Best Halal ETFs To Invest In

If you have any questions or want to invest as an expat or high-net-worth individual, you can email me (advice@adamfayed.com) or use these contact options.

That includes if you are interested in halal ETFs and shariah-compliant fixed-return options.

Table of Contents

Introduction

In this article, we will cover the best halal ETFs to invest in.

Exchange-Traded Funds (ETFs) offer simple access to a specified market sector. Buying ETFs is frequently simpler and quicker for today’s time-pressed investors than analyzing each firm in a certain target category.

Additionally, investors may diversify into a basket of hundreds of equities with just one ETF at a considerably cheaper cost than they would by purchasing index funds.

ETFs might be seen as lower-risk investments than individual stocks even though they provide equal trading freedom to equities. This is because ETFs often include a larger number of component assets, which tends to make them less volatile.

Let’s take a close look at the many ETFs that cater to investors who are halal-conscious in light of the many advantages of investing in ETFs.

Here are the best halal ETFs to invest in.

Understanding Shariah-Compliant Investment Principles

When exploring Halal ETFs to invest in, it’s crucial to grasp the foundational Shariah-compliant investment principles. These principles are not only a guideline but also a reflection of ethical and moral values in financial dealings.

The Essence of Halal Investing

Halal investing signifies aligning investments with Islamic principles. It transcends the mere avoidance of interest (riba) and extends to shunning prohibited industries like alcohol, gambling, and pork products. For an investment to qualify as Halal, it must meet these stringent criteria.

This ensures that the Halal ETFs to invest in are not only financially sound but also ethically aligned.

Key Principles Guiding Halal Investments

Several core principles underpin Halal investing. First, the prohibition of interest is paramount. In Islamic finance, earning or paying interest is considered exploitative and unjust. This principle significantly influences the type of financial instruments included in Halal ETFs to invest in, as they must avoid interest-bearing securities.

Second, investing in businesses engaged in Haram (forbidden) activities is strictly off-limits. This includes industries like alcohol production, gambling, and those dealing with pork products. Therefore, Halal ETFs to invest in must meticulously screen and exclude companies involved in these sectors.

Charity and Social Responsibility in Halal Investing

A unique aspect of Halal investing is the emphasis on charity and social responsibility. Muslims are encouraged to fulfill Zakat (charity obligations), making Halal investing a vehicle for both financial growth and moral responsibility.

By choosing Halal ETFs to invest in, investors can support initiatives that benefit society and contribute positively to the community.

Risk Management in Shariah-Compliant Investing

In Halal investing, adhering to risk and debt parameters is crucial. Islamic law discourages excessive risk and speculation, advocating for a conservative investment approach. Halal ETFs to invest in, therefore, should align with these principles, avoiding high leverage and speculative practices.

The Growing Landscape of Halal ETFs

As the financial world evolves with technological innovation and shifting geopolitics, the landscape of Halal ETFs to invest in has expanded, offering more options than ever before.

These ETFs are tailored to include Shariah-compliant stocks, providing a diversified investment vehicle that aligns with Islamic principles. The benefits of investing in Halal ETFs are multifaceted, including lower fees, tax efficiency, and adherence to ethical standards.

Aligning Investments with Faith-Based Principles

For Muslim investors, aligning financial strategies with faith-based principles adds a layer of complexity to investment decisions. Halal ETFs to invest in provide a solution by offering a well-coordinated investment strategy that achieves financial objectives within the boundaries of Islamic law.

This strategy encompasses asset allocation, risk management, and ethical investing, ensuring that investments grow while adhering to religious guidelines.

Are All ETFs Halal?

This is determined by the composition of the fund. The simplest approach to determine this is to seek ETFs that have been recognized as Sharia-compliant by Muslim authorities. Otherwise, you’d have to make a manual check.

When doing a manual review, you must first ensure that the ETF genuinely owns the underlying assets. ETFs that use derivative instruments to simulate the same impact is not permitted to be invested in.

The next step is to identify if every business or piece of property in a fund adheres to halal standards. If that is the case, then the entire ETF is halal.

