(This article was last updated on March 8, 2023).

This article will review which bank accounts pay the world’s highest interest rates in developed and developing countries alike, and for both expats and local savers.

It will also ask if putting money in the bank is a good idea in the first place, compared to other forms of investing.

For those interested in contacting me about fixed returns investments, savings accounts or investing in general, please email me at advice@adamfayed.com or use the chat function below.

If you prefer visual content, I have summarized the article below, in video format:

This post will be updated regularly. So, a lot of the interest rates discussed below are “maximum levels” that might change in the coming weeks and months.

Table of Contents

Understanding Interest Rates

The money you deposit at a bank won’t just be left there. It will be lent to other individuals and organizations. The money will have a fee added to it when the borrowers repay it. The term “interest rate” refers to this. As you are effectively lending the bank money when you deposit, you will receive a share of the profits the bank makes.

The interest rate on all but the largest deposits will be negligible in some nations. Because of this, many people choose offshore banks where they can earn a better return on their accounts. But, it’s important to remember that higher interest rates frequently come with higher dangers.

Does Inflation Affect Interest Rates?

Inflation is the term used to describe a prolonged hike in the cost of goods plus services. A certain level of inflation is deemed normal, but elevated rates of inflation are problematic. The issue arises when people spend money instead of saving it, which raises inflation and reduces the dollar’s purchasing value. The Federal Reserve will occasionally increase interest rates in order to control inflation and promote saving.

To better appreciate the impact of a rate increase, let’s say the inflation is 3% but you may earn 5% interest by putting your funds in a savings or money market account. You might decide to save money rather than spend money in these circumstances. Interest rate less the inflation rate = your real interest rate. In this scenario, you would earn 2% on your initial investment.

While earning 5% annually in interest, the cost of goods and services rises by 3% as a result of inflation, which only leaves you with 2%. To determine how much money your deposit will actually earn, you must take inflation into account when comparing deposit interest rates.

Before starting the list, what are the risks associated with bank deposits?

The first risk is inflation risk. Inflation can erode the purchasing power of your deposits over time. If the interest rate on your deposit is lower than the rate of inflation, you could end up losing money in real terms.

Even in the US, which has been pushing up interest rates recently, the 4.75% base rate as of February barely covers inflation.

Many expats, and indeed locals, are looking for alternatives. Most of the high-interest rate alternatives are in developing countries.

This isn’t a free lunch. In fact, you often are facing numerous risks, including:

- Currency risks. Interest rates have been very high in South Africa and Brazil in recent years, but the currencies have fallen hard, especially against the USD, and even against the Euro and British Pound

- Government/economy risk. Most developing countries can’t guarantee deposits in the event of a banking crisis.

- Political risk. Compared to developed offshore jurisdictions, such as Isle of Man, Puerto Rico and some others, many developing countries regularly change rules about money movements, especially if there is a political backlash against hot money being moved in to buy property using bank accounts.

- Institution risk. This is especially the case for small local banks as opposed to Western banks operating subsidiaries in developing countries. The banks may collapse, with the government unable to bail them out.

- The relative risk of losing out. 5% may sound good, but the historical returns on the US S&P and Dow Jones have been 10% in USD terms. The volatility is just more prevalent, meaning 10% is merely a historical average. Therefore, using a deposit account for 3-6 months’ expenses makes sense, but not for long-term investment money (meaning those with 10, 15, 20 years + timeframes). The difference between getting 4%-5% and 10%, could be millions over a lifetime, even on relatively small amounts of money.

So, what countries offer some of the best rates on bank deposits?

Despite the risks mentioned in the first section, below are countries with some of the best rates on USD and local currency. I have listed a few, based on data as of December 2022 through March 2023 from Trading Economics.

