Are you eyeing a second passport through Vanuatu Citizenship by Investment Program? Here’s a quick guide.

The comparatively low investment requirement and quick application procedure are the main factors that draw investors to the Vanuatu passport program.

Vanuatu Citizenship by Investment is actually the sole immigration scheme available in Oceania. An applicant must contribute at least $130,000 to the nation’s National Development Fund in order to be considered for the program.

Vanuatu has one of the most cost-effective citizenship by investment programs in the world. You may become a citizen of Vanuatu for as little as $130,000, and you will be eligible for all the perks that come with it, such as visa-free travel to more than 115 nations.

If you have any questions or want to invest as an expat or high-net-worth individual, you can email me (advice@adamfayed.com) or use these contact options.

Some facts might change from the time of writing, and nothing written here is financial, legal, tax, or any other kind of individual advice, or a solicitation to invest.

For updated guidance, please contact me.

What You Need To Know About Vanuatu

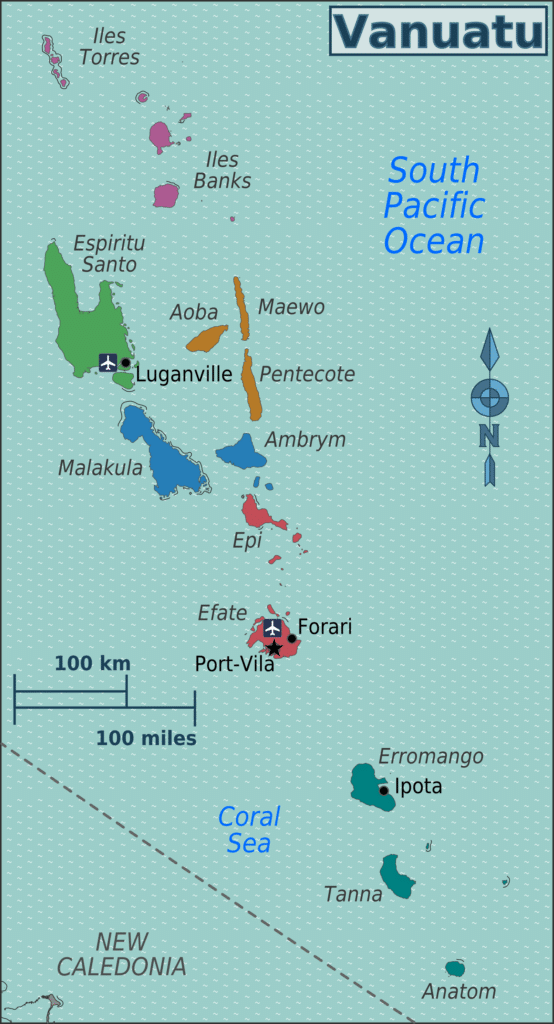

The Republic of Vanuatu is comprised of 83 tiny islands, and 65 of them are inhabited. After gaining independence from the UK and France in 1980, the island country is now a member of the Commonwealth of Nations.

The major city and capital of the archipelago is Port Vila; there are 278,000 people living there as of 2015. Bislama, an English-based creole, along with a number of Austronesian languages, are the main languages spoken in the country.

The Vanuatu Archipelago is one of the top tourist spots in the South Pacific Ocean area, known for its stunningly unspoiled coastline and laid-back atmosphere.

Despite being most known for being the location for the ninth season of the enduring TV series Survivor in 2009, Vanuatu is a highly sought-after tropical resort thanks to its amazing beaches, climate, and isolated islands.

Regardless of the island they choose to visit inside Vanuatu, visitors are always made to feel welcome and at home by the island’s friendly people.

There is a location and pace for every kind of traveller, whether it be on Mavea Island, which is the least inhabited island in Vanuatu, or Efate Island, which is the busiest and most dynamic island in the country.

However, as the nation’s capital and geographic centre, most tourists will undoubtedly spend some time in Port Vila.

Vanuatu is accessible from Australia and New Zealand. The country is becoming a genuinely fantastic vacation spot and is reasonably priced. Day trips may be taken to neighbouring Fiji, New Caledonia, and the Solomon Islands.