The ETF is still permissible to invest in provided it has fewer than 5% of non-compliant firms or assets, but you need donate that portion of your gains to charity in order to make sure they are pure.

Manually screening a stocks and shares ETF is actually fairly challenging for the investor. This is so because most ETFs contain anywhere from 30 to hundreds of distinct active holdings.

Sticking to the approved halal ETFs may be the best course of action for this reason. For the time being, at least, until a screening procedure is more quickly automated.

What Is A Halal ETF?

Halal ETFs function similarly to regular ETFs. Halal exchange-traded funds (ETFs) follow an underlying asset through a portfolio of assets. Halal ETFs are different since they abide with Islamic laws.

They often follow an Islamic benchmark index, which is made up of businesses that shouldn’t engage in any activities that Islam forbids, such as gambling (maisir), ambiguity (gharar), and interest-based lending (riba).

Finally, a committee that has been created to handle halal ETFs constantly examines the ETF to verify that it strictly adheres to Islamic standards.

The Role of Halal ETFs in Diversifying Investment Portfolios

Understanding Halal ETFs in the Global Investment Landscape

In 2023, Halal ETFs have emerged as one of the best halal investments. These funds are meticulously structured to adhere to Islamic law, which prohibits investing in industries such as gambling, alcohol, tobacco, and interest-based transactions.

Halal ETFs are designed to include only Shariah-compliant stocks, offering a diversified investment vehicle that aligns with Islamic principles.

The Benefits of Diversification with Halal ETFs

The primary advantage of Halal ETFs is their ability to diversify investments across various asset classes while still adhering to ethical guidelines.

This diversification is crucial for Muslim investors seeking to spread risk and achieve long-term stability in their investment portfolios. By investing in Halal ETFs, individuals support companies that align with their values, promoting socially responsible practices.

This approach ensures that investors do not have to compromise their religious beliefs for financial gains.

Halal ETFs: A Synergy of Ethics and Wealth Building

A compelling aspect of Halal ETFs is their integration of sound financial strategies with a value-based approach.

This synergy aims to create a balanced portfolio that is both profitable and ethical. Halal investing, especially through Halal ETFs, contributes significantly to wealth creation by mitigating risks and ensuring adherence to Islamic investment principles.

Strategies for Investing in Halal ETFs

Investing in Halal ETFs is simpler than direct stock investments, offering several strategic approaches. The ‘buy and hold’ strategy is the most straightforward, focusing on long-term investments in Halal ETFs.

This method is complemented by consistent investing, reinforcing the strategy’s effectiveness over time. By incorporating Halal ETFs into their investment strategies, individuals can achieve financial prosperity while ensuring their investments are ethically sound.

Future Outlook for Halal ETF Investments

As we look ahead, the role of Halal ETFs in investment portfolios is expected to grow. Their ability to offer ethical investment options without compromising on profitability makes them an increasingly popular choice.

This trend is likely to continue as more investors seek options that align with their religious beliefs and ethical considerations.

How To Invest In Halal ETFs?

Every religious and legal concept, as well as the procedures for establishing standards and guidelines for how to interpret Islamic doctrine, are included in the Sharia.

Rules that apply to investing in international financial markets can be deduced from religious practice.

Indexes are likewise subject to these guidelines. Western financial institutions are typically omitted from such rankings since interest revenue from loans is regarded as being inconsistent with Sharia law.

Additionally, businesses must have a certain level of stability, and as a result, cannot exceed set limitations for leverage or debt.

Furthermore, there are a number of exclusion standards for non-Sharia-compliant markets and sectors that are quite comparable to standards for sustainable indexes.

As a result, the healthcare and technology industries are heavily represented in Sharia-compliant indexes. A well-known advisory council of Sharia specialists keeps an eye on the index rules.

You may access ETFs that provide access to investments that comply with Sharia in this investing guide.

11 Best Halal ETFs To Invest In

1. Wahed FTSE USA Shariah ETF (HLAL)

One of the best halal ETFs to invest in is Wahed FTSE USA Shariah ETF since it has a low expense ratio of 0.50%.

