(This article was last updated on March 7, 2023.)

How to retire in the Philippines as a foreigner, you ask? Well, this article will answer your question and give you additional information to help you settle in your new target home.

If you want to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

With over 7,100 islands, retirees will surely find the best city for them in the Philippines. Whether they prefer the bustling streets of city life, a more slow-paced lifestyle near the beach, or a relaxing view from high in the mountains, the country offers a unique experience for retirement. Even better, a dollar will go a long way because of the affordable cost of living.

Knowing how to retire in the Philippines starts with residency and visa requirements, so let’s get into that first.

Table of Contents

How do you become a resident if you retire in the Philippines?

The Philippines has a specific government corporation, the Philippine Retirement Authority (PRA), for retirees. The institution is mandated to attract foreign nationals to retire in the Philippines. They do so by creating globally competitive programs to provide a suitable social and economic environment for such purposes.

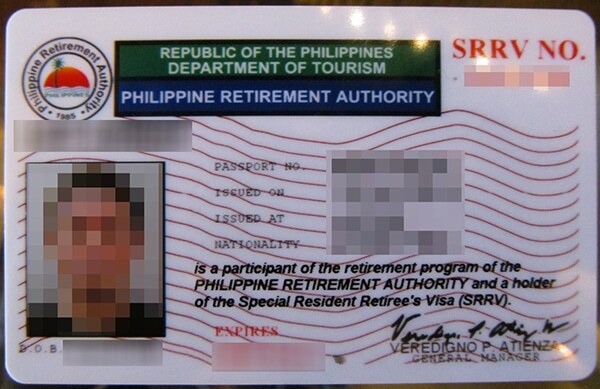

To become a resident of the Philippines, retiring expats can apply for the Special Resident Retiree’s Visa (SRRV). It is a special non-immigrant visa granted to foreign nationals who are interested in retiring in the country or making it an investment destination.

Who can apply for a Special Resident Retiree’s Visa?

The principal applicant for an SRRV should be of foreign nationality or a former Filipino citizen who is at least 50 years of age.

Principal applicants who are married and have children shouldn’t worry about making the big move on their own. There are also visa options for their loved ones to live in the Philippines. But it does come with certain conditions.

Specifically, only a spouse who is legally married to the principal applicant will be recognized as a dependent. For children, they must be legitimate or legally adopted, of single civil status, and less than 21 years of age, to be able to come with you as you retire in the Philippines.

What are the Requirements to Apply for a Special Resident Retiree’s Visa?

If interested in applying for such a visa, you should prepare the following:

- Original valid passport

- Completely filled out visa application form

- Original valid medical clearance

- Original valid police clearance

- Eight 2”x2” photos

- SRR visa deposit, remitted to an account in the Philippines

- Marriage certificate for a dependent spouse

- Birth certificate for a dependent child

The passport of the applicant should have a non-expired Temporary Visitor’s Visa.

Regarding the police clearance, it must be obtained from the country of origin. If already residing in the Philippines for more than 30 days, the applicant should additionally obtain an NBI Clearance. An application for an NBI Clearance can be done online. Regardless of where the police clearance was obtained, it should not be older than 6 months.

Similarly, the validity of the medical clearance only lasts until 6 months from when it was issued.

Documents not obtained within the Philippines must be translated into the English language. There are also instances where the documents must be verified by the Philippine Embassy where the applicant resides.

The specific amount of the SRR visa deposit depends on the chosen SRR visa option. Each one will be further discussed in the next few sections.

How much are the application fees for a Special Resident Retiree’s Visa?

Those who want to retire in the Philippines have to make a one-time payment when applying for an SRRV.

The principal applicant must pay a fee of $1,400.00 USD, while the dependent applicant has to pay $300.00 USD.

However, an annual fee is also charged for its renewal. It costs $360.00 USD for the principal and two dependents.

What are the different SRR Visa Options?

There are different options available for the SRRV, depending on the applicant’s health status and previous occupation.

Each option has a specific SRR visa deposit to be made. But regardless of the option applied for, the SRR visa deposit covers the principal and two dependents. Any more than that will require an SRR visa deposit amounting to $15,000 USD per additional dependent.

SRRV Smile

Retirees who are active and healthy can apply for the SRRV Smile. The SRR visa deposit for this option is $20,000.00 USD.

SRRV Classic

Retirees who are active and healthy but want to invest in real estate can opt for the SRRV Classic. Their SRR visa deposit can be used to buy a unit in a condominium or lease a house and lot for the long term.

For applicants who are 50 years of age or older, an SRR visa deposit of $10,000.00 USD is required for those who have a pension. The pension should be at least $800 USD for a single applicant or $1,000 USD for married couples.

