I have often been asked to write an article focusing on expat investments.

What is my review of RL360 PIMS, Zurich Vista and similar products? This is a timely question in the age where most expats are focusing on getting a yield on their money.

In this article I will review some common expat investments, such as RL360 Personal Investment Management Service (PIMS) and Zurich Vista, whilst discussing whether people should keep investing into them or seek an alternative arrangement.

Whilst investing is much wiser than keeping money in the bank, not all plans are made equally.

A case in point is savings plans (sometimes called offshore regular savings plans) and offshore bonds.

In the offshore expat markets, savings plans are one of the most commonly sold financial products. Few people seem happy with them.

For those that prefer visual content, I made the video below:

If you want to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

This includes if you have a policy and aren’t happy.

What are expat savings plans?

Most expat savings plans are insurance-investment plans, offered by expat financial advisers and wealth managers, locals and banks. If you die you will get 101% of the value of the account. For example, if the value of the investment is $100,000, your offspring will get $101,000 upon your death.

Typically, the plans have a contribution period. 5 years is often the shortest time you can save, with 25-30 years being the longest plans. Typically, the 20-30 year savings plans are sold more widely in the expat markets.

These plans are generally coming from Isle of Man, Jersey, Cayman Islands, Bermuda, Puerto Rico, Guernsey and numerous other offshore locations.

That isn’t the problem with these plans. All locations these days, whether offshore and onshore, have strict investment rules in the wake of the financial crisis. It does also make sense for expats to invest offshore, for tax reasons, with the exception of Americans.

The issue is more the investments within the plans, and the terms and conditions, not the locations where the money is held.

Who buys these plans?

People from all around the world. In general, I find British expats are most likely to buy the plans, followed by Nordic, French, Indian, Chinese, Australian and numerous other nationalities.

What can you do if you have one of these plans and are worried about them?

Seek advice. Depending on the terms and conditions associated with your account, it may be possible to go for a cheaper alternative or reduce the existing fee structure in the account. I hope this article helps in that process.

Major Providers and Products

Who are the major providers and products and where are they sold?

- Generali Vision. Now provided by Utmost Wealth Solutions in Guernsey. So, Generali Vision is now commonly called Utmost Vision Plan.

- Zurich Vista

- Platform One Hallmark Savings Plan

- Friends Provident International Premier Advance Savings Plan

- Hansard Vantage savings plan

- Hansard International Vantage Platinum II

- RL360 Insurance Company Ltd. (RL360) Quantum

- RL360 Paragon

- AXA Pulsar

- Providence Life Compass Account

- Hansard Infinity Wealth

- Hansard Infinity Wealth Access

- Premier Trust Global, now called M1 Specialty

- Premier Trust Global Premier Provest Principal Protection

- Premier Trust Global Provest plan

- Metlife International Wealth Builder

- HSBC International Wealth Builder Accounts

- Canada Life Offshore Savings Account

- Liberty Life/liberty mutual for expats in South Africa

- The FlexGlobal international savings plan

These plans are sold all over the world. Some typical destinations where the plans are sold include Singapore, Hong Kong, Dubai, Abu Dhabi, Qatar, Amsterdam, Shanghai, Thailand especially in Bangkok, Kuala Lumpur, Jakarta, Ho Chi Minh City (HCMC) in Vietnam, Spain, France, Tokyo, South Africa, Seoul, Germany, Switzerland and Brussels.

The plans are also sold in Phnom Penh in Cambodia, Manila, Laos, India and countless other emerging destinations, where expat numbers are rising.

The lump-sum products associated with these life companies are also sold extensively in Australia, Canada and New Zealand, due to qualifying recognised overseas pension scheme (QROPS) and self-invested personal pension (SIPP) for British expats.

Due to the fact that most of these insurance companies are based in the Isle of Man or other overseas British territories, it is common for British expats to buy the policies.

How do they typically work?

The cost of the plans is typically levied upfront, due to sales and admin costs. The client is then reimbursed some of that cost at the end of the plan, in the form of bonuses.

Let’s take a simple example of a person who buys a 10-year savings plan. If he or she pays the premium over 120 months, the total costs of the plans are often 1%-2% per year.

Sounds reasonable enough. But if the client stops paying halfway through the contract, the actual cost is closer to 4% per year, because the end of contract bonuses is usually not given back to the client.

Premium holidays are possible, but they don’t come cost-free.

Can the client make good money on these plans?

A small percentage do, but almost all those small percentage of success stories are people who keep contributing to the end of the term.

However, only 3%-4% of people contribute to the full 25-year terms. I have seen several people make quite reasonable returns from 10- or 15-year plans.

But even then, many people stop contributing because in the first few years the charging structure is high. Unless the client knows that they will get a big bonus at the end of the contract, they often stop contributing.

What makes this particularly confusing is that the charges aren’t levied consistently. On the Generali plans, for example, the charging structure gets very high in years 7, 8 and 9. So high that it isn’t easy to make any on-paper returns.

But after year 10, the charging structure falls dramatically, to approximately 0.2% per year. Many people, therefore, stop contributing after 6, 7, 8 or 9 years.

In general, the old-school plans should be avoided like the plague unless you can contribute every single month.

How many years does the typical person invest in these plans for?

7 years is about the average, statistically speaking, for the 25-year product. A higher percentage of people investing in the shorter 10-year plans contribute until maturity.

Has anyone attempted to cancel Zurich Vista and similar policy before the end of tenure?

Of course, countless have.

So, if somebody wants to stop contributing what can they do?

There are numerous options. People can go for a maximum surrender value and just stop the accounts. However, the surrender value can be quite low, depending on how close the client is to maturity.

For example, let’s say a client has invested in a regular savings plan. It is a 25-year plan and after 5 years the value is $100,000. There are still 20 years to go, and therefore, the surrender value might be extremely low. In comparison, if person B has $100,000 in a 10-year plan, and we are now in year 8, the surrender value may be 90%+ of the account value.

A second option is a maximum penalty-free surrender and withdrawal, which can be reinvested elsewhere, in a more productive way.

A final option is to stop paying but take no money out of the policy.

Can somebody make money if they stop contributing?

It depends on many factors, including which funds are selected within the savings plans. In general, if people stop contributing, they either lose money yearly on the plans, break-even or at best make 4% per year. It is a numbers game. As the cost of the account will shoot up to over 4% per year, in some cases, due to non-contribution, if markets are performing at 8%-9%, the client’s account may go up by 4% if the right funds are selected.

What are the biggest mistakes most people make in this situation?

Researchers call it loss-aversion. People find losses more painful than gains. That is one reason why some people are terrified of investing in the first place, despite the fact the Dow Jones has gone from 66 in 1900 to about 37,000 in 2022.

In terms of savings plans, typically consumers will make the following mistakes:

- Keep contributing and wait until the value reaches a certain level

- Never consider alternatives

- Bury their heads in the sand

Sometimes, it is rational to accept a loss. Typical example: let’s say your account is worth $100,000, but you can only get $80,000 back. Getting out of the account will cost you $20,000. A tough pill to swallow.

But let’s work something out. If markets perform at their average historical rate of return, your $80,000 will be worth over $100,000 in three years and about $207,000 in 10 years.

Of course, nobody knows what will happen to markets. In the last nine years, markets in the US have increased by about 300%, whereas they produced bad returns from 2000 until 2009.

However, statistically speaking, accepting losses can sometimes be rational if it leads to a better outcome.

Can I lose all my money if I stop contributing early?

Typically, these savings plans have an 18 month `indemnity period`. That means if you stop contributing before the first 18 months you will lose all your money. On the Generali plans, the 5- and 10-year plans both have indemnity periods of less than a year.