In collaboration with FTSE Russell and the US Banks Lifted Funds Trust, Wahed Invest introduced the Wahed FTSE USA Shariah ETF. It was launched in October 2019.

This NASDAQ-listed ETF monitors the performance of the FTSE Shariah USA Index’s total return and trades under the ticker symbol HLAL.

The ETF consists of 224 equities from big and mid-cap US corporations that pass the financial ratio screening requirements and the business activity of Shariah.

Although the majority of these stocks are from different industries, the technology sector makes up 37.4% of the total.

As of March 2022, the top ten holdings are: Apple Inc, Tesla Inc, Johnson & Johnson, Procter & Gamble Co., Exxon Mobil Corp., Chevron Corp., Pfizer Inc., Lilly(Eli) & Co, Cisco Systems, Inc., and Thermo Fisher Scientific Inc.

With a dividend yield of 0.8% in 2021, Wahed FTSE USA Shariah ETF delivered an annual total return of 28.59%.

The index is updated twice a year, in March and September, and is calculated in real-time and at closing.

Additionally, Yasaar Ltd. conducts a quarterly audit of the ETF’s shariah compliance in the months of March, June, September, and December.

2. Wahed Dow Jones Islamic World ETF (UMMA)

As the first ESG-aware ETF with a low-cost ratio, Wahed Dow Jones Islamic World ETF is included on the list of best halal ETFs to invest in.

In January 2022, Wahed Invest, Dow Jones, and US Bank’s Listed Funds Trust collaborated to launch this specific ETF.

The Dow Jones Islamic Market International Titans 100 Index is tracked by the ETF, which is traded on NASDAQ under the symbol UMMA.

This USD-based ETF invests in equities securities from numerous emerging and established markets, with the exception of those with US domiciles.

The cost ratio is minimal at 0.65% despite being an actively managed ETF.

Investors looking for a varied investment portfolio with globally active shares that are also socially, environmentally, and politically responsible have new options thanks to the Wahed Dow Jones Islamic World ETF.

The ETF provided 102 components as of 2021, representing 21 nations and a variety of sectors.

The top ten holdings of Wahed Dow Jones Islamic World ETF are: Taiwan Semiconductors Manufacturing Co., Samsung Electronics Co., ASML Holding NV, Rogers Corp., Roche Holding Ltd, Tencent Holdings Ltd, Nestle SA Reg, Novartis AG, Novo Nordisk A/S Class B, JD.com Inc

A sizeable portion of the ETF—27.1%—is made up of the information technology industries.

Japan is the country that contributes the most holdings.

The following countries also have holdings: Australia, Britain, Canada, Brazil, China, Denmark, France, Germany, Finland, Hong Kong, Ireland, Netherlands, Russia, Italy, South Korea, Spain, Switzerland, Taiwan, and Sweden.

3. SP Funds Dow Jones Global Sukuk ETF (SPSK)

One of the best halal ETFs to invest in is SP Funds Dow Jones Global Sukuk, which provides lower length and interest rate risk while allowing you to invest in Sukuk.

The Dow Jones Sukuk Total Return Index is tracked by this stock, which is traded on NYSE Arca under the symbol SPSK. The SPSK is a USD-denominated portfolio of investment-grade Sukuk for several nations.

5.93 years is the weighted average maturity.

It consists of holdings like KSA Sukuk Limited, KSA Sukuk Limited, SA Global Sukuk Limited, KSA Sukuk Limited, Perusahaan Penerbit SBSN Indonesia III, Perusahaan Penerbit SBSN Indonesia III, Perusahaan Penerbit SBSN Indonesia III, KSA Sukuk Limited, IsDB Trust Services No. 2 SARL, and SA Global Sukuk Limited.

The SP Funds Dow Jones Global Sukuk ETF has an expense ratio of 0.65% and pays monthly dividends of $0.03.