So, take in the rich culture and spirit of the Vanuatuan people while enjoying this South Pacific gem.

What Is The Economy of Vanuatu Like?

Vanuatu has been a sovereign nation since 1980, although its history has not yet been recorded. Like any other island country, Vanuatu suffers from an excessive reliance on a small number of sectors.

The four primary economic pillars of Vanuatu are beef export, offshore financial services, tourism, and agriculture.

The many citizenship programs targeted towards foreigners generated over 30% ($88 million) of the Vanuatu government’s income in 2018.

It actually surpassed VAT collections for the first time and became the government’s main source of income. In 2019, that percentage increased to 37%, and it is anticipated to keep rising.

Investors can be guaranteed that the rug won’t be yanked out from under them. The administration is fully aware of how crucial the Vanuatu citizenship program is to the country’s economy and how crucial it will be for its further expansion.

However, one thing is certain about Vanuatu CBI: it won’t continue to expand forever. Vanuatu should approach this money as a “windfall, and not a new normal,” according to the International Monetary Fund (IMF), which stated this in 2019.

As a result, the nation keeps seeking for new sources of income and strategies to diversify its economy. Fortunately, its other significant businesses are expanding as well.

Vanuatu received just 57,000 tourists in the year 2000. Today, the islands get over 100,000 visitors annually, many of whom come for world-class scuba diving.

Of course, the financial sector remains quite important to Vanuatu’s economy. It has long been considered a tax haven, or the Bahamas of the Pacific. Vanuatu didn’t exchange any information with foreign authorities or law enforcement until 2008.

However, as a result of the influence of foreign political forces, the nation has begun to change and adopt more open procedures.

Vanuatu has been able to remove itself from the OECD’s money laundering blacklist, but the European Union continues to place it on since it has not complied with its rules for the exchange of financial information.

Overall, Vanuatu still has a long way to go until its tax structure is implemented and taxes are really collected, but because to its CBI program, the country’s economy is in good position.

What Is The Vanuatu Citizenship By Investment Program?

With the introduction of the Vanuatu Citizenship by Investment Program in 2015, investors now have an easy and economical way to get a second citizenship.

The Vanuatu Citizenship by Investment Program offers investors a variety of advantages, including the freedom to travel to more than 98 countries, countless business advantages, and the chance to live in a safe and secure nation with their family after making the necessary donation to the government’s Development Support Program.

80 uncharted islands make up the Vanuatu group, which is adjacent to Australia and is distinguished by its empty beaches and steep topography. The first program of its sort in the Asia-Pacific Hemisphere, Vanuatu’s own citizenship by investment program was just launched.

The single investment option available through the Vanuatu Citizenship by Investment Program is a nonrefundable, one-time donation to the government’s Development Support Program.

Investors will acquire a Commonwealth Passport called a Vanuatu Passport within two to three months of the start of their application.

One of the fastest-processing economic citizenship schemes is the Vanuatu Citizenship by Investment program. Investors may then quickly take advantage of the numerous advantages a second passport has to offer.

The favourable tax climate of Vanuatu, which has no income tax, wealth tax, or even inheritance tax, is one advantage.

An investor does not need to pass any interviews or language exams in order to get Vanuatu citizenship.

Before receiving citizenship, an investor must, however, take the oath. Without the requirement to go to or live in Vanuatu at any stage during or after the application procedure, this ceremony may be held anywhere the investor chooses.

The investor is granted full citizenship rights and is allowed to hold dual nationalities with Vanuatu. Investors can pass on their Vanuatu citizenship to subsequent generations via descent without having to give up their existing citizenship.

What Are The Benefits Of Vanuatu Citizenship By Investment?

Even though each applicant’s motivations for applying for Vanuatu Citizenship by Investment may differ, the program offers a wide range of advantages.

For whatever reason they choose, applicants can take advantage of all the advantages of having a Vanuatu passport, including the following:

Travel Benefits

The Vanuatu passport has rapidly gained momentum as a result of the government’s intensive efforts over the past 15 years to extend worldwide visa exemptions with other nations.