If you stop contributing after 18 months, it is a misconception that you are likely to literally lose all your money. What will happen instead is that the high fees will eat into the returns.

Are the plans flexible?

The days of the career expat are largely over, with expats needing to move from city to city more often.

Most of these plans aren’t very flexible. It is true that after the initial period is up, you can stop contributing, decrease or increase your premium, but each option comes with ramifications. Decreasing your premium will still potentially lead to very low returns or losses.

This is because the charging structure is based on the initial premium. So, if you started with a $2,000 per month premium and then reduce your premium to $300 a month, the charging structure (percentage-wise) will still be linked to the $2,000 premium.

Do they all work in the same way?

I have been asked one question commonly from readers of that blog posts and in-person: do other savings plans usually work in the same way?

The answer, at least for the old school plans, is yes. Different providers have different fees, but all of them:

- Have high fees. Some have higher fees in other years than others, but overall, they are remarkably similar.

- Have especially high fees if you don’t pay in every time. The way the accounts work is that you are reimbursed some of the costs of the account if you pay in every month until maturity. If you even miss 1 month, you often can’t get the bonuses.

- Are much more expensive than various lump sum and newer savings products.

Are there some circumstances when you should continue to contribute?

Yes. If you are 110 months into a 10-year savings plan, it clearly makes sense to contribute for the final 10 months, as you will be given bonuses which will reduce the average cost of the account. Likewise, if you have invested for only 5, 10 or 15 years it may be worth continuing.

This will especially be the case if you have invested a small percentage of your income. It is common sense that an expat making $10,000 after tax will probably be able to afford a $500 to $1000 monthly premium. An expat making $3,000 a month might struggle to maintain the premium level.

Are there tax implications of coming out early?

Sometimes. If you deposit $30,000 into your home countries bank account, questions may be asked. That is one reason why seeking an alternative investment solution for the money often makes sense unless you are close to retirement.

Are there additional outsourced costs for investing?

Sometimes advisor firms outsource the management of the accounts for a 1% yearly fee. For example, Tilney BestInvest is widely used in Malaysia, Cambodia, Hong Kong, Thailand, Qatar and China – due to the fact they are sold by W1 Investment Group and Infinity Financial Solutions.

The problem is, investing in BestInvest from a UK platform and investing from an offshore base is quite different. Using BestInvest in the UK can be up to 5-10 cheaper than buying the same funds through an offshore life company. So, typing in BestInvest reviews or Tilney BestInvest reviews into Google will often lead to reviews relating to UK SIPPS and regulated products.

Other outsourced services include Purple Asset Management in Singapore used by the Fry Group and Brewin Dolphin are also used in the expat market.

What other insurance-related products are typically sold?

Offshore portfolio bonds are also widely sold. These are lump sum products which are typically shorter in length – for example 5- or 10-year charging structures. Such bonds are also used for British, Irish, Dutch and Belgium expats who want to transfer their pensions overseas. They are typically more flexible as 70% or more of the money can be withdrawn without penalty on day 1.

What are the provider and product names?

Some of the most popular and widely sold names are:

- Friends Provident International Reserve Investment Bond

- Friends Provident International Summit Bond

- Friends Provident International Zenith

- Generali International Choice Account

- Generali Worldwide Professional Portfolio Bond

- Hansard International Capital Investment Bond

- Quilter International (used to be called Royal Skandia) Collective Investment Bond

- Quilter International Collective Redemption Bond

- Quilter International Executive Redemption Bond

- RL360 PIMS

- RL360 Oracle

- Investors Trust Access Portfolio

- Investors Trust Fixed Income Portfolio

- AXA Evolution Bond

- Premier Trust Global Premier

- Canada Life Wealth Preservation Account

- Prudential International Portfolio Bond

Some of the biggest banks such as HSBC Expat, Standard Bank, Santander International, Swissquote, Lloyds International, Nedbank Private Wealth and Barclays International also offer products and funds. They tend to be slightly different lump sum products to portfolios bonds, but the fees tend to be high nonetheless.

Standard Bank has the Quantum series investments. Standard Bank Quantum Plus 10, 11, 20 and 23 are all part of the investment series. This investment seeks to cap the upside, whilst limiting the downside. Sounds good on paper, but the terms and conditions often mean you will get much lower than market returns.

Fees and charges within offshore bonds

Fees within offshore bonds are much more reasonable than savings plans as a generalization. That doesn’t automatically mean that is automatically explained in the application form and key feature, in a transparent way.

Also, many hidden fees eat into returns. This is especially the case with offshore pension transfers for expats, as the trustee fees can eat into the returns.

Once again it makes sense to get a second opinion on these accounts, especially if your returns are low.

As portfolio bond values can typically be higher, the fees become even more important.

Let’s take an example of an investor who has a $500,000 lump sum. The fund fees are 2% per annum, in addition to the broker management fee of 1% and the life insurance firms fees. Markets rise 8% and the investor gets a 4% per year return.

Ultimately, if the fees could even be reduced by 0.5% to 1% per annum, that can make a huge compounded difference over time. It doesn’t sound like much, but it is $2,500 to $5,000 in year one alone, and potentially close to $100,000 over a period of 10 to 15 years.

Remember as percentage fees go up if markets rise, a 1% fee in cash terms will become bigger and bigger over the years.

Some offshore bonds do have more low-cost fund options, including tracker funds. This means that many expats out there have plans which could be reduced in price dramatically.

As offshore bonds aren’t as long-term as savings plans and don’t have the same contractual dimension to them, they tend to attract fewer complaints.

Often in year 1, 70%+ of these accounts are liquid on day 1, rising to 100% within 5 to 8 years.

Funds within offshore bonds

The biggest mistake is to have many illiquid funds held within the offshore bonds. Several of these illiquid funds, such as LM Investment Management in Australia, collapsed due to liquidity problems or fraud.

There have been recent changes to the fund lists/fund center which make it harder for advisers to pick such funds.

RL360 Review

The performance of these bonds can vary differently depending on the funds that are chosen. For example, the Old Mutual Executive Investment Bond and RL360 PIMS all have low-fee funds available, which can make a huge difference to the performance.

Fund performances and fact sheets are all available online.

Please click here for an RL360 review with a more in-depth analysis or keep reading to see the comparisons.

Is the RL360 platform safe?

Yes, the platform in and of itself is secure, and it benefits from a favorable location; in addition, it is a member of a larger family of International Financial Group Ltd. (IFGL) platforms that collectively has more than $26 billion in assets under management (AUM).

Where do we stand with the fees?

Because this is a commission lead platform, you will have the ability to have commissions built into the purchase of this product. Because of this, there will be a significant increase in the price of the platform.

In addition, it enables funds to bill upfront and trail fees for advisers, thereby providing the advisers with an additional kickback. Because of this, you should be extremely cautious about it, and you should be on the lookout if you are just being proposed this platform.

What are the charges involved with the RL360 Personal Investment Management Service?

There are a few additional fees that must be paid in addition to the monthly premium for the RL360 PIMS plan. These fees are not based on a percentage of the total cost. These fees are associated with the maintenance of your plan, and the most recent fees are detailed down below (for plans issued from 2019).

When you make an investment in PIMS, you will be given a plan schedule that provides details regarding the charges that are particular to the charging framework that you and your financial adviser did agree upon.

Costs associated with dealing as well as custodial duties

These fees are assessed both during the buying and selling processes of an asset. If the assets that are connected to your plan are handled by a discretionary manager or through a third-party platform, then the dealing and custodian fees may not be applicable to your situation.

It is recommended that you discuss the matter with your financial adviser, as well as the provider of the platform or the discretionary manager, in order to confirm the costs that you will incur.