Applicants who do not have a pension are required to have an SRR visa deposit of $20,000.00 USD.

Furthermore, the value of the property being purchased or leased should be at least $50,000.00 USD.

SRRV Human Touch

Retirees who already need medical care can apply for an SRRV Human Touch. The applicant should have a monthly pension of $1,500.00 at the minimum and a health insurance policy recognized in the Philippines.

The SRR visa deposit is $10,000.00 USD.

SRRV Courtesy

Those who have retired after working at international organizations recognized by the Department of Foreign Affairs (DFA) can apply for an SRRV Courtesy. An SRRV visa deposit of $1,500 USD must be made.

SRRV Expanded Courtesy

Retired Armed Force officers from countries that have military ties or an agreement with the Philippines can apply for the SRRV Expanded Courtesy. To do so, they must have a pension of at least $1,000.00 USD per month. Also, an SRR visa deposit of $1,500.00 USD is required.

Furthermore, the SRR visa deposit must be credited to the partner banks of the PRA. There are 7 different institutions accredited by the PRA for this purpose. These include the Bank of Commerce, Banco de Oro (BDO), Development Bank of the Philippines (DBP), KEB Hana Bank, Philippine National Bank (PNB), Shinhan Bank, and Union Bank.

What are the Benefits of the Special Resident Retiree’s Visa?

Applicants who are granted an SRRV are set for life. There will be no need to renew it every so often. This is a lifetime visa that entitles holders to work, study, and invest in the country for an indefinite period.

At the same time, traveling to and from the Philippines can be as easy as booking a flight. This is because multiple entries and exits are allowed. Holders of the SRRV do not need to comply with the requirements of the Bureau of Immigration, such as the ACR I-Card.

Moreover, there are tax exemptions in certain situations. Customs duties and taxes for one-time importing of household goods and personal effects worth $7,000.00 USD or less do not need to be paid. Pensions and annuities are also exempt from being taxed. Lastly, travel taxes are not charged to retirees who have been away from the Philippines for more than a year.

Those who have obtained an SRRV will be warmly welcomed by the PRA through their “Greet and Assist Program.” Once you step foot at the airport, representatives will be ready to guide you as you maneuver through the immigration process.

However, it doesn’t end when you leave the airport. The PRA is also active in continuously providing the necessary support to expats retiring in the Philippines. They have services to assist retirees in obtaining government-issued documents. These include, but are not limited to, a driver’s license, NBI clearance, and an Alien Employment Permit (AEP).

Lastly, holders of the SRRV are covered by the national health insurance program, the Philippine Health Insurance Corporation (PhilHealth). This provides them with financial protection from costs related to availing medical services.

How is the Philippine weather?

The weather in the Philippines is generally hot and humid throughout the year. The country has a tropical climate, with dry season and rainy season.

The dry season in the country runs from December to May, and it is characterized by hot and humid weather with little to no rainfall. This season is the peak tourist season in the country. It is also a popular time for outdoor activities such as beach-going, hiking, and sightseeing.

The rainy season runs from June to November, and it is characterized by heavy rainfall and occasional typhoons or tropical storms. The weather during this time can be unpredictable, with some days being sunny and others being rainy or stormy. The rainy season can make travel and outdoor activities more challenging, but it can also provide opportunities for beautiful scenery and lush green landscapes.

It’s worth noting that the weather can vary across different regions of the Philippines, with some areas being more prone to typhoons or experiencing more rainfall than others. It’s always a good idea to check the weather forecast and prepare accordingly before you retire in the Philippines.

Are expats safe to retire in the Philippines?

The Philippines is generally considered a safe country for travelers and expats. In fact, it has a large expat community in certain areas. But like any country, there are some safety concerns to be aware of.

One of the main safety concerns in the Philippines is crime. Petty crime such as pick-pocketing and theft can occur in crowded areas such as markets and public transportation, and more serious crimes such as robbery and kidnapping can occur in some areas.

Another safety concern in the Philippines is natural disasters, as the country is prone to natural disasters due to its location in the Pacific Ring of Fire, where several tectonic plates meet, and the country’s location in the Western Pacific typhoon belt. Natural disasters that can occur in the Philippines include typhoons, earthquakes, volcanic eruptions, landslides, and flooding.

Typhoons are the most common and most destructive natural disasters in the Philippines, particularly during the rainy season from June to November. These storms can cause strong winds, heavy rain, storm surges, and flooding, which can result in significant damage to infrastructure and property, as well as loss of life.

Landslides and flooding are extensive during the rainy season, particularly in areas with steep terrain or poor drainage systems, such as Metro Manila and other provinces.

