Read this Fidelity Investments trading platform review before signing up for this stockbroker.

Fidelity Investments is a stockbroker based in the United States. The Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), two top-tier authoritities, regulate it.

Fidelity Investments is known to be safe and secured due to its long track record and regulation by top-tier financial authorities.

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

Some facts might change from the time of writing, and nothing written here is financial, legal, tax, or any other kind of individual advice, or a solicitation to invest.

For updated guidance, please contact me.

What is Fidelity Investments

1946 saw the founding of Fidelity Investments. The longer the broker has been in business, the more evidence that a broker has successfully weathered prior financial crises.

If you’re trying to find out more about Fidelity Investments because it’s a privately held company, you might run into some difficulties. Compared to other brokers, there is not as much financial information available. The company is owned by FMR LLC, the parent organization of the Fidelity Investments group.

The fact that Fidelity Investments is governed by reputable agencies, has a proven track record, and offers additional insurance are all excellent indicators of its security.

Click here to go to Fidelity Investments website.

Pros and Cons of Fidelity Investments

Commission-free US stocks and ETFs are offered by Fidelity Investments. Additionally, it provides a wide range of excellent research tools, such as trading suggestions, comprehensive fundamental data, and charting.

The web trading platform is user-friendly and provides sophisticated order types. You can trade with stocks from other countries in addition to US stocks.

On the downside, some mutual funds charge high fees and have higher margin rates. The account verification process takes a little while, and sometimes an account isn’t opened entirely digitally. The speed of the live chat could also be increased.

Fidelity Investments Fees

Low trading, non-trading, and commission-free stock trading fees are offered by Fidelity Investments. The drawback is that some mutual funds may have high margin rates and fees.

Fidelity Investments Trading Fees

Low trading fees are charged by Fidelity Investments. Additionally, we valued the fee structure’s openness.

ETF Fees and Stock Fees

When trading US stocks, Fidelity Investments levies no commissions on stocks or ETFs. International stock trade commissions, however, are quite expensive. However, US brokers rarely, if ever, offer stocks from other countries.

A small fee of $0.01 to $0.03 per $1,000 of principal is also assessed on sell orders as part of the activity assessment fee.

On the majority of international markets, Fidelity Investments levies flat per-trade commissions, as shown in the table below.

You should review Fidelity Investments’s margin rates if you prefer margin trading for stock purchases. Which margin rate is it? When you trade on margin, you are charged margin rates. In essence, this means that you must pay interest on any money you borrow from your broker to trade.

The margin rates at Fidelity Investments are high at 11.3%.

The margin rate at Fidelity Investments is volume-tiered. Depending on how much is borrowed, there is a base margin rate plus an additional premium or discount. The base rate was 10.075% at the time of the review.

Fund Fees

For non-Fidelity Investments and transaction-fee funds, mutual fund fees are high. Around 3,500+ free mutual funds are provided by Fidelity Investments. However, there is a $49.95 fee applied if you sell these funds within 60 days of the original purchase.

A purchase costs $49.95 or $75 for all other funds, based on the fund. Due to the average fee for popular mutual funds being $49.95, we used this figure in our calculations. Only when you buy a fund will you be charged a fee; not when you sell one. To make Fidelity Investments’s fee comparable to other brokers who charge for both buying and selling, we cut it in half for this reason.

Bonds Fees

Bond fees at Fidelity Investments are typically low. By bond type, bond fees differ. The charges for Treasury bonds sold on the secondary market were calculated.

Purchasing Treasury bonds carries no commission. Other bonds, such as corporate bonds, are subject to a $1 per bond commission with a $250 maximum fee. For bonds that mature in a year or less, the maximum fee is $50.

Option Fees

Fidelity Investments charges only $0.65 per contract for its options.

Fidelity Investments Non-trading Fees

Non-trading fees at Fidelity Investments are reasonable. Inactivity or account fees are not charged.

For both ACH and USD wire withdrawals, there are no withdrawal fees. However, withdrawals made via wire that are not in USD are charged 3% of the total amount. An electronic (ACH) withdrawal was tried during our review, and it went off without a hitch.

Opening a Fidelity Investments Account

There is no minimum deposit required when opening an account at Fidelity Investments. There are numerous account types available as well. Account verification, however, takes a while.

Fidelity Investments is a US stockbroker with a focus on US clients. We evaluated the services offered by Fidelity Investments in the US for this review.