Vanuatu now ranks 40th on the Guide Passport Rating Index thanks to its residents’ ability to visit 135 nations without a visa.

The Vanuatu passport is genuine in its worth, providing simple entry to the UK, Singapore, and Hong Kong and even qualifying for B1 or B2 visas to the US. Lastly, those with Vanuatu passports can request a lengthy visa to Australia.

Individual Tax Benefits

Vanuatu, which is regarded as a “tax haven,” does not impose any kind of tax on its citizens, including income tax, capital gains tax, withholding tax, inheritance tax, gift tax, or corporation tax.

For rich families who frequently have to pay significant taxes abroad, this makes it a very attractive citizenship-by-investment option.

Start Your Own Business

Opening an international business in Vanuatu is now feasible with a Vanuatu passport. Despite the fact that businesses created in this manner are unable to receive funding from Vanuatu, they are nevertheless able to conduct business abroad and pay little taxes.

A firm will not be required to pay taxes on profit, income, capital gains, gifts, or inheritance for up to 20 years after it first opens. However, company owners should anticipate paying a fixed cost of $300 each year.

Simple And Fast Process

It will take time, effort, and, of course, money to participate in any citizenship by investment scheme. On the other hand, the Vanuatu Citizenship by Investment Program has one of the most straightforward procedures and has few qualifications.

No language barriers, residency requirements, or protracted application procedures are concerns for applicants. The time it takes to obtain a Vanuatu passport and get it ready for travel is only one month.

How To Get Vanuatu Citizenship By Investment?

Vanuatu has a complicated past and a number of CBI programs going at once, yet getting a CBI is quite straightforward.

Things aren’t so awful if you can ignore the past of every program and simply concentrate on the Vanuatu Development Support Program (VDSP).

Donations are the only way to reach Vanuatu CBI. The only expense of becoming a citizen of Vanuatu is a one-time, non-refundable gift to the local government fund.

- The fee for a single candidate is $130,000.

- The cost for a married pair is $150,000.

- At least $180,000 will be paid by a family of four.

Dependents may be added for an additional $25,000 each. Don’t forget to pay the $5,000 application cost, which will take care of everyone under the same main applicant’s government fees and due diligence.

Additionally, there is a $400 fee that covers the costs of the citizenship commission, the passport application, and the citizenship certificate.

Since the agent’s compensation is derived directly from the government donation you make, whoever agent you choose to partner with must be providing the same pricing as indicated above.

Finding a different agent is advised if the agency wants to charge more than $135,400 for a single application.

Another thing you’ll need to demonstrate is that you have at least $500,000 in net assets and funds with a minimum availability of $250,000 in banking assets. Regarding this, there is some latitude.

How To Apply For Vanuatu Citizenship By Investment?

Would you like a passport from Vanuatu? Please confirm your eligibility to apply before we proceed. What individuals can obtain a Vanuatu passport?

The Vanuatu CBI program allows for a lot of flexibility, however there are several qualifications to make sure that you are a candidate with excellent morals and sound finances:

- You must show evidence of personal net assets totaling at least $500,000, at least $250,000 of which must be in the form of banking assets.

- You must be completely free of criminal history.

- You must have a solid reputation in your neighborhood, society, or nation.

- You must not have spent the previous five years residing in Syria, Iraq, North Korea, Iran, or Yemen.

STEP 1: Due Diligence

Due diligence is carried out as the initial step in the application procedure. This entails delivering a few of your primary papers, undergoing a police check, and forking over the $5,000 non-refundable cost for processing and due diligence by the government.

After that, processing will take around a week. Due diligence on the principal applicant and his family members is performed by the Financial Department of Vanuatu (FIU).

Your chances of receiving your passport if accepted are 99%.

Here is the full picture of the due diligence process:

- DSP/VCP Agents who have been given permission by the unit carry out the first due diligence by learning about the applicants’ backgrounds, sources of funding, and criminal histories.

