutional Services

Vanguard provides investment management services to institutional investors, e.g., endowments, foundations, and pension funds. These services include portfolio management, investment consulting, and risk management.

Are the products and services offered by Vanguard the same in Singapore and Dubai?

Vanguard offers index mutual funds and ETFs in both Singapore and Dubai. These low-cost investment options are designed to track specific stock and bond market indexes. The firm also offers investment research and educational resources to investors in both locations.

In addition, Vanguard investment management services to institutional investors in both Singapore and Dubai. These services include portfolio management, investment consulting, and risk management.

However, while the company offers retirement savings products in Singapore, such as Central Provident Fund (CPF) Investment Scheme-approved funds, it does not offer such products in Dubai.

The CPF is a mandatory savings scheme in Singapore that requires employees and employers to contribute a percentage of the employee’s salary to the employee’s CPF account, which can then be used to fund retirement, housing, and healthcare expenses.

So, the difference is most probably due to local regulations and market conditions.

The investment advisory services and investment options available in Singapore and Dubai are also likely to be affected by local market conditions and regulations. For example, Vanguard may offer different mutual funds and ETFs in Singapore compared to Dubai.

It’s important to note that the specific products and services offered by Vanguard may vary depending on the country or region in which they operate.

How can you invest in Vanguard Index Funds in Singapore, Dubai, and beyond?

I have had many questions from readers over the years, but this has been among the most common ones. Whether it is readers from Singapore, India, New Zealand, Australia, Hong Kong, Dubai, the UK or Qatar, this question has come out again and again.

How to invest in Vanguard Index Funds in Singapore

Who is Eligible?

To invest in Vanguard funds in Singapore, you need to be at least 18 years old and have a valid identification document, such as a passport or National Registration Identity Card (NRIC). There may be additional eligibility requirements depending on the investment platform you choose.

The Process

Choose an investment platform

You can invest in Vanguard funds through a brokerage account, robo-advisor, or CPF Investment Scheme.

Through a brokerage account

You can open a brokerage account with a local brokerage firm in Singapore that offers access to Vanguard funds. Some of the brokerage firms that offer access to Vanguard funds in Singapore include DBS Vickers Securities, OCBC Securities, and Phillip Securities.

Each platform has its own requirements and fees, so it’s important to do your research before choosing one.

Through a robo-advisor

Another option is to invest in Vanguard index funds through robo-advisors, which are digital platforms that create and manage investment portfolios through algorithms. Some of the robo-advisors that offer access to Vanguard funds in Singapore include StashAway, Syfe, and Endowus.

Through the CPF Investment Scheme

If you are a Singaporean or a permanent resident and have a Central Provident Fund account, you can invest in Vanguard index funds through the CPF Investment Scheme. The program allows CPF members to invest their CPF savings in approved funds.

Open an account

Once you have chosen an investment platform, you will need to open an account. This may involve providing personal information and completing some paperwork. You may also need to provide additional documentation if you are a non-resident or if you are investing through the CPF Investment Scheme.

Fund your account

After your account is set up, you will need to fund it with cash or securities. The amount you need to invest will depend on the investment platform and the minimum investment requirements of the Vanguard funds you want to invest in.

Choose your Vanguard funds

Once your account is funded, you can choose which Vanguard funds you want to invest in. There are several Vanguard index funds available in Singapore, such as the Vanguard Total Stock Market Index Fund and the Vanguard Total International Stock Index Fund.

Monitor your investments

It’s important to regularly monitor your investments to ensure they align with your investment goals and risk tolerance. You can monitor your investments through your investment platform or through Vanguard’s website.

Are there regulations and restrictions for Vanguard investments in Singapore?

Some regulations and restrictions to be aware of when investing in Vanguard funds in Singapore include:

Minimum investment requirements

Some Vanguard funds may have minimum investment requirements that you need to meet in order to invest in them.

CPF Investment Scheme limits

There are limits to how much you can invest in approved funds through the CPF Investment Scheme. The limits vary based on your age and the type of account you have.

Tax implications

It’s important to understand the tax implications of your investments and to consult a tax adviser if necessary. Luckily, there are no capital gains tax in Singapore for individuals, according to PricewaterhouseCoopers (PwC).

Overall, investing in Vanguard index funds in Singapore can be a straightforward process

What are the upsides and downsides of investing in Vanguard index funds in Singapore?