The dealing fee is 28 US dollars, 36 Australian dollars, 24 euros, 20 pounds, 26 Swiss francs, 200 Hong Kong dollars, or 3,100 Japanese yen. On the other hand, the custodian charge is 56 US dollars, 72 Australian dollars, 48 euros, 40 pounds, 52 francs, 400 Hong Kong dollars, or 6,200 yen.

Fees associated with servicing

When you sign up for a new plan, you will be subject to the following servicing charges at the time of your enrollment. The rate of inflation causes an annual increase in their total cost. The charge is deducted from your account every three months beginning on the date that your plan went into effect, and it will continue doing so up until the date that the plan expires.

The amount of the servicing charge, expressed in US dollars, is $140. Meanwhile, it costs 180 in Australian dollars, 120 in euros, 100 in pounds, 1,00 in Hong Kong dollars, 130 in francs, and 15,500 in yen.

Charges on valuation

In the event that you require a paper valuation to be mailed to you, you will be subject to the same fees that are associated with servicing.

What about RL360 Quantum Savings Plan?

RL360 has provided investors with the opportunity to save money offshore through their Quantum policy issued in the Isle of Man. The value of the policy is tied to the performance of investment funds, and it can jump midway or in the long run.

What plans can you choose from under the RL360 Quantum Savings Plan?

Life assurance option

The life assurance option can be purchased on the basis of a single life or a joint life, with the proceeds going to the survivor. In a lot of situations, the life or lives assured are the same as the applicants. Even so, if necessary, they can be different as well. When the policy is first issued, the youngest life that can be insured cannot be more than 65 years old.

The policy will continue to be in effect until either all lives covered by it have passed away or the policy has been canceled.

Capital redemption option

The lives of any participants are not tied to the capital redemption option. The policy can be kept active for an aggregate of 99 years, including the term of the premium, at which point the fund value on top of 160 US dollars (or its currency equivalent) will be payable. Then, the policy will be terminated.

In the event that the insurance policy is returned early, the fund value will be paid out to the policyholder, minus any applicable early surrender charges that may be incurred.

What are the features of the RL360 Quantum Savings Plan?

- At any time that you desire, you will always have the ability to switch between funds and reroute any future premiums.

- According to the terms and conditions, you are permitted to make withdrawals on a recurring basis as well as a one-time withdrawal.

- You are free to surrender your policy at any time; however, if you do so while the premium term is still in effect, you will be liable for a surrender charge and it is possible that you will receive a refund that is lower than the total amount of premiums paid.

- Your policy will be rewarded with a loyalty bonus at the conclusion of the term if your premium term is ten years or if it is longer than that. Your bonus will be calculated as 0.25% of the fund value that is comprised solely of the regular premiums that you have paid into your policy. This percentage will then be multiplied by the number of full years that you have paid premiums into your plan.

- Any periods in which the policy is put on a premium holiday or paid in full will not be counted for the loyalty bonus that will be given. Additionally, there is no provision made for the payment of a loyalty bonus on the fund value that is mainly owing to supplemental single premiums.

Which different kinds of currencies can I choose to invest in with the RL360 Quantum Savings Plan?

The Quantum plan could use various currencies, such as the British pound sterling (GBP), the Euro (EUR), the United States dollar (USD), the Swiss franc (CHF), the Australian dollar (AUD), the Hong Kong dollar (HKD), and the Japanese yen.

How do premiums work?

It is required that any and all premiums be paid within the first thirty days after the due date.

If either you or your financial adviser have enrolled for online switching of funds, you will have the opportunity to invest in a wide variety of funds offered by a variety of UK-authorized and global collective investment vehicles.

If you do not have online access, you will be restricted to investing the total premium you pay into no more than 10 different funds.

Do I have the option of taking a break in paying into the plan?

Following the conclusion of the initial allocation period for your original premiums, you have the option of taking a premium holiday for a period of two years max, so long as the following conditions are met:

- The value of the fund is greater than the required minimum

- RL360 has obtained all of the premiums that were anticipated.

The standard fees will continue to be assessed, except that there will be an increase in the policy fee that will be in effect for the length of such premium holiday.

What about paying the appropriate taxes?

RL360 is required to comply with the tax regulations of the Isle of Man. Your policy’s growth or income is not subject to taxation on the Isle of Man, regardless of how much it brings in.

Even so, RL360 said that a withholding tax may be deducted at source against income that results from investments held in certain countries. This tax cannot be reclaimed by the countries holding the investments.

What charges are applied to the RL360 Quantum Savings Plan?

Initial unit charge

In the event that preliminary units are canceled, a fee equal to 0.50% each month of the value of those units will be deducted from the customer’s account. This charge will remain outstanding for the duration of the premium term, or until the thirty-year policy anniversary, whichever comes first.

Contract charge

A contract charge will be deducted from the value of the fund every month, and this charge will be equivalent to a defined percentage of the fund’s value on an annual basis. The current fee for the contract is 1.5% per annum; this amount is deducted from the total value of the fund every month in the amount of 0.125%. It will be subtracted from the total through the cancellation of an equivalent number of initial and accumulation units.

Policy fee

Through the discontinuation of accumulation units, a policy fee in the amount of 5 pounds, 6 euros, 7.5 francs, 8 US dollars, 9 Australian dollars, 62.5 Hong Kong dollars, and 850 yen will be subtracted from the policy on a monthly basis.

Charges levied on external fund management

An annual management fee will be deducted from each of the external funds by their respective managers. This will be accounted for within the costing of the specific funds, at a rate that will be ascertained by each of the specific fund’s manager.

What are the steps that need to be taken in order to withdraw funds?

For withdrawals made on a regular basis

So as to make withdrawals from your policy, the initial allocation time frame for your original premiums must have passed, and you must have raised accumulation unit value. It is possible that you will not be able to make withdrawals right off the bat due to the fact that your regular premiums will not be used to acquire accumulation units unless the initial allocation time frame has come to an end.

It is possible to make recurring withdrawals based either on a predetermined amount or on a predetermined percentage of the value of the fund. Withdrawals made on a regular basis are subject to minimum amounts — 400 US dollars, 450 Australian dollars, 250 pounds, 300 euros, 375 francs, 3,125 Hong Kong dollars, as well as 42,500 yen.

Within one policy year, you are only allowed to take a maximum of 10% of the fund’s value during the beginning of the policy year. You can execute this in the form of regular withdrawals. The percentage given includes any fees that may have been charged by your investment adviser.

The policy currency will be used to process regular withdrawals, which can be executed per month, per quarter, per term, per half a year, or per annum, depending on your preferences.

For withdrawals made only once (one-time withdrawals)

The max withdrawal will be restricted to the value of the accumulation units held in your policy. This amount cannot be higher than the surrender value of the plan or it can push the fund’s value lower than the 8,000 US dollar minimum amount.

What will happen after I pass away?

For life assurance policies:

The life assurance policy will be terminated as soon as the last surviving life assured passes away. Before RL360 makes a payout, they need to receive a written notice of the death plus the appropriate documentation for legal entitlement that should be delivered to the address of their head office. The percentage of the fund’s value that will be distributed will be equivalent to 101%.

The personal representatives of your estate are eligible to receive the ownership of the policy after you pass away, according to RL360.

Do note that the amount paid will be the fund value minus any applicable charges for early surrender, if the policy is surrendered before the end of the premium term.

If the policy was issued on the basis of joint ownership, then ownership of such plan will be transferred to the policyholder who is still alive after the other owner pass away.

For capital redemption policies:

On the passing of the policyholder, the capital redemption policy will not be terminated automatically.

The personal representatives of your estate have the authority to make a determination regarding ownership.

Please take note that the amount paid will be 100% of the fund value minus any applicable charges for early surrender, if the policy is ceded before the end of the premium term.

