(This article was last updated on Feb. 1, 2023.)

Best Savings Rates in South Korea in 2023 – that will be the topic of today’s article.

Please take note that it remains our position that saving is a losing game if and when interest rates are 0%, compared to long-term investing.

If you want to invest in more productive assets as an expat, don’t hesitate to contact me, email (advice@adamfayed.com) or use the WhatsApp function below.

Table of Contents

Introduction

Before we begin our discussion on the best savings rates in South Korea, it is important to first know what savings accounts are for, how to open a bank account if you decide to have one, what requirements must be fulfilled, and other data relevant to the topic.

What is a Savings Account?

In general, a savings account is a type of account offered by banks and other financial institutions for keeping money safe.

As the money deposited into a savings account is generally managed by a bank or any other reputed financial institution, the funds are considered to be safe and secure.

One of the main drawbacks while depositing money in a savings account is that people would generally be offered a very low interest compared to other traditional investment options such as stock trading.

However, people who want to access their funds whenever they want and don’t want to go aggressive for income while opting for steady growth would generally choose savings accounts as the best option available.

While most of the saving accounts offer accessibility of funds without charging additional fees, deposit accounts might charge an early withdrawal fee when a person tries to withdraw money before the maturity of the deposit.

A deposit account is known to offer higher interest rates in contrast to a traditional savings account.

The funds in a savings account can be accessed from an ATM with the help of a debit card or credit, with the help of net banking, using the credit/debit card at the selected merchant locations, and finally by approaching a bank.

Best Savings Rates in South Korea: Bank Account Opening

People who are willing to move over to South Korea might go there for a variety of reasons, whether it is for a job or acquiring education, or any other particular reasons.

Moreover, based on factors like attractive salaries and great potential for savings, South Korea has gained a reputation as one of the best destinations for expats.

A downside to the attractive salaries offered in South Korea is the current personal income tax rates, which according to PricewaterhouseCoopers (PwC) can be as high as 45% depending on the salary of an individual.

Before moving there, individuals are required to take care of important aspects such as gathering all the necessary documents, applying for a visa, searching for a house to live in, and others.

After moving there, one of the most important things that should be done by an individual is opening a bank account. A bank account is very necessary for a person to manage their finances, make payments, and sometimes (for employees) the salary might even be deposited into a bank account.

What are the operating hours of banks in South Korea?

Usually, people from overseas that moved into South Korea might experience a bit of inconvenience when it comes to the timings. The banks might have limited working hours compared to those in a person’s country of origin.

Go during the working hours of a bank. The most common working hours are from 9 a.m. to 4 p.m. and operate from Mondays to Fridays. Almost all the banks will have an hour break during the afternoons and a lot of banks won’t be operating during weekends.

As most expats are attracted to living in South Korea, banks usually operate in the same way they normally do in places such as Europe and North America.

Even the financial institutions in South Korea are used to foreign customers, which makes it easy for non-residents to acquire and manage their financial needs and services.

Adding to that, some of the banks and financial institutions offer specialized products and services, which have been specifically designed for non-residents.

What about ATMS?

Although ATMs are available all over the country, the time they are available might be limited too. Some of the major bank ATMs will be closed during the night times while some bank ATMs might be closed even earlier.

International bank cards may not always be accepted at ATMs. If you are having trouble finding an ATM that will accept your card, you might want to consider using an international banking brand that’s popular.

If you’re traveling through one of South Korea’s cities and find yourself short on cash, you shouldn’t have too much cause for concern because the majority of establishments, including cabs, generally accept card payments.

If you want to withdraw money from an ATM with an international debit or credit card, you’ll have to look for one that’s labeled Global Services or Global ATM and displays the logo of Visa or Mastercard. Some ATMs will only let people with local bank accounts take money out of the machine.

It is highly probable for cash withdrawals to easily go through using credit and debit cards at cash dispensers if they are located in central places such as subway stations. Nevertheless, you might be required to pay a charge for the service.

If you try to withdraw money from an ATM and your credit or debit card is declined, look for another machine in the area. It is possible for various types of cards to be accepted at various banks and even at various ATMs located within the same building.

Tenacity is absolutely necessary because some visitors have disclosed that even ATMs showing the Visa or Mastercard logo are incapable of processing foreign cards at times.

In South Korea, the payment networks Visa and Mastercard enjoy the highest levels of acceptance.

Are there withdrawal limits?

There is a regulation in place that governs the maximum amount of cash that can be withdrawn from a bank account in South Korea by a foreign national who’s outside of the nation.

