Investing After Selling A Business

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

Introduction

You might get a one-time cash payment after selling your company. The allocation and investment of the proceeds from the sale of your business is a significant decision that calls for careful planning.

Create an investment strategy if you anticipate receiving a windfall unexpectedly to ensure that you don’t keep too much cash on hand.

Take into account these important points as you decide how to spend the proceeds from the sale of your company.

Investing After Selling a Business

Your net worth is heavily based on one asset when you own a business. You have the chance to derisk your portfolio and diversify your investments by selling.

Here are some things to think about if you suddenly become wealthy after selling your business.

- Review your financial objectives and timetable. Are you contemplating retirement? What financial needs do you have? Are you planning any significant purchases or brand-new financial investments? How do your other assets and investments compare to the cash from the business? Don’t undervalue your non-financial objectives or your plans for after you sell the business. Some people may find it challenging to transition from running a business to becoming suddenly retired.

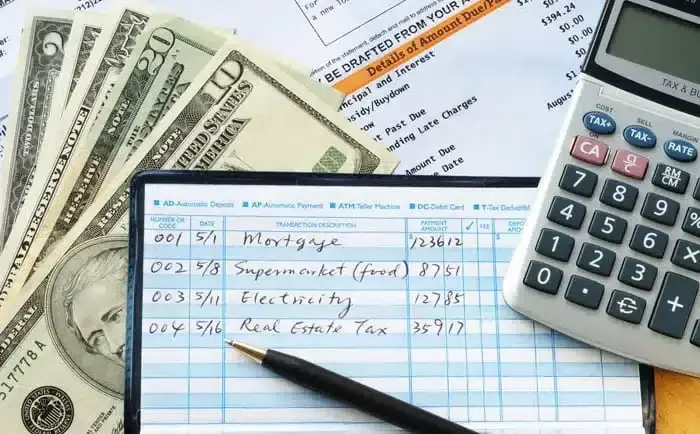

- Make a formal budget plan. You can determine if you can maintain your lifestyle on the sale proceeds and what factors you can play with to improve the result by using a detailed financial plan. Understanding your risk capacity vs. appetite, balancing your need for current income and future growth, and finding tax-saving opportunities for your taxable accounts are all important components of an investment management strategy.

- Put the strategy into practice. Use a financial advisor to help you invest the cash received from the sale of your business in line with your plan. Also take action to put other aspects of your plan into action, such as asset protection and estate planning strategies.

Investing After Selling a Business: Your Options

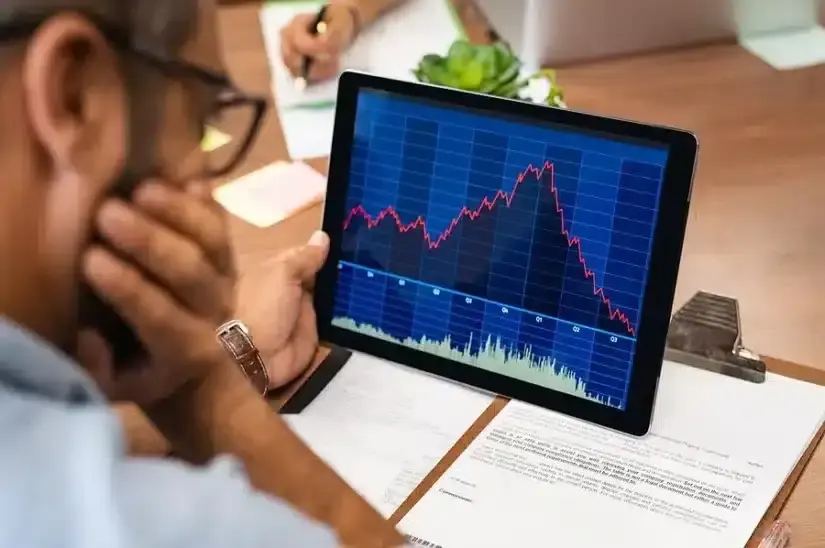

1. Invest in the stock market after selling a business

When creating a nest egg, most people first thought is investing in stocks.

So how do you get started?

There are many different investment options available on the stock market. Take these factors into account before investing in stocks:

- How unpredictable is the market?

- When do you want to start seeing a profit?

- How much ROI do you need?

To reduce risk, professional stock traders advise you to invest in over 20 companies across various industries.

If there are market downturns, you won’t be at risk from single-security risks if you own stocks in more than 20 different companies. The ideal number of stocks to maintain for manageability is between 20 and 30.

Additionally, seasoned investors advise that you periodically review your holdings. In order to more effectively achieve your goals, you can buy or sell assets based on performance.

You have plenty of room to invest when you start out by owning at least 20 different asset classes. Let’s examine the various stock categories to include in your portfolio.

2. Invest in individual stocks after selling a business

Stocks are what you purchase when you trade shares of a company on a public stock exchange. After purchasing shares, you become a shareholder in the business.