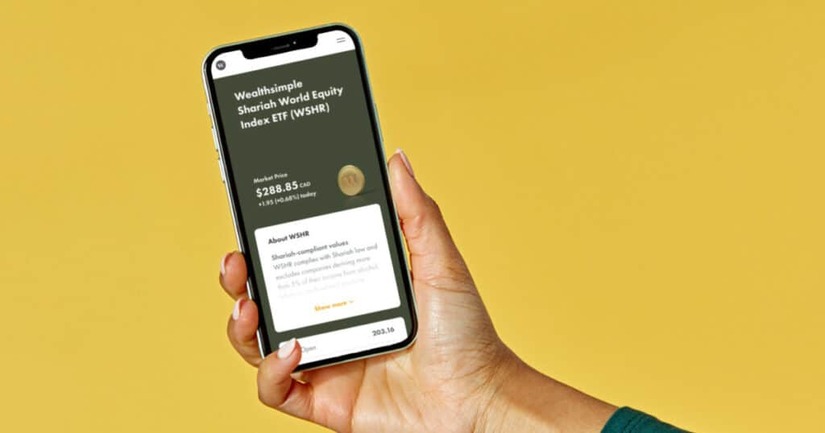

4. Wealthsimple Shariah World Equity Index ETF (WSHR)

The first Canadian ETF that complies with shariah law to be released by Wealthsimple in October 2020 is the Wealthsimple Shariah World Equity Index.

The Dow Jones Islamic Market Developed Markets Quality and Low Volatility Index is replicated by this index, which is quoted on NEO Exchange under the symbol WSHR.

Rating Intelligence Partners, the well-known Islamic advice company, conducts a biannual review of the trustee, Mackenzie Investments, for conformity with Shariah.

The cost ratio and very low risk of Wealthsimple Shariah World Equity Index ETF make it one of the best halal ETFs to invest in.

This ETF, which trades in Canadian dollars and has an expense ratio of 0.50%, is passively managed, focuses on stocks from sharia-compliant firms, and satisfies the ESG standards.

The consumer staples sector, which accounts for 13.9% of this ETF, is its main component.

The top ten holdings of this ETF are Nestle SA, Hong Kong and China Gas Co Ltd, CLP Holdings Ltd., Waste Connections Inc., Givaudan SA, Beiersdorf AG, McDonald’s Holdings Co Japan Ltd., Singapore Telecommunications Ltd., SGSSA, and Walters Kluwer NV.

This ETF provides minimal risk since it invests in high-quality equities with less volatility. Distributions from the ETF are made quarterly in March, June, September, and December, with a dividend yield of 0.34%.

5. SP Funds S&P500 Shariah Industry Exclusions ETF (SPUS)

One of the best halal ETFs to invest in is the SP Funds S&P500 Shariah Industry Exclusions ETF since it complies with shariah requirements while providing exposure to the S&P500 index.

It debuted in 2019 under the ticker SPUS on the NYSE Arca. The S&P500 Shariah Industry Exclusions Index is tracked by this ETF. Together with S&P Dow Jones Indices LLC, SP Funds created the index.

Data processing, outsourced services, financial exchanges, and aerospace and defense are among the constituents that SPUS excludes using an industry exclusion mechanism.

This ETF’s top ten holdings are as follows: Apple Inc, Microsoft Corporation, Alphabet Inc – Ordinary Shares – Class A, Alphabet Inc – Ordinary Shares – Class C, Tesla Inc, NVIDIA Corp, Meta Platforms Inc – Ordinary Shares – Class A, Johnson & Johnson, Procter & Gamble Co., and Home Depot, Inc.

The SP Funds S&P 500 Shariah Industry Exclusions ETF’s major sector is the technology industry, which makes up 40.79% of the ETF.

Additionally, it pays a monthly dividend of $0.03 and has a 0.49% expense ratio.

6. iShares MSCI Emerging Markets Islamic UCITS ETF (ISDE)

The iShares MSCI Developing Markets Islamic UCITS ETF was included on the list of best halal ETFs to invest in because it provides exposure to emerging markets through direct investment in several international emerging markets firms.