However, the other subsidiaries of the Fidelity Investments group offer Fidelity Investments in a number of nations. Only Canadians are served by Fidelity Investments Canada, whereas Fidelity Investments International has a significant presence in South-East Asia and Western Europe. Every country has a different selection of goods and services.

What is the minimum deposit amount at Fidelity Investments?

For basic accounts at Fidelity Investments, there is no minimum deposit requirement. For trading on a margin account or if you prefer to invest in portfolios, there is a minimum deposit required.

Types of Fidelity Investments Accounts

Fidelity Investments offers a variety of account types, including:

Investing and Trading

All retail investment accounts, with the exception of the Fidelity Investments Account for Business, offer joint and individual options.

- Brokerage Account – Tested account: Common brokerage account

- Cash Management Account: An alternative to checking that is FDIC-insured.

- Brokerage and Cash Management: An account with all the benefits of a brokerage and a cash management account combined.

- Fidelity Investments Account for Businesses: Account with full trading and cash management features for business requirements.

Saving for Retirement

Retirement growth plans with tax contributions.

- Rollover IRA: A Fidelity Investments account used to combine a previous 401(k) IRA and preserve tax benefits.

- Traditional IRA: An account that will assist you with deductible contributions and earnings for retirement withdrawals.

- Roth IRA, Roth IRA for Kids: Conditions must be met for tax-free withdrawals. Young people can open accounts that an adult will manage.

- Inherited IRA, Inherited Roth IRA: If you would like to continue a Traditional IRA, SIMPLE IRA, SEP IRA, or Roth IRA account that you inherited, these accounts are for you.

- Self-Employed IRA, Self-Employed 401(k): Assists you in creating workplace savings plans for either self-employed people or business owners.

- Simple IRA: Provides tax breaks for small businesses (fewer than 100 employees).

- Investment-Only plans for Small Businesses: A brokerage account for small businesses with qualified plans who want to expand their investment options through Fidelity Investments.

- 401(k) Plan for Small Businesses: Offering retirement schemes to your staff.

Managed Accounts

Accounts managed by the professionals and technology of Fidelity Investments. Fidelity Investments-managed robo-advisor accounts.

Saving for education / medical expenses / ABLE (Achieve a Better Life Experience)

Savings accounts for various objectives

- 529 Account: An account that qualifies for state tax breaks.

- Custodial Account: It is possible to invest on behalf of a minor using this brokerage account.

- Health Savings Account: A plan that enables you to avoid paying unnecessary medical costs.

- The Attainable Savings Plan: An account that supports saving and investing for expenses associated with disabilities for people with disabilities and their families.

Charitable Giving

- Fidelity Investments Charitable: An account that enables you to donate to any charity and claim a tax deduction.

Estate Planning

Trust, Estate Accounts: Accounts that permit you to manage and invest money in a brokerage account on behalf of a trust or an established estate.

Annuities

- Personal retirement annuity from Fidelity Investments: A tax-deferred account used to save for retirement.

- Deferred Fixed Annuities: An account that, for a specific time period, offers a rate of return.

- Immediate Fixed Income Annuities: Gives a client a steady income stream for the rest of their life or for a predetermined amount of time.

- Deferred Income Annuities: Gives you and your spouse a steady income starting at a later time.

Life Insurance

- Universal Life, Term Life Insurance: Permanent life insurance coverage.

You must sign up for a supplemental service called “International Stock Trading” for your brokerage account if you want to trade in foreign stocks. You can start the registration process inside your brokerage account, and it is simple and quick.

How to Open a Fidelity Investments Account

In most cases, opening an account is a simple, digital process. There may be instances where you must send the account opening form, along with a photocopy of the relevant ID card, to Fidelity Investments via mail or fax. We opened the account in 3 business days, which is a little slow when compared to other brokers.

Steps to Open a Fidelity Investments Account:

- Decide on an account type.

- Include your personal data, such as your Social Security number, place of residence, employment status, etc.

- Choose your trading or investment preferences.

- Review the data you have.

- Accept the rules and regulations.

- Print the application, then mail or fax it.

While the mail-in application process took about 3 business days to open and verify the account, the online portion of the application only takes about 20 minutes.

After the brokerage account was verified, registering for international stock trading was comparatively quick and simple, taking only five minutes.

Fidelity Investments Withdrawals and Deposits

Fidelity Investments provides an incredibly broad selection of base currencies. The lack of acceptance of credit/debit cards is a drawback.