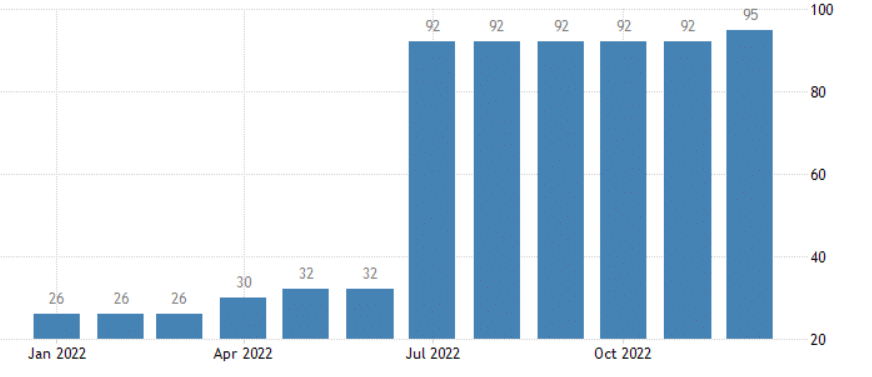

World’s Highest Interest Rates: Zimbabwe 95%

What currencies do they use?

Zimbabwe’s financial position is difficult. Further austerity measures were enforced in 2019 to restore the economy’s stability after years of neglect.

Although it is not a recognized currency globally, the Zimbabwe dollar (ZWL) is the country’s official unit of exchange. Bond Notes and RTGS (real time gross settlement) are the two forms of this currency.

- Zimbabwe Bond Notes are the actual currency notes. They serve only as a banknote to facilitate transactions and are not actually money in and of themselves. Yet there aren’t enough of them around, and the amounts are too little to be of much service. Outside of Zimbabwe, there is no value to these notes.

- On the other hand, the Zimbabwe Dollar is available electronically in the RTGS format. To pay for something, RTGS is sent from one local bank account to another. RTGS cannot be used to transfer funds to foreign bank accounts. RTGS can be used to buy US dollars, but it’s not that simple. To receive RTGS, you need a Zimbabwean bank account.

- Holders of Zimbabwean bank accounts with Zimbabwe Dollar deposits can also process payments using their debit cards by swiping them. This is applicable as long as the item being acquired is priced in Zimbabwe Dollar.

The US Dollar, however, is effectively the dominating currency because the nation’s economy is tied to the US Dollar.

Is it easy to set up a bank account?

To open a bank account in Zimbabwe, the following are usually required:

- A valid identification document such as a passport, national identity card, or driver’s license.

- Proof of residence, such as a utility bill or rental agreement.

- Proof of income, such as a pay slip or letter from your employer.

- A minimum opening deposit, which varies depending on the bank and type of account you want to open.

Once you have all the required documents and information, you can visit a bank branch to open your account. Some banks also offer online account opening options, which can be convenient if you are unable to visit a branch in person.

Certain banks also allow setting up of foreign currency accounts.

What are the pros and cons of opening a bank account in the country?

There are several pros and cons to opening a bank account in Zimbabwe. Here are some of the key factors to consider:

Pros:

- Interest rates: Some banks in Zimbabwe offer competitive interest rates on deposits and other accounts, which can be attractive to customers looking to save and earn interest on their funds.

- Access to credit: Banks in Zimbabwe offer a range of loan products to individuals and businesses, which can help customers access the credit they need to invest, grow, and achieve their financial goals.

- Government guarantees: The Reserve Bank of Zimbabwe provides guarantees on bank deposits up to a certain amount, which can provide some assurance to customers that their funds are safe and protected.

Cons:

- Fees: Some banks charge fees for various services, such as account maintenance, ATM withdrawals, and fund transfers. These fees can add up over time and reduce your savings.

- Minimum Balance Requirements: Some banks require customers to maintain a minimum balance in their account. If you fail to meet this requirement, you may be charged penalties or additional fees.

- Limited Branch Network: Some banks may have limited branch networks, making it difficult to access their services in certain areas.

- Exchange Rate Risk: Zimbabwe’s currency has been volatile in recent years, and this can affect the value of your savings if you hold your funds in Zimbabwean dollars.

- Limited Insurance Coverage: The deposit insurance scheme in Zimbabwe provides limited coverage for deposits, which may not be sufficient to cover all losses in the event of a bank failure.

