(This article was last updated on February 28, 2023.)

In this article, you can find out the options of how to buy US ETFs from Europe, such as Vanguard and BlackRock ETFs. Recently many of you asked me “when is the best time to invest?”

No one can count the markets and tell you the best period that is good to make your investment, and it is always better to be diversified. At the same time, these estimates look attractive for any long-term investor.

According to Warren Buffett, you should invest “when there is blood on the streets.”

For details about how to open your accounts and invest in US funds including Vanguard from Europe, you can contact me using this form, the WhatsApp function below, or just by emailing me (advice@adamfayed.com).

Those who prefer video content can also watch the summarized video here:

Table of Contents

What are ETFs?

ETFs or exchange-traded funds first appeared in the markets in 1993. Exchange-traded funds are similar to stocks and are usually traded on stock exchanges.

It typically consists of assets such as bonds, stocks, equities, and commodities that exist to trade closer to net asset value (with little chance of deviation). Each ETF individually consists of more assets. For example, the ETF following the S&P 500 index is made up of 500 stocks. Some of the popular post-ETF stock indexes are the NASDAQ 100 and the S&P 500.

Asset management companies such as Vanguard or BlackRock issue ETFs and each of the individual asset management company is able to issue more ETFs. Exchange-traded funds generally track an Index which is Stock Index or Bond Index. It is estimated that between 1993 to 2015, 2 trillion US dollars were invested in ETFs in the United States.

The most attractive features that make ETFs into a worthy investment option are their lower costs, tax efficiency, a big number of choices, features similar to the ones related to stocks, etc.

How different are ETFs from other investments?

Low Costs: When you compare ETFs to other mutual funds, they have lower costs. The annual overall costs can be 0.1%, but the annual management fees of mutual funds can be around 1% to 2%.

Tax Efficiency: ETFs have an attractive tax efficiency, compared to other popular investment options. But there is an exception in the case of Vanguard company’s ETFs, as there you cannot enjoy the tax advantages.

Many Choices: You can find a wide range of options for choosing ETFs from various sectors.

Trading of ETFs: In comparison with the mutual funds that can be traded only at the end of the day, ETFs can be traded at any time when the market is open.

How can you buy ETFs online?

The most common questions that people usually ask themselves when they want to buy online or invest in an ETF are:

- What are the most important key factors should I keep in mind while buying an ETF online?

- How can I invest in an ETF online?

- What is the process involved in trading an ETF online?

The main steps of buying an ETF online are:

Getting Accurate and Reliable Information

You must secure correct and updated data about the country, region, or sector in which you are going to invest. If you predict growth in the country’s market, you can purchase an ETF which follows an index of that country’s stocks. On the other hand, you can buy a sector-specific ETF that follows the sector stock index for the respective country if you are forecasting growth for the sector rather than the country-wide market.

For example: If you predicted the US market is going to rise, you can go ahead and buy an ETF that follows an index made up of US stocks, such as the S&P 500. If you expect growth in a sector such as technology, then you can buy an ETF that tracks an index containing US technology-related stocks like the NASDAQ 100.

Checking the ETFs

Check ETFs based on their size and expense ratio, and try choosing a larger ETF with a lower expense ratio. Large ETFs tend to be more liquid than smaller ones. The size of ETFs is classified based on their assets under management, which is known as AUM.

The higher the value of the ETF, the more the liquidity of the ETF will increase. The ETF expense ratio indicates the ETF’s average annual fee. It is highly recommended to choose an ETF with an expense ratio below 0.1%.

Selecting Where to Trade

Pick the location, stock exchange, and currency of the preferred ETF you plan to trade. ETF taxation varies by location. 90% of ETFs are based in the US and the EU (70% in the US and 20% in the EU). The stock exchange is different from the place of residence.

You can also trade ETFs on a wider range of stock exchanges. Although it is recommended to choose stock exchanges with low commission rates. Commission rates actually can be different depending on the broker you choose. To avoid conversion fees, you must choose an ETF and a broker with the same currency, since the stock exchange results in a different currency.