Account Base Currencies

You have a choice of 16 base currencies at Fidelity Investments. It’s a fantastic choice.

Deposit Fees and Options

There are no deposit fees with Fidelity Investments.

Customers can deposit money using a check, an electronic (ACH), a wire transfer, PayPal, or Venmo. No deposits can be made using credit or debit cards.

BillPay is a feature that Fidelity Investments provides as an extra service. You can use your brokerage account to pay bills and manage your subscriptions.

A credit/debit card can be used to make an instantaneous payment while a bank transfer may take several business days.

The funds arrived after 2 business days when we tested the ACH transfer.

Only funds from accounts that are in your name may be deposited.

Fidelity Investments Withdrawal Fees and Options

If you use an ACH or USD wire withdrawal, Fidelity Investments doesn’t charge any withdrawal fees. Withdrawals made in currencies other than USD cost 3%.

How long does it take to withdraw from a Fidelity Investments account? The ACH bank transfer withdrawal worked as expected and was finished in two business days.

Only accounts with your name on them are eligible for withdrawals.

How does Fidelity Investments handle cash withdrawals? Take these actions:

- Register for the account.

- Select “Transfer” under “Accounts & Trade,” “Portfolio.”

- Choose the withdrawal method you want to employ.

- Choose your Fidelity Investments account as “Transfer from”.

- As “Transfer to,” choose the account you want to withdraw the funds to.

- Set the date and enter the withdrawal amount.

- start the withdrawal process.

- Also possible are automatic withdrawals.

Fidelity Investments Trading Platform Review – Web Version

The web platform from Fidelity Investments is user-friendly, offers a wide variety of order types, and offers two-step authentication. The lack of customization is a drawback.

Fidelity Investments has its own, internal-developed web trading platform. Only English is offered.

Fidelity Investments Web Trading Platform Design

The Fidelity Investments web trading platform is easy to use and offers a positive user experience. It cannot be altered, though.

Fidelity Investments Web Trading Platform Login and Security

In addition to the standard one-step login, Fidelity Investments also provides a two-step authentication login option. The Validation and ID Protection (VIP) Access app from Symantec, which generates a random 6-digit code, is provided to you free of charge by Fidelity Investments. As an alternative, you can also get a text message with a login code, but it’s less secure.

You must supply three security questions and answers when setting up your account. Answering one of these security questions is required the first time you log in on a new device. You can log into your account using your regular ID and password once these steps have been completed.

Fidelity Investments Web Trading Platform Search Functions

The search tools work as intended. A company’s name or ticker can be entered in the search box. Relevant results are returned when searching for company names.

If you enable international stock trading, you should search using the ticker and a country code since without the latter the search will only include the US market. For easier searching, this feature could be improved. Located in the upper right corner is the search field.

Placing Orders at Fidelity Investments Web Trading Platform

There are numerous order types available on the Fidelity Investments web trading platform, including more complex ones:

- Market

- Limit

- Stop

- Stop Limit

- Trailing stop ($, %)

- Trailing stop limit ($, %)

- Multi-contingent

- One Cancels the Other (OCO)

- One Triggers the Other (OTO)

- One Triggers a One Cancels the Other (OTOCO).

Additionally, you can use the following order time restrictions: Good ‘Til Canceled (GTC), Day, Fill or Kill, Immediate or Cancel, On the Open, and End of Day.

Fidelity Investments Web Trading Platform Notification and Alerts

Numerous alerts and notifications are available for setting. The three main categories of account services, research and market monitoring, and products and offerings contain a wide variety of alert types, from price to research alerts.

Email or text messages can be used to receive notifications. Additionally, you can configure push notifications if you download the mobile trading app.

You can access the alerts from the ‘Home’ menu. Click on “News & Research” at the top of the page, then select “Alerts.” You can also just type in a stock’s name and select “Set alert.” We appreciated how easily an alert could be made active on another platform after being set up on another by simply clicking a button.

Fidelity Investments Web Trading Platform Reports on Fees and Portfolios

Portfolio and fee reports from Fidelity Investments are transparent. These are listed under “Account Positions” in the “Accounts & Trade” section.

The reports are only available for download in CSV format.