Pros

- A wide range of Vanguard index funds are available, providing investors with a diverse selection to choose from.

- The funds are relatively low-cost, with expense ratios that are generally lower than many actively managed funds.

- Singapore has a well-regulated financial industry, which can give investors confidence in the safety and reliability of their investments.

- There are no capital gains or dividend taxes in Singapore, which can help investors maximize their returns.

Cons

- Some Vanguard funds may not be available in Singapore due to regulatory restrictions.

- Investors may be subject to currency exchange risk if investing in funds denominated in a currency other than the Singapore dollar.

- As with any investment, there is always the risk of loss and potential volatility in the market.

How to invest in Vanguard Index Funds in Dubai

Eligibility Requirements

You must be at least 18 years old and in possession of a valid identification document, like a passport, in order to invest in Vanguard funds in Dubai.

There is a chance that you will be required to fulfill additional requirements depending on the particular investment platform that you go with.

What’s the process for Vanguard investments in Dubai?

The process for investing in Vanguard index funds in Dubai is indeed very similar to that in Singapore, such as opening an account and adding funds to it, selecting your specific Vanguard funds, as well as keeping tabs of your investments.

To invest in Vanguard index funds in Dubai, you’ll need to find a brokerage firm or mutual fund platform that offers access to Vanguard funds and open an account. This process may involve submitting personal information and documentation, such as your passport or visa. You can also invest through a financial adviser.

Once your account is open, you’ll need to transfer funds into it to invest in Vanguard funds. The minimum amount required to invest may vary depending on the platform and the specific funds you’re interested in.

You can start choosing which Vanguard funds to invest in after putting money into your account. Make sure to consider factors such as your investment goals, risk tolerance, and fees associated with each fund.

What about regulations and constraints in the emirate?

However, there are some differences in the regulations and restrictions that investors should be aware of, such as:

- Tax implications. Tax rules in the UAE (in which Dubai is an emirate) do not charge capital gains for citizens and residents.

- Shariah-compliant options. There also Shariah-compliant Vanguard funds available for investors who want to invest in accordance with Islamic finance principles.

- Regulatory framework. The Dubai Financial Services Authority (DFSA) sets rules and regulations for financial services firms operating in the Dubai International Financial Centre (DIFC).

What are the benefits and risks of investing in Vanguard index funds in Dubai?

Pros

- Dubai offers a range of Vanguard funds that are available to investors, including both equity and fixed income options.

- The financial industry in Dubai is well-regulated, which can provide investors with confidence in the safety and reliability of their investments.

- Many funds are available with low minimum investment requirements, making it accessible for investors with varying levels of financial resources.

- Dubai has no income or capital gains tax, which can help investors maximize their returns.

Cons

- As with Singapore, some Vanguard funds may not be available in Dubai due to regulatory restrictions.

- There may be currency exchange risk if investing in funds denominated in a currency other than the UAE dirham.

- Investors may be subject to various fees, such as platform or brokerage fees, which can impact returns.

How to Invest in Vanguard Index Funds in Other Expat Markets

There is a possibility that investing in Vanguard index funds in other expat markets will involve steps that are comparable to those in Singapore and Dubai; however, there is also a possibility that there will be some differences depending on the particular nation and the regulatory framework that is in place.

It is possible that in order to invest in Vanguard funds in certain expat markets, you will be required to meet certain residency or tax status requirements first. In order to determine whether or not you are qualified for the program, you should talk to a financial planner or the appropriate regulatory agency.

When it comes to investing in Vanguard funds, you might have access to a selection of different brokerage or investment platform options. You will want to do some research and evaluate each of these choices to find the one that meets your requirements and falls within your price range the best, taking into account where you are located.

You might be able to fund your account with a wire transfer, a bank transfer, or one of several other methods, depending on the platform you’re using and the country you’re in. You should be aware of any fees that may apply as well as any minimum investment requirements that may be imposed.

How to Invest in Vanguard Index Funds: Is it good?

Investing in Vanguard index funds can be a good choice for many investors, but whether or not it is the right choice for you depends on a variety of factors, including your individual investment goals, risk tolerance, and financial situation.

I would make two quick points on this issue. Firstly, whilst Vanguard are good funds, there are countless equivalent funds that will perform in the same way.