The values of individual stocks change every day, occasionally significantly. This could be the riskiest addition to your portfolio if you have little experience with the stock market. Although you might experience high returns in the short term, you must do extensive research before making an investment.

3. Invest in bonds after selling a business

When you assist a company in paying off its debt, you issue bonds. They’re getting a loan from you, and you’re getting paid interest.

Bonds can be classified as corporate, municipal, or treasury.

When a company needs to raise capital, it issues corporate bonds to investors. Local governments and the U.S. federal government, respectively, issue treasury bonds and municipal bonds.

Bonds are regarded as relatively safe investments, but they offer lower returns than higher-risk stocks.

4. Invest in dividend stocks after selling a business

You purchase company shares in a manner similar to buying individual stocks, with the exception that dividend stocks regularly pay you interest.

Companies that pay dividends tend to be more established, like Coca-Cola and Apple.

Because you typically invest in much larger corporations with a solid market position, they are thought to be safer than individual stocks. Even though dividend stocks are more expensive, including a few in your portfolio can help you generate regular passive income.

5. Invest in ETFs after selling a business

A collection of stocks known as an exchange-traded fund (ETF) tracks the performance of a particular industry or index. One of the most well-known funds that tracks the S&P 500 index is the SPDR S&P 500 ETF, as an example.

ETFs have the ability to be sold on the stock exchange and are managed by computers and algorithms.

Although they are inexpensive investments, the primary risk is that investors will panic sell. As a result, a fund won’t have enough cash on hand to distribute investor earnings, which could result in the loss of your long-term gains.

Although it’s unlikely, you can read up on the various ETF types before buying to avoid this circumstance.

6. Invest in mutual funds after selling a business

The difference between mutual funds and ETFs is that a group of investors manages mutual funds.

A great illustration of a mutual fund is the DWS Blue Chip Growth Fund, which holds shares of Disney, Apple, 3M, and Google.

Considered safe, boring, and predictable, these qualities make this type of investment a good choice for financial investments. An additional incentive to make wise investments is provided by the fact that investors share an equal stake in the fund’s growth.

7. Invest in index funds after selling a business

You can invest in a wide range of businesses by purchasing a single index fund unit, much like mutual funds and ETFs allow you to do.

Only at a predetermined time each day and for a predetermined price are index funds tradable. ETFs, however, can be traded all day long just like stocks.

Due to the fact that they follow indices like the S&P 500, index funds are regarded as relatively risk-free investments. With the appropriate index funds, you could generate annual returns of 8% to 10%.

8. Purchase annuities from an insurance provider after selling a business

If you have insurance, think about purchasing annuities from your insurance companies.

When you retire, typically, you pay a lump sum or in instalments and receive interest-bearing payments over time.

Although annuities are regarded as low-risk investments, inflation may have an impact on your returns. Your returns might be lower than investing in a money market account if inflation outpaces interest rates.

9. Invest in real estate after selling a business

One of the most reliable long-term investments worldwide for a very long time has been real estate.

The cost of real estate and homes, however, has grown faster than the average wage. In 2021, the median price of a home in the United States was $374,000, and the typical down payment was $27,850.

With $500k, purchasing a single property might consume a sizable portion of your portfolio.

Fortunately, buying an entire property is not necessary to begin investing in real estate. You can own a portion of a property or a real estate portfolio, similar to stocks.

10. Invest in Real Estate Investment Trust (REIT) after selling a business

You can invest in businesses that use investor money to purchase real estate through Real Estate Investment Trusts (REITs).

By making an investment in REITs, you can own real estate equity without having to deal with tenants or property management.

Despite the fact that REITs are typically held as long-term investments, they can be traded on the public stock market.

11. Invest in crowdfunded real estate after selling a business

Crowdfunded real estate might be a better addition to your portfolio if trading REITs is not your thing.

On a private social media group or a crowdfunding website, you buy real estate with other investors.

Given that it only requires a $1,000 minimum investment, this choice might make real estate investing simpler. The biggest risk, though, is that you’re funding a little-known real estate business.

12. Invest in real estate syndication after selling a business

You could investigate real estate syndication if you have $500k and a bigger desire to invest in real estate.

This choice is a crowdfunded real estate option that has been privatized. Investors who choose this path typically have a lot more real estate development experience.

Real estate syndications are not publicized because they are made up of more valuable assets. You must be an accredited real estate investor with a track record of profitable trading and enough liquidity.

13. Invest in rental properties after selling a business

The best return on investment in real estate could come from buying properties and renting them out.

It does, however, demand the most labor-intensive effort. You’ll be directly in charge of maintenance and tenant management. You could make an annual profit of more than 15% if you have the patience and good fortune to find good tenants.

14. Put money in angel investing after selling a business

Even if a company isn’t publicly traded on a stock exchange, you can invest in it.

A portion of your $500k could be used to help early-stage startups grow by lending them money. Angel investors are compensated with equity and a share of the company’s profits. You can assist businesses that share your interests by making angel investments.