These caps were set at 5,000 USD per day or 10,000 USD per month; however, if you plan to take a larger amount of funds while you are away, you should probably consult with your South Korean bank before you leave.

If you’re in South Korea, meanwhile, the withdrawal amount limit will depend if your bank imposed such a restriction on your account type. Some banks do not have a cap on either deposits or withdrawals.

So, how do you open a South Korean bank account?

Unlike certain other countries, a person who wants to open a bank account in South Korea is required to visit a branch of the bank in person. There is no possibility of opening an account online in South Korea for domestic banks.

However, a person will be allowed to open an account without having to visit a branch of the bank physically by having an account with an international bank that has branches in South Korea.

There won’t be a necessity for a prior appointment with the bank for opening an account. You can walk in directly carrying all the necessary documentation, select a queue ticket, and wait for your turn.

Most banks in major cities such as Busan and Seoul have employees that speak English. However, if you are living in a rural area that isn’t as developed as these areas, you might have to wait until an English-speaking employee is available.

It is better to be prepared as you might have to reschedule your visit if the English-speaking employee of the bank is on leave or only reports to work on certain days. In the worst-case scenario, none of the staff is fluent in English.

If this is the case, it is strongly recommended that you either bring a local with you to open a bank account, or have someone who speaks Korean available to assist you over the phone.

You can also try calling the Dasan Hotline at the number 120 or the Korea Tourism hotline at the number 1330 if you do not know anyone who could assist you. They might be able to aid you in translating the most essential components of your bank account opening procedure.

What paperwork do you need to submit?

In order to open a bank account in South Korea as an expat, you will be asked to present the following documents:

- Passport / Visa

- Employment Certificate

- Alien Registration Card (ARC)

- Korean Phone Number

Passport/Visa

If you are in South Korea for work or school, you are expected to already possess a valid passport and Visa. Simply put, if you don’t bring it with you when you apply for opening a bank account, your effort will be of no use. In most cases, they will ask for your passport in addition to another form of photo identification.

Employment Certificate

Large banks would usually request you to provide this document. It could also be in a form of work contract, any paperwork that could serve as evidence of your employment.

Don’t forget to bring it with you to work if you’re going to be in South Korea. If you are a student or are in the country on an education visa, your school should have a partnership with a local bank and be able to assist you in opening a bank account as well as provide you with the necessary information to do so.

Alien Registration Card

One of the major requirements to open an account as a foreigner in South Korea is the Alien Residence Card, which is also one of the hardest things to acquire.

When you arrive in South Korea, you will need at least one month of time in order to acquire this card. Most banks are aware of this situation, and therefore, they offer bank accounts even without an alien residence card.

If you are opening an account without having an ARC, you will be subject to some of the restrictions that are set by the bank. For instance, you would need to visit a branch in person for being able to withdraw money.

If you have an ARC, you will have access to the widest range of functional options for your bank account. It is possible, for instance, for you to carry out online banking, to obtain an ATM card, and to move funds to a foreign country.

It’s possible that you won’t be able to get an ARC if you’re in South Korea on a visa that only allows you to study for a limited amount of time.

Korean Phone Number

Should it become necessary, the bank will use the Korean telephone number that you provided in order to contact you regarding your bank account. In most cases, they won’t take a number with an international prefix. In any event, you are going to want to make sure that you provide them with a phone number at which they are able to get in touch with you.

You can use the phone number of a friend until you get your own, and then you can change it later at the bank when you get yours.

Although the chances for your bank application to get rejected are less likely, there is a possibility for it to happen.

Are there fees and minimum deposits?

The policies related to the fees and minimum deposits might differ depending on the bank that you choose.

However, most of the banks and financial institutions in South Korea will offer you bank accounts that are free of monthly fees. It is also possible for you to find a bank that does not have a requirement for minimum deposits.

Nonetheless, there will be a fee charged for making use of the ATM card, which also can be avoided by choosing to have special accounts. Withdrawal fee is common among all the banks when a person withdraws funds from another bank’s ATM.

Anything that requires actual labor will result in service charges in the banks of South Korea. For example, if you go to a bank teller and ask them to make a transfer, you will be charged a small amount as a service fee.

Additionally, online transactions also incur a small fee which might be less than what you would have to pay when you opt to execute them directly through a bank teller.

You submitted the requirements, what’s next?

A bank card will be offered to you on the same day you opened an account. Sometimes, it may be provided to you even before you actually leave the bank.