World’s Highest Interest Rates: Argentina – 70.28%

What is the best currency to use in Argentina?

The official currency of Argentina is the Argentine Peso (ARS), denoted by the “$” symbol.

In addition to the official currency, some businesses in Argentina may accept US dollars or Euros, particularly in tourist areas. However, it is recommended to use the official currency for ease of transactions within the country.

Is it easy to open a bank account in Argentina?

Opening a bank account in Argentina can be a somewhat time-consuming endeavor and can involve a lot of paperwork. It may also be more difficult for foreigners who do not have a local address or who do not speak Spanish fluently.

To open a bank account in Argentina, you usually have to submit the following documents:

- Passport or national identity card (DNI)

- Proof of address (such as a utility bill)

- Tax Identification Number (known as CUIT for individuals or CUIL for employees)

You may also be required to provide additional documents depending on the bank and the type of account you are opening.

It is recommended that you contact the bank you wish to open an account with beforehand to inquire about the specific requirements and any fees that may be involved. Some banks may require you to make a minimum deposit when opening an account.

What benefits and disadvantages are associated with banking in Argentina?

Pros:

- Wide range of banking services: Argentina’s banking system offers services, such as traditional banking services like savings accounts, checking accounts, and loans, as well as investment products like mutual funds and stocks.

- Strong regulation: Argentina has a strong banking regulatory system that provides some assurance for customers that their funds are safe and protected.

- Advanced technology: Many Argentine banks have adopted advanced technology, such as mobile banking and online banking, which can make it easier for customers to manage their accounts remotely.

Cons:

- Bureaucracy: As mentioned earlier, setting up a bank account in Argentina can be a bureaucratic process that requires a lot of paperwork and may take some time.

- Economic instability: Argentina has a history of economic instability, which can affect the banking system. For example, during times of economic crisis, there may be restrictions on how much money customers can withdraw from their accounts.

- High inflation: Argentina also has a relatively high rate of inflation, which can erode the value of savings and investments over time.

- Currency fluctuations: The value of the Argentine peso can be volatile, which can impact customers who hold their savings in that currency.

- High ATM fees: Withdrawal fees from ATMs can be relatively high, at roughly 11 USD.

Do note that many locals and expats living in Argentina are trying to get money out of the country, and not the other way around!

World’s Highest Interest Rates: Venezuela 36%

What is the currency in Venezuela called?

The bolivar is the currency used in Venezuela. It bears Simon Bolivar’s name, a hero and freedom fighter from Latin America. The bolivar has undergone numerous changes during the course of its history.

Prior to being superseded by the bolivar fuente (VEF), the Venezuelan bolivar (VEB) served as the country’s official tender. Then the bolivar soberano took over the fuente. In 2021, Venezuela debuted a new currency to combat the nation’s inflation.

As a result of the recent political and economic woes in Venezuela, the country’s currency has gone through periods of insecurity and hyperinflation.

To acquire products and services, Venezuelans mainly use the US dollars, euros, crypto, and bartering.

How can you open a bank account in Venezuela?

Setting up a bank account in Venezuela can be a challenging process due to the country’s economic and political situation.

To open a bank account in Venezuela, you will typically need to provide the following documents:

- National Identification Document (Cédula) or Passport if you are a foreigner.

- Proof of income or economic activity in Venezuela.

It is important to note that due to the hyperinflation and economic instability in Venezuela, some banks may have limited or no services available to non-residents.

Moreover, the process of setting up a bank account in Venezuela can be complicated and time-consuming, and it may be more difficult for foreigners.

What are the upsides and downsides of opening a bank account in Venezuela?

Pros:

- High interest rates: Due to the country’s high inflation, some banks in Venezuela offer relatively high interest rates on deposits and other accounts.

- Banking services: Many banks in Venezuela offer a wide range of services, including savings accounts, checking accounts, loans, and credit cards.

Cons:

- Economic turmoil: Venezuela has a history of economic unsteadiness, including high inflation, currency devaluation, and shortages of basic goods, which can impact the banking system and the value of customers’ savings.