The ETF trades under the ticker symbol “ISDE.”

ISDE ETF is very similar to ISWD ETF in many ways. Both are based in Ireland and are USD-denominated exchange-traded funds. Both were also launched in 2007 and also have the same fund manager.

The ETF tracks stocks from the London Stock Exchange and Berne Stock Exchange-listed MSCI EM Islamic Index.

The ETF held 324 holdings as of 2022, with 32.02% of its holdings in the technology sectors.

The stocks of the iShares MSCI Emerging Markets Islamic UCITS ETF come from numerous international businesses, including Taiwan Semiconductor Manufacturing, Samsung Electronics Ltd, Reliance Industries Ltd, CIA Vale Do Rio Doce SH, SK Hynix Inc, Al Rajhi Bank, Samsung Electronics Non-Voting Pre, Saudi Basic Industries, Saudi Arabian Oil, and Samsung SDI Ltd.

ISDE has a 1.90% distribution yield and a 0.85% expense ratio.

7. iShares MSCI World Islamic UCITS ETF (ISWD)

One of the best halal ETFs to invest in is the iShares MSCI Globe Islamic UCITS ETF because it provides diversity through direct investment in stocks of developed firms all over the world.

iShares, an Irish company, debuted this US dollar-denominated ETF on the Swiss Stock Exchange and London Stock Exchange in December 2007.

The ticker symbol for this ETF is ISWD. The ISWD fund is managed by Black Rock Asset Management Ireland Ltd. MSCI World Islamic Net Total Return Index-USD is tracked by ISWD.

The iShares MSCI World Islamic UCITS ETF holds shares in several international businesses, including Johnson & Johnson, Procter & Gamble Co, Exxon Mobil Corp, Chevron Corp, Pfizer Inc, Roche Holding AG, Cisco Systems Inc, Thermo Fisher Scientific Inc, Shell PLC, and Abbott Laboratories.

The Healthcare sector makes up the majority of the 350 holdings, accounting for 25.66% of the total. ISWD has a 1.56% distribution yield of 1.56% and a 0.60% expense ratio.

8. Saturna Al-Kawthar Global Focused Equity UCITS ETF (AMAP.L)

The Saturna Al Kawthar Worldwide Focused Equity UCITS ETF, which holds a selection of premium stocks from diverse global ESG companies, is one of the best halal ETFs to invest in.

This ETF, which debuted in September 2020, is traded on the London Stock Exchange under the ticker AMAP/ AMAL.

Saturna Capital Corporation actively manages it, and it does not follow any particular Index. There are 40 holdings in the Saturna Al Kawthar Global Focused Equity UCITS ETF.

The Saturna Al Kawthar Global Focused Equity UCITS ETF holds shares in several international businesses, including Edwards Lifesciences Ord, Cisco-T Ord, Accenture Plc-A Ord, Schneider Electric Se, Apple Ord, Nintendo Ord, Novozymes Ord, Tokyo Electron Ord, Roche Ord, and Aveva Group Ord.

The ETF’s cost ratio is 0.75%.

9. SP Funds S&P Global REIT Shariah ETF (SPRE)

As a low-cost investment choice that can expose you to Shariah-compliant real estate-related assets, this ETF is one of the best halal ETFs to invest in.

The SP Funds S&P Global REIT Shariah ETF is a REIT ETF, which combines the features of real estate and trust funds.

The S&P Global All Equity REIT Shariah Capped Index is tracked by this ETF, which SP Funds debuted in 2020 on the NYSE Arca with the symbol SPRE.

There are 44 holdings in the SP Funds S&P Global REIT Shariah ETF as of 2022, with the following 10 being among the top holdings: Prologis Inc, American Tower Corp., Crown Castle International Corp, Equinix Inc, Public Storage, Equity Residential Properties Trust, Avalonbay Communities Inc., Weyerhaeuser Co., Mid-America Apartment Communities, Inc., and SEGRO Plc.