Finding a Good Broker

Having a good broker plays a key role in ETF trading. Considering important aspects such as broker commissions, easy access, trading platform and user friendliness, you can find the right broker according to your requirements. It is also very important that you choose a reliable and reputable broker while you are looking to avoid risks.

Buying the ETFs You Want to Trade

Find the ETFs you want to buy on the online trading platform. You can buy ETFs through an online trading platform where you can choose from a variety of order types.

Monitor Your ETFs

Always keep an eye on the details of your ETF, regularly and impartially. Now that you’ve bought an ETF, it’s important to keep an eye on the details from time to time. It is best if you cultivate a strategy for choosing to keep ETFs for a longer or shorter period and manage them properly to prevent losses and achieve a targeted profit.

These tips are the basis of trading by ETFs and can be necessary for you. By having the right plan and following these techniques thoroughly, you can be able to reach benefits from the ETFs that you have purchased.

Are do-it-yourself providers (DIY) okay?

DIY investing often doesn’t work statistically speaking . But for a number of people who are interested in DIY providers, here are some of the best in the market online brokers for investing in ETFs in 2023:

Charles Schwab

Charles Schwab is considered the best online platform for investing in ETFs. It was and always has been the best financial services firm for those who want to invest individually. It is also popular for its discounts and is considered to be one of the most affordable platforms on the market. Brokerage fees on all ETFs are equal to zero, and individual stock trades are also free.

You will have the ability to trade regardless of where you are thanks to Schwab’s provision of not one but two trading platforms in addition to a mobile app.

Schwab.com web trader

Schwab.com Web Trader is an online trading platform that allows investors to trade stocks, options, and other securities through their web browser. The platform is designed to be user-friendly and intuitive, with a range of features and tools to help investors manage their investments.

Some of the key features of Schwab.com Web Trader include:

- Trading tools: The platform provides a range of trading tools, including real-time quotes, charts, and market news, to help investors make informed trading decisions.

- Order types: Schwab.com Web Trader supports a variety of order types, including market, limit, and stop orders, as well as conditional orders and advanced orders like trailing stops.

- Customization: Investors can customize their trading experience by creating watchlists, setting up alerts, and customizing the platform’s layout and features to meet their individual needs.

- Security: Schwab.com Web Trader uses advanced security features to protect investors’ accounts and data, including two-factor authentication and encryption technology.

- Education and support: The platform provides educational resources and support to help investors learn more about trading and investing, including access to market research, trading tutorials, and customer support.

StreetSmart Edge

StreetSmart Edge is a trading platform that is designed to provide advanced trading tools and features for active traders. The platform offers a wide range of tools for traders, including real-time market data, advanced charting tools, customizable watchlists, and trading ideas and insights.

Some of the key features of StreetSmart Edge include:

- Real-time market data: The platform provides real-time quotes and news updates for stocks, options, and other securities.

- Advanced charting tools: Traders can use a variety of charting tools to analyze market trends and patterns, including technical indicators, drawing tools, and customizable chart settings.

- Customizable watchlists: Users can create customized watchlists to track their favorite stocks, ETFs, and other securities, and set up alerts to receive notifications when certain price or volume levels are reached.

- Trading ideas and insights: StreetSmart Edge provides a range of trading ideas and insights, including analyst ratings, earnings estimates, and market news.

- Order execution: The platform offers fast and reliable order execution, with the ability to place trades directly from the charts.

What are the pros of Charles Schwab?

- You can create a better and well-diversified portfolio using the ETF Portfolio Builder.

- You can find the best funds for a portfolio using ETF screeners.

- Schwab does an excellent job of giving investors the information they require, research-wise plus all of the tools that are offered by the broker.

- Trades in stocks and exchange-traded funds (ETFs) at Schwab are not charged, and there are no extra or hidden charges for using Schwab platforms and mobile applications.

- The Schwab team is available for online chats, email, and calls 24/7.

What are the cons of Charles Schwab?

- The presence of an overabundance of platforms makes it difficult to find tools.

- Obliging an investor to hire the Schwab financial advisor.

- There are fees associated with transferring out. A transfer of a portion of your balance will cost you $25, while transferring the full balance will cost you $50.