What are some of the benefits and drawbacks of participating in the RL360 Quantum Savings Plan?

The Pros

- Commonly accessible and sold, with a good company rating

- Offers some tax buffer in certain territories

- If maintained to the term that was originally planned, then a savings concept could be promoted

The Cons

- Full withdrawal is not flexible and complete access to funds when needed during the early years of the policy are always subject to certain penalties

- There are many countries that do not recognize any tax breaks

- There is a commission that cancels out all preliminary investments made, which makes it an incredibly costly alternative

- Does not offer complete access to the funds with the lowest possible costs or passive trackers

Please take note that the RL360 Quantum Savings Plan is no longer accepting new customers as of July 2019, according to the provider.

Whatever the case may be, international investors now have more access to options that are more convenient, flexible, and easy to understand.

Should people complain to the regulators if they feel mis-sold?

It depends on the market. Markets in highly regulated markets like the EU, Hong Kong or Singapore may get some luck going down this avenue, but it depends on what documents were signed on day 1, and what you can prove.

In most expat markets, financial services aren’t as well-regulated as in developed countries, and it is highly unlikely the regulators will care about any expat complaints.

In the majority of cases, therefore, complaining isn’t productive.

What are some of the other platforms that are typically used in the expat market?

Interactive Brokers and Internaxx are two of the most popular ones. Others that are commonly used include:

- DBS Vickers Securities

- E*trade Financial

- iFast International

- Novia Global

- Platform One International

- Praemium

- Raymond James

- Saxo Capital Markets/Saxo Bank

- Ardan International

- Capital Platforms Isle of Man/Capital International Group

- Capital Platforms Singapore

- Momentum Wealth Personal Portfolio

- Moventum Platform/Moventum Capital Platform in Luxembourg

- Devere Group fund platform

- Nucleus platform

- Aria platform

Some of these platforms are quite good and others aren’t. What is more important is which investments are sold within these platforms.

Funds, Discretionary Managers, and Pension Trustees

What funds and discretionary fund managers are typically sold within bonds, savings plans and platforms?

In terms of funds, GAM Star Portfolios and Tilney BestInvest have been commonly used in Dubai, Cambodia, Bangkok, Hong Kong, Singapore and Kuala Lumpur. Both funds contain high fees.

In addition, the following funds are widely sold; both inside these plans and outside on independent platforms:

- Guinness funds – Guinness Global Equity Income and Guinness Global Investors

- VAM funds, including US microchip growth a and VAM managed funds such as cautious A and B.

- Commerzbank structured notes

- Valartis Group

- Momentum Investment Management.

- Harmony portfolios, including sterling balanced, sterling growth, usd balanced fund and Euro diversified

- Jumbo Alliance Funds

- Premier Asset Management plc

- SAM Group funds

- Brooks Macdonald strategic growth

- dVAM funds

- Sanlam funds

- Various AXA, iShares and BlackRock funds

- Franklin Templeton funds

- Pimco bond funds

- Castlestone low volatility income fund + faang fund

- St James Place alternative assets fund; greater European progressive unit trust, balanced portfolio and equity income fund

- TAM Asset Management

- ARIA Capital Management

- NEBA structured notes/products

- ABSA Structured Notes

- Portman structured notes/products

- Chronus structured notes/products

- Cornhill asset management Luxembourg

- Pacific Asset Management

- Allan Gray South Africa

- Investec

- Canaccord Group fund

- Rudolf Wolff funds

- Dominion Funds

- Mariana Capital structured notes

- iDAD

- The Hinton Group

- Jool Life

Historically, various suspended funds have been sold as well, including the Brandeaux Student Accommodation and LM Investment Management.

Some of these funds have performed well, whilst others have not, for a whole range of reasons.

What Pension Trustees are often used together with offshore bonds?

For British expats, popular SIPPs and QROPS trustees are Momentum Pensions, STM Group, Forthplus pensions and the Sovereign Group. Others include:

- Pantheon Pension Trustees

- Trireme Pension Services

- New Zealand Endeavour

- Hornbuckle Mitchell Group

- The Concept Group

- Brooklands Pensions/IVCM Heritage Pensions Limited

- Bourse Pension Trustees

- Baker Tilly Isle of Man/RSM

In many cases, you can lower your fees and improve your performance by making changes to these plans.

Should Americans buy these plans?

Before the Foreign Account Tax Compliance Act (FATCA) was enacted in the US in 2010, it did make sense for American expats to invest offshore, although in a sensible way like everybody else.

These days, it is tough for Americans to invest productively offshore. Investing in an unproductive way can lead to tax problems.

For Americans who have already bought these plans, however, it makes sense to seek a solution like any other nationality, and get the plans working more efficiently.

How have these plans performed during the 2022 stock market falls?

Most of these plans have performed poorly, which is to be expected. Most stock markets are down 10% to 15%, with the Nasdaq 25% below its peak.

Why do investors fail in general?

We have previously looked at how emotions can lead to lower investment returns when it comes to greed, fear and egoism and also how some investor seem to like lower returns.

So often what happens is that people get emotionally connected to their existing accounts (not wanting a paper loss or waiting until it hits a certain level before selling) instead of just looking at the math and academic evidence.

How about US taxation of Friends Provident paid-up plans?

This is complicated and depends on several factors which I can’t elaborate on fully here.

Do you have any case studies?

One of the people who posted in the comments section below this article (Graham), has produced a case study for me. It can be accessed here.

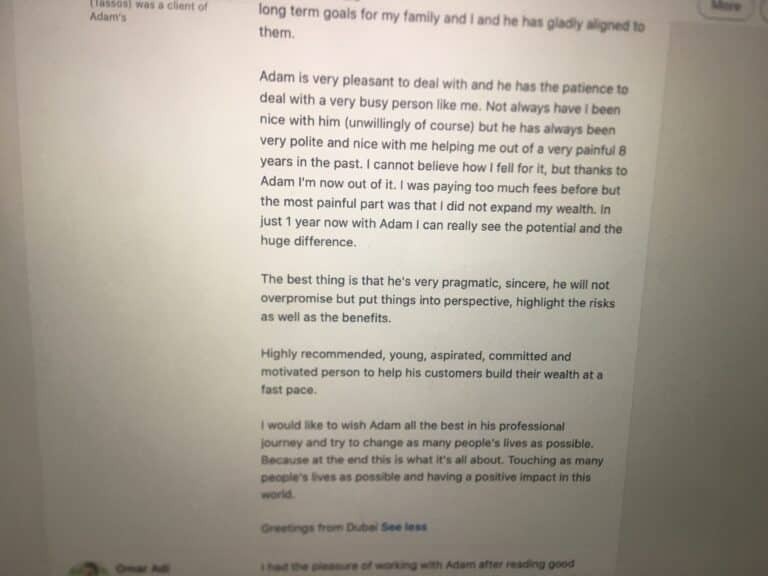

Moreover, numerous of my 28 LinkedIn recommendations came from cases like this, and one from Dubai has specifically mentioned Friends Provident in his recommendation.

You can see it here. If you aren’t on LinkedIn, I have posted a picture of a section of the review.

As he has specifically mentioned the name of the financial advisory firm that sold him the Friends Provident in the first place, I have cut that part out, but it can be accessed on the original Linkedin post.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.

Hi Adam,

I have a Zurich Vista account (25 years) and almost finished the ICP of 18 months. My actual invested amount is already lower than the current value (which the broker of course will blame on the market conditions). I want out after the 18 months but they say I will lose all my money due to surrendering before the maturity date and the fees that will be charged.

I feel mislead by my financial advisor as he claimed I could do with my money after 18 months as I please. Take it out, increase or decrease my premium or keep it as is.