- Agents send applications to the FIU, which conducts due diligence within 48 hours and provides a written conclusion to the Citizenship Screening Committee. Applications must also include a valid passport, a police or judicial clearance, a curriculum vitae (VC), and any other needed papers.

- In its due diligence process, FIU uses a number of internationally renowned screening databases to check for criminal convictions, including the INTERPOL database or past criminal conviction records, sanctions, global blacklisting, financial disqualification, individual bankruptcy, terrorism, corporate solvency, and political-affluent individuals.

- The Vanuatu Citizenship Commission (VCP) receives information from FIU regarding any negative findings regarding all successful candidates in the Program.

- VCP recommends the application for honorary citizenship to the Prime Minister’s office.

- To each successful candidate, a passport and citizenship are granted.

STEP 2: Application

You must then compile all of your supporting documentation (the list is quite typical) and submit the complete payment.

If everything is in order, it will take the government between 30 and 60 days to decide whether to approve your application.

The length of time it takes for the committee to approve your citizenship also relies on when you submit your application because they meet twice a month.

STEP 3: Take an oath and receive your passport

In contrast to other countries, Vanuatu mandates that all new citizens participate in an oath ceremony, which often lasts little more than 30 minutes. You cannot avoid it since there is no other way to acquire a passport. There are two ways to take an oath:

- Go to Vanuatu and take the oath before a Vanuatu Commissioner; or

- Take the oath outside Vanuatu by flying two government representatives there.

You might meet the officials, for instance, in Dubai or London. Since you must cover the costs of the Vanuatu officials’ travel and lodging at your local Consulate, choosing this option always entails additional costs.

The second choice can cause a delay in the issuance of your passport because you’ll need to make travel plans.

You will now need to make travel plans in addition to the extra $400 price, which consists of $100 in certificate fees, $250 for the passport application fee, and $50 for the citizenship commission fee.

Following the ceremony, a Naturalization certificate will be given to you, enabling you to apply for and get a Vanuatu passport.

What Is Unique About Vanuatu Citizenship By Investment?

You should contrast the Vanuatu CBI program with others before enrolling, aside from the very great bragging rights that come with having a Vanuatu citizenship.

It’s not the most affordable program. For instance, the starting price for a family of four in Antigua and Barbuda’s citizenship by investment program is just $100,000.

Vanuatu’s biggest selling appeal, other than its unusual location and isolation, is that it is the quickest way to get a second passport. It takes a simplified procedure of just two months. In just eight weeks, you might be the delighted owner of a brand-new passport. That is the best CBI program available.

The complete investment amount (or a significant portion of it) is not required to be paid in full upfront in any other jurisdiction. To start the application procedure and receive government permission, all you need to pay is the $5,000 charge.

You won’t be required to make any more investment payments until that process is finished. Almost no probability remains for your citizenship to be denied at this point.

The Vanuatu CBI program is quite quick and great for investors who aren’t as risk-tolerant. Vanuatu’s passport, which is fairly typical among CBI nations, allows travellers to enter 105 nations without a visa.

What Is The Alternative To Vanuatu Citizenship By Investment?: Permanent Residency In Vanuatu

Is applying for a Vanuatu Citizenship by Investment too complicated for you? Would you rather put money into a real estate investment than a government grant? In doing so, you’ll have the opportunity to live tax-free in Vanuatu.

You need to invest at least $100,000 in real estate and earn at least $2,500 per month to be eligible for permanent residency in Vanuatu.

By doing this, you will be able to take advantage of all the advantages that Vanuatu residency has to offer, such as 0% taxation, top-tier international schools, pure air and water, magnificent beaches, and an isolated location.

You can ultimately become a naturalized citizen of the island if you stay there as a permanent resident for at least ten years. But if you want citizenship and don’t want to wait ten years, you can always pay $130,000 and gain citizenship in a couple of weeks.

Final Thoughts

Significant advantages, such as the ability to travel to Europe and other countries without a visa, can be had by obtaining a second citizenship in Vanuatu. The moment to apply for Vanuatu citizenship by investment is right now.

If you are interested in getting an Vanuatu Citizenship By Investment, you should talk to your financial planner for proper advice.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.