Fidelity Investments

Best for online research and tools. The company offers good ideas for investments aimed at generating income. The research center provides ETF comparisons and exchange-traded products (ETP) comparisons to help the investor get better and improved results. Their Screener gives you the opportunity to search based on their standards, that includes fundamentals, exposure, rankings, performance, unpredictability, and more.

Active Trader Pro

Active Trader Pro is a trading platform offered by Fidelity Investments to its active traders. It provides real-time market data and analytics, advanced trading tools, and customizable charting capabilities to help traders execute sophisticated investment decisions. The platform is designed for experienced traders who require advanced features and tools to manage their investments.

Fidelity Spire app

Fidelity Spire is a financial planning app designed to help individuals set financial goals, create a budget, and track their progress towards achieving those goals. The app provides personalized recommendations and insights based on the user’s financial profile and helps users stay on track with their financial goals.

Real-time Analytics

Real-time analytics refers to the use of advanced data analysis tools and techniques to provide investors with up-to-the-minute insights into the financial markets. Fidelity Investments provides real-time analytics through its trading platforms and market data services, allowing investors to stay on top of market trends and make informed investment decisions.

Trade Armor

Trade Armor is a feature within Fidelity’s Active Trader Pro platform that provides investors with real-time market insights and analysis. It offers a suite of advanced trading tools, including customizable charting capabilities, risk management tools, and order execution options, to help investors stay ahead of market trends and make informed trading decisions.

Trade Armor is designed for active traders who require advanced features and tools to manage their investments.

Daily Dashboard

Fidelity’s daily dashboard provides investors with a quick and easy way to stay up-to-date on market news and events that could impact their investments. The dashboard provides a summary of market activity, including key market indices and news headlines, as well as insights into individual stocks and sectors. It also includes tools and resources for investors to research and analyze potential investment opportunities.

What are the pros of Fidelity Investments?

- No account minimum.

- The process of researching and analyzing ETFs is comparably easy with the help of their ETF Research Center.

- It has a well-cultivated mobile app, which is easy to navigate and use.

- You won’t have to pay anything for stock or ETF trades, and the broker won’t charge you anything for the standard categories of fees, either, such as account or activity fees as well as transfer-out fees. They won’t even charge you for some of the less common ones like the IRA closeout and reorganization fees.

What are the cons of Fidelity Investments?

- It is advised to utilize more than one platform to have an access to all the offers provided by the company.

- The company’s branches are not available 24/7.

- Has trading restrictions on some of the riskier corners of the stock market, including certain types of preferred stocks. You won’t be able to buy these securities, but you won’t be forced to sell if you’ve transferred them in, per Fidelity’s policy.

TD Ameritrade

Great for beginners and those who invest in ETFs. US clients have a number of benefits as they charge no fees for trading ETFs, stocks, options, etc. This is the best choice if you want to control your investments online or using your mobile device.

Note that TD Ameritrade has been acquired by Charles Schwab in 2020.

Web platform

TD Ameritrade’s web platform is an online trading platform that allows investors to trade stocks, options, ETFs, and other securities from their web browser. The platform provides real-time market data and news, customizable charts, and research tools to help investors make informed trading decisions.

Thinkorswim platform

Thinkorswim is a desktop trading platform offered by TD Ameritrade that is designed for advanced traders. It provides real-time market data and advanced trading tools, including customizable charting capabilities, risk management tools, and order execution options. The platform is designed for experienced traders who require advanced features and tools to manage their investments.

In addition to its trading platforms, the firm offers a variety of account types to meet the needs of different investors. These account types include individual brokerage accounts, retirement accounts, education savings accounts, and more.

TD Ameritrade also offers managed portfolios through its Essential Portfolios and Selective Portfolios programs, which provide investors with a professionally managed investment portfolio based on their investment goals and risk tolerance.

What are the pros of TD Ameritrade?

- You can make voice transactions using Amazon Alexa.

- You can access all of their trading platforms and both of their mobile apps.

- Access to useful articles, instructional videos and live streams.

- It does not impose a fee on ETFs for the redemption of short-term holdings.