Vanguard was the original for this type of fund, but countless other firms (including 3-4 large ones) have close to identical index/tracker funds, with similar costs, portfolio, and performance. In fact, they’re almost identical.

Some people do engage in analysis paralysis. Whether you invest in fund A for 0.09% per year, or fund B for 0.08% per year, that tiny difference really won’t make a huge difference.

Second, Vanguard can’t take clients directly from many countries around the world. However, numerous platforms can accept Vanguard and equivalent funds as I have pointed out here.

Below is a rundown of some potential benefits and drawbacks of investing in Vanguard index funds:

Benefits

- Diversification: Vanguard index funds offer investors exposure to a diverse range of assets, which can help to spread risk and potentially reduce volatility in a portfolio.

- Low cost: Vanguard is known for offering index funds with low expense ratios, which means that investors can potentially save money on fees compared to actively managed funds.

- Passive management: The Vanguard index funds are passively managed, which means that their primary objective is to replicate the performance of a particular market index rather than competing actively with that index for superior results. In the long run, this could lead to lower fees and potentially more stable returns.

- Simplicity: Investing in index funds can be a simple and convenient way for investors to build a diversified portfolio, without needing to spend significant amounts of time researching individual stocks or funds.

Drawbacks

- Limited upside potential: Because the goal of Vanguard index funds is to replicate the performance of a particular market index, it is unlikely that these funds will outperform the market. While this can be a benefit in terms of stable returns, it also means that there is limited potential for above-average returns.

- Risks associated with the market: As is the case with any investment, there is always the possibility of suffering a loss as a result of changes in the market. While Vanguard index funds offer exposure to a diversified range of assets, they are still subject to the ups and downs of the market.

- Currency risk: If investing in Vanguard funds denominated in a currency other than your home currency, you may be subject to fluctuations in currency exchange rates which could impact your returns.

- Not suitable for all investors: While index funds can be a good choice for many investors, they may not be the right choice for those with more specific investment goals or who are looking for more control over their investments.

Investing in Vanguard index funds can be great for many investors, but it is important to carefully consider your individual circumstances and investment goals before making any decisions.

Frequently Asked Questions

This section will answer a few FAQs:

Is now a good time to invest?

- Now is always the right time to invest if you are long-term investor.

- Nobody can time markets but these lower valuations do appear to offer a great opportunity if you happen to be liquid.

- The crisis related to the 2020 pandemic, showed that many people can’t DIY invest. Not technically but emotionally. I have lost count of the number of people that have panic sold during this period.

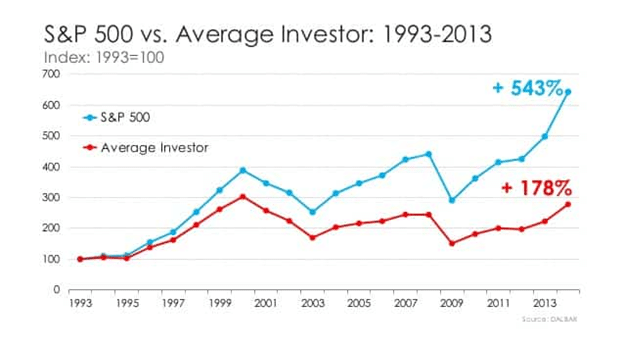

- Point 4, could help to explain these figures below. Too many people buy high (1999) and sell low (2008, 2020):

This crisis also shows, once again, the benefits of buying and holding both stock and bond indexes. Bonds don’t beat stocks long-term but usually rise during periods like 2008 and any crisis.

Is there a big difference between index-linked ETFs and index funds?

Not if you are a buy and hold investor and the costs are similar. ETFs can just be sold more quickly which isn’t always a benefit.

Does Vanguard accept directly in most countries?

Vanguard only accepts directly for a certain number of countries. In general, it is better to have access to a platform which also gives you a wider range of investment choices.

Do you offer access to Vanguard, iShares or BlackRock index funds or ETFs?

Yes, I do. Minimums are $100,000 or currency equivalent. Fees are 1%, 0.75% above $500,000 and 0.5% above $1million.

Some restrictions might be placed depending on your country of residency.

Additionally, I can set up “80:20 portfolios” which combine indexes with higher net wealth assets which you usually can’t get access to directly yourself.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.