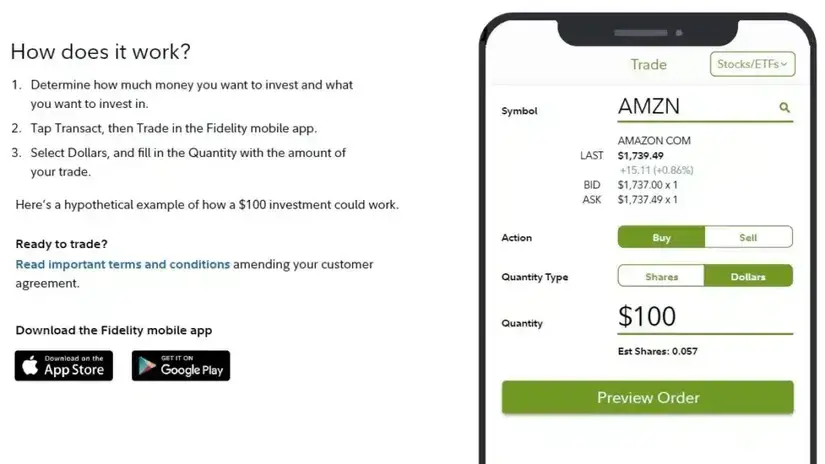

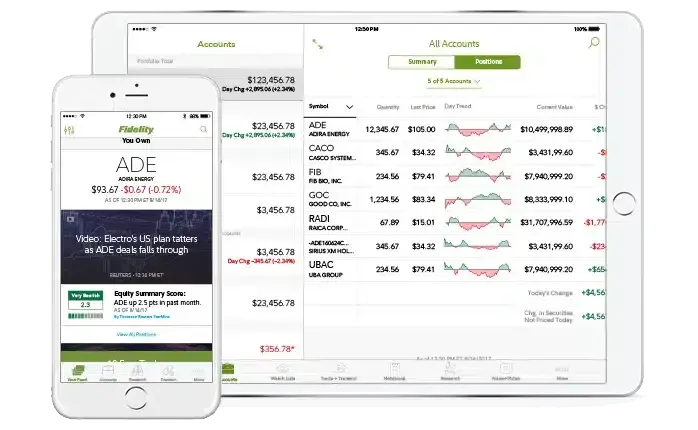

Fidelity Investments Trading Platform Review – Mobile Version

Great mobile trading platform provided by Fidelity Investments. It is well-designed and user-friendly.

The mobile trading platform from Fidelity Investments is accessible on both iOS and Android devices. We evaluated the iOS version for this review. There is an English version of the platform.

Design

The mobile trading platform from Fidelity Investments is easy to use. Compared to the web trading platform, it is more recent.

Login and Security

You can log in for free with the Validation and ID Protection (VIP) Access app from Symantec, which generates a random 6-digit code, or you can use text messages instead.

Additionally, Fidelity Investments provides biometric authentication, which is a useful feature.

Search Functions

The search features work well. It is simple to use and makes it simple to locate the appropriate stock options.

Using the country code, you can search for stocks from other countries. The search would only include the US market without that.

The extensive research features were appealing to us; for instance, numerous equity categories display third-party evaluations.

Placing Orders

The order types Market, Limit, Stop, Stop Limit, Trailing Stop ($,%), and Trailing Stop Limit ($,%) are all available for use.

Good ‘Til Canceled (GTC), Day, Fill or Kill, Immediate or Cancel, and On the Open are additional order time limits you can use.

Notifications and Alerts

On the Fidelity Investments mobile app, setting alerts and notifications is simple. Additionally, you can approve push notifications.

Fidelity Investments Trading Platform Review – Desktop Version

The desktop platform from Fidelity Investments has many order types, is highly customizable, and has a transparent fee report.

Fidelity Investments provides Active Trader Pro, a desktop trading platform that was created in-house. This platform is primarily for seasoned investors and active traders. It integrates numerous research functions with great flexibility and functions as an extension of the web platform.

The desktop trading platform, like the web and mobile platforms, is only available in English.

Design

The desktop trading platform from Fidelity Investments is very customizable.

The platform loads slowly when a new window is opened or when it is cross-linked to the web-based platform, which is a drawback.

Login and Security

The desktop platform can also be used to configure Symantec’s Validation and ID Protection (VIP) Access app.

Search Functions

The search feature in Fidelity Investments Active Trader Pro is excellent. By typing a stock’s name or ticker into a search engine, you can find relevant results.

Placing Orders

The order types available are the same as those on the web trading platform.