Earthquakes are also a common natural disaster in the Philippines due to its location. Meanwhile, volcanic eruptions are a possibility in the nation, which has several active volcanoes.

Finally, there have been occasional incidents of terrorism in the Philippines, particularly in the southern part of the country. The Philippine government has made efforts to combat terrorism, and the likelihood of a tourist or expat being affected by terrorism is low. However, it’s still important to remain vigilant and follow advice from local authorities.

Are expats allowed to own property as they retire in the Philippines?

According to the real estate laws of the Philippines, foreign nationals are not allowed outright ownership of real property. Only Filipinos, former Filipino citizens, and corporations that are majorly owned by Filipinos can own land, buildings, condominiums, and townhouse properties.

However, there is still some leeway for foreign nationals to have ownership of real estate. Specifically, they may purchase condominium units given that foreign nationals do not own more than 40% of the units in the property.

At the same time, foreigners are permitted to own townhouses but not the land on which they are built. Expats are allowed to own buildings or structures on leased land for a period of up to 50 years, with an option to renew for an additional 25 years.

Because of this, it may be easier to rent property. There are different options, ranging from expensive to budget-friendly apartments across the country. The cost would greatly depend on the location and size of the property.

Are there any exclusions to the limitations placed on expats acquiring land in the country?

The 1987 Philippine Constitution restricts the acquisition of private lands by foreigners, but there are some exceptions:

- Inheritance – Foreigners can inherit land from their Filipino ancestors, subject to certain limitations.

- Former Natural-born Filipinos – Foreigners who were natural-born Filipinos can acquire land, subject to certain conditions.

- Acquisition through a Corporation – A foreign corporation may acquire land in the Philippines, subject to certain conditions, such as the extent of foreign ownership of the corporation and the purpose of the acquisition.

- Republic Act No. 9225, also known as the Citizenship Retention and Re-acquisition Act of 2003, provides certain exceptions too. It stipulates that a former natural-born Filipino citizen who has acquired foreign citizenship may still own private land in the Philippines, subject to the limitations provided by law. This means that if a person who was born in the Philippines but later acquired foreign citizenship decides to re-acquire Philippine citizenship under RA 9225, they may still own land in the Philippines as a Philippine citizen.

What’s the process of acquiring dual citizenship in the Philippines?

If you are currently residing in the country, you should submit a request to the Bureau of Immigration (BI) asking for the revocation of your alien registration certificate as well as the provision of an identification certificate in accordance with RA 9225.

If you are abroad and are not registered with the BI, you must submit the said petition to the closest consulate or embassy.

What are the necessary requirements?

- Completed application form for dual citizenship

- Photocopy of your foreign passport

- Photocopy of your birth certificate

- Photocopy of your Philippine passport or any other proof of Philippine citizenship

- Proof of payment of application fee

Another way former Filipinos can acquire land aside from the Dual Citizen Law is through

Batas Pambansa (BP) 185 and RA 8179, with certain restrictions and limitations as outlined below:

Residential Use

- purchase of a maximum of 1,000 square meters of land in the city or a maximum of one hectare of land in a rural area, both for residential purpose

Business/Commercial Use

- procurement of a maximum of 5,000 square meters of land in an urban area or a maximum of three hectares of agricultural land

How is Healthcare in the Philippines?

Healthcare in the Philippines is a mix of public and private healthcare systems. The public healthcare system is managed by the government, and the private healthcare system is provided by private hospitals and clinics.

The public healthcare system in the Philippines is supposedly funded by the government, and services are provided to citizens at little to no cost. However, the quality of care in public hospitals and clinics can vary. Many complain about long waiting times, shortages of medical supplies and staff, as well as poor services overall.

In recent years, the Philippine government has taken steps to improve the healthcare system, such as increasing healthcare funding and expanding health insurance coverage. The Philippine Health Insurance Corporation (PhilHealth) is the government-owned health insurance provider, and it covers a significant portion of healthcare expenses for both public and private healthcare services.

However, if you plan to retire in the Philippines, you should know that one of the major controversies in the healthcare system is the lack of accessibility, particularly for those living in rural areas or low-income communities. Many people do not have access even to basic healthcare services.

Moreover, there have been allegations of corruption within the healthcare system, including bribery and kickbacks involving pharmaceutical companies and medical professionals.

Is private medical care available?

The private healthcare system in the Philippines is generally of a higher quality and more reliable than the public system. Private hospitals and clinics are generally well-equipped with modern facilities and equipment, and the medical staff are often highly trained and experienced.

There are many hospitals in the country that offer quality healthcare on par with international standards. But it is important to note that most of them are located in major cities, such as Manila, Dumaguete, and Cebu.

Note that private healthcare can be expensive and not everyone can afford the costs associated with it, so you should prepare before you retire in the Philippines.