All of the information I am receiving now when I want out has not been communicated to me beforehand and I know I am not the only one they have mislead.

Therefore my question would be; can they actually take all your money just like that and get away with it or do the people with an account with Zurich Vista have a chance to get there initial investment of 18 months back which they worked really hard for?

Hi Nido

Sorry to hear that. Anyway I emailed you.

Thanks

Adam

Hi Adam

As above I was also mislead into investing in RL360 quantum where I was told I could take my money out after the 18 month allocation period. Will I be charged a percentage ( 66% according to their website) of just the initial units?

Hi Sam

I have emailed you. But what I would say is that if you want to completely surrender after barely 18 months, a 66% charge (getting back 34%) is unlikely unless it is a 5 year plan. If it is a 25 year plan, the surrender value will be tiny, but it will depend on many things.

Thanks

Adam

Dear Adam, thanks for this information.

I’ve had a Provest Principal Protection Plan, from Premier Trust, for about 3 years. Never have I found any strange information or happening, but recently the page I always use to do payments had blocked all payments made with credit cards.

My advisor says it’s because they’re changing their legal residence, but it got me thinking. I do love my plan and how it’s coming along, but I don’t know anyone else with it since in my country it’s not in our culture to save money and no one has this kind of plans.

In your experience with this company, have you ever seen first hand when the client received their earnings?

Sorry to bother you and thanks for any detail you could share.

I will email you as this is a very specific case.

Hello, I have the same plan and I got the same response from the company handling the plan. Apperently they are moving to Panama. Could you share the response you sent by email with me as well?

Hello I have the same situation, and just got an email from KPMG but trying to understand the situation. Would you be able to help?

What kind of help are you looking for more specifically?

The situation is a bit of a waiting game at the moment .

I also got the same letter from kPMG but I have already surrendered my fund prior to receiving the letter, and now my surrendered fund is showing as pending surrender. Please advise what I should do.

Hi Mike – have you contacted them directly about this? I think you can’t surrender until the process has been finalised.

Adam

I do have a Generaly Vision plan, 25yrs. I am at year 8 now. Returns are not bad, but fee’s are eating all. I even suspect of some Hidden fees or not correctly charged fee’s by Generally.

All in all i believe that perhaps i can optimize this plan to be profitable, as fee’s should decrease after year 10 and higher premiums can be automatically indexed by 2%. But i still fail to understand the current valuation of the plan and the actual future expectations.

perhaps we should talk for alternatives.

Thanks

Hi David – sure I have emailed you.

Hi Adam, i’m about to start in a couple of days a 20 year investment on the RL360 Quantum plan, i make about 4000 USD a month and i’ve commited 1000 USD a month.

After reading this article you made me rethink my commitment.

OK Guilemero – I just emailed you

Hi Adam, tomorrow I have an appointment to start RL360º for 15 yrs at 1750 USD a month. Please could you advice if it is a sound retirement plan. Thanks Mel

Just emailed you Mel.

I am looking to invest $50000 in Hansard International Universal Personal Portfolio: Option Z8. Please recommend

Thanks Vicky I just emailed you

Hi, i am Indian expat working in DUBAI and wanted to save for my child education. I have METLIFE international saving plan with $400 premium for 11 year and in for 4 plus year. Another is generali vision $500 a month for 10 years and in for a year and finally friends provident $600 a month going to start in a week. Can you review and advise.

Good day Adam,

First off congrats and thanks for what is the best article I have read so far in my researching of expat investments.

I am a freelance Oil and Gas professional, a Brit living and will retire in Philippines. 2013 I started an FPI plan that will mature in 2025 initially putting away 1000gbp per month. In the same year the same Singapore based broker switched my UK pension value of 90K gbp into a Qrops Isle of Mann based fund. In 2016 I took a 10 month payment holiday on the FPI due to no work. Upon the payment restart in Oct 2016 I increased the monthly to 2000 gbp which I have maintained to this date.

Last year I took my monthly provided performance reports on both accounts and noted that 2017 was by far the best period for growth, however 2018 was pretty abysmal. I put all of my monthly figures into a spread sheet to show which months show growth and which show loss. The Qrops grew to 105K but dropped back to 90k 2018. Over the full year of 2018 I payed into the FPI funds 24k but the fund grew by only half that. Essentially losing half my annual investment. I had stern words with the advisor and we agreed to switch funds in my FPI portfolio and the Qrops. I am monitoring as we progress 2019.

November 2018 I started looking at alternatives and was put onto RL360 and a 10 year Quantum option. After a lot of to and fro emails mostly answers to my many questions I did not go ahead as it just did not feel right. Something was telling me NO.

I have approx 40k tied up in various crypto I deal with myself and should have pulled out in Dec 2017 when at 150k. I am sitting on that now. I want to do something over say a 5 year period that will maximise returns on a 2k gbp per month. Its looking like my income future is secure for at least the next 5 years.

Appreciate any comments, advise etc…

And thank you very much

Kindest regards

Graham Hill

Thanks Graham I sent you an email just now.

HI Adam,

I have enrolled FPI premier Advance for 20 Years and paid ICP of 18 months. Do you recommend to continue or its not worth to do. Both ways please send us pros and cons . Thanks in advance.

Thanks Raghavan I sent you an email

Hi Adam,

I’m signed up for a Zurich – vista plan for 25 years, which I’m 3.3 years into to date.

My FA has advised me to reduce my monthly amount of $1,000 to $150 to avoid any charges. Pay the remaining $850 into a Union Hansard Infinity Wealth as there is lower fees, therefore more growth and introductory bonus.

What is your view on this?

Can you run 2 x plans at the same time? Will I still pay the same high fees in the zurich vista on the original $1000 signed up for, even if I go down to $150 per month?

Will I get penalized for doing this change by Zurich?

What is the best course of action for me now?!

Thanks

Andrew

Hi Andrew – thanks for reaching out. Just emailed you. Adam

Hi Adam ,

I ve been approached by a Hansard agent. They claim I can get my initial investment back after 5 years and if anything goes wrong fsa guarantees 90 percent of m investment.

I am not a UK citizen. I am not living in uk.

They claim their system s safer than any other bank can offer.

What do you think ?

Hi Cem – it is true that Isle of man guarantees 90%….but that means if there is a financial crisis and something happens to the bank. In other words, it guarantees 90% of your account value, but your account value isn’t guaranteed of course. Anyway I sent you an email.

Hi Adam,

My adviser, a friend for many years and who gave some good advice, sold me an OMI Executive Redemption Bond. I asked no questions since I trusted him. The bond ran for about 5 years and I even topped it up twice before I started studying it properly. The charges were amazing and then I learned there was a penalty for early redemption which I had not been advised of. The underlying investments were generally ok but fees were killing it. My adviser proved incapable of explaining the fee structure. I modelled the bond in excel using the information I had – turns out that 70%or so of any decent profit is consumed by fees which get more onerous if the investments underperform. In essence the whole thing is leveraged to fail. I cashed it anyway losing about 15% of the original investment and I reckon I got off lightly and am happy to be out given what my model predicted.

I would like to ask what is the point of such investments since I find it easier to invest directly on the stock exchange where you know what the broking fees are,. You can easily build a sound portfolio just by reading and asking, and you can enter and bail out at will. It takes days to get out of any investment in one of these bonds.

Hi George – well you know what the fees are with any investment. There are some tax advantages of bonds for expats, but as you say, fees are also important. Different fee structures can be put in for the same bonds. So for the OMI bond, there can be client 1 paying 5x more than client b, due to hidden fees.These days as well, there are cheaper options – both on bond side and platform side.