Notifications and Alerts

On the desktop trading platform, you can configure notifications and alerts. The web platform and the notifications are in sync. Additionally, you can use “Real-time Analytics,” which examines the historical data on your watchlist and indicates when potential trading opportunities arise.

Reports on Fees and Portfolios

Fidelity Investments provides transparent fee and portfolio reports. The tab can easily be modified to include information on commission, profit/loss balance, currency, etc. The reports are accessible through the ‘Account History’ menu.

Fidelity Investments Trading Platform Markets and Products

International stocks are just one of the many trading products that Fidelity Investments provides, along with stocks and options. Trading in foreign exchange and futures is not possible, though.

Due to the fact that few US brokers offer access to foreign stock exchanges, Fidelity Investments stands out among US brokers in this regard. Bond and mutual fund selections from Fidelity Investments are excellent, but its ETF and options offerings are only fair.

ETFs and Stocks

Fidelity Investments offers coverage for numerous international stock exchanges in addition to US markets. There are 25 stocks and 2,300 ETFs available.

The following US stock exchanges are available for stock trading: NYSE, NASDAQ, AMEX, OTC. Fidelity Investments also offers a huge selection of international markets. Trade settlement options include using USD or local currency.

Funds

Fidelity Investments offers 550 mutual funds in total, which is a good selection. Along with funds from other sizable providers like BlackRock and Vanguard, you will also find Fidelity Investments funds.

Bonds

Fidelity Investments provides a wide selection of bonds totaling 106,000 in number. Both corporate and government bonds are offered in the bond selection.

Options

Only 8 options markets are covered by Fidelity Investments’s average options selection. Options from important US options exchanges, like CBOE, are available.

Crypto

You can invest in two ETFs at Fidelity Investments that are related to cryptocurrencies: the Fidelity Investments Crypto Industry and Digital Payments ETF and the Fidelity Investments Metaverse ETF.

Fidelity Investments Managed Accounts

Additionally, Fidelity Investments provides a variety of managed account services, which are excellent if you require assistance managing your investments.

- Fidelity Investments Go: A robo-advisory service with a $10 minimum starting investment and an annual fee of 0-0.35%.

- Fidelity Investments Personalized Planning and Advice: A robo-advisory service with expert consultation, either with a team or a dedicated advisor. $25,000 is the minimum starting investment and the annual fee is 0.50%.

- Portfolio Advisory Services: A personalized solutions compiled by Fidelity Investments experts. The minimum required amount to start is $50,000 to work with a team of advisors and $250,000 for a dedicated advisor. The annual fee is 1.10% if with a team of advisors and 0.50-1.50% if with a dedicated advisor.

- Separately Managed Accounts: A preset portfolios you can invest in, e.g. Fidelity Investments U.S. Large Cap Equity Strategy. The minimum starting investment is $100,000-$350,000 and the annual fee is 0.20-0.90%.

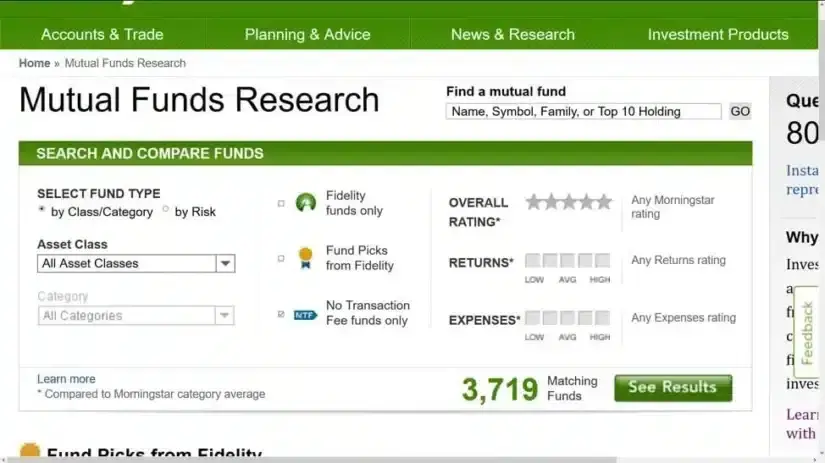

Fidelity Investments Trading Platform Research

Fidelity Investments offers a wide range of services, including trading ideas, in-depth fundamental data, and excellent screeners, along with excellent research tools. The quality of the news flow, however, could be higher.