After the card is provided, you will be required to set a pin for that card, which will be asked during withdrawals at an ATM or while using online banking services. A passbook is also given to you for keeping a record of all your bank transactions.

English is a language which is most commonly spoken in almost all the places of South Korea. However, language support is limited when it comes to mobile applications.

In general, all of your bank transactions can be accessed with the help of a mobile application, but the services will be limited. The main purpose of a bank card is to withdraw money from an ATM, and it cannot be used to make any purchases with your bank account.

What about online banking?

As we have discussed already, online banking features might be limited as the English support in apps is not yet fully supported. To deal with this issue, you can opt for an international bank that has a branch in South Korea.

Along with the card, online banking services will also be activated on the same day you opened an account. If you have any trouble regarding the process of registering with online banking services, the teller at a bank will help you.

Finally, as we said already, bank accounts can be opened without having to approach a bank, if you already have a bank account at an international bank that has branches existing in South Korea.

What types of bank accounts can you open in South Korea?

Basically, there is an availability of a wide range of accounts which are offered to non-residents and citizens alike.

Savings Account

The working procedure for savings accounts in South Korea is the same as it is in most other countries in the world. For the money that has been deposited by the customer, the bank provides returns in the form of interest.

For people who go for a longer-term commitment, the interest rate would be higher than usual.

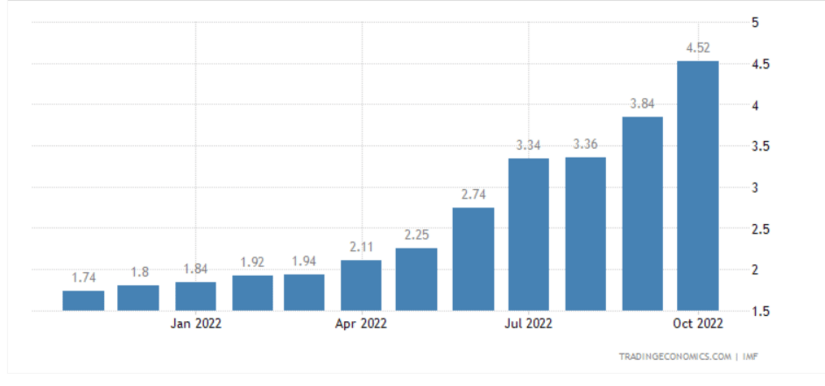

In October 2022, South Korea’s deposit interest rate jumped to 4.52% from 3.84% in September, according to available data from Trading Economics, citing the International Monetary Fund (IMF).

Time Deposit Account

A Time Deposit account in South Korea works similarly to a checking account. While some banks do offer interest on the funds deposited within a time deposit account, the interest might be low when compared to savings accounts.

However, if a person keeps their funds in a time deposit account for a longer period, then he or she might get higher interest rates.

South Korea was earlier reported to be paying increased deposit rates, based on data from the Korea Federation of Savings Banks mentioned in Korea JoongAng Daily. In November 2022 the rates averaged 5.51% for one-year time deposits.

Installment Account

Installment accounts are something similar to a savings account in South Korea. The person would be required to pay a monthly installment to the bank, which upon maturity will have a profit in the form of interest.

It is more similar to that of a certificate of deposit, but the money isn’t needed to be paid upfront. Instead, the money can be deposited by the customer in monthly installments.

Depending on the account and the bank that you choose, you can even get tax benefits, mostly when you are considered a resident of South Korea.

Best Savings Rates in South Korea: Top Banks

Opening a bank account in South Korea can be very easy, whether it is for a resident or a foreigner. There are currently around 20 domestic banks in South Korea out of which four banks control majority of the banking industry. These four are:

- Kookmin Bank

- Shinhan Bank

- Hana Bank

- Woori Bank

These banks have an excellent reputation when it comes to dealing with foreigners and has non-residents as the majority of their customers.

We will have a look at the savings rates offered by the top 5 banks for expats as well as the top 5 international banks in South Korea. Before that, let us take a minute and have a look at what the top 5 banks in both categories are.

Top Banks for Expats:

- Kookmin Bank

- Standard Chartered Bank Korea

- KEB Hana Bank

- Woori Bank

- Shinhan Bank

Top International Banks:

- HSBC

- CitiBank

- Deutsche Bank

- DBS Bank

- Scotia Bank

Given below are the interest rates for savings accounts, which are offered by the banks that are considered to be best for foreigners. Please note that some of the details might be related to the resident individuals.