What are the cons of TD Ameritrade?

- Charge a fee of $75 for each transfer out, but make partial transfers free of charge.

- TD Ameritrade does not currently offer fractional shares trading, which may limit investment options for some investors who want to buy (though this isn’t a big deal since it has been bought by Schwab).

Vanguard Group

As the world’s largest mutual fund provider, this is a good option for ETF trading, suitable for any type of investor. The group is also the second largest ETF provider in the world. This is the base level and is not preferred by active traders or individuals who want to use advanced charting capabilities. However, it is a great choice for those who are interested in investing in low-cost ETFs and want an EA to do the analysis.

Vanguard Digital Advisor

This is an online, automated investment advisory service offered by Vanguard Group. The service uses computer algorithms to create and manage a personalized investment portfolio for clients based on their individual financial goals, risk tolerance, and time horizon.

Vanguard Digital Advisor provides a convenient and low-cost way for investors to access personalized investment management services. While the service is automated, clients can still access human advisors for additional support or guidance if needed.

However, it’s important to note that the service may not be suitable for investors with complex financial situations or those who require more customized investment management services.

Vanguard Portfolio Watch

This is a free service offered by Vanguard Group to help investors analyze and evaluate their investment portfolios. The service uses a series of analytical tools to help investors assess the diversification, risk level, and overall performance of their portfolios.

What are the pros of Vanguard?

- No commission on trading all available ETFs.

- 2. Clients who have invested over $1 million in Vanguard funds won’t be subject to any additional fees when ordering ETFs over the phone from other fund house.

- Advanced analysis level.

What are the cons of Vanguard?

- Accounts at Vanguard have a yearly fee of $20 deducted from their balances, with certain exemptions.

- Depending on the amount of money you chose to invest in Vanguard funds, you may be subject to a charge of $25 if you use the phone to place an order for ETFs offered by another fund company.

- Not suitable for active investors and charting professionals.

E*TRADE

No fees for trading stocks and ETFs in the US, as well as a zero basic commission. The online brokerage firm offers a range of investment products and services to individual investors, including trading platforms, research tools, and educational resources.

There are also effective tools and resources. Features such as the All-Star ETF List, ETF Screener, and pre-built ETF Portfolios (this is a tool that helps you choose the best ETF based on your preferences, such as investment timeframes and risk tolerance) help you select your own investments.

Power E-Trade

Power ETRADE is designed for active traders who require advanced trading tools and features. The platform offers real-time streaming data and customizable dashboards, as well as a range of technical analysis tools and options trading capabilities.

Some of the features of Power E*TRADE include:

- Advanced charting and scanning tools

- Real-time streaming data and customizable dashboards

- Options trading capabilities

- Risk analysis tools to help manage trades

E-Trade Web

ETRADE Web is a user-friendly platform that requires no downloads or installations. The platform provides access to a range of investment products, including stocks, options, mutual funds, and ETFs, and offers a variety of research and educational resources, including news, market analysis, and educational webinars.

Some of the features of E*TRADE Web include:

- Easy-to-use web-based interface

- Access to a range of investment products

- Research and educational resources

- Watch lists and alerts to track market activity

E-Trade Mobile

ETRADE Mobile is a mobile app that allows users to manage their investments on-the-go. The app provides access to real-time streaming data, news, and market analysis, and offers trading capabilities for stocks, options, and ETFs.

Some of the features of E*TRADE Mobile include:

- Easy-to-use mobile app interface

- Real-time streaming data and news

- Trading capabilities for stocks, options, and ETFs

- Watch lists and alerts to track market activity

What are the pros of E*TRADE?

- No account minimum.

- Quickly respond to market news outside business hours.

- The tools can be used through the web platform.

- Availability of watchlists for mobile applications.

What are the cons of E*TRADE?

- Margin rates are slightly more expensive.

- As with Fidelity Investments, it is recommended to use multiple platforms to access all the offers they provide and the tools you intend to use.

Ally Invest

This is another good US-based broker where you can make good profits by investing in ETFs. The broker provides you with very good research tools and resources that can help you when trading ETFs. Its web platform is user friendly and very efficient. It also comes with the same benefits as the other online brokers we talked about above.