There is a genuine chance that the business you invest in will fail. If the startup fails, you won’t see any return on your investment.

If a startup’s minimum viable product attracts interest from a large audience, there are potentially significant returns. Software firms have the potential to increase in value significantly.

15. Invest in peer-to-peer lending after selling a business

Lending money to individuals for mortgage or loan payments is similar to angel investing. You could provide loans with more favourable terms of repayment than banks.

With annual returns of over 10%, peer-to-peer lending may have a higher ROI than other investment options, even if your interest rate is lower than that of financial institutions.

Keep in mind that this choice carries significant risks. Your debt may never be repaid by the lender.

16. Invest in gold after selling a business

Due to the widespread belief that gold is a valuable commodity, numerous gold bars are kept in reserve by central banks around the world.

Including precious metals in your portfolio, such as gold, may be a wise long-term investment. Gold is purchased by investors as an inflation hedge. Gold has historically appreciated in value over time and has lasting value.

Things to Consider Before Investing After Selling a Business

1. Will you be able to retire on the proceeds from the sale of your business?

The sudden acquisition of wealth after the sale of a business does not necessarily indicate that you are on track to retire comfortably. The amount you’ll need is largely determined by your expenses rather than your savings.

To demonstrate, take a look at the example below, which is simplified and leaves out variables like inflation, market volatility, etc.

- Let’s say you sell your business for $5 million, pay cash for a $2 million home, and withdraw $500,000 per year to cover living expenses. You’ll run out of money in year 8 if you assume a 6% annual return, even without taking taxes or market volatility into account. Instead, if you spent $1 million on a home and borrowed $300,000 annually, your money would theoretically last for more than 27 years. The amount of money is the same, but spending determines the result.

Cutting costs can help a lot if you’re worried about running out of money. Remember that spending determines your financial options as you decide how to use the sudden wealth you receive from selling a business.

2. Be careful not to time the market

Simply because the S&P 500 is reaching new highs, holding cash after selling your business is a mistake on many levels.

First, when investing, it’s crucial to base your choices on long-term expectations rather than momentary market fluctuations.

Second, past performance does not guarantee future outcomes. Making new highs doesn’t always indicate that the market has peaked and that a correction is about to begin, just as a pause during a sharp selloff doesn’t always indicate that there isn’t still more ground to be lost.

The idea that making investments at a time when the market is booming will probably result in lower future returns isn’t supported by historical data either.

In actuality, making investments on days when the market hit a new record high can result in higher returns than making investments on days when the market didn’t.

3. Taxes can be reduced by investing wisely and locating your assets

You’re probably looking to put the majority of the money you received in cash from the sale of your business into a brokerage account if the deal was completed in cash (or perhaps a brokerage account titled as a revocable living trust). There are no tax advantages with a brokerage account, unlike a retirement account, which makes it a completely flexible type of investment account.

4. Try out your budget under pressure

Understanding your options and risks is a crucial component of deciding what to do with the money you receive after selling your business.

Your plan should have a Monte Carlo simulation to take market volatility into account so that you can be sure it is not too early to retire. The best method for stress testing a retirement plan is this.

Stress testing is crucial in retirement planning because basic straight-line calculators for retirement return don’t take into account the erratic nature of investment returns or the timing of down years.

A constant average annual return is the only variable. Notably, these straightforward calculators for compounded returns only make the assumption that your investment portfolio will increase. They disregard how the average was created by the other half of the equation.

5. Don’t rush into paying off your mortgage or purchasing a home outright

Each choice we make has an opportunity cost, just like almost everything else in life. Recognize that prepaying your mortgage isn’t always a smart move, whether you share the desire to live without a mortgage or are just unsure of where else to put extra money.

Using the proceeds from the sale of your business to pay off your mortgage early could be a mistake if your interest rate is low.

It might become more challenging for new buyers to benefit from the leverage spread as interest rates rise. The opposite is also true: the more advantageous it may be to obtain a mortgage and invest cash in the market, the lower the interest rate on the loan.

6. Take into account trusts, gifting methods, and estate planning strategies

After selling your business, your estate plan is probably going to change significantly. To create a strategy that works for your situation and family’s objectives, consult a trusts and estates attorney.

Discuss options to meet your charitable goals and ways to lower your taxable estate with gifts to family if you feel so inclined, taking into account your assets and anticipated cash needs.

Also take into account strategies using trusts to achieve various objectives. For instance, irrevocable trusts provide superior asset protection, but you lose complete control. Revocable living trusts, on the other hand, allow you to maintain control over your assets while avoiding probate.

As with any financial plan, it’s crucial to make sure that it aligns with your overall goals and priorities. Avoid making decisions solely based on tax implications.

For instance, donor advised funds are an excellent resource for investors to help them maximize the tax advantages of charitable giving.

But are you really better off if you’re not charitable or enthusiastic about the cause? Making a sizable donation the year you sell your business (and are subject to the highest marginal tax rates) can be very advantageous if you have a charitable streak.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.