The ETF, which solely invests in real estate, produces consistent rental income earnings. This ETF delivers a $0.07 monthly dividend payment and has a 69% expense ratio.

10. iShares MSCI USA Islamic UCITS ETF (ISUS)

This list of best halal ETFs to invest in includes the iShares MSCI USA Islamic UCITS ETF because it can give you exposure to a variety of US-based businesses.

This iShares ETF is based in Ireland, denominated in USD, and managed by BlackRock Asset Management Ireland Ltd., much like the two iShares ETFs mentioned above.

The ETF tracks the MSCI USA Islamic Net Total Return Index and is traded on the London Stock Exchange under the ticker name ISUS.

The healthcare industry accounts for 30.26% of the 115 equity holdings in total.

The following are the top 10 holdings of the iShares MSCI USA Islamic UCITS ETF: Johnson & Johnson, Procter & Gamble, Exxon Mobil Corp, Chevron Corp, Pfizer Inc., Cisco Systems Inc., Thermo Fisher Scientific Inc., Salesforce.com Inc., Abbot Laboratories, and Merck & Co. Inc.

The distribution yield of the ISUS ETF is 1.09%, and its expense ratio is 0.50%.

11. Invesco Dow Jones Islamic Global Developed Markets UCITS ETF (IGDA)

The Invesco Dow Jones Islamic Global Developed Markets UCITS ETF, with an exceptional cost ratio of 0.40%, is one of the best halal ETFs to invest in.

This US dollar-denominated ETF tracks the Dow Jones Islamic Market Developed Markets Index’s performance. Invesco Capital Management LLC also oversees the management of this equity-based vehicle.

The major sector, which accounts for 32.79%, is technology.

Among the many holdings of IDGA are Apple Inc., Microsoft Corp., Amazon.com, Tesla Inc., Alphabet Inc-CL A, Alphabet Inc-CL C, Nvidia Corp., Meta Platforms Inc., Johnson & Johnson, and Procter & Gamble Co.

The Invesco Dow Jones Islamic Global Developed Markets UCITS ETF tries to replicate the performance of equities in developed global markets.

Future Trends in Islamic Finance and Halal Investing

The landscape of Islamic finance and Halal investing is evolving, with several key trends shaping its future. Understanding these trends is essential for anyone looking to invest in Halal ETFs.

Growth Trajectory in Islamic Finance

Despite global economic challenges, the Islamic finance industry is poised for growth. In 2023-2024, a growth rate of around 10% is expected, following a similar expansion in 2022.

This growth is primarily driven by favorable dynamics in core markets like the Gulf Cooperation Council (GCC) countries, notably Saudi Arabia and Kuwait.

These regions have significantly contributed to the growth in Islamic banking assets, with Saudi Arabia’s Vision 2030 and mortgage lending growth playing a vital role. However, a slowdown in real GDP growth is anticipated in GCC economies due to factors like lower oil production.

Sukuk Market Dynamics

The sukuk market, a critical component of Islamic finance, is undergoing notable changes. Although overall sukuk issuance volumes are expected to decline in 2023, new issuances are likely to surpass maturities.

This trend indicates a continued positive contribution to industry growth. Challenges such as lower global liquidity, greater complexity in structuring sukuk, and reduced financing needs in core Islamic finance countries may impact the market.

Nonetheless, corporate issuances, especially in countries with transformation plans like Saudi Arabia, are expected to bolster the sukuk market.

Sustainability and Digitalization

Sustainability-linked sukuk issuances are expected to rise, reflecting a growing focus on sustainability in Islamic finance.

This trend aligns with the broader financial industry’s shift towards sustainable and responsible investing. Additionally, the digitalization of sukuk issuance could further enhance the industry’s growth potential, offering new opportunities and efficiencies.

Expansion in South-East Asia

In South-East Asia, Islamic banking is projected to grow by about 8% in the next few years, despite economic challenges in major markets like Malaysia and Indonesia.

The demand for Islamic products and services, coupled with low market penetration, especially in Indonesia, supports this growth trend. Islamic banking is likely to continue gaining market share over conventional banking in these regions.