Ally Invest offers a range of investment products, including stocks, options, mutual funds, ETFs, bonds, and futures. The platform also offers managed portfolios, which are professionally managed portfolios that are tailored to an investor’s goals and risk tolerance.

Ally Invest LIVE

Ally Invest LIVE is a web-based trading platform that offers real-time streaming data, customizable charts and tools, and a range of educational resources.

Ally Invest Managed Portfolios

Ally Invest Managed Portfolios is a robo-advisory service that offers automated investing and portfolio management.

Ally Invest has a team of customer service representatives available to help investors with their account and trading questions. The platform also has a community forum where investors can ask questions and share ideas with other investors.

Pros:

- No fees and no account minimum.

- Extremely helpful research tools.

- Well-designed and efficient web-based platform.

- Client support is available 24/7.

Cons:

- You pay $9.95 while transacting the mutual funds.

- Ally continues to assess a fee of $25 for closing an IRA. There will be an additional fee of $50 if you decide to transfer the account (whether it’s a partial or full transfer).

- There are no branches for the online broker.

In case you are interested in using Robo advisors (like Betterment) to make the investment for yourself, below you can find a table that will be useful for you. Always try to keep the tips in mind and look for the best online broker to make a profit by investing in ETFs.

ETFs.

| Broker Name | Charles Schwab | Fidelity Investments | E*TRADE | TD Ameritrade | Vanguard | Ally Invest |

| Account Minimum | $0 | $0 | $0 | $0 | $0 | $0 |

| Fees | $0 | $0 | $0 | $0 | $0 | $0 |

| Promotion | Up to $1,000 | $100 | Up to $3,500 | N/A | N/A | N/A |

| Number of commission-free ETFs | all | all | all | all | all | all |

| Mutual fund Transaction Fees | $0 | $0 | $0 | $0 | $0 | $9.95 per trade |

Choosing between US or EU ETFs:

Since you have read the details about ETFs and online brokers to buy ETFs, below you can find some other details about US ETFs and EU ETFs. As already mentioned, the US accounts place about 70% of the ETF market, while the EU accounts have 20%.

The main difference between US ETFs and EU ETFs is based on the country or region where the ETF was issued. An ETF can track the same index but have a different address.

What are the main and most important factors to consider when choosing between US and EU ETFs?

Taxation

The taxation of an ETF is affected by the location of the ETF and the tax residency of the respective investor. When trading ETFs, taxes such as withholding tax, income tax, and capital gains tax may arise. In that case, try to always keep these aspects in mind when trading. You can get more information from your accountant or tax adviser.

Liquidity

By the end of 2022, the EU ETF market recorded net inflows worth 80.2 billion euros ($86.36 billion). Meanwhile, the US ETFs bagged $597.9 billion for the same period.

It was previously mentioned that ETFs with higher liquidity are preferable for transactions over a short period of time compared to ETFs with lower liquidity. EU ETFs have lower liquidity than US ETFs, making them higher spread costs.

Regulation

In January 2018, a regulation came into effect that officially prohibits European investors from buying US-registered ETFs. This is due to the lack of a document with key information. They can trade EU-registered ETFs that comply with the rules of the new PRIIPs (packaged retail investment and insurance products) regulation.

How to Buy US ETFs From Europe: Will I be able to?

Now you may be interested if there is a chance to buy US ETFs in Europe. We will try to give you a comprehensive answer and all the details that will dispel your doubts about this.

Under the PRIIPs regulation, you cannot trade US-registered ETFs while in Europe because US-registered ETFs do not contain a key information document (KID). The KID contains the details of the investment such as risk, cost, etc. This key information document gives the investor complete information about the investment.

Instead of providing KID, some large ETF issuers invited EU clients to invest in similar EU-domiciled ETFs, which is effectively allowed under the PRIIPs regulation.

An alternative is to invest in UCITS (Undertakings for the Collective Investment in Transferable Securities) ETFs. These ETFs are regulated by the European Union and have a UCITS KID.