- Limited access to foreign currency: The Venezuelan government has imposed restrictions on foreign currency transactions, which can limit customers’ ability to transfer money internationally or convert bolívares into foreign currency.

- Political instability: Venezuela has experienced political uncertainty in recent years, which can impact the banking system and the ability of customers to access their funds.

- Limited banking services: Due to the economic and political situation in Venezuela, some banks may have limited services available or may be unable to process certain types of transactions.

World’s Highest Interest Rates: Uzbekistan 17.6%

What’s the official currency used?

Uzbekistan’s official currency is the Uzbekistani Som (soʻm), which has been the country’s legal tender since 1994. The so’m is issued by the Central Bank of the Republic of Uzbekistan.

The exchange rate of the Uzbekistani soʻm to the US dollar is subject to fluctuation. However, like many of the countries on this list, the so’m has had its share of huge devaluations against the USD.

In recent years, the Uzbek government has taken steps to stabilize the exchange rate and reduce inflation, including implementing market-oriented reforms and increasing foreign investment.

Soʻm is a convertible currency, meaning that it can be bought and sold on international currency markets.

In September 2017, the Uzbek government announced that it would liberalize the country’s foreign exchange regime, allowing the free conversion of the soʻm at market-determined rates. This move was part of a broader program of economic reforms aimed at attracting foreign investment and modernizing the country’s economy.

Setting up a bank account in Uzbekistan – is it simple?

Bank account opening in Uzbekistan can be a relatively straightforward process for both individuals and businesses. There are several commercial banks operating in the country, including both state-owned and private institutions, which offer a range of banking services such as savings accounts, current accounts, and loans.

To set up an account, individuals need identification documents like a passport or national ID card, as well as proof of address, and a TIN. Some banks may also require additional documentation, such as employment proof or income.

For businesses, the process of opening a bank account may be more complex, as it can involve providing company registration documents, articles of incorporation, and other legal paperwork.

The process of opening accounts for expats, and others, can be straightforward or long, depending on many factors.

What are the positives and negatives of banking in the country?

Pros:

- Stable banking system: The banking system in Uzbekistan is generally stable and well-regulated, with the National Bank of Uzbekistan serving as the central bank.

- Government support for banking sector: The Uzbekistan government has been actively promoting the growth and modernization of the banking sector through various policies and programs.

- Developing economy: Uzbekistan has been experiencing economic growth in recent years, which could potentially lead to increased investment opportunities and financial stability.

Cons:

- Limited consumer protection: While there are regulations in place to protect consumers, some customers may find that they have limited options for recourse if they encounter issues with their bank.

- Restricted options for non-Uzbek currency transactions: Certain uses of foreign currency is restricted in Uzbekistan, which could limit options for individuals or businesses that need to make transactions in non-Uzbek currency.

World’s Highest Interest Rates: Moldova 15%

What is the currency used in Moldova?

The currency of Moldova is the Moldovan Leu that was introduced in 1993, replacing the previous Soviet ruble.

One of the unique features of the Moldovan currency is that it has a polymer banknote series, which was introduced in 1999. These banknotes are made of a plastic material that is more durable than traditional paper banknotes, making them more resistant to wear and tear.

The exchange rate of the Moldovan leu can fluctuate depending on various economic factors, such as inflation rates, trade balances, and political developments. The Central Bank of the Republic of Moldova is responsible for managing the country’s monetary policy and regulating the banking system.

While the Moldovan leu is the official currency of the country, some transactions may also be conducted in other currencies, such as the US dollar or the euro. Nevertheless, it is important to note that the use of foreign currencies in Moldova is subject to certain restrictions and regulations.

How is banking?

Banking in Moldova can be both easy and complex, depending on the individual’s banking needs and level of experience. The banking sector in Moldova is relatively well-developed, with a range of local and international banks operating in the country.

For those who are new to banking in Moldova, opening a bank account can be a straightforward process. Many banks offer a range of account options to suit different needs and requirements, and the account opening process usually involves handing over identification documents. There could be additional paperwork to finalize.