Adam

Thumbs up for this article. I have been studying online about option for investment for my retirement (let’s say 20 to 25 years) Like many, I have always been approached by companies to invest in some plans. I am based in Bangkok. Always turned them down. Up until recently, I decided to know a bit more. Still trying to find out what is the best way to save and hopefully growth with reasonable profits until the years to come. I just clicked a link from a google search and end up here, where should I follow you to keep reading interesting articles? I am going to share this with my friends 🙂

Thanks Ben, there should be a place to click on the bottom of the website to keep following.

HI Adam,

I am presently having a Union hansard infiniti access plan of 5 years term in which I contributed for 24 months at 2000 USD/month. My agent is now offering to switch to hansard infinity wealth scheme of 10 years instead with an initial bonus. The charges however seems to be higher compared to present plan.

Is it a good move ? Can you advise please

Hi Rohan – thanks for reaching out. I have emailed you.

Hi, I signed up for a Zurich Life Vista 20 year plan and I am now into year 6. After 6 years I have a return of 14% which is very low considering bonuses are included in here. This sought me to do some more research and with a sick to the stomach feeling I am being confronted with what many others are also experiencing. Do I continue with this no-flex inflation-following investment or take a hit and get out now before the fees stack up even further?

Hi Jo – thanks for reaching out. I just emailed you. Adam

I was recently sold a Providence Compass Savings plan to which I agreed £400 per month for a 15 year term. After further reading I’m not feeling very comfortable with this plan. Luckily enough my credit card payment was blocked by the bank so only my initial payment has been taken. I’ve been ignoring the warning emails for the past 5 months. Should I cut my losses and walk away from this investment at this early stage??

Thanks James I emailed you – depends on many factors really.

Hi James – I emailed you. Adam

Hello Adam,

After see careless follow up my finance advisor, I decided to stop my contribution in both Hansard Aspire plans. What should I do to get my money back….I have zero trust on Hansard.

I have also been falsely enrolled in hansard plan for 15 years now with 500$ permonth investment,

i ask the advisor and support after 18 months now to surrender my account, they say i cant do that before 24 months of regular contributions.If i do so i will loose all my money. If i surrender after 24 months i may still loose a big chunk 90% but not sure if it will be on inital unit of 9000 $ (18 months) or accumulator unit (3000$ if i continue to pay for next 6 months as well) or total unit (9000 + 3000) after 2 years.

Please guide me what to do here

I will email you.

Hello Adam

I have difficulties with MFS Meriden and finally have access to my accounts. I looking to move the funds. One broker from Blusestar AMG is recommending the Ardan International platform to reinvest my funds. I would appreciate your thoughts. Regards Mark

Hi Mark – I have emailed you. Adam

Hi Adam,

I confess my ignorance on investments, but I am about to sign up with Hansard Vantage Platinum worldwide scheme to save up over 15 years and complete pension income. They promise a growth of 4-6% but I am a bit dubious about the final return if I stay until the end and how much I can actually expect to take away. Is it common practice that they apply charges as all previous comments say?

Also what is the risk of a company like Hansard to disappear or will they be backed by government/Isle of Man in case something goes wrong.

Hi Michael. I have emailed you. The risk of Hansard going out of business, and you losing your money from that, is very low. Most offshore jurisdictions do have safeguards in place, so I wouldn’t worry about that. I would more concern yourself with whether investing through Hansard is the most efficient structured, which I doubt as per my article. Adam

Hi.. I am planning to start a 10year saving plan with Zurich Vista of 1250USD pm. I am uncomfortable with the charges, but this looked like the most suitable investment for a long term perspective. What else do you suggest?

Depends where you are based. I have emailed you in any case.

Hello Adam,

I have signed up for a Union insurance contract promoting Infinity Wealth by Hansard. Is this a good plan? Union insurance not being an International company I’m concerned if it will affect my investment in case they shut down due to any reason . What will happen to my investment if Union insurance winds up their operations in the UAE ? Hansard is not licensed in the UAE and I guess that’s why it’s being sold through Union Insurance.

Is Union infinity wealth better than Zurich Vista ?

Hi Bijo – thanks for your message. I have emailed you.

Please do not invest in hasard.they lie specially the seguro agent (who are maintaining and running the hansard company in UAE)

Hi Adam,

I’m 8 years into a 12 yr Vista policy and I want out. From what I’m reading the good news for me is if I pull the total amount (current encashment value Vs total premiums paid) I will get back ~10% more than I’ve invested. I have spoken to Zurich to understand if I can take the money in the denomination of each plan (USD & Euro) and they have advised that I can only withdraw in one currency, I may be over reacting but I’m assuming I will get screwed on the currency conversion if I leave it to Zurich; my question is: could I do a max partial surrender in USD then follow up immediately after with a full surrender on the Euro?

Thanks Ross.You can usually only withdraw in one currency. However, if you have 2 plans (1 in Euros and 1 in USD) you should be able to withdraw in each currency.

I would just withdraw to a bank account in the same currency and indeed withdraw in the currency the account is denominated in. This will avoid any huge currency fees.

Hi

I had taken a 20 year Vista plan and pay 1100 usd a month starting sept 2008. Its current value looks ok vs what I have invested but am feeling unsure given stuff I am reading and hearing from friends. Feel clueless about the charges actually. Can you help me understand pls?

Hi Rajesh – I just emailed you

Hi Adam,

Firstly, I’d like to thank you on behalf of all the many expats you are helping with your impartial advice and guidance.

I’m a British expat in Saudi working in downstream oil & gas and am planning to invest around 1,500GBP into a 15-year plan with Premier Trust (Provest Principle Protection) to boost my retirement planning.

Because the policy is invested in market indexes (e.g. S&P 500, FTSE 100, MSCI Emerging Markets etc.) instead of managed funds, my advisor says the management fees are lower at 1.25% and most funds don’t tend to outperform their index.

I’m planning to retire back to UK and my advisor says I can draw down the funds without tax liability as the fund is owned in trust and I can take the money as an interest free loan.

I’d appreciate your any advice or guidance you may have.

Thanks

Alan

Thanks Alan I have emailed you

Hello Adam,

I have invested in a 25 years Zurich Vista plan, I am at my 3.5 year.

I finished paying the 18th month premium, but at the 19th month I quit my job in the middle east therefore I am paying the minimum now. As now I read so many negative about this plan.

I wonder if I should stop it completely now, or to continue. I do have the money to continue, but the charges are really high due to my initial Premium paid.

What is your recommendation? to take the hit? or maybe stay another 5 to 10 years to minimize lost? I have invested about 30k now and the value is about 33k. Based on my financial situation, contributing about 5k per year is not a problem, and my FA assure me that even with 5k per year I will gain, and charges will decrease with years. However is it worth it to continue? every year I have a mental fight about if I should take the hit.

Thank you

Hi Jana – thanks for your message. The maths usually dictates that you should stop paying in. I have emailed you. Adam

Hello Adam,

I took out Skanska/OMI Executive Redemption Bond via Brooklands Trustee over 9 years ago. I was led to understand by my then FA that the 1.5% fees would stop after 8 years but this is not the case and the fees apply till the end of the bond period, 99 years.

I am currently looking at surrendering this ERB and looking at alternatives. RL 360 PIMS is one product that I have been asked to consider and this in tandem with changing the Trustee to PSG SIPP.

My current investment portfolio contains the two suspended funds from Caldora and LM and I am told that this restricts my possibilities in changing to an alternative provider.

I will be pleased to receive your observations on the above.

Thanks for reaching out Kanu. I just emailed you.

Hi Adam, great article, I’m considering taking out a RL360 Pims but I am now having doubts given what I am reading about charges vs investment growth. I’m a UK citizen living in Switzerland. S

Hi Adam,

I have some questions about the tax implications when withdrawing sums from an RL360 Oracle policy and when finally cashing in the policy. Would you be able to help me?