You can invest in your favorite ETFs as long as they are UCITS ETFs from issuers like Vanguard and BlackRock.

These two issuers are mentioned among many other issuers as they are highly liquid due to their assets under management worldwide. As of the time of update, Vanguard is valued at $8.1 trillion while BlackRock is valued at $8.6 trillion. Because they have higher assets under management, they have high liquidity as well as lower fees.

The following are the S&P 500 UCITS ETF from Vanguard and BlackRock:

The S&P 500 UCITS ETF – (USD) Distributing (VUSA) for Vanguard and the iShares Core S&P 500 UCITS ETF (CSPX) for BlackRock.

What differentiates US-domiciled funds from UCITS funds?

There are three main aspects that are considered when comparing the US-domiciled funds to UCITS funds:

Annual Expenses

The annual expenses of trading US-domiciled ETFs are generally lower than UCITS ETFs.

Commissions

These include fees for buying an ETF for the first time. When you trade to maintain a good and well-balanced portfolio by using communication brokers and buying ETFs that follow the S&P 500 Index, you will be charged certain fees. Note that fees for US-listed ETFs are comparatively lower compared to UCITS ETFs.

Liquidity

We already know that the liquidity of an ETF depends on the assets under the management of the respective ETF. A growth in the number of assets results a high amount of liquidity and a lower spread cost. Thus, with higher liquidity, the purchase price and the sale price of an ETF can be similar to each other.

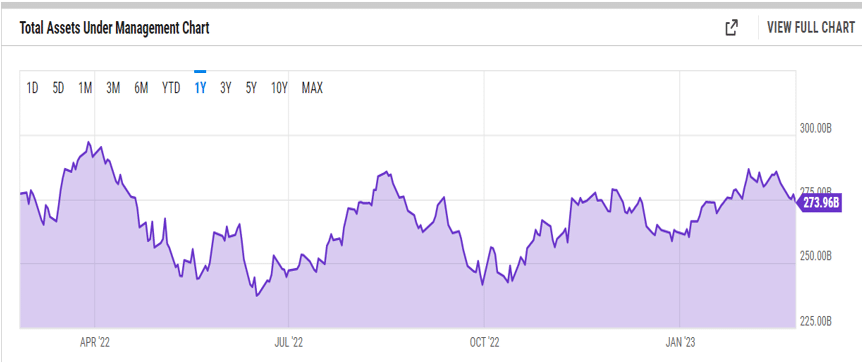

- The assets under management of Vanguard (US Domiciled) VOO stood at $276.87 billion as of Feb. 27, 2023.

- The assets under management of Vanguard UCITS VUSA stood at $34.59 billion as of Feb. 17, 2023.

- The assets under management of iShares UCITS CSPX stood at $52.20 billion as of Feb. 27, 2023.

The US-based ETFs have a high percent of liquidity, which is more than UCITS ETFs as the assets under management for the US-based ETFs are relatively higher.

As result, we can summarize that UCITS ETFs are far less profitable than US-listed ETFs. This is in line with the results we have seen compared to US-listed ETFs with the UCITS ETF.