However, for more complex banking needs, such as obtaining a loan or conducting international transactions, the process may be more involved. Some banks may require additional documentation and may have sterner qualifications for loan eligibility, while international transactions may be subject to currency exchange restrictions and fees.

Additionally, while many banks in Moldova offer online banking services, the availability and quality of these services can vary. Some banks may have more limited online banking options, while others may offer more advanced services such as mobile banking apps.

It is also worth noting that while the banking sector in Moldova is generally well-regulated, there have been some concerns about corruption and fraudulent activity in the sector. As such, it is important for individuals to carefully review their account statements and to report any suspicious activity to their bank or the relevant authorities.

When deciding whether or not to create a bank account in Moldova, what factors should you consider?

Pros:

- Range of banking options: There are several local and international banks operating in Moldova, providing a range of banking options for individuals and businesses.

- Competitive interest rates: Many banks in Moldova offer competitive interest rates on deposits, which could be beneficial for those looking to save money.

- Access to online banking: Most banks in Moldova offer online banking services, allowing customers to manage their accounts and conduct transactions from anywhere with internet access.

Cons:

- Limited foreign currency options: The use of foreign currency is restricted in Moldova, which could limit individuals or businesses that need other currencies for their dealings.

- Potential for corruption and fraud: There have been issues of corruption and unlawful behavior in Moldova’s banking industry.

- Currency exchange restrictions: Transactions involving foreign currencies may be subject to restrictions and fees, which could make them more costly or complicated.

- Limited English-language support: While major banks may offer English-language support, not all banking services may be available in English, which could be challenging for non-Moldovan speakers.

World’s Highest Interest Rates: Madagascar 13%

What is the currency in Madagascar?

Madagascar’s official currency is the Malagasy Ariary (MGA), which replaced the Malagasy Franc in 2005.

The Euro is the most generally recognized foreign currency, however US Dollars and British Pounds can also be exchanged with no difficulty. Moreover, banks and foreign exchange bureaus are available in major cities, making currency exchange relatively straightforward for visitors or those engaging in international transactions.

How hard is it to get a bank account in Madagascar?

Securing a bank account in Madagascar is accessible for both residents and non-residents. Many local and international banks operate within the country, offering a range of account types and services. The account opening process typically involves providing identification details plus completing the necessary paperwork.

However, some banks may have stricter requirements for non-residents or for those seeking to open certain types of accounts. Additionally, some language barriers may exist for those who do not speak French or Malagasy, as these are the official languages of the country.

In what ways could having a bank account in Madagascar could be for and against you?

Pros:

- Favorable interest rates: Some banks in Madagascar offer good interest rates on savings accounts and deposits, which can be helpful to save money.

- Availability of mobile and online banking: Many banks in Madagascar offer mobile and online banking services, providing easy access to account information and enabling transactions to be made from anywhere with internet access.

- Availability of foreign currency exchange: Major currencies such as US dollars, euros, and British pounds can be easily exchanged throughout the country.

Cons:

- Language barriers: Malagasy and French are the official languages of Madagascar, and some banking services may only be available in these languages, making it challenging for non-French or Malagasy speakers to navigate the banking system.

- Limited ATM availability: While ATMs are available in major cities, they may be less common in rural areas, which can make accessing cash more challenging.

World’s Highest Interest Rates: Hungary 12.5%

What is Hungary’s currency?

The official currency of Hungary is the Hungarian Forint (HUF), which was introduced in 1946 after the Second World War. The currency is managed by the National Bank of Hungary, which is responsible for maintaining the stability of the currency.

Does Hungary have simple bank account opening procedures?

Creating an account in Hungary is generally a straightforward process, with simple bank requirements and procedures in place. Most banks offer online account opening services, making it easy to open an account remotely.

Individuals must provide some basic personal information, such as their name, date of birth, and contact details. Non-residents may also be required to provide proof of their residency status, such as a visa or work permit.