Hi Adam,

Several years ago was pursuaded into buying both a Zurich Futura and Vista policies ( both 20 year plans).

Have been paying $1k and $3k per month respectively now for 2.5 years. After reading a lot on the internet I have understood that these pland have crazy fees and I am concerned that i will never achieve the financial goals I had in mind when the salesperson was selling these products to me.

I am quite angry with myself and am trying to make sense of what to do. The current surrender value on vist is so low I will only get back 43% of what I have contributed to date if i were to get out of this policy now. I cannot decided if it is better to keep paying either full or reduced sums until such point that my surrender value will equal the invested amount to at least avoid any loss or not. Is this even achievable? I am struggling to make a decision and am fearfull i am not getting rhe right advice from my advisor.

As for the Futura plan i believe i have mistakenly gone for a whole life plan rather than a tern insurance and have already contributed $30k of which i understand all goes towards upfront fees. Do i just continue paying this plan or do I have other options?

Really in true need of some proper, unbiased and sound financial advice as I am no longer sleeping well and extremely concerned about my financials and future given these plans I have signed up to. The thought of these crazy payments for another 17 years to only find out i made nothing or lost money (only paid stupid fees so many years) is daunting and exhausting.

Your time and advice will be much appreciated.

Best,

Hi Guss – thanks for reaching out. I just emailed you. Adam

I am 2 years into a RL360 25 year plan. I’ve reduced the fees with the funds I am invested in, and have currently 80% of my investing money a month going straight into Interactive Brokers (much lower fees!) which I learned about afterwards. RL360 is a good way for me getting my money out of China, but would love to know your thought, as I am really hoping that all my research is OK and that despite the gains not being huge, it is still not a terrible idea. Thanks!

Apologies, I couldn’t work out how to delete the post and kept thinking of things to add. I am invested in 2 funds, 1 has AMC of 0.85% and the other of 1.5%. These are lower than what I started in (2% and 1.5%) when I started to learn more about what I should’ve been looking out for!

Hi Adam

We got a 15 year Zurich Vista savings plan in April 2019. Due to bonuses (60%) in the first 12 months we decided to put in the maximum of $3500 per month. At present we have paid $21 000 and the value already is $33 271.55.

For a normal person this looks good but after speaking to someone today they told us to cut our losses and get out of the plan. And also after reading all the negative reviews I am really worried.

We can keep up the $3500 while we are living in Dubai, but our future plan was to lower the amount when we leave (which we don’t have a date for yet).

Our worries……People mention:

-the initial fee is linked to your initial monthly contribution (ours being $3500 which is high).

– you can’t get your money out and if you try you get minimum back.

– the fees eating at your investment as soon as you reduce the monthly amount.

– and the list goes on.

We are unsure of what to do now…cut our losses ($21000) which leaves a pit in my stomach, or keep on paying for 14.6 more years?

Please advise.

Thanks in advance

Hi Chrissie – thanks for your message.I just emailed you. Adam

Hi Adam, I’m just in the process of starting my savings plan with RL360, a 25 years plan with a monthly saving of US$1.000. Your article has made me doubt the investment. I will appreciate your advice.

Thanks for your message Carlos. I just emailed you. Adam

Hi Adam,

Thank you very much for this extensive research and information. I have just enrolled in a Zurich Vista plan for 17 years at 2,000 Us dollars pm with a welcome bonus of 168% for the first 12 months. I just signed the papers and currently in the 30 days grace period for cancellation. Judging by what I’m reading it seems like i need to do 2 things reduce it to 10 years plan given i have the money available and reduce the monthly contribution to 500-1000 $ to minimise the charges and hidden fees. Question remains though , should i pull out and consider an alternative investment option given that i have never invested before and i have the lump sum amount already in my bank to pay for the 10 years at 1000$ pm ? Or does the year and instalment reduction suffice ?

Hello, thank you so much for your post. It is really helpful.

I have enrolled in the Providence life compass saving product when I was living in Switzerland. Now it is nearly up for the first initial period (28 months) and I am in the UK and I believe I will be in the UK for a while until I retire. I signed with 30 years plan.

Currently, it is doing okay as the profit wise but I am very much afraid that this plan could hit me hard due to the tax purposes. Hence, I am considering to close this plan and move to more local based investment. However, I see that the plan value is over 20000 dollars but if I surrender now, I only get 400 dollars. Hence, I know I cannot surrender the policy yet. Like you said, I was told that I can change the premium contribution value so I will definitely need to change the contribution value from 1100 dollars down to 300 dollar (minimum value for 30 years plan) at least that Is what I can afford now. Could you advise me what I should do with this plan? I am fed up with this plan that I would like to go for more managable investment. Thank you

Hi David I just emailed you.

Hello, I started a 20 year pension retirement with RL360 6 months ago and reading all the negative comments I am worried. Should I Iook for a way to get my money out and stop paying. I committed to a $1000 monthly plan. Please advise! Thanks

I will email you.

Hi, my husband and I started the Premier Advanced plan 5 years ago, paying in around £1.5k per month. It’s a 25 year plan. I have read your article and many others like it and am extremely worried about what to do. We are expats in the UAE with a young family and the plan was to help with retirement. We are in year 5 and took a payment holiday for around 11 months. Should we try and withdraw as much as possible? Keep the money where it is and stop making the contributions? I am really at a loss as to the best thing to do. Thanks.

Just emailed you Kay

Dear Adam. Its ironic how one gets to read articles like yours, which are very enlightening, but after one has entangled themselves into that which you are warning against. I have been burying my head in the sand for sometime now, but I know this is not going to help me in the longrun. Basically, I just signed into a 15 year Hansard Infinity Wealth, through Union Insurance in the UAE. I took it out in June 2019 and so I am just a few months in. I am contributing $1000, which I am able to afford comfortably. I am just worried now as to whether it is worth to continue with this on the long run. Should I stop now and cut my losses (which would basically be $7000 or brave it out and continue until the end of the 14 years, 6 months left?

It might make sense to stop payments, especially if you can’t keep going with the plan

Dear Adam, I wanted to check with you on the Ardan International Platfor. I was about to invest around 50000 usd in to the platform to purchase structured notes. I am informed that the charge will be 0.4% per annum and no other charges. Your advise please

Dear Adam, I am considering an RL360 Regular Savings plan, for an affordable amount (1000CHF per month) to cover the 101% allocation, for 15 years. I understand that I will suffer a penalty if I stop contributing early, but if I take this plan and keep up the contributions for the full term, it seems like a sensible way to switch the proportion of savings I hold from cash to mutual funds, hopefully for higher returns. The funds available are from mainstream fund managers. Are you opposed to all of these schemes in principle, or could I be making a sensible choice?

Hi Chris – I will email you.

Dear Adam,

Where were you before 29 Sep 2014?Q :))

To be quite frankly, the adviser was an honest person and he did mention a lot of things that you are talking about as well.

I read recently some really terrible things about RL360 Quantum from some of their customers, that’s why such intro… If i had read these 5.5 years ago, I would have not decided to start with these guys for sure.

But, again, “every medal, the gold and wooden one, has two sides”, as we say.

I’m on 25 years plan with RL360 Quantum, paying USD320 a month, and it’s more or less the same case like with any other expat: the fee structure has never been fully explained to me. However, been told that if I take the money before the 2years period I’d lose a lot. The situation after 5.5 years with the plan right now is as follows:

” Current policy value: USD 16,816.29

Estimated early surrender penalty: USD 6,494.79

Estimated surrender value” USD 10,321.50

Current policy value: Converted currency USD 16,816.29

up 5.10% as a percentage of premiums invested”

So, despite to what my wife has been telling me for the last few years, I’m staying with the plan. I believe, this is what you suggested as well.