How are expats’ access to medical care during their retirement in the Philippines?

While the SRRV entitles the holder to membership in the national health insurance program of the country, the amount covered by PhilHealth may not always be sufficient to pay for medical expenses, depending on your condition. Because of this, obtaining private health insurance may be reasonable to avoid high out-of-pocket expenditures for health.

Of course, healthcare is more affordable in the Philippines if you compare it to other countries like the US. Consultations with a general physician often cost 500 pesos (9 USD) in provinces and 800 pesos (14.5 USD) in Manila, while it costs over 1,000 pesos (18.12 USD) for a consultation with a specialist.

Are expats taxed on their income when they retire in the Philippines?

Foreign retirees who receive income from sources within the Philippines, such as pension or social security benefits, are generally subject to Philippine income tax. The Philippine tax system operates on a progressive tax rate, which means that the tax rate increases as income increases.

During the 2023 tax year, a foreign employee’s annual social tax contribution is worth up to 35,400 pesos. Such payment is comprised of payments into the Philippine Health Insurance Corporation (PHIC) and the Social Security System (SSS). Expats who are employed in the country are not mandated to pay into the Home Development Mutual Fund (HDMF).

Expats who have no resident status in the country are levied on their capital gains generated locally. Specifically, the rates are 0.6% of the gross selling price of stock exchange-listed and traded shares; 15% of the net gains for unlisted shares; and 6% of an offloaded property’s gross sales price or fair market value, whichever is higher.

The are also taxed on income from investments that are generated locally, including interest, dividends, and royalties. The levy is withheld at a respective rate of 20% or 25% for those with a business/involved in trading in the country and those who are not.

What about for Special Resident Retiree’s Visa holders?

Holders of the SRRV are offered several benefits, including tax exemptions on their pension and other retirement benefits. Retirees who hold an SRRV are exempt from paying tax on their foreign-sourced income, including pensions, annuities, and investment income.

Expat retirees who are not eligible for the SRRV are subject to Philippine personal income tax, which ranges from 0% to 35% depending on their income level.

The Philippines also has tax treaties with several countries, which can provide relief from double taxation for foreign retirees who receive income from both the Philippines and their home country.

Can you get a driver’s license once you retire in the Philippines?

In the Philippines, the Land Transportation Office (LTO) is the government agency responsible for issuing and regulating driver’s licenses. The specific requirements for obtaining a driver’s license can vary depending on the type of license, as well as the age, residency status, and other factors of the applicant.

For expat retirees, the eligibility criteria for obtaining a driver’s license in the Philippines may include having a valid passport and a special resident retiree’s visa (SRRV) or other appropriate immigration documents.

In addition to these documents, applicants may also need to pass a medical examination, a written test, and a practical driving test. The written test typically covers topics such as traffic rules, signs, and safety guidelines, while the practical test evaluates the applicant’s ability to operate a vehicle safely in various traffic situations.

It is worth noting that the process for obtaining a driver’s license in the Philippines can be somewhat complex and may require some patience and persistence, particularly for expat retirees who are not familiar with the local language and customs. However, with the right documentation and preparation, it is generally possible to obtain a driver’s license in the country as an expat retiree.

How much do you need for a comfortable retirement in the Philippines?

An individual can subsist on 28,124 pesos or 1,521 USD on average for a month of living in the country. Meanwhile, a family with four members need 95,913 pesos per month to live comfortably here. Both figures are exclusive of rent, according to Numbeo.

200 pesos is the estimated price of a meal at a low-priced establishment in the nation, whereas 1,200 pesos might be the cost of a three-course meal for two at a more expensive establishment.

Monthly rentals inside the country’s central city will set you back roughly 18,396 pesos per month on average. If you’re looking for cheaper rent, head outside the city center. There the average fee per month is about 10,415 pesos.

For per-square-meter acquisitions, an apartment within and outside the central city can cost about 133,235 pesos and roughly 72,858 pesos, respectively.

Such prices will generally depend on the exact place you’re retiring in the Philippines. There are cities that are more expensive than others, so knowing which places could offer you more discount in terms of living costs will be of great help.

Do note that the general prices of goods and services have surged. There could be other Asian countries that could offer more affordable living costs. However, if you’re just comparing the country with the US or European nations, then your money can really go a long way.

How to Retire in the Philippines: Final Thoughts

If you really wish to retire in the Philippines, it can easily be done by applying for an SRRV. Though it comes with a deposit, being able to live in a relatively affordable country can make up for it. Just take note of the negatives that come with living in the country. If you think you can retire in the Philippines even with such disadvantages mentioned, then enjoy life inside and outside of the city without digging a hole through your retirement fund.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.