In some cases, a minimum deposit may be required to open an account, although this varies between banks and account types. Some banks may also require proof of income, such as a pay slip or tax return.

In recent years, the use of cashless payment methods has become increasingly popular in Hungary, with card payments and mobile banking gaining popularity. Contactless payments are also widely accepted, particularly in urban areas and tourist destinations.

Is it a good idea to get a bank account in Hungary?

Pros:

- Hungary has a stable banking system that is regulated by the National Bank of Hungary, which helps to ensure the safety and security of deposited funds.

- The country has a well-developed banking infrastructure, with a range of banking services and products available to meet the needs of individuals and businesses.

- Online banking and cashless payment methods are becoming increasingly popular in Hungary, making banking more convenient and accessible for residents and visitors.

- Hungary is a member of the European Union, which means that EU regulations and protections for consumers and investors apply to the banking sector in Hungary.

Cons:

- Some banking fees and charges in Hungary can be relatively high, particularly for non-residents or individuals with lower account balances.

- Instances of financial fraud and scams have been reported in Hungary, highlighting the importance of monitoring account activity and reporting suspicious transactions.

- While the banking system in Hungary is generally stable, economic and political instability in the region can sometimes affect the stability of the Hungarian Forint and the banking sector as a whole.

- Foreign currency transactions in Hungary can sometimes be subject to higher fees and less favorable exchange rates compared to domestic currency transactions.

World’s Highest Interest Rates: Georgia 12.45%

What currency does Georgia use?

The currency of Georgia is the Georgian Lari. It is the only legal tender in the country and has been in circulation since 1995.

The Lari is a relatively stable currency, and its exchange rate is managed by the National Bank of Georgia. The central bank monitors and regulates the exchange rate to ensure stability in the foreign exchange market.

If you’re thinking about opening a bank account in Georgia, what should you know?

Georgia remains as one of the easiest places in the world to open up bank accounts.

Both residents and non-residents can create a bank account in the country, which offers a variety of account options to cater to different needs.

Many banks in Georgia offer online account opening options, which can be a convenient and efficient way to open an account. However, some banks may require an in-person visit to a branch, particularly for non-residents.

The use of cashless payments, such as credit and debit cards, is becoming increasingly popular in Georgia, with most businesses and shops accepting major international cards.

Overall, the process of opening a bank account in Georgia is generally uncomplicated, and banks are normally receptive to serving foreign customers. You may even be able to open a bank account in as little as 20 minutes.

As the above lists shows, it isn’t easy to find a country to deposit money which is safe, straightforward and convenient, and with good interest rates.

There are many benefits to offshore banking, especially for expats, but it is best if banking is used for transactions and short-term cash flow, compared to low-cost investing in index funds and other investments.

Frequently Asked Questions

This section will look at some frequently asked questions (FAQs)

Are offshore bank accounts legal?

It is surprising that in the year 2020, some people still have a “Wolf of Wall Street” view of offshore – secret and dodgy.

The reality is, we now live in a world of more open banking information and banking outside your country of residency is not only legal, it is normal.

Offshore doesn’t just mean traditional offshore. If you are a British expat in Dubai, and you still bank in the UK, you are banking offshore.

So, we are miles away from the kinds of scenes we saw in the 1980s popularized in movies, where people would literally strap money to themselves to evade taxes!

What are the alternatives to bank deposits?

Fixed return and long-term oriented investments are two options, which are typically safer than investing in frontier markets banks.

Is Georgia the easiest place in the world to open up a bank account still so far in 2023?

Probably. TBC Bank and others are very efficient assuming you just want individual banking and can actually visit the country. If you can’t travel to open up an account, there are better options out there.

Company accounts will also require more due diligence.

How about other countries?

Whilst most countries might not as liberal as Georgia, few make it difficult if you are actually a resident.

Take Cambodia as one example of many. To open up an account, you just need your passport, proof of long-term residency, a certificate of employment and so on. All these are easy to get if you are working in the country.

How about options in low-interest environments?

Most of the highest interest rates are in emerging Europe, including Moldova, Hungary, and Georgia.