Tax Considerations and Efficiency in Halal ETF Investments

When investing in Halal ETFs, understanding the tax implications and striving for tax efficiency are crucial. These aspects greatly influence the overall return on investment. This section will explore key tax considerations and strategies to optimize the efficiency of your investments in Halal ETFs.

Understanding Capital Gains and Dividend Taxes in Halal ETFs

Capital gains tax and dividend tax are primary considerations when investing in Halal ETFs. Capital gains tax applies when you sell an investment for more than the purchase price, impacting the profitability of Halal ETFs.

However, it’s important to note that the tax treatment can vary significantly based on your residency and the location of the ETFs. For instance, certain jurisdictions may offer more favorable tax conditions for capital gains on Halal ETFs.

Dividend tax, on the other hand, applies to the dividends received from investments in Halal ETFs. This tax can vary depending on the structure of the ETF and the origin of the dividends.

Some Halal ETFs may invest in companies that distribute dividends, and these distributions are typically subject to tax at the investor’s ordinary income rate. Understanding these tax implications is essential for anyone looking to invest in Halal ETFs, as it affects the net return on investment.

Strategies for Tax Efficiency in Halal ETFs

Investors seeking to invest in Halal ETFs can adopt several strategies to enhance tax efficiency. One approach is to consider the domicile of the ETFs.

For example, ETFs domiciled in certain countries might offer lower dividend tax rates, which can significantly affect the overall tax burden. Investors should research and consider Halal ETFs domiciled in jurisdictions that offer favorable tax treatments.

Another strategy involves timing the sale of investments to manage capital gains tax liabilities. By understanding the tax laws related to capital gains, investors can plan their investment and divestment in Halal ETFs to minimize tax obligations.

This includes considering holding periods and the impact of short-term vs. long-term capital gains taxes.

Navigating International Tax Laws for Halal ETF Investments

For investors residing outside the country where the Halal ETFs are domiciled, navigating international tax laws becomes crucial. This includes understanding tax treaties between countries that can impact the amount of tax payable on dividends and capital gains.

Investors should consult with tax professionals to understand the implications of cross-border investments in Halal ETFs and ensure compliance with all relevant tax laws.

Importance of Tax Planning in Halal ETF Investments

Effective tax planning is paramount for maximizing returns from Halal ETFs. This involves not only understanding the tax implications of investments but also actively planning and managing these investments to optimize tax efficiency.

Consulting with tax advisors who specialize in investment taxation can provide valuable insights and strategies tailored to individual investment goals and the specific characteristics of Halal ETFs.

Navigating Regulatory Compliance in Halal ETF Investments

Navigating regulatory compliance in Halal ETFs to invest in is a critical aspect of Islamic finance. Investors in Halal ETFs to invest in must understand the rules and regulations that govern these investments to ensure they align with Shariah principles.

Shariah Principles in Halal ETFs

Shariah-compliant investing mandates adherence to Islamic principles. Key rules include avoiding interest, unethical concerns like gambling or alcohol, and ensuring contract transparency.

These principles are central to choosing Halal ETFs to invest in, as they dictate the permissibility of the investment from a Shariah perspective.

Evaluating Sharia Compliance in ETFs

When assessing Halal ETFs to invest in, one crucial metric is Islamic Non-Compliance.

This is calculated based on the portfolio’s exposure to non-compliant companies, defined by their business activities or revenue from prohibited sources, such as alcohol or gambling. Understanding this metric is vital for anyone looking to invest in Halal ETFs.

Understanding Fund Flow in Sharia Compliant ETFs

Fund flow data is essential for investors in Halal ETFs to invest in, as it represents the capital movement within these ETFs. This data helps investors understand the market dynamics and popularity of specific Halal ETFs to invest in.

Research and Analytics Tools for Halal ETFs

Utilizing research tools and accessing detailed information, including historical performance, dividends, and expense ratios, is crucial for informed decision-making. Investors looking for Halal ETFs to invest in should leverage these tools for a deeper understanding of their investment choices.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.