Best Savings Rates in South Korea: Kookmin Bank

Kookmin Bank is among the topmost banks available in South Korea. As for having an account that is beneficial to foreigners, Kookmin Bank offers an account called KB Welcome Plus Installment Savings.

What is the KB Welcome Plus Installment Savings?

This account can be opened by an individual by depositing at least 100,000 South Korean won (KRW) or 81.25 US dollars at the time of update. The maximum amount that can be deposited in this account is 3 million KRW per month.

The tenor for this account is a minimum of 6 months and a maximum of 12 months, where the individual is required to pay an installment on a monthly basis or daily basis.

The interest rate differs on the basis of the tenor chosen such as 1% basic interest to 1.5% final interest for 6 months and 1.2% basic interest to 1.7% final interest for 12 months, which includes the 0.3% preferential interest per annum for the people who chose the bank’s package product for foreign customers.

Upon the successful completion of the maturity period, the amount will be automatically remitted into the overseas account of the individual, which makes it a bit more convenient for non-residents if they are not in Korea by that time.

This is a service that will automatically close the Installment Savings Account of a client on the date that elapses 15 working days after the maturity date. The funds from the account are transferred to a bank account abroad that a client has set prior.

The KB Welcome Plus Installment Savings account also offers insurance coverage worth up to 10 million KRW for death or disability by accident.

What other accounts does Kookmin Bank offer?

Salaryman Preferential Installment Savings Deposit

Individuals can open an account with a tenor of one, two, or three years. The deposits for this type of account are fixed at a range of 10,000 KRW to 3 million KRW.

In addition to the fixed deposit per month, an individual is permitted to make a bonus deposit once every three months, which will receive a 0.2% preferential rate. It is recommended that the amount of the bonus deposit be greater than the deposit made per month but lower than 5 million KRW.

KB Kookmin First Investments Installments Deposits

This account is accessible for individuals who are between 18 and 38 years old. If you are not a resident of South Korea, you are not allowed to open this account online.

The deposit required for this account is at least 10,000 KRW, and it cannot be over 300,000 KRW per month. The tenor is three years and no more deposit is accepted a month before the maturity date.

A preferential rate of 0.20% or 0.10% per year is applied, subject to certain conditions.

KB Smart Phone Installments Deposits

Individuals or self-employed individuals can open an account via the KB Star banking app, which is not available for non-residents.

The preliminary deposit required is at least 10,000 KRW. The second deposit and so on can be at least 1,000 KRW. Total deposits per month are capped at 3 million KRW. The tenor is one year and no more deposit is accepted a month before the maturity date.

A preferential rate of 0.2% or 0.3% maximum per year is applied, subject to certain conditions.

KB Mutual Installment Savings Deposits

Anyone is eligible to open an account at a fixed deposit of more than 10,000 KRW per month, but non-residents are not permitted to do so online.

The tenor for this type of account is a minimum of 6 months and a maximum of 60 months, where the individual is required to pay an installment on a monthly basis.

A preferential rate of 0.3% can be applied on the account, subject to certain conditions.

Best Savings Rates in South Korea: Standard Chartered Bank Korea

Most of the accounts offered by Standard Chartered Bank Korea are subject to withholding taxes, which have a normal tax rate of 15.4% applicable to the interest earned, as of January 2023.

Let us have a look at the various type of savings accounts and the interest rates offered with those account at Standard Chartered Bank Korea.

Do Dream Account

The Do Dream Account is a savings account accessible for everyone with no minimum deposit requirement. It will not charge you any bank fees and will give you an interest rate of up to 0.6% per year on your deposits, before tax, regardless of how much money you put in your account.

The applicable interest rate is 0.01% annually for the first 30 days after the date of each deposit, and then it increases to 0.6% per year beginning with the 31st day after the deposit date.

My Wallet Account

Individuals and sole proprietors can open this type of savings account under Standard Chartered Korea Bank, which pays accrued interest once every month.

There are certain conditions that needs to be met for the pay out of interest, but even without fulfilling such conditions, a depositor can earn an interest of 0.1%. Other interest rates that can be applied are 0.1%, 2.1%, 2.8%, 0.3%, and 0.8%, depending on the conditions met as well as the daily balance. \

Certain fee waivers are also provided under this account.

e-Click Passbook

Individuals are allowed to open this account that offers an interest rate of 0.1% per annum, before tax. There is no additional cost associated with converting a Safe Savings account to an e-Click Passbook, Standard Chartered Korea Bank said.