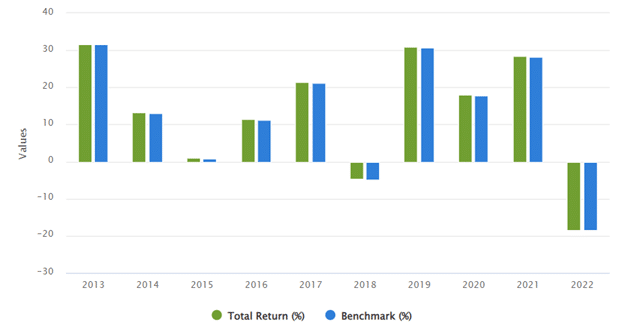

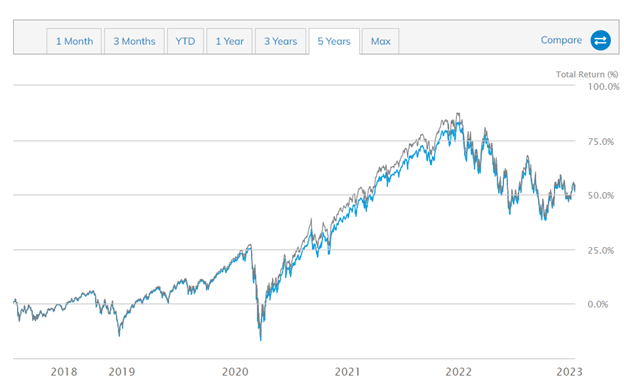

The graph above shows the total return of CSPX based on net asset value (NAV) with a negative value as of 2022. Meanwhile, the graph below shows that Vanguard VOO’s total return remained in the positive territory.

While there are more benefits to trading US-listed ETFs, people looking to invest will be out of luck as the KID is not available for US-listed ETFs, and PRIIPs regulation does not allow trading of ETFs without a KID.

If you are a professional client, trading US-registered ETFs is very difficult. The requirements for a professional client are a huge portfolio, half a million cash, expert level professional training, and significant trading experience.

Let us be clear that despite common misconceptions, it is not against the law for European retail investors to acquire foreign ETFs. Only brokerages that are not permitted to market such products to ordinary retail investors are impacted by the regulation.

However, there remain several ways for retail investors in Europe to obtain US-ETF shares:

Establish a brokerage account using an address located outside of Europe

Obtaining a brokerage account that isn’t required to adhere to the EU regulation is the simplest way to fix this issue. You can do this by opening an account with an address in a region other than Europe.

Create a brokerage account with a company that is not based in Europe

In the event that you do not have an address located outside of Europe, you may be able to establish an account with a brokerage that actively conducts business within Europe and provides services to European customers.

There are businesses located in the United States that do business with European customers despite not adhering to the regulation that is in place in the European Union. As a result, this paves the way for clients in the EU to acquire US-ETFs. This could change at some point if the EU stretches its grasp and include such firms in its rules.

Get a waiver

By requesting an exception from their brokerages, European investors can get around the EU legislation. If the following criteria are met, retail clients could ask to be classed as “elective professional clients” as per the EU:

- An exemption from the safeguards provided by the standard business conduct can be deemed valid if a sufficient evaluation of the customer’s knowhow and experience carried out by the investment firm provides an adequate confidence that the client is in a position to make investment decisions and fully grasps the potential risks.

- During the evaluation, at least two of the following requirements must be met: (1) The client’s financial instrument portfolio size, which is determined by cash deposits and financial instruments, must be worth over half a million euros; (2) the customer has executed deals that are significant in size (minimum of 200,000 euros) at least 10 times for each quarter within the past four quarters, on average, and such transactions must have been made in certain markets; (3) the client is currently employed or has previously been employed for at least 12 months in the financial sector.

Acquire US-ETFs via options

The sale of options on the corresponding ETFs is unaffected by the restrictions the EU has placed on US-ETFs. A European broker can thus enable European individual investors to purchase and offload options on US-ETFs.

The majority of the main US-ETFs have options, which typically expire each week, month, or quarter. Hence, with a high likelihood of purchase, European investors could offer certain put options before they expire.

This results in the acquisition of the underpinning US-ETF indirectly in multiples of 100 shares, since every option contract necessitates the purchase and sale of 100 shares). Although though this method is a little laborious, it is completely legal and complies with all current EU regulations.

In fact, this only makes sense for accounts with high balances because purchasing US-ETFs in multiples of 100 shares frequently demands substantial individual deposits. This strategy is still listed because some investors might find it interesting to know.

Engage a financial management company. Financial advisors may be able to open an account for you via which they may purchase US-ETFs on your behalf. They will handle your account’s management, so you will normally be less flexible, and such service often costs an additional 0.5-1.5% per year.

If none of the other solutions are applicable in your case and if you don’t mind this cost, this could be a viable option for you. Besides, the benefits will more likely outweigh the fees.

Having studied all the information provided, you will be able to choose the ETF in which you are ready to invest. By following the above tips and methods, you can make successful profits by trading ETFs. We hope you found this article helpful.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.