Fidelity Investments provides a variety of helpful tools that are excellent for fundamental research and strategy development. On the online trading platform, we put the research tools to the test.

Trading Ideas

Fidelity Investments offers trading suggestions for mutual funds, ETFs, and stocks. A few research companies offer buy/sell ratings as well as ESG scores. Third-party suppliers like MorningStar also support research on mutual funds and ETFs.

Fundamental Data

Fidelity Investments offers a wealth of information on the basics of data. There is a ton of information available for all kinds of assets, including stocks and funds.

For instance, for businesses, it is simple to access financial statements for the previous five years, businesses in the same industry, a dividend calendar, etc.

Charting

Fidelity Investments has effective charting software. We evaluated the charting toolkit for the web trading platform. The charts are simple to edit, and you can choose from 50 different technical indicators. The charts can also be downloaded and saved.

News Feed

Third parties like Bloomberg and The Wall Street Journal provide the news feed. Although there are no charts or pictures, it is still simple to read and understand.

Other resources

For stocks, ETFs, and mutual funds, there are excellent and sophisticated screeners. The best screener tool we have tested is this one.

If technical analysis proves to be beneficial to your trading, you may find it helpful that Fidelity Investments provides access to Recognia and Trading Central’s tools, both of which recognize chart patterns.

Fidelity Investments Trading Platform Customer Service

The customer support at Fidelity Investments is good. They respond quickly and appropriately, but their live chat could use some work.

You can reach Fidelity Investments by way of:

- live chat

- phone

- Customer service is offered in English

Fidelity Investments’s live chat was incredibly slow when we tested it. Prior to us, there were typically a dozen customers in line, and it could take up to 20 minutes to speak with an operator. Most of the time, the answers made sense.

The average wait time, according to Fidelity Investments, is only five minutes.

The phone support is excellent. The customer service staff was very helpful and provided pertinent responses. The response time was satisfactory because an agent connected to the caller quickly.

Support via email also works well. Within one business day, we had pertinent responses.

On the downside, not all support services are offered around-the-clock. For instance, live chat is only accessible from 8 to 10 a.m. – 10 p.m. (Weekend hours are 9 a.m. to 4 p.m.).

Fidelity Investments Trading Platform Education and Tutorial

A variety of excellent educational resources, including articles, webinars, and videos, are available from Fidelity Investments. A paper trading (demo) account, however, is only offered on the desktop platform.

The following methods of learning about trading are available at Fidelity Investments:

- Platform tutorial videos

- General educational videos

- Webinars

- Quality educational articles

- Demo account, but only for desktop trading platform, called Active Trader Pro

Beginner to advanced topics are covered in the webinars. You can watch older content in addition to the five to ten new videos that are added each month.

We liked Fidelity Investments’s ‘Learning Center’ FAQ because it compiles a lot of pertinent information in a well-organized, searchable format.

Fidelity Investments Trading Platform Safety and Security

High-calibre financial regulators oversee Fidelity Investments, which also offers substantial investor protection. However, there is no protection against negative balances, and no one can access its financial data.

Is Fidelity Investments regulated?

Yes, it is overseen by the Financial Industry Regulatory Authority (FINRA) and the US Securities and Exchange Commission (SEC) (FINRA).

Is Fidelity Investments safe?

The US-based Fidelity Investments services are the main focus of this review. Fidelity Investments Brokerage Services LLC provides services to clients in the US, and as a result, these clients are covered by SIPC, the country’s investor protection program.

If the broker goes out of business, this guards against the loss of money and securities. $5000, including $250,000 for cash, is the maximum SIPC protection amount. In comparison to most investor protection programs, this sum is significantly higher.

Investments not covered by SIPC are not all insured. Notes, stocks, bonds, mutual funds, stock in other investment companies, and other registered securities are all generally covered by SIPC.

It excludes items like unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, money, and stakes in commodities like gold, silver, or other futures or options contracts.

On a corporate level, Fidelity Investments additionally offers coverage totaling $1 billion. There is no cap on securities coverage per customer, but there is a cap on cash coverage per account of $1.9 million.

Fidelity Investments’s Customer Protection Guarantee, which covers losses from unauthorized activity in covered accounts that occurs without your fault, is another measure of protection. All cash and securities held in your covered Fidelity Investments account are automatically covered by insurance (s).

Fidelity Investments does not, however, offer protection against negative balances. You won’t be shielded from the possibility of your account’s balance falling below zero.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.