Deposits and withdrawals can be executed through both online channels and branch counters. Take note of the fee worth 1,000 KRW for branch counter withdrawals that are worth below 2 million KRW. Certain fee waivers are provided under this account as well.

Best Savings Rates in South Korea: KEB Hana Bank

KEB Hana Bank, which it is now known for after the merger of Hana Bank with the Korea Exchange Bank, offers a wide range of products related to banking, out of which we will discuss a few.

Easy-One Pack Savings Account

This is an account, which is also dubbed the Foreigner Personal Account offered by KEB Hana Bank. The enrollment period for this account is 1 year and the individual is required to make a deposit of at least 10,000 KRW.

The interest rate before taxes and after the maturity if completed will be 2.9% per year. A preferential interest rate up to a maximum of 0.3% per year will be added to the above-mentioned interest rate when a depositor hits certain eligibility criteria.

The Wide Foreign Currency Savings Account

This personal account is available in eight currencies, namely US dollars, euro, Japanese yen, British pounds, Swiss Francs, Canadian dollars, Australian dollars, and New Zealand dollars.

The interest rate for this account will depend on the rates posted by the bank during the time of opening an account. A preferential interest rate of up to 0.30% could be added to the above-mentioned interest rate when a person meets certain eligibility criteria.

The enrollment period for this account is 6 months to less than two years, and this type of account is an installment account offered by Hana bank. The installments can be made regardless of the amount, date, or frequency.

This account has no deposit caps and offers a feature of split withdrawals as well.

Foreign Currency Deposit Account

Anyone can open an account and there are no restrictions imposed on the amount of deposits and withdrawals. The deposits are accessible in 27 different currencies, such as USD, euro, pounds, Canadian dollars, Australian dollars, Hong Kong dollars, Singapore dollars, UAE dirhams, Chinese yuan, and South African rand. However, deposits can be made in only 10 currencies for a single account.

The interest rates for this account will vary on the basis of the interest rates announced by the bank on a daily basis, with respect to the type of currency that has been chosen.

There is no term of maturity for this account as well.

Best Savings Rates in South Korea: Woori Bank

Woori Bank offers a wide range of banking products, out of which we will be focusing on one of the main types of account namely ‘Woori We’ll Rich 100 Savings’ for individuals. This account was previously known as “Woori Youth 100 Years Savings”.

The term period ranges between 1 year, 2 years and 3 years, and the limit for re-deposit is around 9 years. The primary objective of this account is to let individuals get prepared by saving money towards their retirement.

The basic interest rate is announced at the branch or the internet banking homepage during the bank account opening date. A preferential interest rate of up to 0.2% could be added to the above-mentioned interest rate when a person meets certain eligibility criteria.

The interest rates for this account are set on the basis of the term selected, i.e., 1.95% for 1 year, 2.05% for 2 years, and finally 2.15% for 3 years.

If the customer does not withdraw their funds, the principal and the interest would again be reinvested for a maximum of two 3-year periods.

Best Savings Rates in South Korea: Final Thoughts

If you choose a savings product offered by an international bank having a branch in Korea, you might even get higher interest rates.

However, if you want to choose between the domestic banks of South Korea, the banks mentioned above are the best, especially when it comes to expats.

There may be an availability of other banks, which might offer a higher interest rate when compared to the savings rates that we have discussed here. But these banks are discussed on the basis of finding a bank that is suitable for a foreigner in South Korea.

South Korea has evolved into a very cosmopolitan nation, and as a result, majority of banks now welcome new customers from outside the country. If a person has all of the necessary documentation, there is a huge chance that they will have no trouble opening a bank account in their name.

Having said that, some locations could have had negative interactions in the past with non-citizens, leading them to adopt policies that restrict the services that can be provided to your account or mandate a waiting period of several months. Your application will, at the very worst, be turned down.

If something like this occurs, try not to let it demoralize you. If you are able to demonstrate that you satisfy the prerequisites set forth by a particular financial institution, you will be eligible to open an account at one of the many available banking institutions. You might even be able to open a new account at a separate branch of the same bank if you visit one of their locations.

We hope that you were able to find this information useful and we wish that you get all your banking needs fulfilled while living in South Korea.

That being said, if you need services related to permanent residency or a second passport, we are here to help you. Additionally, if you are looking for a financial planner or financial solutions, whether it is investment advice or a wealth management service, you can get the best-in-class services by clicking here.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.