Kind regards,

Aleksandar Gutesa

Hi Aleksandar – if you contribute every month until the end, you will probably be OK, as long as the funds as well managed. However, there are cheaper options out there. I will email you anyway.

Hi Adam

I am 18 years into a 25 years plan with OMI managed saving account. Most of the fund’s performance was reasonable but the total increase over the years is 16% which is very low. I got to understand that the compounded fees are really high. What would be the alternative? Thank you Olivier

I will email you thanks Oliver.

I have just completed my 18 months with Zurich Vista of 15 year plan with 1750$ monthly investment. By reading the blog here i am worried . To be honest with you I am interested in long term plan but the fees seems erode all benefits if i withdraw in between . I have invested 27000$ and current value is 42000$ Please advise

Thanks for the article. I am based in Bermuda and have been recommended to invest a GBP500k lump sum in Hansard Worldwide Personal Portfolio. The fees felt a little high to me (6% day one then 1% per year plus some fiddly extras) but your article has made me very skeptical. I’d very much appreciate any better options you could suggest.

Tom

Hi Tom. I will email you. Cheers, Adam

Hi, thank you for the article. I am on the verge of investing in to a monthly plan called the Hansard Vantage PLatinum Worldwide over 15 years, is this ok? After reading your article its kind of putting me off.

Thanks

I will email you Richard

Adam, the same product that Richard mentions is being offered to me and after reading this I’m utterly unsure of taking it. I would like to talk to you. Cheers.

I will email you

Hi, thanks for the article. I signed up for the Union Insurance Infinity wealth product a few months ago in the UAE contributing around 1300 USD a month (done about 4 month’s worth so far), on reading your article I’m concerned. Quite frankly I have no idea what I’ve gotten myself into, it all sounded great when it was pitched and the returns looked good. Any advice would be greatly appreciated.

Please stop if you are doing so ,the early surrender charges are hugeeeeee.I have signed up for this and am at 18 months now and on surrendering i have lost all the money.Just a suggestion to save others

Hello, Adam. Thank you for such a detailed article. I’m going to open the plan in Premier Trust. But after reading your article these idea doesn’t look good anymore. What do you propose?

Hi Adam, great content. Thanks. I reached your page because I was browsing for references of Capital International Group who are offering me an off shore investment account based in the Isle of Mann. I am looking for options in to have my savings safe and away from my home country which is a tax-hell. I am currently working and living in Panama as an expat, expect to be here for the 2-4 more years.

Thanks for this Adam. Very useful. I recently singed up for a Hansard Vantage Platinum II 20 year plan. I’ve only made one month’s payment of 1700 GBP. After reading this I am seriously considering cutting my losses and ending payments. Your advice would be much appreciated.

Thanks Jon I will email you

Dear Adam, Thank you for what is, most prob, the most detailed article about expat inv funds.

I have hired a 10 years wealth builder with Metlife in Middle East. Currently, with a monthly premium of USD 750, during the first year i’m getting charged with 40% fees and the remaining 60% fees being allocated into investment funds. On the second year, 30% of the monthly premium will be charged as fees and 70% remaining will be allocated into investment funds. After reading many articles wanted to get your input if this fee structure is common in the markets.

Dear Adam, Thank you for what is, most prob, the most detailed article about expat inv funds.

I have hired a 10 years wealth builder with Metlife in Middle East. Currently, with a monthly premium of USD 750, during the first year i’m getting charged with 40% fees and the remaining 60% fees being allocated into investment funds. On the second year, 30% of the monthly premium will be charged as fees and 70% remaining will be allocated into investment funds and so on. After reading many articles wanted to get your input if this fee structure is common and also, since my plan is to keep the monthly contribution until the end of the plan, being now in my first year and still 9 to go, how do you see it.

Many thanks again for the great article,

J Lopez

Thanks I will email you.

Hi Adam! Thank you so much for your review! I am in KL and have been randomly contacted by an expat investment company. The adviser is super friendly & answers all of my questions, and *seems* pretty transparent. BUT I’m having cold feet regarding this investment. He gave me the choice between Ardan (at a 10k minimum initial investment) and RL 360 Regular Saving Plan (which I can afford right now) for 25 years as we’re investing for our retirement. He did explain all the high fees for early withdrawal, the bonuses at the end to make up for the high fees at the beginning, etc. He seems pretty transparent and said his fees are 0.5% on top of RL360 fees. So I feel he gave me the right info, but I don’t understand why he’d advise me to go for this, in light of the risks.

Is there an incentive for advisers *from* RL360 or Ardan to push for their products? I know I’m going to reject the RL360 proposition, but I’m also wondering whether I should stop dealing with this specific adviser… Would you trust him based on this?

Hi Gaelle – I will send you an email. I would avoid RL360.

Hi, Adam. Thank you for a wonderful article. Me and my husband are thinking about starting an RL360 Regular Savings Plan for 20 years, but after reading your article and comments I started having second thoughts. Are there any drawbacks or potential pitfalls we should be aware of? Thank you again!

Hi Elena. Thanks for your message. I will email you. The pitfalls, as per the article, are huge.

hi Adam, I’m an Australia expat living in Indonesia, and was sold on the Quantum RL360 savings plan by an advisor from Singapore. The advisor was adamant I should take out a policy, citing diversification of my portfolio, even though I insisted I had great Australian Superannuation plan achieving 8%-12% and my own direct share investments on Australian ASX. Well what a disaster to have RL360, probably not as bad as other people as I’m finding out. I’m exactly 5 years into a 15 year plan, contributing $500 AUD per month = $30,000 in total invested to date. Having access to my portfolio on-line, I have been able to go back through the history of my investment, and never once have I ever been at ‘break even’ on my premiums deducted. Further, when I analyse the fees, they are coming out at a whopping $85 per month from $500 contributed. As a positive, the investment choices across x 3 funds, have combined actually been doing ok, but any gains completely eaten up by these ridiculous fees. On the anniversary of your policy each month, the fees come out, dropping further your principal invested as the ‘units purchased’ drop back. I have been consistently running at -3% return… sounds amazing after 5 years!!!. So based on my plan, if I exit now, I’ll receive circa $25K AUD, given my $30K investment. If I stay to the end, for some bonus – I think is circa 3.75%, I still don’t think I’ll have enough ‘headroom in return’ to offset the fees… basically if I stay in the plan for 15 years, the fees = $15,000 AUD !!!! (180mths x $85 per mth fees) from a $90,000 in total investment. Its like 16% of the total premiums? Its crazzzzzyyyyy…. I think it’s better I exit, loose circa $5K now and then reinvest the $25K myself…. any advice is appreciated!

Hi Graham – sounds better to exit.

Challenging the investment advice

After surrendering my Zurich Vista investment last year (10 years in to a 26 year term) I have a mediation with the financial adviser tomorrow. I am very upset that I was sold this product and I’m interested to know if you have any advice on the arguments that can be brought in a mediation?

Hi Serena. Thanks for your message. A mediation won’t, realistically, work from a legal point of view. A voluntary agreement might be different though.

I’m about 4 years into a 25 year RL360 Quantum Saver plan, and only just realizing what a terrible product this is. 105k invested, will get about 70k back surrendering right now. Is there an option B? Continuing with the policy as is will cost 120k or so in fees alone over the remainder of the policy… How can they get away with these kind of rubbish policies? Would you recommend simply taking the hit and trying to bounce back stronger?

Dear Adam, thank a lot for this detailed information. I am in Netherlands. Can you please inform me which of the providers are better and pros/cons? Blacktower has suggested me Providence Life Compass Saving Plan. How does it compare with other providers?