In terms of traditional Europe, almost all countries have close to 0% interest rates, with banks offering little more.

Is it a mistake to invest in a bank?

Having a small amount of liquid cash is fine, but remember a few points:

- If putting money in the bank was such a good idea, why isn’t George Soros and Warren Buffett rushing to put their money into these institutions?

- If it was such a good deal, how are the banks making a profit from your money? After all, banks are different to investment platforms – they actually use depositors’ money to lend to others.

- Even if it is safe and secure, markets in the long term have always beaten cash.

The video below looks at a simple question, why invest if you can get 6% or even 12% in a bank?

Do you offer banking services?

I don’t offer banking as a standalone product but I do help existing clients who want banking plus investments or second residencies.

What are the main benefits of offshore banking?

It gives you diversification and can be part of a second residency or wider wealth management solution. For example, some second residency programs which allow you to pay less tax, like in Malaysia, require you to open up a local bank account.

International banking can provide greater privacy and confidentiality compared to domestic banking, as offshore banks are subject to strict confidentiality laws and regulations. Moreover, it can provide access to a wider range of investment options, such as stocks, bonds, and mutual funds, that may not be available in your home country.

For some, foreign banking can offer asset protection from legal judgments and creditors in their home country.

However, it’s important to consider the potential risks and legal considerations associated with offshore banking, such as regulatory compliance, currency exchange risks, and the potential for fraud or other illegal activities.

Is it hard to open offshore bank accounts if you live in certain countries?

Yes. As a generalization, if you live in Iran, Iraq, Somalia and even Myanmar, you are more likely to be rejected by banks.

I have had countless clients living in Myanmar, and many of the traditional Isle of Man banks will not accept Myanmar residents as customer.

In fact, many banks make it clear that that they cannot accept such payment even if you aren’t a resident in Myanmar, but you are gaining consulting income from inside the country.

Even international online banks, which tend to be more progressive (such as Revolut) have been known to close down accounts, after receiving payments from locations such as Myanmar.

As you can imagine, for residents in US-sanctioned countries, such as Iran, the situation is more difficult.

In this situation, some of the “fly and buy” options such as Georgia, can be a good option. That doesn’t mean that you should assume that banks in Georgia are always lenient. You should always ask them about rules and regulations before you fly and buy.

However, they tend to be better options than the more traditional banks in the first world.

In general, it is likely to become progressively more difficult to create bank accounts as a non-resident. Even in countries like Hong Kong, it used to be very easy to secure offshore bank accounts. Those days are gone.

Is it harder for Americans to create bank accounts?

In most countries, it is now much more difficult for Americans to open bank accounts due to the aforementioned tax changes by the IRS.

This is especially the case for American residents – “flying and buying” gets more difficult if you have an American tax number and live in the US.

If you are actually a resident of Georgia or the other countries on this list, the situation is much easier. Some financial institutions will still shy away from taking American clients though – especially for investment accounts.

Bottom Line

Banking offshore is fine, as is having some money in the bank for emergencies if you are a local.

The best interest rates in the world are found in emerging markets, which have higher risks and interest.

Getting 6% in the bank sounds good, until you realize 5 years later that the currency has fallen hard against the USD, Euro or Pound, and local inflation is out of control. Or for that matter, you have been stuck with a bank account paying 3%-4% in USD terms, when the US Stock Markets have averaged 10% historically.

Better to use a bank for banking and investment platforms for investing. Ultimately if banking for money was such a good idea, Soros, Buffett and all the institutional money would be moving their cash to emerging market banks!

In general, banking offshore, even for offshore current accounts paying 0%, is also getting more difficult. So, opening an account sooner rather than later is always prudent.

Due to ongoing risks in the banking system in emerging markets, it is usually safer (if you are long term) to invest in markets at lower valuation points, provided you don’t panic during any falls.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.

Further Reading

What kind of investment options are available for American expats now the IRS has gotten more restrictive? The following article focuses on American expats in particular – what good investment options exist these days for those living overseas?

What are the best investing options for American expats in 2023?